Insurance Estimate Car

When it comes to insuring your vehicle, obtaining an accurate insurance estimate is crucial. The process of estimating car insurance involves considering various factors that can significantly impact the final cost. In this comprehensive guide, we will delve into the world of car insurance estimates, exploring the key elements that influence premiums, the steps involved in obtaining an accurate quote, and the strategies to find the best coverage options. By understanding these aspects, you can make informed decisions and ensure you get the right insurance coverage for your vehicle.

Understanding the Factors that Affect Car Insurance Estimates

Several critical factors come into play when insurance providers calculate car insurance estimates. These factors can vary based on individual circumstances and the specific insurance company’s policies. Here’s an overview of the key considerations:

Vehicle Type and Usage

The type of vehicle you own plays a significant role in determining your insurance premium. Insurance companies consider factors such as the make, model, and age of your car. High-performance vehicles, luxury cars, and sports cars often attract higher insurance costs due to their increased risk of accidents and higher repair expenses. Additionally, the intended use of your vehicle, whether for personal, commercial, or business purposes, can also influence the estimate.

Driver’s Profile and History

Your driving record and personal profile are crucial in calculating insurance estimates. Insurance providers examine your driving history, including any accidents, traffic violations, and claims made in the past. A clean driving record with no recent incidents or claims typically results in lower insurance costs. Conversely, a history of accidents or traffic violations may lead to higher premiums. Age, gender, and marital status are also considered, as statistical data suggests certain demographics have higher accident rates.

| Demographic Factor | Impact on Insurance Estimate |

|---|---|

| Age | Younger drivers (under 25) and older drivers (over 65) often face higher premiums due to higher risk. |

| Gender | Insurance rates can vary based on gender, with male drivers often facing slightly higher premiums. |

| Marital Status | Married individuals may enjoy lower rates as they are statistically associated with lower accident risks. |

Location and Coverage Requirements

The geographic location where you reside and drive your vehicle is another essential factor. Insurance rates can vary significantly between states and even within different regions of a state. Areas with higher crime rates, dense traffic, or a history of severe weather conditions may result in higher insurance costs. Additionally, local laws and regulations regarding minimum liability coverage requirements can impact your insurance estimate.

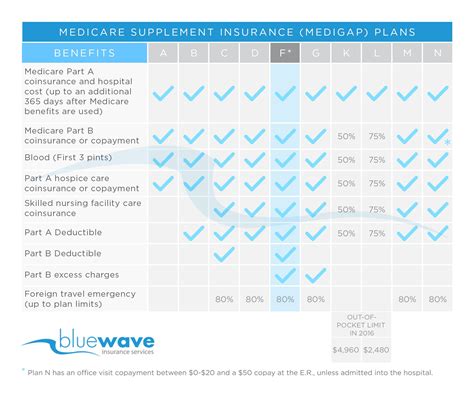

Coverage Options and Deductibles

The coverage options you choose and the deductibles you select also influence your insurance estimate. Comprehensive and collision coverage, which protect against damage to your vehicle, typically increase the overall cost. However, these coverages provide valuable protection against unforeseen events like accidents, theft, or natural disasters. Choosing higher deductibles can reduce your monthly premiums but may require a more significant out-of-pocket expense in the event of a claim.

Steps to Obtain an Accurate Car Insurance Estimate

To ensure you receive an accurate insurance estimate for your vehicle, consider the following steps:

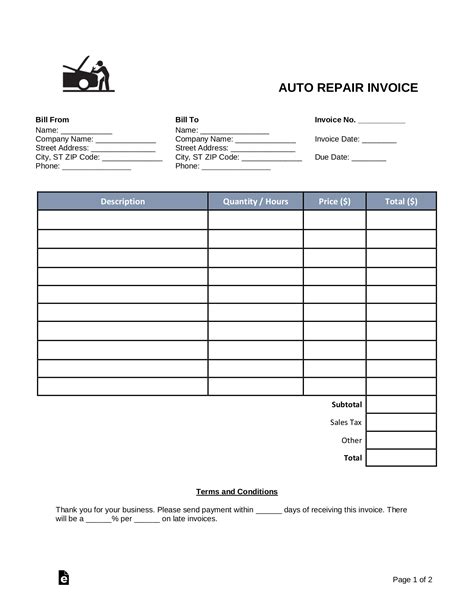

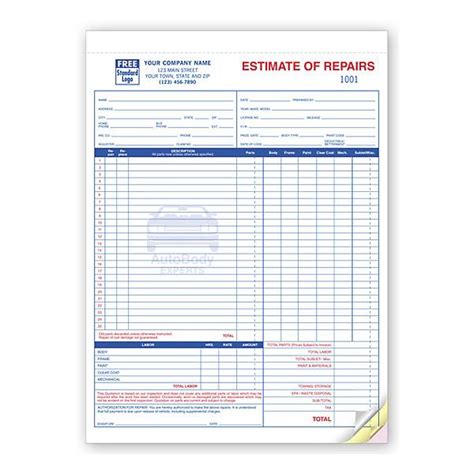

Gather Relevant Information

Before requesting an insurance estimate, gather essential information about your vehicle, driving history, and coverage preferences. This includes details such as the make, model, and year of your car, your driving record (including any accidents or violations), and the coverage options you’re interested in. Having this information readily available will streamline the estimation process.

Compare Multiple Quotes

To find the best insurance estimate, it’s essential to compare quotes from multiple insurance providers. Each company has its own unique rating system and may offer different rates for similar coverage. By obtaining quotes from at least three different insurers, you can identify the most competitive and suitable option for your needs. Comparison websites and insurance brokers can be valuable tools to facilitate this process.

Evaluate Coverage Options

When reviewing insurance estimates, pay close attention to the coverage options and limits included in each quote. Ensure that the estimates provide the level of coverage you require, whether it’s liability-only coverage or a more comprehensive policy. Consider the potential risks associated with your driving habits and location to determine the appropriate level of coverage.

Assess Additional Discounts

Insurance providers often offer various discounts that can reduce your overall insurance estimate. These discounts may include safe driver discounts, multi-policy discounts (for bundling multiple insurance policies), and loyalty discounts for long-term customers. By inquiring about available discounts and meeting the eligibility criteria, you can potentially lower your insurance costs.

Review Policy Terms and Conditions

While comparing insurance estimates, it’s crucial to carefully review the policy terms and conditions. Pay attention to the fine print, including any exclusions, limitations, and restrictions. Understanding these details will help you make an informed decision and ensure that the policy meets your expectations and provides the coverage you require.

Strategies to Find the Best Car Insurance Estimate

To secure the most favorable car insurance estimate, consider implementing the following strategies:

Shop Around Regularly

Insurance rates can fluctuate over time, so it’s beneficial to shop around for insurance estimates periodically, even if you’re already insured. Regularly comparing quotes can help you identify potential savings opportunities and ensure you’re not overpaying for your coverage. Consider revisiting your insurance options annually or whenever significant changes occur, such as purchasing a new vehicle or moving to a different location.

Explore Bundle Options

If you have multiple insurance needs, such as auto, home, or renters’ insurance, consider bundling your policies with the same insurance provider. Bundling your insurance policies can often result in substantial discounts and simplified billing. By combining your insurance needs, you may be eligible for reduced rates and enjoy the convenience of having all your insurance needs covered by a single provider.

Maintain a Clean Driving Record

A clean driving record is a key factor in obtaining lower insurance estimates. Avoid traffic violations and practice safe driving habits to maintain a positive driving history. By avoiding accidents and reducing the risk of claims, you can demonstrate your reliability as a driver and potentially qualify for lower insurance rates.

Consider Telematics Programs

Some insurance companies offer telematics programs that track your driving behavior and reward safe driving habits with discounted rates. These programs use devices or smartphone apps to monitor factors such as acceleration, braking, and mileage. If you’re a safe and cautious driver, participating in a telematics program could lead to significant savings on your insurance estimate.

Evaluate Pay-As-You-Drive Options

Pay-as-you-drive (PAYD) insurance policies are an innovative approach that allows you to pay insurance premiums based on your actual driving behavior and mileage. These policies can be particularly advantageous for low-mileage drivers or those with flexible work schedules. By accurately tracking your mileage and driving habits, PAYD policies can provide more tailored and potentially lower insurance estimates.

Conclusion

Obtaining an accurate car insurance estimate is essential to ensure you have the right coverage for your vehicle at a competitive price. By understanding the factors that influence insurance estimates and implementing the strategies outlined in this guide, you can navigate the insurance market confidently and make informed decisions. Remember to regularly review and compare insurance options, maintain a clean driving record, and explore the various discounts and coverage options available to secure the best insurance estimate for your unique circumstances.

How often should I review my car insurance estimate?

+It is recommended to review your car insurance estimate annually or whenever significant changes occur, such as buying a new vehicle, moving to a different location, or making major life changes. Regularly reviewing your insurance ensures you stay up-to-date with the most competitive rates and coverage options.

Can I negotiate my car insurance estimate with the provider?

+While insurance estimates are primarily based on established rating systems, you can still negotiate with your insurance provider to explore potential discounts or alternative coverage options. Discussing your specific circumstances and needs with your insurer may lead to customized solutions and lower premiums.

What factors can lead to an increase in my car insurance estimate over time?

+Several factors can cause your car insurance estimate to increase over time. These include changes in your driving record (such as accidents or violations), changes in your vehicle’s value or usage, and fluctuations in insurance rates due to market conditions or regional factors. Regularly reviewing your coverage and shopping around for competitive rates can help mitigate these increases.