Whole Vs. Term Life Insurance Comparison

When it comes to financial planning and ensuring the security of your loved ones, understanding the differences between whole life and term life insurance is crucial. These two types of life insurance policies offer distinct advantages and cater to different needs and life stages. In this comprehensive guide, we delve into the nuances of whole life and term life insurance, helping you make an informed decision that aligns with your unique circumstances.

Whole Life Insurance: A Lifetime of Protection

Whole life insurance, also known as permanent life insurance, is a comprehensive financial tool designed to provide coverage throughout your entire life. It offers more than just a death benefit; it serves as a long-term investment and savings vehicle. Here's a closer look at the key features and benefits of whole life insurance:

Guaranteed Coverage for Life

The defining characteristic of whole life insurance is its permanence. Once you purchase a policy, it remains in force as long as you continue to pay the premiums. This means that regardless of your age or health status, your beneficiaries will receive the full death benefit upon your passing.

| Key Feature | Description |

|---|---|

| Lifetime Coverage | Whole life insurance provides coverage until the insured's death, offering peace of mind for your loved ones. |

| Level Premiums | Premiums remain fixed throughout the policy, providing budget stability and predictability. |

| Cash Value Accumulation | A portion of your premiums is invested, building cash value over time, which can be borrowed against or used for various financial needs. |

Cash Value Accumulation

One of the most appealing aspects of whole life insurance is its cash value accumulation feature. A portion of your premiums is invested in a tax-deferred manner, allowing your cash value to grow over time. This accumulated cash value can serve multiple purposes:

- Policy Loan: You can borrow against the cash value to meet financial obligations without affecting your coverage.

- Premium Payment: In certain cases, you can use the cash value to pay for your premiums, providing flexibility during financial hardships.

- Retirement Funding: The cash value can be a valuable asset for retirement planning, offering a lump sum or annuity payments.

Tax Advantages

Whole life insurance policies offer tax benefits that make them an attractive financial instrument. The cash value within the policy grows tax-free, and any loans taken against it are tax-free as well. Additionally, if you surrender the policy, the cash value is taxed at capital gains rates, which are often more favorable than ordinary income tax rates.

Guaranteed Death Benefit

Whole life insurance provides a guaranteed death benefit, ensuring that your beneficiaries receive the full amount stated in the policy, regardless of market fluctuations or other external factors. This provides a solid foundation for your loved ones' financial security.

Term Life Insurance: Temporary Protection, Long-Term Benefits

Term life insurance, on the other hand, offers a more focused and cost-effective solution for individuals seeking coverage during specific life stages or for a defined period. Here's an in-depth look at term life insurance and its advantages:

Affordable Protection for a Specific Term

Term life insurance policies are designed to provide coverage for a specified period, typically ranging from 10 to 30 years. During this term, the policy pays out a death benefit to your beneficiaries if you pass away. The key attraction of term life insurance is its affordability, making it an accessible option for many individuals and families.

| Key Feature | Description |

|---|---|

| Affordable Premiums | Term life insurance offers lower premiums compared to whole life, making it an attractive choice for those on a budget. |

| Flexibility | You can choose the term length that aligns with your financial goals and life stage, such as covering mortgage payments or children's education. |

| Renewal Options | Many term policies offer the option to renew or convert to a permanent policy, providing flexibility as your needs evolve. |

Covers Major Life Events

Term life insurance is particularly useful for covering significant life events and financial responsibilities. For example, if you have young children or are paying off a mortgage, term life insurance can ensure that your loved ones are financially protected during these critical years. Once these obligations are fulfilled, you can reassess your insurance needs.

No Cash Value

Unlike whole life insurance, term life policies do not accumulate cash value. This means that the premiums you pay are solely for the death benefit coverage. While this lack of cash value accumulation might seem like a drawback, it also makes term life insurance more affordable and straightforward.

Renewal and Conversion Options

Many term life insurance policies offer the flexibility to renew or convert to a permanent policy at the end of the term. This allows you to extend your coverage or transition to a whole life policy if your financial situation changes or you want to maintain coverage for the long term.

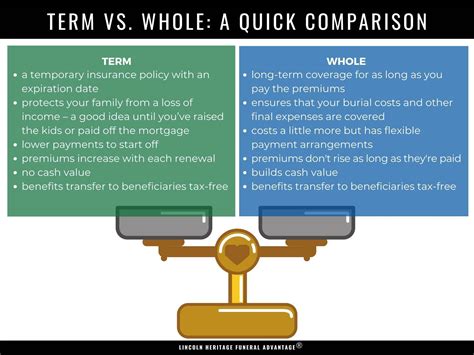

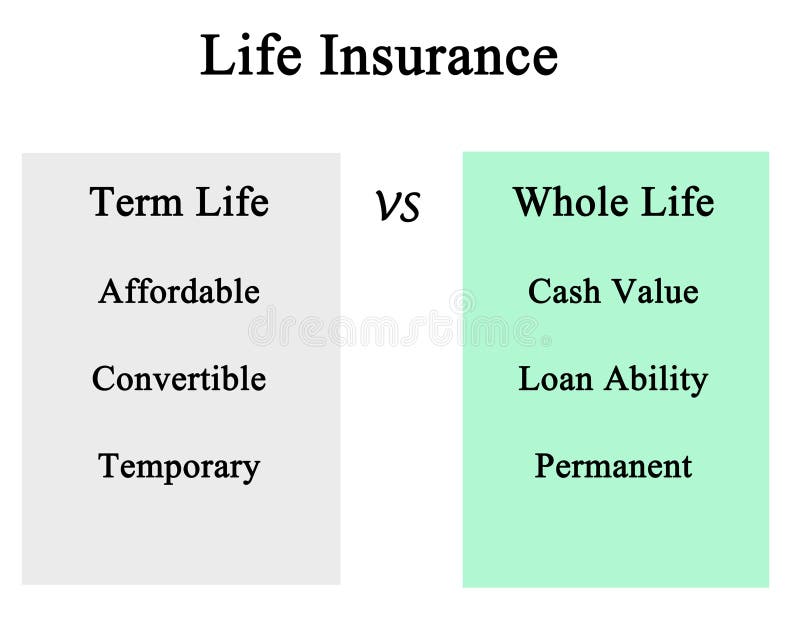

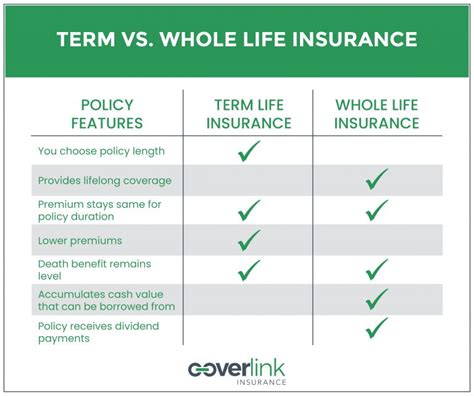

Comparing Whole and Term Life Insurance

Choosing between whole and term life insurance depends on your unique financial situation, goals, and stage of life. Here's a comparison of the key differences to help you make an informed decision:

| Whole Life Insurance | Term Life Insurance | |

|---|---|---|

| Coverage | Lifetime coverage | Coverage for a specified term |

| Premiums | Higher, fixed premiums | Lower, often level premiums |

| Cash Value | Accumulates cash value | No cash value accumulation |

| Flexibility | Provides stability and long-term planning | Flexible, tailored to specific needs |

| Cost-Effectiveness | More expensive over time | Affordable for short-term coverage |

| Renewal/Conversion | Non-renewable | Renewal or conversion options available |

When to Choose Whole Life Insurance

Whole life insurance is an excellent choice if you're seeking long-term financial protection and stability. It's ideal for:

- Individuals who want guaranteed coverage for life.

- Those who wish to build a substantial cash value asset over time.

- People with complex financial needs or high-net-worth individuals seeking tax-efficient wealth accumulation.

When to Opt for Term Life Insurance

Term life insurance is a smart choice when you have specific, time-limited financial responsibilities. It's suitable for:

- Young families looking to protect their loved ones during their earning years.

- Individuals paying off a mortgage or other large debts.

- Those who want affordable coverage for a defined period.

FAQs

Can I switch from term life to whole life insurance later in life?

+Yes, many term life insurance policies offer conversion options, allowing you to convert your term policy into a whole life policy without a medical exam. This provides flexibility as your financial needs evolve.

Is whole life insurance a good investment option?

+Whole life insurance can be a sound investment due to its guaranteed cash value accumulation and tax benefits. However, it's essential to consider your financial goals and consult with a financial advisor to determine if it aligns with your investment strategy.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage ends, and you will no longer have the death benefit protection. However, you can explore renewal or conversion options to extend your coverage.

Can I borrow against the cash value of my whole life insurance policy?

+Yes, one of the advantages of whole life insurance is the ability to borrow against the accumulated cash value. This can provide financial flexibility during times of need, but it's important to understand the terms and potential impact on your policy.

Are there any age restrictions for purchasing whole life insurance?

+While there may be age limits for purchasing whole life insurance, these restrictions vary by insurer and policy. It's advisable to explore options and compare policies to find one that suits your needs and preferences.

In conclusion, both whole life and term life insurance have their unique advantages and cater to different financial needs. Understanding your specific circumstances and consulting with a financial advisor can help you make the right choice to protect your loved ones and secure your financial future.