Apply For Car Insurance

When it comes to safeguarding your financial well-being and peace of mind, car insurance is an essential component. In today's world, where accidents can happen unexpectedly, having adequate car insurance coverage is crucial. Applying for car insurance can seem daunting, but with the right information and a systematic approach, it becomes a straightforward process. In this comprehensive guide, we will delve into the steps and considerations involved in applying for car insurance, ensuring you make informed decisions to protect yourself and your vehicle.

Understanding Car Insurance Coverage

Car insurance provides financial protection against various risks associated with owning and operating a vehicle. It offers coverage for damages to your car, injuries sustained in an accident, liability claims, and more. Understanding the different types of car insurance coverage is vital to tailor a policy that suits your specific needs.

Liability Coverage

Liability coverage is a fundamental component of car insurance. It protects you from claims arising from bodily injury or property damage caused to others in an accident for which you are at fault. This coverage is mandatory in most states and is designed to cover medical expenses, lost wages, and property damage costs.

| Liability Coverage | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages of injured parties. |

| Property Damage Liability | Pays for repairs or replacement of damaged property due to the accident. |

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional but highly recommended. Collision coverage provides protection for damages to your vehicle resulting from collisions with other vehicles or objects, regardless of fault. Comprehensive coverage, on the other hand, covers a wide range of non-collision incidents, such as theft, vandalism, natural disasters, and animal collisions.

| Coverage Type | Description |

|---|---|

| Collision | Repairs or replaces your vehicle after a collision, regardless of fault. |

| Comprehensive | Covers non-collision incidents, including theft, weather damage, and animal collisions. |

Additional Coverage Options

Depending on your state and personal needs, you may consider additional coverage options. These can include personal injury protection (PIP), medical payments coverage, uninsured/underinsured motorist coverage, rental car reimbursement, and more. Each of these options provides specific benefits and should be evaluated based on your circumstances.

Assessing Your Car Insurance Needs

Before applying for car insurance, it’s crucial to assess your specific needs and requirements. Factors such as your driving history, the value of your vehicle, your financial situation, and the level of coverage you desire all play a role in determining the right policy for you.

Evaluating Your Driving Record

Your driving record is a significant factor in determining your car insurance rates. A clean driving record with no accidents or violations can lead to lower premiums. However, if you have had accidents or received traffic citations, it’s essential to be transparent about your history when applying for insurance. Some insurance providers offer programs or discounts for drivers with less-than-perfect records, so it’s worth exploring these options.

Determining the Value of Your Vehicle

The value of your vehicle is a critical consideration when choosing car insurance coverage. If you own an older vehicle with low resale value, you may opt for basic liability coverage to meet legal requirements. However, for newer or more expensive vehicles, you might consider comprehensive and collision coverage to protect your investment.

Assessing Your Financial Situation

Your financial situation is another key factor in deciding on car insurance coverage. Consider your ability to pay for repairs or replacement costs in the event of an accident. If you have significant financial resources, you may choose higher deductibles to reduce your premiums. Conversely, if your financial situation is more limited, you might prefer lower deductibles and more comprehensive coverage.

Researching Car Insurance Providers

With numerous car insurance providers in the market, researching and comparing their offerings is essential. Each provider has unique policies, coverage options, and pricing structures. Taking the time to understand their services and reputation can help you make an informed decision.

Online Research and Reviews

Start your research by exploring online resources. Visit the websites of reputable insurance providers to understand their coverage options, policy details, and customer reviews. Online reviews can provide valuable insights into the provider’s service quality, claim handling, and customer satisfaction.

Comparing Quotes and Coverage

Obtain quotes from multiple insurance providers to compare their rates and coverage. Pay attention to the fine print, as policies may vary in terms of coverage limits, deductibles, and exclusions. Ensure that the quotes you receive align with your specific needs and desired level of protection.

Evaluating Customer Service and Claims Handling

The quality of customer service and claims handling is a critical aspect of choosing an insurance provider. Look for providers with a strong track record of prompt and efficient claims processing. Consider factors such as their response time, ease of communication, and overall customer satisfaction ratings.

Gathering Required Information for Your Application

Before submitting your car insurance application, ensure you have all the necessary information and documentation. This will streamline the application process and reduce the chances of delays or errors.

Personal Information

Collect and organize the following personal information: your full name, date of birth, driver’s license number, and social security number (if applicable). Additionally, have your vehicle’s make, model, year, and vehicle identification number (VIN) readily available.

Driving History and Records

Gather your driving history, including any accidents, violations, or traffic citations you have received. If you have a clean driving record, ensure you have the necessary documentation to prove it. Some insurance providers may offer discounts for drivers with a certain number of accident-free years.

Vehicle Information

Provide accurate and detailed information about your vehicle, including its current mileage, any modifications or upgrades, and any existing damage or repairs. Be transparent about your vehicle’s condition to ensure accurate coverage and avoid potential issues in the event of a claim.

Completing the Car Insurance Application

With your research and information gathering complete, you’re ready to apply for car insurance. Follow these steps to ensure a smooth and efficient application process.

Choose Your Insurance Provider

Based on your research and evaluation, select the insurance provider that best meets your needs and offers competitive rates. Consider their coverage options, customer service reputation, and overall value proposition.

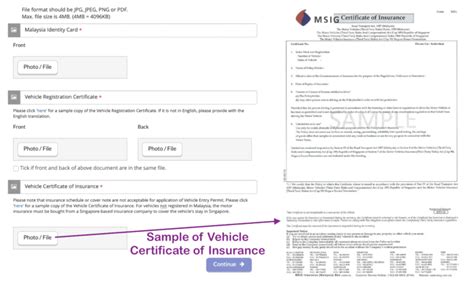

Gather Additional Required Documents

Depending on your provider and the type of coverage you select, you may need additional documents. This could include proof of previous insurance coverage, vehicle registration, or other relevant paperwork. Ensure you have these documents readily available to expedite the application process.

Complete the Application Form

Access the insurance provider’s application form, either online or through their agent. Carefully fill out all the required fields, providing accurate and honest information. Double-check your entries to avoid errors that could lead to coverage issues or higher premiums.

Submit Your Application

Once you have completed the application form, review it thoroughly for any errors or omissions. Ensure all the information is up-to-date and accurate. Submit your application, either online or by mail, depending on the provider’s preferred method.

Reviewing Your Car Insurance Policy

After submitting your application, you will receive a car insurance policy proposal from your chosen provider. It’s crucial to review this document carefully to ensure it aligns with your expectations and requirements.

Understanding Policy Terms and Conditions

Read through the policy document thoroughly, paying close attention to the coverage limits, deductibles, exclusions, and any special conditions or endorsements. Understand the terminology used in the policy and seek clarification if any terms are unclear.

Comparing the Policy with Your Application

Compare the policy proposal with the information you provided in your application. Ensure that all the details, such as your personal information, vehicle details, and coverage options, are accurately reflected. If any discrepancies arise, contact your insurance provider immediately to resolve them.

Considering Optional Add-Ons

Review the optional add-ons or endorsements available with your policy. These can provide additional coverage for specific situations or risks. Evaluate whether these add-ons are necessary for your circumstances and budget. Discuss any concerns or questions with your insurance provider to make an informed decision.

Finalizing Your Car Insurance Application

Once you are satisfied with the policy proposal and have addressed any concerns, it’s time to finalize your car insurance application.

Paying Your Premium

Most insurance providers offer flexible payment options, including monthly, quarterly, or annual premiums. Choose the payment method that best suits your financial situation and preferences. Ensure you understand any fees or penalties associated with late payments.

Reviewing and Updating Your Policy Regularly

Regularly review your car insurance policy to ensure it continues to meet your needs. Life circumstances, such as changes in your driving habits, vehicle upgrades, or marital status, can impact your insurance requirements. Stay informed about any changes in your provider’s policies or coverage options and adjust your coverage accordingly.

Seeking Professional Guidance

If you have complex insurance needs or are unsure about certain aspects of your policy, consider seeking professional guidance. Insurance brokers or agents can provide personalized advice and help you navigate the often-confusing world of car insurance. Their expertise can ensure you have the right coverage for your specific situation.

Frequently Asked Questions

What factors influence car insurance rates?

+

Car insurance rates are influenced by various factors, including your age, gender, driving history, location, vehicle type, and coverage options. Younger drivers and those with a history of accidents or violations may face higher premiums. Additionally, the value of your vehicle and the level of coverage you choose can impact your rates.

Can I switch car insurance providers after I’ve applied?

+

Yes, you can switch car insurance providers at any time. However, it’s essential to understand the terms of your existing policy, as some providers may have cancellation fees or other requirements. Compare quotes from multiple providers to ensure you find the best coverage and rates for your needs.

What happens if I have an accident before my car insurance policy takes effect?

+

If you have an accident before your car insurance policy takes effect, you may be responsible for any costs associated with the accident. It’s crucial to ensure your policy has an effective date that covers the period during which the accident occurred. In some cases, you may be able to backdate your policy to cover the accident, but this depends on the provider’s terms and conditions.

How often should I review and update my car insurance policy?

+

It’s recommended to review your car insurance policy annually or whenever your circumstances change significantly. Life events such as getting married, having children, purchasing a new vehicle, or moving to a different location can impact your insurance needs. Regularly updating your policy ensures you have adequate coverage at all times.