How Much Of Life Insurance Do I Need

Life insurance is a vital financial tool that provides security and peace of mind to individuals and their loved ones. Determining the appropriate amount of life insurance coverage is a crucial decision that requires careful consideration of various factors. In this comprehensive guide, we will delve into the intricacies of life insurance, explore the factors influencing coverage needs, and offer expert insights to help you make an informed choice.

Understanding Life Insurance and Its Importance

Life insurance is a contract between an individual (the policyholder) and an insurance company. The policyholder pays a premium, typically on a monthly or annual basis, and in return, the insurance company agrees to provide a financial benefit to the designated beneficiaries upon the policyholder’s death. This benefit, known as the death benefit, can be a vital source of financial support for families, helping them cover various expenses and maintain their standard of living.

The primary purpose of life insurance is to ensure that your loved ones are protected financially in the event of your untimely demise. It can provide them with the means to pay off debts, cover funeral expenses, maintain their current lifestyle, and pursue future goals without the added burden of financial strain. Life insurance is especially crucial for those with financial dependents, such as spouses, children, or aging parents, as it can offer them a safety net during a challenging time.

Factors Influencing Life Insurance Coverage Needs

The amount of life insurance coverage you require is unique to your individual circumstances and financial goals. Several key factors come into play when determining the appropriate coverage amount:

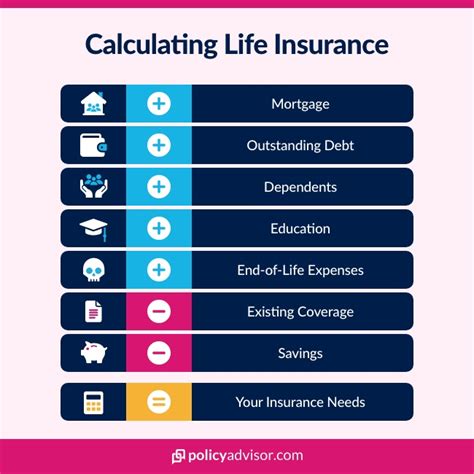

Financial Dependents and Liabilities

One of the primary considerations is the number and nature of your financial dependents. If you have a spouse, children, or other individuals who rely on your income, their financial needs should be a top priority when calculating coverage. The coverage amount should be sufficient to replace your income for a significant period, allowing your dependents to maintain their current lifestyle and meet their financial obligations.

Additionally, you should take into account any outstanding debts or liabilities, such as mortgages, loans, or credit card balances. The life insurance coverage should be adequate to pay off these debts, ensuring that your loved ones are not burdened with financial obligations after your passing.

Future Financial Goals

Life insurance can also play a crucial role in helping your family achieve future financial goals. Consider the expenses associated with your children’s education, such as tuition fees, books, and living expenses. The coverage amount should be enough to cover these costs, ensuring your children’s educational aspirations are not compromised.

Moreover, if you have long-term financial goals, such as saving for retirement or building a nest egg for your family's future, life insurance can provide the necessary funds to continue pursuing these goals even in your absence. It can act as a financial cushion, ensuring that your family's future plans remain on track.

Inflation and Cost of Living Adjustments

When determining the coverage amount, it’s essential to consider the impact of inflation and the rising cost of living. Over time, the value of money decreases, and the cost of goods and services increases. To ensure that the life insurance benefit remains adequate, it’s advisable to factor in inflation and choose a coverage amount that accounts for future price increases.

Many life insurance policies offer cost of living adjustments (COLAs), which automatically increase the death benefit to keep pace with inflation. This feature ensures that the coverage amount remains relevant and provides sufficient financial protection over the policy's term.

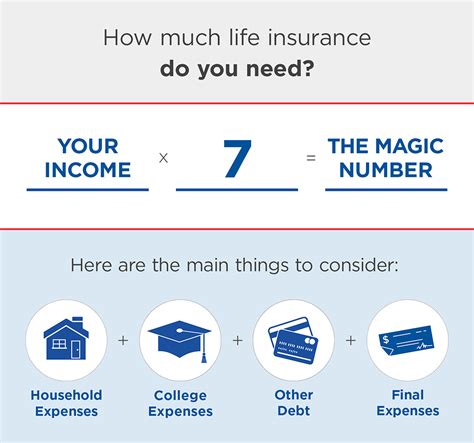

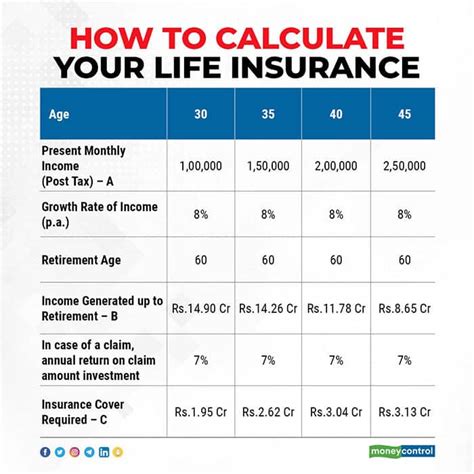

Income Replacement and Time Horizon

Life insurance is often used to replace a significant portion of the policyholder’s income. The coverage amount should be sufficient to replace your income for a specific time horizon, taking into account your dependents’ needs and financial goals. For example, if you have young children, you may require coverage that extends until they reach adulthood and become financially independent.

Consider your current income, the potential for future income growth, and the time it would take for your dependents to become self-sufficient. This analysis will help you determine the appropriate coverage amount and the length of time for which the coverage should be in place.

Expert Insights and Strategies

Determining the right amount of life insurance coverage requires a thoughtful approach and expert guidance. Here are some valuable insights and strategies to help you make an informed decision:

Seek Professional Advice

Consulting with a qualified financial advisor or insurance professional can provide invaluable guidance tailored to your specific circumstances. They can help you assess your financial situation, identify your coverage needs, and recommend appropriate life insurance options.

Consider Term Life Insurance

Term life insurance is a popular and cost-effective option for individuals seeking coverage for a specific period. It offers a fixed death benefit for a predetermined term, typically ranging from 10 to 30 years. Term life insurance is ideal for individuals with temporary financial obligations, such as young families with dependent children or those with significant debts.

The advantage of term life insurance is its affordability, making it accessible to a broader range of individuals. It provides essential financial protection during critical stages of life without incurring high premiums. However, it's essential to review and potentially renew the policy as your financial situation and needs evolve.

Evaluate Your Needs Periodically

Life insurance coverage should be a dynamic aspect of your financial plan, subject to regular review and adjustment. As your life circumstances change, such as the birth of a child, purchasing a new home, or achieving significant financial milestones, your coverage needs may also change.

Periodically evaluate your life insurance coverage to ensure it remains adequate and aligned with your current financial situation. Consider updating your coverage amount, policy type, or beneficiaries as necessary to maintain optimal protection.

Explore Permanent Life Insurance Options

Permanent life insurance, such as whole life or universal life insurance, offers lifelong coverage and typically includes a cash value component. While permanent life insurance tends to be more expensive than term life insurance, it provides long-term financial protection and can be a valuable asset for individuals with specific financial goals.

The cash value component of permanent life insurance grows over time and can be accessed through policy loans or withdrawals. This feature makes permanent life insurance a flexible financial tool, providing both death benefit protection and potential investment opportunities.

Utilize Online Tools and Calculators

Numerous online resources and calculators are available to help you estimate your life insurance coverage needs. These tools consider factors such as your income, debts, financial goals, and dependents to provide a rough estimate of the coverage amount you may require. While these tools offer a starting point, it’s essential to consult with a professional for a more accurate assessment.

Real-World Examples and Case Studies

To illustrate the importance and impact of life insurance, let’s explore some real-world examples and case studies:

Case Study: The Smith Family

The Smith family consists of John and Jane, both in their early 30s, with two young children. John is the primary breadwinner, earning 80,000 annually, while Jane works part-time, contributing an additional 20,000 to the family’s income. They have a mortgage of 300,000 and a combined credit card debt of 15,000.

Upon evaluating their financial situation, the Smiths determined that John's life insurance coverage should be sufficient to replace his income for at least 10 years. This would provide Jane with the means to cover the mortgage payments, pay off debts, and maintain the children's education and living expenses. They opted for a term life insurance policy with a coverage amount of $1 million, ensuring financial security for their family in the event of John's untimely demise.

Case Study: The Johnson Family

The Johnson family, consisting of Michael and Sarah, has a unique financial situation. Michael, aged 45, is the sole breadwinner, earning 120,000 annually. They have a mortgage of 400,000 and a significant amount of savings and investments. Their two children are teenagers and nearly self-sufficient.

Given their financial stability and the children's impending independence, the Johnsons opted for a smaller term life insurance policy with a coverage amount of $500,000. This policy provides sufficient financial protection to cover their mortgage and any remaining debts, ensuring that Sarah can maintain her current lifestyle and continue pursuing her financial goals.

Performance Analysis and Industry Trends

The life insurance industry is dynamic, and staying informed about its performance and trends is essential for making informed decisions. Here’s an overview of the current landscape and future prospects:

Industry Growth and Innovation

The life insurance industry has experienced steady growth in recent years, with increasing awareness and demand for financial protection. Insurers have adapted to changing consumer needs, offering a wider range of products and services to cater to diverse financial situations.

Innovations in technology have also transformed the industry, with online platforms and digital tools making it easier for individuals to compare policies, obtain quotes, and manage their life insurance portfolios. These advancements have enhanced accessibility and convenience, attracting a broader range of consumers.

Changing Demographics and Financial Needs

Shifts in demographics and societal trends have influenced the demand for life insurance. The aging population and increasing life expectancy have led to a growing need for long-term financial protection. Additionally, changing family structures and the rise of single-parent households have highlighted the importance of life insurance for individuals with sole financial responsibility.

Focus on Financial Education

The life insurance industry recognizes the importance of financial literacy and education. Many insurers and financial institutions have launched initiatives to raise awareness about the benefits of life insurance and its role in financial planning. These efforts aim to empower individuals to make informed choices and take control of their financial futures.

Adapting to Economic Challenges

Economic downturns and market fluctuations can impact the life insurance industry. During times of financial uncertainty, the demand for life insurance may increase as individuals seek to protect their loved ones from potential financial hardships. Insurers must adapt their strategies to meet these changing needs and provide flexible solutions that offer both financial protection and peace of mind.

Future Implications and Conclusion

Life insurance is an essential component of comprehensive financial planning, offering individuals and their families a vital safety net during challenging times. As we’ve explored in this guide, determining the appropriate amount of life insurance coverage requires a thoughtful analysis of your unique circumstances and financial goals.

By considering factors such as financial dependents, liabilities, future financial goals, and the impact of inflation, you can make an informed decision about the coverage amount that best suits your needs. Consulting with financial advisors and exploring a range of life insurance options, from term policies to permanent coverage, will help you tailor your protection to your specific circumstances.

The life insurance industry continues to evolve, adapting to changing demographics, economic landscapes, and consumer needs. As individuals become more financially literate and aware of the benefits of life insurance, the industry is poised for continued growth and innovation. By staying informed and seeking expert guidance, you can navigate the complex world of life insurance with confidence, ensuring that your loved ones are financially protected for years to come.

What happens if I overestimate my life insurance needs?

+

Overestimating your life insurance needs may result in higher premiums. However, it’s generally better to have more coverage than you need than to have insufficient protection. You can always adjust your coverage later if your financial situation changes.

Can I have multiple life insurance policies?

+

Yes, you can have multiple life insurance policies from different insurers. This can be beneficial if you have specific financial goals or if you want to diversify your coverage. However, it’s important to ensure that your total coverage amount is appropriate for your needs.

How often should I review my life insurance coverage?

+

It’s recommended to review your life insurance coverage periodically, ideally every few years or whenever there are significant changes in your life, such as marriage, birth of a child, purchasing a new home, or changes in income or financial obligations.

What if I have pre-existing health conditions?

+

Pre-existing health conditions may impact your life insurance options and premiums. It’s important to disclose any health conditions accurately during the application process. Some insurers offer specialized policies for individuals with pre-existing conditions, so it’s worth exploring these options.

Can I cancel my life insurance policy if I no longer need it?

+

Yes, you can cancel your life insurance policy at any time. However, it’s important to consider the implications, as you may lose the coverage and any accumulated cash value. It’s advisable to consult with a financial advisor before making any decisions to ensure you fully understand the consequences.