Ohio Vehicle Insurance

Ohio, like many other states in the US, requires its residents to have adequate vehicle insurance coverage to ensure financial protection in the event of accidents and other unforeseen circumstances. The state's insurance regulations and requirements play a crucial role in shaping the insurance landscape, influencing the cost and availability of coverage for its citizens. This article aims to provide an in-depth analysis of Ohio vehicle insurance, exploring the unique aspects of the state's insurance system, its impact on drivers, and the future implications for Ohio's automotive industry.

Understanding Ohio’s Vehicle Insurance Requirements

Ohio has specific laws regarding the minimum levels of insurance coverage that drivers must carry. These requirements are designed to ensure that individuals can cover the costs associated with accidents and protect themselves from financial hardship. Here’s a breakdown of the key insurance requirements in Ohio:

- Liability Coverage: Drivers in Ohio are required to carry liability insurance, which provides coverage for bodily injury and property damage caused to others in an accident for which the insured driver is at fault. The minimum liability limits are set at $25,000 per person, $50,000 per accident for bodily injury, and $25,000 for property damage.

- Uninsured/Underinsured Motorist Coverage: Ohio also mandates uninsured and underinsured motorist coverage, which offers protection to policyholders in the event of an accident with a driver who has insufficient or no insurance. This coverage helps cover the costs of medical treatment, lost wages, and other related expenses. The minimum limits for uninsured/underinsured motorist coverage mirror those of liability coverage.

- Additional Coverages: While not mandatory, Ohio drivers may choose to add other coverages to their insurance policies, such as collision coverage (covering damage to the insured vehicle in an accident), comprehensive coverage (covering non-collision-related damages like theft or natural disasters), and medical payments coverage (providing additional medical expense coverage for the insured and passengers).

It's important to note that while these are the minimum requirements, many drivers opt for higher coverage limits to ensure more comprehensive protection. The cost of insurance can vary significantly based on individual factors such as driving history, age, vehicle type, and location.

Ohio’s Unique Insurance Laws and Regulations

Ohio has implemented several unique laws and regulations that impact the insurance industry and drivers within the state. One notable regulation is the Ohio Auto Insurance Repair Law, which ensures that policyholders have the right to choose their preferred repair shop after an accident. This law promotes competition among repair facilities and gives drivers the freedom to select the shop that best suits their needs.

Additionally, Ohio has a Mandatory Offer Law, which requires insurance companies to offer policyholders the option of purchasing additional coverage beyond the state's minimum requirements. This law empowers drivers to make informed decisions about their insurance coverage and ensures they are aware of the available options to customize their policies.

The Impact of Ohio’s Insurance System on Drivers

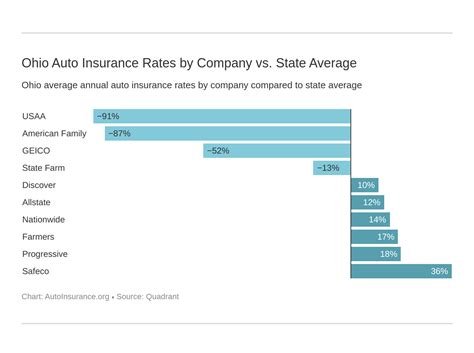

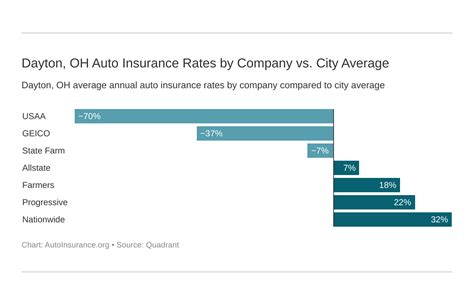

Ohio’s insurance system plays a significant role in the daily lives of its drivers. While the state’s regulations provide a baseline level of protection, the cost of insurance can be a burden for many individuals. The average cost of car insurance in Ohio is relatively high compared to the national average, with factors such as population density, traffic congestion, and the prevalence of accidents contributing to these elevated rates.

To help drivers manage their insurance costs, Ohio has implemented various programs and initiatives. For instance, the Ohio Automobile Insurance Plan (OAP) is a residual market mechanism that ensures coverage for high-risk drivers who may have difficulty obtaining insurance through the standard market. This plan provides a safety net for drivers with a history of accidents or violations, ensuring they can still obtain the necessary insurance coverage.

Furthermore, Ohio offers discounts and incentives to encourage safe driving and promote insurance affordability. These include discounts for multi-policy coverage (bundling auto and home insurance), good driving records, and safety features in vehicles. Additionally, some insurance companies provide discounts for completing defensive driving courses or for being a member of certain organizations.

Comparative Analysis: Ohio vs. Other States

When comparing Ohio’s vehicle insurance landscape to that of other states, several key differences emerge. One notable aspect is the variation in minimum insurance requirements. While Ohio’s liability limits are relatively standard, some states require higher limits, especially in states with higher population densities and a greater risk of severe accidents.

| State | Minimum Liability Limits (per person/per accident) |

|---|---|

| Ohio | $25,000/$50,000 |

| California | $15,000/$30,000 |

| New York | $25,000/$50,000 |

| Texas | $30,000/$60,000 |

| Florida | $10,000/$20,000 |

Another significant difference is the approach to insurance regulation. Some states, like California, have a more consumer-friendly approach, with regulations that favor policyholders. On the other hand, states like Ohio and Texas have a more balanced approach, aiming to strike a middle ground between consumer protection and insurer profitability.

Future Implications and Trends in Ohio’s Insurance Industry

The insurance landscape in Ohio is constantly evolving, influenced by technological advancements, changing consumer preferences, and emerging risks. Here are some key trends and future implications for Ohio’s vehicle insurance industry:

- Telematics and Usage-Based Insurance: The use of telematics devices and usage-based insurance (UBI) is gaining traction in Ohio. These technologies allow insurance companies to track driving behavior and offer discounts to safe drivers. As UBI becomes more widespread, it could lead to more personalized insurance rates based on individual driving habits.

- Autonomous Vehicles and Liability: With the advent of autonomous vehicles, Ohio, like other states, will need to address the question of liability in accidents involving self-driving cars. The state's insurance regulations will need to adapt to assign responsibility and ensure proper coverage for these new technologies.

- Climate Change and Natural Disasters: Ohio is susceptible to various natural disasters, including tornadoes, floods, and severe storms. As climate change continues to impact the frequency and severity of these events, insurance companies may need to adjust their rates and coverage to account for the increased risk. This could lead to higher premiums for drivers in certain regions of the state.

- Digital Transformation: The insurance industry in Ohio, like many others, is embracing digital transformation. This includes the use of online platforms for policy management, claims processing, and customer service. As this trend continues, it will improve efficiency and convenience for policyholders, but it may also present challenges in terms of data security and privacy.

Conclusion

Ohio’s vehicle insurance system is a complex landscape, shaped by the state’s unique laws, regulations, and demographics. While the cost of insurance can be a challenge for many drivers, Ohio’s insurance regulations provide a solid foundation for financial protection and peace of mind. As the industry evolves, Ohio’s insurance companies and regulators will continue to adapt to ensure the state’s residents have access to the coverage they need, at a price they can afford.

FAQs

What happens if I don’t have vehicle insurance in Ohio?

+

Driving without insurance in Ohio is illegal and can result in severe penalties. If caught, you may face fines, license suspension, and even jail time. Additionally, you’ll be responsible for paying any costs associated with an accident out of pocket.

How can I find affordable insurance in Ohio?

+

To find affordable insurance, compare quotes from multiple insurers, take advantage of discounts (e.g., safe driver discounts, multi-policy discounts), and consider raising your deductible. Additionally, maintaining a clean driving record and shopping around regularly can help you secure the best rates.

What is the Ohio Automobile Insurance Plan (OAP)?

+

The Ohio Automobile Insurance Plan is a residual market mechanism designed to ensure that high-risk drivers who have difficulty obtaining insurance through the standard market can still secure coverage. It acts as a last resort for drivers who might otherwise be uninsured.