How To Cancel My Progressive Insurance

Unsubscribing from Progressive Insurance: A Comprehensive Guide

If you're looking to cancel your insurance policy with Progressive, it's important to understand the process and the potential implications. Progressive is a well-known insurance provider, offering a range of coverage options for vehicles, homes, and more. However, circumstances may arise where you need to terminate your policy. This guide will walk you through the steps to ensure a smooth and informed cancellation.

Step-by-Step Process to Cancel Progressive Insurance

Canceling your insurance policy with Progressive is straightforward, but it’s essential to follow the right procedures to avoid any complications.

1. Review Your Policy and Terms

Before initiating the cancellation process, take a moment to review your insurance policy. Understanding the terms and conditions, including any cancellation fees or penalties, is crucial. Progressive’s policies often come with specific terms regarding cancellations, so familiarize yourself with these details.

| Policy Type | Cancellation Fee |

|---|---|

| Auto Insurance | $50 or 10% of the remaining premium, whichever is greater |

| Home Insurance | Varies based on state regulations and policy terms |

| Life Insurance | No cancellation fee, but a surrender charge may apply for early withdrawals |

Remember, the above fees are general guidelines, and your specific policy may have different terms. Always refer to your policy documents for accurate information.

2. Contact Progressive’s Customer Service

Reach out to Progressive’s customer service team to initiate the cancellation process. You can do this via phone, email, or live chat. Provide them with your policy details and clearly state your intention to cancel.

Progressive's customer service representatives are trained to handle cancellation requests efficiently. They will guide you through the necessary steps and answer any questions you may have. It's a good idea to have your policy number and relevant personal information ready when contacting them.

3. Provide Reason for Cancellation (Optional)

While not mandatory, providing a reason for canceling your insurance can be beneficial. Progressive may use this information for improvement and to better understand customer needs. Additionally, in some cases, disclosing the reason might lead to a waiver of certain fees or penalties.

For instance, if you're moving to a new state with different insurance requirements, informing Progressive of this change might result in a more favorable cancellation outcome.

4. Choose Your Cancellation Date

Progressive will ask you to select a cancellation date. This date should align with your insurance needs and any potential penalties. If you’re canceling due to a change in circumstances, such as selling your car or moving, choose a date that corresponds with these events.

Keep in mind that Progressive may require a minimum notice period, usually around 10-14 days, before canceling your policy. Ensure your chosen date provides sufficient time to meet this requirement.

5. Confirm and Finalize Cancellation

Once you’ve provided all the necessary details and chosen your cancellation date, Progressive will send you a confirmation. Review this confirmation carefully to ensure all the information is accurate.

If everything is in order, proceed with finalizing the cancellation. Progressive will then process your request and provide any necessary documentation or refunds.

6. Refund and Final Settlement

After canceling your policy, Progressive will calculate any refunds owed to you. This typically includes a portion of your premium for the unused coverage period. The refund amount and timing may vary based on your policy type and the reason for cancellation.

Progressive will issue the refund via your preferred method of payment, as specified in your policy documents. Ensure that your contact and payment details are up-to-date to facilitate a smooth refund process.

Implications and Considerations

Canceling your Progressive insurance policy has several implications and considerations that you should be aware of.

1. Impact on Coverage

Once your policy is canceled, you’ll no longer have insurance coverage from Progressive. This means that any incidents or claims that occur after the cancellation date won’t be covered by Progressive. Ensure you have alternative coverage in place before canceling to avoid any gaps in protection.

2. Potential Penalties and Fees

As mentioned earlier, Progressive may charge cancellation fees or penalties. These fees can vary based on your policy type and the reason for cancellation. Be sure to understand these fees and factor them into your decision-making process.

In some cases, Progressive might waive these fees if you're canceling due to specific circumstances, such as a change in employment or residence. Always inquire about potential fee waivers when discussing your cancellation with their customer service team.

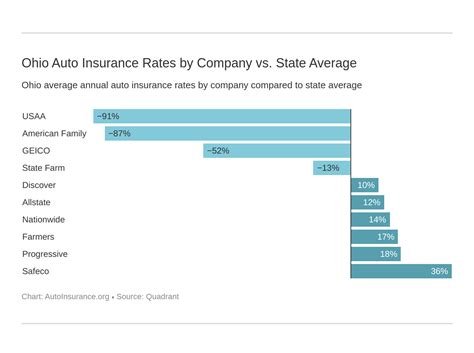

3. Effect on Future Insurance Applications

Canceling your insurance policy with Progressive may impact your future insurance applications. Insurance providers often consider your history of coverage and cancellations when assessing your risk profile. Frequent cancellations or a pattern of short-term policies might raise red flags and lead to higher premiums or even denials.

It's essential to maintain a stable insurance history to ensure the best rates and coverage options in the future. If possible, aim to keep your policies active for extended periods to demonstrate reliability and responsibility.

Alternative Options to Cancellation

Before canceling your Progressive insurance policy, consider whether alternative options might better suit your needs. Progressive offers a range of coverage customizations and add-ons that can enhance your policy’s fit for your circumstances.

1. Policy Adjustments

If your insurance needs have changed, discuss potential policy adjustments with Progressive. They may be able to modify your coverage limits, deductibles, or other policy features to align with your current requirements. This could be a more cost-effective solution than canceling and starting a new policy.

2. Payment Plan Adjustments

If financial constraints are a concern, Progressive might offer alternative payment plans or installment options. This can help spread out your premium payments and make insurance more affordable without the need for cancellation.

3. Exploring Discounts

Progressive provides various discounts based on factors like your driving record, vehicle safety features, and loyalty. Review your policy to ensure you’re taking advantage of all eligible discounts. If not, discuss potential discount opportunities with their customer service team.

FAQs

Can I cancel my Progressive insurance online?

+

Yes, Progressive offers an online cancellation process. You can access your account through their website and follow the steps to initiate the cancellation. However, it’s always recommended to confirm the cancellation with their customer service team to ensure a smooth transition.

Will I receive a refund after canceling my Progressive insurance policy?

+

Yes, if you’ve paid for a full term and cancel before the end date, you’re eligible for a refund. The refund amount will depend on your policy type and the reason for cancellation. Progressive will calculate and issue the refund accordingly.

What happens if I don’t provide a reason for canceling my Progressive insurance?

+

While not mandatory, providing a reason for cancellation can be beneficial. Progressive may use this information to improve their services. However, not disclosing a reason won’t impact the cancellation process itself.

Can I cancel my Progressive insurance if I’ve already made a claim?

+

Yes, you can cancel your Progressive insurance even if you’ve made a claim. However, it’s important to note that canceling your policy may impact any ongoing claims. Discuss this with Progressive’s customer service team to understand the potential implications.

Will Progressive provide a reference or proof of cancellation for my records?

+

Absolutely! Progressive will provide you with a cancellation certificate or a confirmation letter for your records. This document serves as proof that your policy has been canceled and can be useful for future insurance applications or other purposes.