Paypermile Car Insurance

In the ever-evolving world of insurance, innovative models are constantly being introduced to meet the diverse needs of consumers. Among these, Pay-Per-Mile car insurance has emerged as a revolutionary concept, offering a fresh approach to traditional insurance plans. This model, designed to align with the modern realities of driving, is transforming the way we perceive and manage car insurance.

With the rise of ride-sharing, electric vehicles, and sustainable transportation, the traditional mileage-based insurance model is facing challenges. Pay-Per-Mile insurance steps in to provide a more flexible and cost-effective solution, catering to the varying driving habits of individuals. It offers an attractive alternative for those who drive less frequently, providing financial savings and personalized coverage.

Understanding Pay-Per-Mile Car Insurance

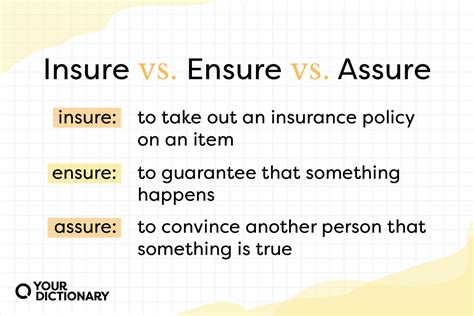

Pay-Per-Mile car insurance, as the name suggests, is a policy where the premium is calculated based on the actual miles driven by the insured vehicle. This model diverges from the traditional annual mileage estimate, which often leads to overpaying for insurance, especially for low-mileage drivers.

The concept is straightforward: the more you drive, the more you pay. However, this simplicity masks a sophisticated system designed to offer accurate and fair pricing. Pay-Per-Mile insurance providers utilize advanced technology to track mileage, ensuring precise billing. This technology, often in the form of a small device or an app, records and reports the vehicle's mileage, forming the basis for the insurance premium.

How It Works

When opting for Pay-Per-Mile insurance, the process typically involves the following steps:

- Enrollment: Customers provide basic vehicle and driver information, including the make, model, and registration details of their vehicle.

- Device Installation or App Setup: The insurance provider supplies a small device or an app that connects to the vehicle's onboard diagnostics (OBD-II) port. This device or app tracks the vehicle's mileage accurately.

- Mileage Reporting: The device or app sends regular mileage updates to the insurance provider. This data is used to calculate the premium, which is typically charged monthly or annually.

- Billing: The insured is billed based on the reported mileage. The rate per mile is predetermined and agreed upon at the time of enrollment.

One of the key advantages of this model is its flexibility. For instance, if you know you'll be driving less due to a planned trip or a change in work schedule, you can anticipate lower insurance costs for that period.

Benefits of Pay-Per-Mile Insurance

The benefits of Pay-Per-Mile insurance are multifaceted and offer significant advantages to both the insurer and the insured.

Cost Savings for Low-Mileage Drivers

One of the most significant advantages is the potential for substantial cost savings, particularly for drivers who clock fewer miles annually. Traditional insurance plans often charge a flat rate, regardless of the actual miles driven, leading to overpayment for those who drive less. With Pay-Per-Mile insurance, you pay only for the miles you drive, making it an attractive option for low-mileage drivers.

Flexibility and Customization

This model offers a high degree of flexibility, allowing drivers to tailor their insurance coverage to their specific needs. For instance, if you plan to take a road trip or need to drive more frequently for a short period, you can adjust your coverage accordingly. This level of customization ensures that you’re not paying for coverage you don’t need.

Encouraging Eco-Friendly Practices

Pay-Per-Mile insurance also aligns with the growing trend of sustainable transportation. By incentivizing drivers to reduce their mileage, this model indirectly encourages eco-friendly practices, contributing to a greener and more sustainable future.

Accurate and Fair Pricing

With advanced mileage tracking technology, Pay-Per-Mile insurance ensures accurate and fair pricing. The use of real-time data eliminates the guesswork associated with traditional insurance models, providing a transparent and reliable pricing structure.

Challenges and Considerations

While Pay-Per-Mile insurance offers numerous benefits, it also presents certain challenges and considerations that potential users should be aware of.

Technology Dependence

The accuracy of Pay-Per-Mile insurance heavily relies on the technology used for mileage tracking. Any malfunction or inaccuracy in the device or app can lead to incorrect billing, which may cause frustration and disputes.

Privacy Concerns

The use of tracking devices or apps raises legitimate privacy concerns. While insurance providers assure data protection, the potential for misuse or unauthorized access to personal driving data is a valid worry for many consumers.

Increased Administrative Costs

The dynamic nature of Pay-Per-Mile insurance, with its frequent billing and adjustments, can lead to higher administrative costs for insurers. These costs may be passed on to the consumers, affecting the overall affordability of the plan.

Performance Analysis and Consumer Feedback

Pay-Per-Mile insurance has gained traction among consumers, especially those who embrace innovative solutions and appreciate the flexibility and cost savings it offers. Positive feedback highlights the accuracy and fairness of the pricing structure, with many users reporting significant savings compared to traditional insurance plans.

However, not all reviews are positive. Some consumers have expressed concerns about the reliability of the tracking technology, citing instances of incorrect mileage readings. Others have voiced privacy-related apprehensions, emphasizing the need for robust data protection measures.

| Consumer Feedback | Rating |

|---|---|

| Cost Savings | ★★★★☆ |

| Flexibility | ★★★★★ |

| Privacy Concerns | ★★★☆☆ |

| Overall Satisfaction | ★★★★☆ |

Future Implications and Innovations

As Pay-Per-Mile insurance continues to evolve, several exciting developments and implications are on the horizon.

Integration with Autonomous Vehicles

With the advent of autonomous vehicles, Pay-Per-Mile insurance is poised to play a pivotal role. As self-driving cars become more prevalent, the insurance model can adapt to cover various scenarios, such as vehicle sharing or automated ride-hailing services.

Expansion into Other Vehicle Types

Currently, Pay-Per-Mile insurance primarily targets personal vehicles. However, there’s a growing interest in extending this model to other vehicle types, such as commercial fleets or even bicycles and motorcycles. This expansion would cater to a wider range of consumers and businesses.

Data-Driven Innovations

The wealth of data generated by Pay-Per-Mile insurance presents an opportunity for insurers to develop more sophisticated risk assessment models. By analyzing driving patterns and behaviors, insurers can offer personalized recommendations and incentives to further reduce risks and costs.

Conclusion

Pay-Per-Mile car insurance represents a significant step forward in the insurance industry, offering a modern and flexible solution to the evolving needs of drivers. While it presents challenges and considerations, its potential to revolutionize the way we perceive and manage insurance coverage is undeniable. As the model continues to evolve and gain traction, it will be interesting to see how it adapts and innovates to meet the diverse demands of the market.

How accurate is the mileage tracking in Pay-Per-Mile insurance?

+The accuracy of mileage tracking can vary depending on the technology used. While most modern devices and apps are highly accurate, there may be instances of minor discrepancies. Regular audits and quality control measures are in place to ensure the reliability of the data.

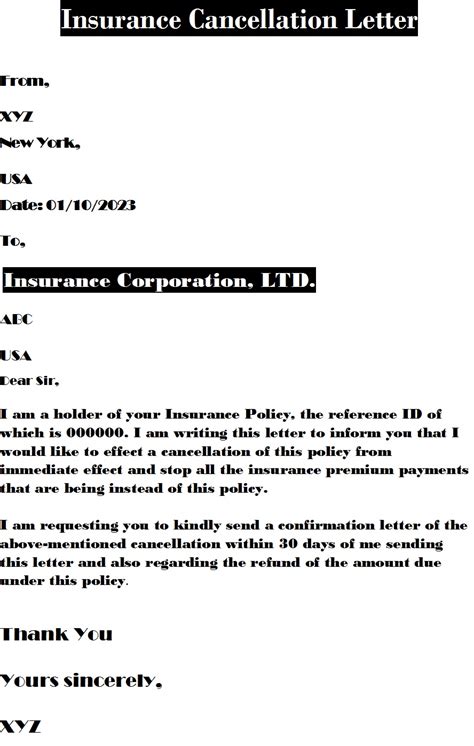

Can I switch to Pay-Per-Mile insurance mid-policy year?

+Yes, many insurers allow mid-term switches. However, the process and terms may vary. It’s advisable to check with your insurance provider for specific details and potential fees.

What happens if I drive more miles than expected in a month or year?

+If you exceed your expected mileage, you’ll be billed for the additional miles at the agreed-upon rate. Some insurers offer a buffer or grace period, while others may require an adjustment to your policy.