North Carolina Insurance

North Carolina, known for its diverse landscapes and vibrant cities, is a state that offers a unique set of insurance considerations for its residents and businesses. From the picturesque Outer Banks to the bustling streets of Charlotte, understanding the insurance landscape in this state is crucial for ensuring adequate protection and peace of mind. This comprehensive guide aims to delve into the world of North Carolina insurance, exploring the key aspects, regulations, and strategies to navigate the market effectively.

Understanding North Carolina’s Insurance Landscape

North Carolina, with its rich history and diverse industries, presents a dynamic insurance environment. The state’s unique geography, ranging from coastal regions to mountainous areas, influences the types of insurance policies sought by residents. Additionally, the state’s robust business climate attracts a wide range of industries, each with its own insurance needs.

Key Insurance Categories in North Carolina

The insurance landscape in North Carolina is broad and encompasses various categories, each tailored to meet specific needs. Here’s an overview of the key areas:

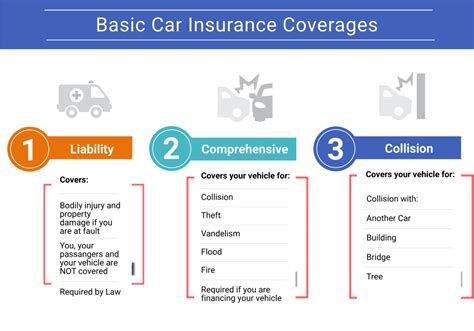

- Auto Insurance: North Carolina requires all drivers to carry liability insurance, with minimum coverage limits of $30,000 for bodily injury or death per person, $60,000 for bodily injury or death per accident, and $25,000 for property damage. However, many residents opt for additional coverage to protect against a range of risks, including collision and comprehensive coverage.

- Homeowners Insurance: Given the state's varied climate and potential for natural disasters, homeowners insurance is crucial. Policies typically cover damage caused by fire, wind, and hail, but may exclude certain perils like floods and earthquakes, requiring separate policies.

- Health Insurance: North Carolina has a diverse healthcare landscape, and health insurance is essential for accessing medical services. The state offers various plans, including individual and family policies, as well as Medicaid and Medicare options for eligible residents.

- Business Insurance: With a thriving business environment, North Carolina businesses require tailored insurance solutions. This includes general liability insurance, workers' compensation, and industry-specific policies to mitigate risks and protect assets.

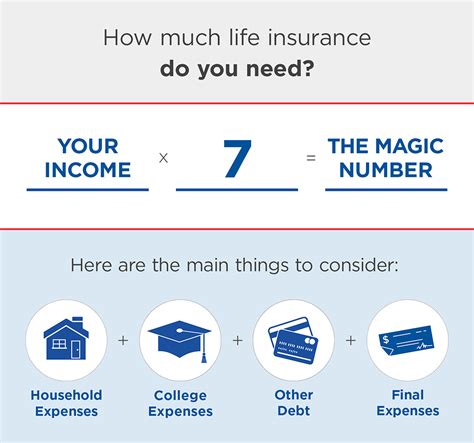

- Life Insurance: North Carolina residents often seek life insurance to provide financial security for their loved ones in the event of their passing. Policies can vary, from term life to permanent life insurance, offering different coverage periods and benefits.

Regulations and Compliance in North Carolina

North Carolina’s insurance market is heavily regulated to ensure consumer protection and fair practices. The North Carolina Department of Insurance (NCDOI) is the primary regulatory body, overseeing all aspects of the industry. Key regulations include:

- Rate Regulation: The NCDOI reviews and approves insurance rates to ensure they are not excessive, inadequate, or unfairly discriminatory. This process helps maintain a competitive market while protecting consumers from excessive premiums.

- Consumer Protection: North Carolina has implemented measures to safeguard consumers, including mandatory disclosure of policy terms, prompt handling of claims, and clear guidelines for policy cancellations.

- Solvency Oversight: The NCDOI closely monitors insurance companies' financial health to ensure they can meet their obligations. This includes regular financial examinations and strict capital requirements.

- Market Conduct Examinations: These examinations are conducted to assess insurance companies' compliance with laws and regulations, ensuring fair practices and ethical conduct.

Navigating the Market: Tips for North Carolina Residents

With a thorough understanding of North Carolina’s insurance landscape and regulations, residents can make informed decisions when selecting insurance policies. Here are some tips to navigate the market effectively:

- Compare Policies: Shop around and compare policies from multiple insurance providers. Consider factors such as coverage, deductibles, and additional benefits to find the best fit for your needs.

- Understand Your Risks: Assess your unique circumstances and potential risks. For instance, if you live in a flood-prone area, consider purchasing flood insurance even if it's not mandated.

- Review Coverage Regularly: Life changes, such as marriage, buying a home, or starting a business, may require adjustments to your insurance coverage. Regularly review your policies to ensure they align with your current needs.

- Utilize Discounts: Many insurance companies offer discounts for various reasons, such as multiple policies, safety features, or good driving records. Take advantage of these opportunities to reduce your premiums.

- Work with Licensed Agents: Licensed insurance agents can provide valuable guidance and expertise. They can help you understand complex policies and ensure you have adequate coverage without overspending.

Performance Analysis and Trends

Analyzing the performance of insurance companies in North Carolina provides valuable insights into the market’s health and stability. Here’s a brief overview:

| Insurance Provider | Financial Strength Rating | Market Share |

|---|---|---|

| State Farm | A++ (Superior) | 15% |

| Allstate | A+ (Superior) | 12% |

| Progressive | A (Excellent) | 10% |

| Geico | A++ (Superior) | 9% |

| Liberty Mutual | A (Excellent) | 8% |

These ratings and market shares provide a snapshot of the competitive landscape in North Carolina. It's important to note that financial strength ratings are a key indicator of an insurance company's ability to meet its obligations, while market share reflects their popularity and reach.

Emerging Trends in North Carolina Insurance

The insurance market in North Carolina is evolving, with several emerging trends shaping the industry. These include:

- Digital Transformation: Insurance companies are increasingly adopting digital technologies to enhance customer experiences. This includes online policy management, mobile apps for claims reporting, and digital payment options.

- Telematics-Based Insurance: With the rise of connected cars, telematics-based insurance policies are gaining traction. These policies use real-time data from vehicles to assess driving behavior, offering personalized premiums based on usage and safety practices.

- Cybersecurity Insurance: As cyber threats become more prevalent, cybersecurity insurance is gaining importance. This type of insurance provides coverage for businesses and individuals against data breaches, cyber attacks, and related liabilities.

- Health Insurance Innovations: North Carolina's healthcare industry is embracing innovative models, such as telemedicine and value-based care. Insurance companies are adapting to these changes by offering flexible health plans that cater to diverse healthcare needs.

Future Implications and Industry Insights

Looking ahead, the insurance landscape in North Carolina is expected to continue evolving, driven by technological advancements, changing consumer preferences, and regulatory updates. Here are some key insights and predictions for the future:

- Personalized Insurance: Insurance companies will increasingly leverage data analytics and artificial intelligence to offer highly personalized policies. This could include customized premiums based on individual risk profiles and behavior.

- Sustainable Insurance Practices: With growing environmental concerns, insurance companies may adopt more sustainable practices. This could involve offering incentives for eco-friendly behaviors and promoting resilience against climate-related risks.

- Regulatory Updates: The NCDOI is likely to continue updating regulations to keep pace with industry changes. This may include revisions to rate-setting processes, consumer protection measures, and insurance product guidelines.

- Expanded Coverage Options: As the state's economy and demographics evolve, insurance companies may introduce new coverage options to address emerging risks. This could include specialty policies for gig economy workers or expanded cyber insurance coverage.

What is the average cost of auto insurance in North Carolina?

+The average cost of auto insurance in North Carolina varies based on factors such as the driver’s age, driving history, and the type of vehicle. According to recent data, the average premium is around 800 per year. However, this can range significantly, with some drivers paying as little as 400 while others pay over $1,200.

Are there any discounts available for homeowners insurance in North Carolina?

+Yes, homeowners insurance providers in North Carolina offer various discounts. These may include discounts for having a security system, multiple policies with the same insurer, or for being a long-time customer. Additionally, some insurers offer discounts for certain home features, such as impact-resistant windows or roofs.

How does North Carolina’s health insurance market compare to other states?

+North Carolina’s health insurance market is relatively competitive, with a good mix of insurers offering a range of plans. The state’s average premiums for individual and family plans are slightly lower than the national average. However, the availability of plans and coverage options may vary depending on the region within the state.