What Is A High Deductible Insurance Plan

In the complex world of health insurance, understanding the different plan options is crucial for making informed decisions about your healthcare coverage. Among the various types of insurance plans available, High Deductible Health Plans (HDHPs) have gained significant attention due to their unique features and potential benefits. This article aims to provide an in-depth analysis of High Deductible Insurance Plans, shedding light on their definition, how they work, and their impact on individuals and the healthcare system as a whole.

Understanding High Deductible Health Plans (HDHPs)

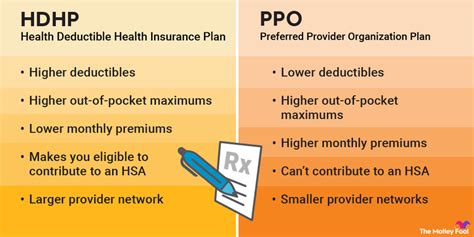

A High Deductible Health Plan is a type of insurance coverage characterized by a higher annual deductible compared to traditional health plans. The deductible is the amount an individual must pay out of pocket before the insurance company starts covering the costs of medical services. HDHPs are designed to encourage individuals to take a more active role in managing their healthcare expenses and to promote cost-conscious decisions.

HDHPs are often paired with Health Savings Accounts (HSAs), which are tax-advantaged savings accounts specifically designed to help individuals set aside money for future medical expenses. HSAs offer a unique opportunity to save pre-tax dollars, providing additional financial flexibility when it comes to healthcare.

Key Features of HDHPs

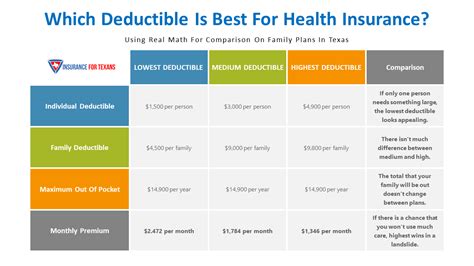

- Higher Deductibles: As the name suggests, HDHPs have significantly higher annual deductibles than other plans. These deductibles can range from a few thousand dollars to over $10,000, depending on the specific plan and the individual’s healthcare needs.

- Lower Premiums: One of the primary advantages of HDHPs is the potential for lower monthly premiums. Because individuals are responsible for a larger portion of their healthcare costs upfront, insurance companies can offer more affordable premiums, making healthcare coverage more accessible to a wider range of individuals.

- Focus on Preventive Care: HDHPs often prioritize preventive care by covering these services at little to no cost. This encourages individuals to stay on top of their health, potentially preventing more costly medical issues down the line.

- Tax Benefits with HSAs: When paired with an HSA, HDHPs offer tax advantages. Contributions to HSAs are tax-deductible, and withdrawals for qualified medical expenses are tax-free. This makes HDHPs an attractive option for individuals looking to maximize their tax savings.

How HDHPs Work: A Step-by-Step Guide

To understand the mechanics of HDHPs, let’s break down the process step by step:

Step 1: Choosing an HDHP

Individuals select an HDHP based on their healthcare needs and financial situation. It’s important to consider factors such as the plan’s deductible, premium, and out-of-pocket maximum when making this decision.

Step 2: Paying Premiums and Deductibles

Once enrolled in an HDHP, individuals pay their monthly premiums to maintain their coverage. When medical services are needed, they pay the full cost of these services until they meet their annual deductible.

Step 3: Utilizing Preventive Care

HDHPs typically cover preventive care services, such as annual check-ups, immunizations, and screenings, at no additional cost. Taking advantage of these services can help individuals stay healthy and identify potential issues early on.

Step 4: Meeting the Deductible

As individuals incur medical expenses, they pay these costs out of pocket until they reach their annual deductible. Once the deductible is met, the insurance company starts covering a larger portion of the costs.

Step 5: Using an HSA (if applicable)

For those with an HSA, funds can be used to cover qualified medical expenses. HSAs allow individuals to save money for future healthcare needs while enjoying tax benefits.

Advantages and Disadvantages of HDHPs

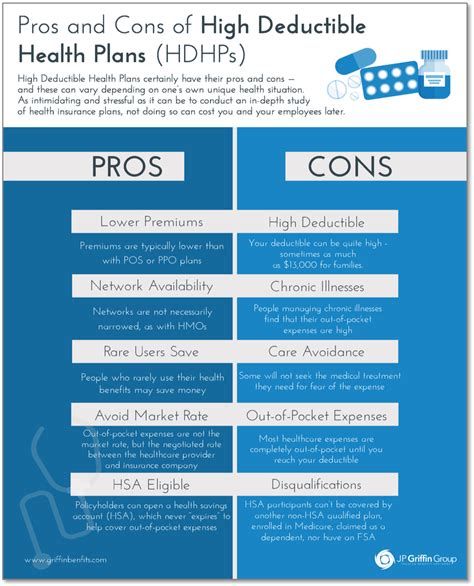

Like any insurance plan, HDHPs come with their own set of advantages and disadvantages. Let’s explore some of the key pros and cons:

Advantages of HDHPs:

- Lower Premiums: As mentioned earlier, HDHPs often have lower monthly premiums, making healthcare coverage more affordable for individuals.

- Tax Benefits: When paired with an HSA, HDHPs offer significant tax advantages, allowing individuals to save money on their taxes.

- Encouragement of Cost-Conscious Decisions: With a higher deductible, individuals are incentivized to make more informed healthcare choices, potentially reducing unnecessary expenses.

- Access to HSAs: HSAs provide a flexible and tax-efficient way to save for future medical needs, giving individuals greater control over their healthcare finances.

Disadvantages of HDHPs:

- High Out-of-Pocket Costs: Until the deductible is met, individuals are responsible for the full cost of their medical expenses, which can be a significant financial burden, especially for those with unexpected or ongoing medical issues.

- Limited Coverage Before Deductible: Many HDHPs provide limited coverage for services before the deductible is met, which may discourage individuals from seeking necessary medical care.

- Complexity: HDHPs can be more complex to navigate, especially when it comes to understanding which services are covered and how to utilize HSAs effectively.

Real-World Examples and Case Studies

To better illustrate the impact of HDHPs, let’s explore some real-world scenarios and case studies:

Case Study 1: John’s Story

John, a healthy individual in his 30s, opted for an HDHP with a lower premium and a $6,000 deductible. Throughout the year, he made regular contributions to his HSA, taking advantage of the tax benefits. When he required a minor surgical procedure, he paid the full cost out of pocket until he met his deductible. After that, his insurance covered a significant portion of the remaining costs.

Case Study 2: Sarah’s Experience

Sarah, a young professional with a chronic condition, chose an HDHP with a higher premium but a lower deductible of $3,000. This allowed her to manage her ongoing medical expenses more effectively. With her condition requiring regular doctor visits and medications, the lower deductible made it easier for her to access the necessary care without incurring excessive out-of-pocket costs.

Performance Analysis and Future Implications

HDHPs have shown promising results in certain demographics, particularly among younger and healthier individuals. These plans offer a cost-effective solution for those who prioritize financial flexibility and tax savings. However, for individuals with chronic conditions or unexpected medical needs, HDHPs may not provide the same level of financial protection.

Looking ahead, the future of HDHPs is intertwined with the evolving healthcare landscape. As healthcare costs continue to rise, HDHPs may play a crucial role in promoting cost-conscious behavior and encouraging individuals to take a more proactive approach to their healthcare decisions. Additionally, advancements in healthcare technology and telemedicine could further enhance the efficiency and accessibility of HDHPs.

It's worth noting that the success of HDHPs relies on individuals' financial literacy and their ability to navigate the complexities of healthcare coverage. Education and support in understanding HDHPs and HSAs are essential to ensure individuals make informed choices that align with their healthcare needs and financial goals.

| HDHP Plan Type | Deductible | Premium |

|---|---|---|

| Standard HDHP | $6,000 | $250/month |

| Enhanced HDHP | $3,000 | $350/month |

| Premium HDHP | $8,000 | $200/month |

Can I change my HDHP during the year if I find it’s not suitable for my needs?

+Generally, insurance plans have specific enrollment periods, and changes outside of these periods may be limited. However, some life events, such as marriage or the birth of a child, may qualify you for a special enrollment period. It’s best to check with your insurance provider to understand your options.

Are there any age restrictions for HDHPs?

+HDHPs are available to individuals of all ages. However, older individuals may find that the higher deductibles can be a financial burden, as healthcare needs tend to increase with age. It’s important to carefully consider your healthcare needs and financial situation when choosing an HDHP.

How do HDHPs impact the overall healthcare system?

+HDHPs are designed to promote cost-consciousness and encourage individuals to actively manage their healthcare expenses. This shift in mindset can potentially lead to more efficient healthcare utilization and reduced overall healthcare costs. However, it’s essential to ensure that individuals have the necessary support and resources to make informed healthcare decisions.