Life Insurance Best Companies

Life insurance is an essential financial tool that provides peace of mind and security to individuals and their families. With numerous companies offering life insurance policies, choosing the right provider can be a daunting task. In this comprehensive guide, we delve into the world of life insurance, exploring the top companies, their unique offerings, and the key factors to consider when making your selection. By the end of this article, you'll have a clear understanding of the best life insurance companies and be equipped to make an informed decision that aligns with your specific needs.

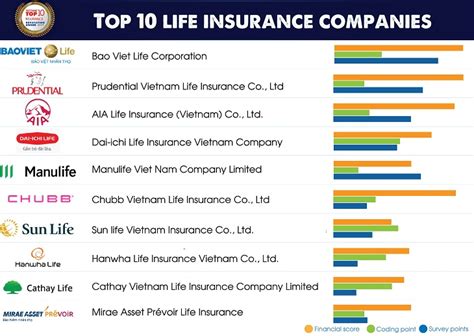

The Top Life Insurance Companies: A Comprehensive Overview

When it comes to choosing a life insurance company, several factors come into play, including financial stability, policy options, customer satisfaction, and overall reputation. Let’s explore some of the industry leaders and their standout features.

Prudential

Prudential, a well-established name in the insurance industry, boasts a strong financial foundation and a rich history dating back to 1875. With an A++ rating from AM Best, Prudential stands out for its comprehensive range of life insurance products, including term, whole life, and universal life policies. The company offers flexible plans that cater to various life stages and financial goals. Prudential’s customer-centric approach and robust online resources make it a top choice for those seeking convenience and reliability.

| Key Features | Prudential |

|---|---|

| Financial Strength | A++ (AM Best) |

| Policy Options | Term, Whole Life, Universal Life |

| Customer Service | Excellent, with online tools and resources |

New York Life

New York Life, founded in 1845, is another stalwart in the life insurance industry. With a strong focus on long-term financial security, the company offers a diverse range of life insurance products, including term, universal, and indexed universal life policies. New York Life’s policies are known for their competitive pricing and flexibility, allowing policyholders to tailor their coverage to their unique circumstances. The company’s commitment to community and its strong financial performance make it a reliable choice.

| Key Highlights | New York Life |

|---|---|

| Financial Stability | A++ (AM Best) |

| Policy Flexibility | Customizable term and permanent life insurance |

| Community Involvement | Active in various charitable initiatives |

State Farm

State Farm is a prominent player in the insurance market, offering a comprehensive suite of insurance products, including life insurance. Known for its exceptional customer service and community involvement, State Farm provides term and permanent life insurance policies. The company’s strength lies in its local agents who offer personalized guidance and support. State Farm’s competitive rates and extensive network of agents make it a popular choice for those seeking a personalized insurance experience.

| State Farm's Advantages | |

|---|---|

| Local Agent Support | Personalized guidance and assistance |

| Financial Strength | A++ (AM Best) |

| Policy Options | Term and permanent life insurance |

Northwestern Mutual

Northwestern Mutual, with its long-standing history dating back to 1857, is renowned for its financial strength and personalized approach to life insurance. The company offers a range of life insurance products, including term, whole life, and variable universal life policies. Northwestern Mutual’s advisors work closely with clients to develop tailored financial plans, ensuring that their life insurance coverage aligns with their specific goals. The company’s strong financial performance and commitment to long-term relationships make it a trusted partner for many.

| Northwestern Mutual's Strengths | |

|---|---|

| Financial Stability | A++ (AM Best) |

| Personalized Financial Planning | Tailored advice and strategies |

| Policy Flexibility | Term, whole life, and variable universal life options |

MassMutual

MassMutual, short for Massachusetts Mutual Life Insurance Company, is a leading provider of life insurance and financial services. The company offers a comprehensive range of life insurance products, including term, whole life, and variable universal life policies. MassMutual’s focus on long-term financial security and retirement planning sets it apart. With a strong financial foundation and a commitment to community involvement, MassMutual is a trusted partner for those seeking comprehensive financial solutions.

| MassMutual's Key Offerings | |

|---|---|

| Financial Strength | A++ (AM Best) |

| Policy Options | Term, whole life, and variable universal life |

| Retirement Planning | Comprehensive retirement solutions |

Factors to Consider When Choosing a Life Insurance Company

While the above companies are leaders in the industry, it’s essential to evaluate your specific needs and preferences when selecting a life insurance provider. Here are some key factors to consider:

- Financial Strength: Look for companies with a strong financial rating, indicating their ability to pay out claims.

- Policy Options: Assess the range of policies offered, ensuring they align with your short-term and long-term goals.

- Customer Service: Evaluate the company's reputation for customer satisfaction and ease of doing business.

- Price and Coverage: Compare prices and coverage amounts to find the best value for your needs.

- Personalized Approach: Consider companies that offer tailored financial planning and guidance.

The Future of Life Insurance

The life insurance industry is evolving, with a growing focus on digital platforms and personalized experiences. Companies are leveraging technology to streamline the application process and offer more tailored coverage options. Additionally, the rise of wellness-based insurance policies and the integration of health data are shaping the future of life insurance, providing policyholders with incentives for healthy lifestyles.

What is the average cost of life insurance?

+The cost of life insurance varies based on factors like age, health, and the type of policy. On average, a 30-year-old non-smoker can expect to pay around 25-30 per month for a $500,000 term life policy.

Can I get life insurance with a pre-existing condition?

+Yes, many life insurance companies offer policies for individuals with pre-existing conditions. However, the coverage and pricing may be impacted, so it’s essential to disclose all relevant health information during the application process.

How do I choose the right amount of coverage?

+The right amount of coverage depends on your financial goals and the needs of your beneficiaries. A general rule of thumb is to aim for 10-15 times your annual income. However, factors like outstanding debts and future financial goals should also be considered.