Long Term Care Insurance Costs By Age

The cost of long-term care insurance is a crucial factor when considering this type of financial protection. This article aims to provide an in-depth analysis of how long-term care insurance costs vary by age, offering a comprehensive understanding of the financial implications and strategies to navigate this important aspect of insurance coverage.

Understanding Long-Term Care Insurance Costs by Age

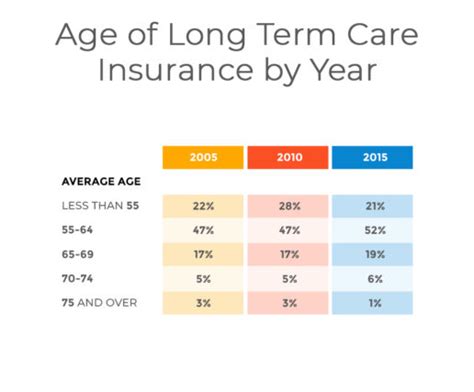

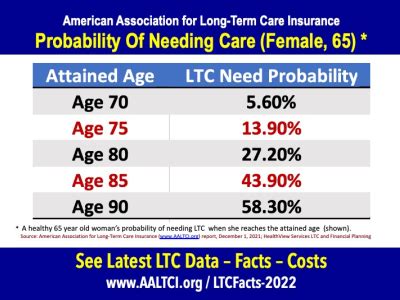

Long-term care insurance is designed to provide financial coverage for the potential need for extended care services, such as assistance with daily activities or skilled nursing care. The cost of this insurance is influenced by several factors, including the policyholder’s age, health status, and the level of coverage chosen. As we delve into the analysis of long-term care insurance costs by age, it becomes evident that timing plays a significant role in determining the affordability and accessibility of this essential coverage.

The Impact of Age on Premium Rates

One of the primary determinants of long-term care insurance premiums is the applicant’s age. Insurance providers typically offer lower premiums for younger applicants, as they are considered less likely to require long-term care services in the near future. This is due to the statistical likelihood that younger individuals have fewer health issues and a lower probability of needing extensive care. As individuals age, the risk of requiring long-term care increases, leading to a corresponding rise in insurance premiums.

| Age Group | Average Annual Premium |

|---|---|

| 30-39 years | $1,200 - $1,800 |

| 40-49 years | $1,500 - $2,200 |

| 50-59 years | $2,000 - $2,800 |

| 60+ years | $3,000+ (varies widely) |

The table above provides a general overview of the average annual premiums for long-term care insurance across different age groups. It's important to note that these figures are estimates and can vary significantly based on individual circumstances and the specific policy chosen.

Benefits of Early Enrollment

Enrolling in long-term care insurance at a younger age offers several advantages. Firstly, younger applicants typically enjoy lower premiums, as mentioned earlier. This means that by starting early, individuals can secure affordable coverage and potentially save thousands of dollars over the long term. Additionally, early enrollment allows for a longer coverage period, providing peace of mind and financial security for a more extended period of life.

Another benefit of early enrollment is the opportunity to lock in good health rates. Many insurance providers offer preferred rates to applicants with no significant health issues. By securing coverage while in good health, individuals can avoid potential rate increases due to health conditions that may develop later in life.

Increasing Costs with Advancing Age

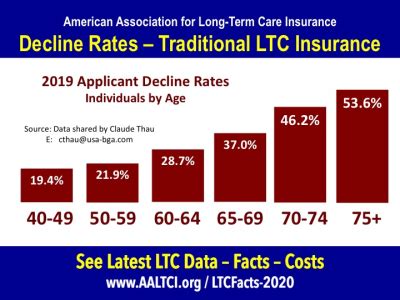

As individuals progress through their life stages, the costs of long-term care insurance tend to rise. This is primarily due to the increasing likelihood of health issues and the need for long-term care as one ages. Insurance providers take into account the statistical probability of claims and adjust premiums accordingly. Consequently, those in their 60s and beyond often face significantly higher premiums, which can be a financial burden for some individuals.

It's worth noting that while the cost of long-term care insurance increases with age, the benefits of having this coverage become increasingly valuable. The financial protection and peace of mind it provides can be invaluable, especially during a time when medical and care needs may be more prevalent.

Factors Influencing Long-Term Care Insurance Costs

While age is a significant factor in determining long-term care insurance costs, it is not the only consideration. Several other variables play a role in shaping the overall cost of this insurance, and understanding these factors can help individuals make more informed decisions.

Health Status and Medical History

An individual’s health status and medical history are closely scrutinized by insurance providers when assessing long-term care insurance applications. Pre-existing conditions, chronic illnesses, and the overall health of the applicant can significantly impact premium rates. Those with a history of serious health issues or multiple chronic conditions may face higher premiums or even denial of coverage.

To mitigate the impact of health-related factors, it's advisable to maintain a healthy lifestyle and regularly monitor one's health. Early detection and management of health conditions can improve the chances of securing more affordable long-term care insurance coverage.

Coverage Options and Policy Features

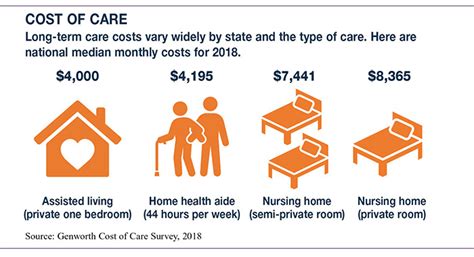

The level of coverage chosen and the specific policy features selected can greatly affect the overall cost of long-term care insurance. Policies with more extensive benefits and higher daily benefit amounts will typically carry higher premiums. Similarly, policies that cover a broader range of care services, such as home healthcare or assisted living, may be more expensive than those with more limited coverage.

When selecting a policy, it's essential to strike a balance between the desired level of coverage and the affordability of the premiums. Working with a knowledgeable insurance agent or financial advisor can help individuals tailor their policy to their specific needs and budget.

Inflation Protection and Benefit Periods

Long-term care insurance policies often include inflation protection, which accounts for the rising cost of healthcare over time. This feature ensures that the policy’s benefits keep pace with inflation, providing adequate coverage for future care needs. While inflation protection can increase the initial premium, it is a valuable addition that helps maintain the policy’s real value over the long term.

The benefit period is another critical aspect of long-term care insurance policies. This refers to the duration for which the policy will provide coverage. Longer benefit periods, such as lifetime coverage, are generally more expensive but offer greater peace of mind. Shorter benefit periods, such as 3 or 5 years, may be more affordable but may not provide sufficient coverage for an individual's potential long-term care needs.

Strategies for Managing Long-Term Care Insurance Costs

Given the potential financial impact of long-term care insurance costs, especially for older individuals, it’s essential to explore strategies that can help manage these expenses effectively. Here are some approaches to consider:

Shopping Around and Comparing Policies

Long-term care insurance is offered by various providers, each with its own set of policies and pricing structures. Shopping around and comparing different policies can help individuals identify the most cost-effective options that align with their specific needs. Online tools and insurance brokers can assist in this process, providing a comprehensive overview of available policies and their features.

Understanding Discounts and Special Programs

Many insurance providers offer discounts and special programs that can reduce the cost of long-term care insurance. These may include discounts for spouses or partners who purchase policies together, group discounts through employers or associations, or discounts for individuals who maintain a healthy lifestyle or complete certain wellness programs.

Adjusting Coverage Levels and Benefit Periods

As mentioned earlier, the level of coverage and benefit periods chosen can significantly impact the cost of long-term care insurance. Individuals may consider adjusting these aspects to find a balance between affordability and adequate coverage. For example, opting for a shorter benefit period or a lower daily benefit amount can result in more manageable premiums.

Exploring Alternative Financing Options

In some cases, traditional long-term care insurance may not be the most suitable or affordable option. Fortunately, there are alternative financing approaches that individuals can explore. These may include hybrid policies that combine life insurance and long-term care coverage, annuities with long-term care riders, or even self-funding through careful financial planning and savings.

The Future of Long-Term Care Insurance Costs

The landscape of long-term care insurance is constantly evolving, influenced by various factors such as demographic shifts, healthcare advancements, and regulatory changes. As we look to the future, several trends and developments are worth considering when assessing the potential impact on long-term care insurance costs.

Changing Demographics and Healthcare Advances

The aging population is a significant factor in the long-term care insurance market. As life expectancies increase and the proportion of older adults grows, the demand for long-term care services is expected to rise. This, in turn, may lead to increased insurance costs to accommodate the growing need for coverage. However, advancements in healthcare and technology could potentially offset some of these cost increases by improving the efficiency and effectiveness of long-term care services.

Regulatory Changes and Industry Innovations

Regulatory changes and industry innovations can also shape the future of long-term care insurance costs. Efforts to standardize policies and improve consumer protection may lead to more consistent pricing and coverage across the industry. Additionally, insurance providers are continuously developing new products and features to meet the evolving needs of consumers, which could introduce more affordable and flexible options in the market.

The Role of Technology in Long-Term Care

Technological advancements are transforming the long-term care industry, and this has the potential to impact insurance costs. Telehealth services, remote monitoring devices, and assistive technologies can improve the efficiency and accessibility of long-term care, reducing the overall need for traditional in-home or institutional care. As these technologies become more prevalent and affordable, they may contribute to lowering the cost of long-term care and, consequently, the associated insurance premiums.

Conclusion

Understanding the relationship between age and long-term care insurance costs is a critical aspect of financial planning. By recognizing the impact of age on premiums and exploring the various factors that influence insurance costs, individuals can make informed decisions about when to enroll and how to manage their long-term care insurance coverage effectively. While the costs may increase with age, the peace of mind and financial protection provided by this insurance are invaluable for many individuals.

As the future of long-term care insurance unfolds, staying informed about industry trends, regulatory changes, and technological advancements will be essential for navigating this evolving landscape. By staying proactive and seeking expert advice, individuals can ensure they have the necessary coverage to meet their long-term care needs while managing the associated costs effectively.

How do long-term care insurance costs compare to the potential costs of long-term care without insurance coverage?

+Long-term care insurance costs can vary significantly based on individual circumstances and policy features. On average, the annual premiums for long-term care insurance range from a few hundred dollars to several thousand dollars. In contrast, the out-of-pocket costs for long-term care services without insurance coverage can be considerably higher. For example, the average cost of a private room in a nursing home can exceed $100,000 per year. Thus, while long-term care insurance may seem costly, it provides valuable financial protection against the potentially devastating expenses of long-term care.

Are there any tax benefits associated with long-term care insurance premiums?

+Yes, long-term care insurance premiums may offer certain tax advantages. In the United States, a portion of the premiums paid for qualified long-term care insurance policies may be eligible for a federal income tax deduction. Additionally, some states also provide tax deductions or credits for long-term care insurance premiums. However, it’s important to consult with a tax professional or financial advisor to understand the specific tax implications in your situation.

What happens if I need long-term care but don’t have insurance coverage?

+If you require long-term care and don’t have insurance coverage, you will likely need to cover the costs out of pocket or rely on other sources of funding. This could include personal savings, assets, or government assistance programs like Medicaid (in the U.S.). However, these options may have limitations and eligibility requirements, and the costs of long-term care can quickly deplete personal finances. Long-term care insurance is designed to provide a financial safety net, ensuring that individuals have the necessary funds to access the care they need without compromising their financial stability.