Which Medical Insurance Is Best

The Complex Landscape of Medical Insurance: A Comprehensive Guide

In today's healthcare system, navigating the world of medical insurance is crucial for ensuring access to quality medical care. With a myriad of options available, choosing the right medical insurance plan can be a daunting task. This comprehensive guide aims to shed light on the key aspects of medical insurance, helping you make an informed decision that aligns with your unique healthcare needs and financial situation.

Understanding Medical Insurance: A Necessary Investment

Medical insurance, often referred to as health insurance, is a vital component of modern healthcare. It provides financial protection against the high costs of medical treatments, hospitalizations, and other healthcare services. In an era where medical advancements and treatments can be costly, having adequate medical insurance is not just a luxury but a necessity.

The primary objective of medical insurance is to safeguard individuals and families from the financial burden of unexpected medical emergencies. By paying regular premiums, policyholders gain access to a network of healthcare providers, ensuring they receive the care they need without incurring overwhelming out-of-pocket expenses.

Types of Medical Insurance: Navigating the Options

The medical insurance landscape is diverse, offering various types of plans to cater to different needs and preferences. Understanding these options is crucial for making an informed choice.

Private Medical Insurance

Private medical insurance, also known as individual or family health insurance, is a popular choice for those seeking comprehensive coverage. These plans are purchased directly from insurance companies and offer a wide range of benefits, including coverage for hospital stays, specialist consultations, and often, access to exclusive healthcare facilities.

Private insurance plans are customizable, allowing individuals to choose the level of coverage they require. Some plans may focus on specific areas such as dental or vision care, while others offer more comprehensive coverage for a broader range of medical services.

| Benefits | Considerations |

|---|---|

| Flexible coverage options | Typically more expensive than public plans |

| Access to exclusive healthcare facilities | May have restrictions on pre-existing conditions |

| Comprehensive coverage for various treatments | Requires careful plan selection to avoid gaps in coverage |

Public Medical Insurance

Public medical insurance, such as government-sponsored plans or social health insurance, is often more affordable and widely accessible. These plans are typically funded through taxes or social contributions, making them a cost-effective option for many individuals and families.

Public insurance plans often have a broader reach, covering a larger portion of the population. They provide essential healthcare services, including primary care, emergency treatments, and sometimes specialized care. However, the level of coverage and access to certain treatments may vary depending on the specific plan and the country's healthcare system.

| Benefits | Considerations |

|---|---|

| Affordable premiums | May have longer wait times for certain treatments |

| Widely accessible | Limited coverage compared to private plans |

| Essential healthcare services covered | Potential restrictions on choice of healthcare providers |

Employer-Provided Medical Insurance

Many individuals receive medical insurance coverage through their employers. Employer-provided plans are a significant benefit offered by companies to attract and retain talented employees. These plans are often group policies, which can lead to cost savings due to the larger pool of insured individuals.

Employer-provided insurance plans vary widely, and the level of coverage depends on the specific employer and the type of plan they offer. Some plans may cover only basic healthcare needs, while others provide more comprehensive coverage, including dental and vision benefits.

| Benefits | Considerations |

|---|---|

| Cost-effective due to group coverage | Coverage may be limited to the employee and their family |

| Convenient and often comprehensive | May not be portable if employment changes |

| Potential for additional benefits like dental or vision care | Plan options may be restricted to a few choices |

Factors to Consider When Choosing Medical Insurance

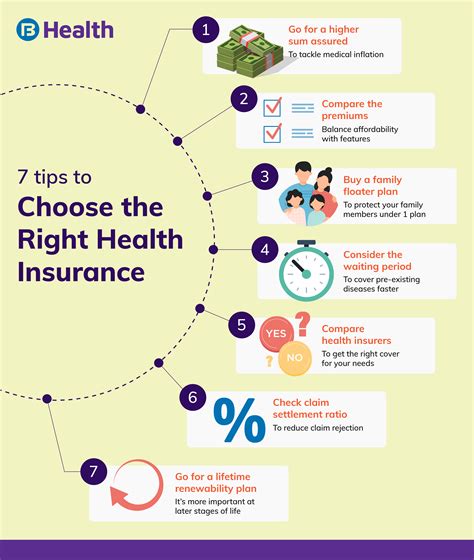

Selecting the best medical insurance plan involves careful consideration of several factors. Here are some key aspects to evaluate:

Coverage and Benefits

The coverage and benefits offered by a medical insurance plan are crucial. Consider the specific healthcare services you or your family may require, such as hospital stays, specialist consultations, prescription drugs, mental health services, and preventive care. Ensure the plan covers these essential services adequately.

Premiums and Deductibles

Premiums are the regular payments made to maintain insurance coverage, while deductibles are the out-of-pocket expenses you pay before the insurance coverage kicks in. Balance the cost of premiums with the deductibles to find a plan that aligns with your budget and healthcare needs.

Network of Healthcare Providers

Medical insurance plans often have networks of preferred healthcare providers. Check if your preferred doctors, hospitals, and specialists are included in the plan's network. If not, you may incur higher out-of-pocket costs or have limited access to certain treatments.

Pre-Existing Conditions

If you or a family member have pre-existing medical conditions, it's essential to choose a plan that provides coverage for these conditions. Some plans may have waiting periods or exclusions for certain pre-existing conditions, so review the policy carefully to understand the coverage limitations.

Portability and Flexibility

Consider the portability of the insurance plan, especially if you anticipate career changes or relocations. Some plans may be more flexible and allow you to continue coverage even if you change jobs or move to a different area.

Customer Service and Claims Process

The quality of customer service and the ease of the claims process are crucial. Choose a plan with a reputable insurance company that provides efficient and responsive customer support. A straightforward claims process can save you time and hassle during medical emergencies.

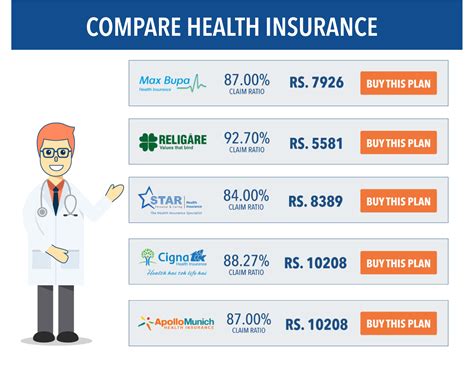

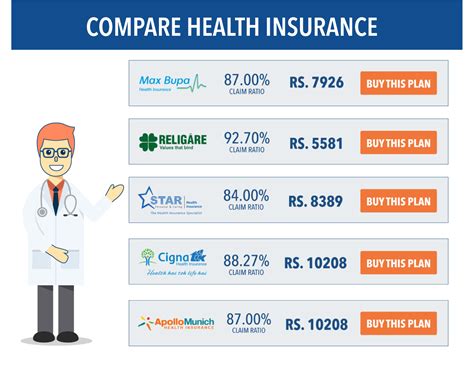

Evaluating the Best Medical Insurance Plans

With a clear understanding of the different types of medical insurance and the factors to consider, you can now evaluate the best plans for your needs. Here's a comparative analysis of three popular medical insurance plans:

Plan A: Comprehensive Care Plan

The Comprehensive Care Plan is a private medical insurance option designed for those seeking extensive coverage. It offers a wide range of benefits, including:

- Hospitalization coverage with no room and board limits

- Specialist consultations with no referral requirements

- Comprehensive dental and vision care

- Mental health services with unlimited sessions

- Preventive care, including annual check-ups and screenings

This plan has a slightly higher premium compared to other options but provides extensive coverage for a wide range of healthcare needs. It is ideal for individuals and families who prioritize comprehensive care and want minimal out-of-pocket expenses.

Plan B: Value-for-Money Option

Plan B is a public medical insurance plan known for its affordability and accessibility. It covers essential healthcare services, such as:

- Hospital stays with basic room and board

- Access to primary care physicians

- Emergency treatments

- Limited specialist consultations

- Prescription drug coverage

While the coverage is more limited compared to private plans, Plan B offers an affordable option for those on a budget. It provides a safety net for essential healthcare needs and can be a great choice for individuals or families with fewer complex healthcare requirements.

Plan C: Employer-Provided Group Plan

Plan C is an employer-provided medical insurance plan, offering a balance of coverage and cost-effectiveness. Here's what it includes:

- Hospitalization coverage with moderate room and board limits

- Access to a network of preferred healthcare providers

- Dental and vision benefits with annual limits

- Prescription drug coverage

- Limited mental health services

Plan C is a convenient option for employees, as it often comes at a discounted rate due to group coverage. It provides a good level of coverage for a range of healthcare needs, making it a popular choice for many working professionals.

Expert Insights and Tips

Choosing the right medical insurance plan is a critical decision that requires careful consideration. Here are some expert insights and tips to help you make an informed choice:

Understand the fine print of your insurance policy. Read through the terms and conditions carefully to avoid any surprises or gaps in coverage. Pay attention to exclusions, waiting periods, and any limitations on pre-existing conditions.

Compare multiple plans to find the best fit. Look beyond just the premiums and consider the overall value, including coverage, network of providers, and customer service. Online comparison tools can be helpful in evaluating various options.

If you have specific healthcare needs, such as ongoing treatments or complex medical conditions, consult with a healthcare professional or insurance advisor. They can provide personalized advice and help you choose a plan that meets your unique requirements.

Remember, medical insurance is a long-term investment in your health and financial well-being. Take the time to research and choose a plan that provides peace of mind and access to quality healthcare.

FAQs

What is the difference between private and public medical insurance?

+Private medical insurance is purchased directly from insurance companies and offers customizable coverage options. It often provides access to exclusive healthcare facilities and more comprehensive benefits. Public medical insurance, on the other hand, is typically funded through taxes or social contributions and offers essential healthcare services to a wider population. It may have more limited coverage but is often more affordable.

Can I switch medical insurance plans if I’m not satisfied with my current coverage?

+Yes, you have the option to switch medical insurance plans. However, it’s important to review the terms and conditions of your current plan, as some policies may have restrictions or penalties for early termination. Additionally, consider the open enrollment periods or special enrollment events offered by insurance providers to ensure a smooth transition to a new plan.

How do I know if a medical insurance plan covers my pre-existing condition?

+When evaluating medical insurance plans, carefully review the policy documents to understand the coverage for pre-existing conditions. Some plans may have waiting periods or exclusions for certain conditions. If you have specific concerns, consult with the insurance provider or an insurance advisor to clarify the coverage and any potential limitations.

Are there any government programs or subsidies available to help with medical insurance costs?

+Yes, many countries offer government programs or subsidies to assist with medical insurance costs. These programs vary depending on the country and your eligibility criteria. It’s worth researching and reaching out to local healthcare authorities or insurance providers to explore the available options and potential financial support.

Can I have multiple medical insurance plans to maximize coverage?

+In some cases, it is possible to have multiple medical insurance plans. This can be beneficial if you want to combine the coverage and benefits of different plans to meet your specific healthcare needs. However, it’s important to understand how the plans interact and coordinate benefits to avoid any gaps or duplications in coverage.