Insurance Comparison Websites

Welcome to a comprehensive guide on the world of insurance comparison websites. In today's digital age, these platforms have become indispensable tools for consumers seeking the best insurance deals. From car insurance to health coverage, these websites offer a one-stop solution for comparing various policies and providers. This article will delve into the intricacies of insurance comparison websites, exploring their features, benefits, and the impact they have on the insurance industry and consumer choices.

Unraveling the Insurance Comparison Website Ecosystem

Insurance comparison websites have revolutionized the way consumers shop for insurance. These online platforms aggregate insurance policies from multiple providers, allowing users to compare prices, coverage options, and other key features in one place. With just a few clicks, consumers can access a wealth of information, making the process of choosing the right insurance policy more transparent and efficient.

The ecosystem of insurance comparison websites is diverse, with various players offering different services. Some websites act as intermediaries, connecting consumers directly with insurance providers, while others function as lead generators, collecting user information and selling it to insurers. Additionally, there are niche comparison websites that focus on specific insurance types, such as travel insurance or pet insurance, providing specialized comparisons for unique needs.

The Evolution of Insurance Comparison Websites

The concept of insurance comparison websites is not new, but their evolution over the years has been remarkable. In the early days, these websites were basic, often limited to listing a few insurance providers and their contact details. However, with advancements in technology and an increasing digital presence of insurance companies, these websites have transformed into powerful tools, offering advanced features and personalized recommendations.

Today, insurance comparison websites utilize sophisticated algorithms and data analytics to provide tailored results. They collect user preferences, location data, and even historical insurance claim information to deliver precise comparisons. This level of personalization ensures that consumers receive accurate quotes and recommendations, making the decision-making process more informed and efficient.

Key Features and Benefits of Insurance Comparison Websites

Insurance comparison websites offer a multitude of features and benefits that enhance the insurance shopping experience. Here are some of the key advantages:

- Time and Cost Savings: One of the most significant advantages is the time and money consumers can save. By comparing multiple policies on a single platform, users can quickly identify the most affordable options without the need for extensive research or multiple quote requests. This efficiency not only saves time but also reduces the administrative burden associated with traditional insurance shopping.

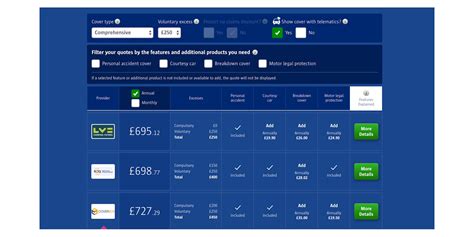

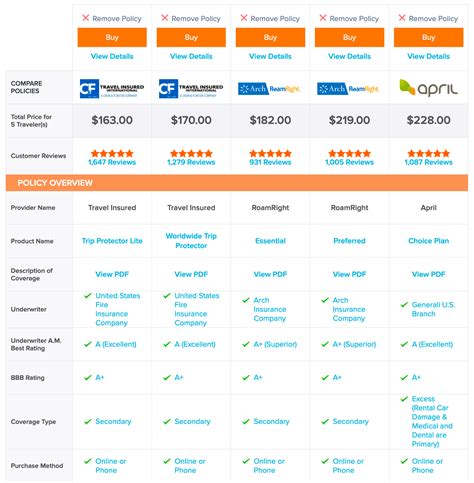

- Transparent Comparison: These websites provide a transparent platform for comparing insurance policies. Users can easily view and compare various factors, including coverage limits, deductibles, and add-on options. This transparency ensures that consumers are well-informed about the features and benefits of each policy, helping them make educated choices.

- Personalized Recommendations: Many insurance comparison websites utilize advanced algorithms to offer personalized recommendations. By considering user preferences, demographics, and historical data, these platforms can suggest policies that align with individual needs. This level of customization enhances the user experience and increases the likelihood of finding the perfect insurance coverage.

- Easy Policy Management: Some insurance comparison websites go beyond comparison and provide additional services. They offer tools for policy management, allowing users to make changes, renew policies, or even file claims directly through the platform. This centralized approach simplifies the insurance journey, making it more convenient and efficient for consumers.

- Access to Exclusive Deals: Insurance comparison websites often have partnerships with insurance providers, giving users access to exclusive deals and discounts. These partnerships can result in lower premiums or additional perks, making insurance more affordable and attractive for consumers.

The Impact on the Insurance Industry

The rise of insurance comparison websites has had a profound impact on the insurance industry. These platforms have disrupted traditional insurance distribution channels, forcing insurers to adapt and innovate to stay competitive. Here are some ways in which insurance comparison websites have influenced the industry:

- Increased Competition: With insurance comparison websites, consumers have more options and can easily compare multiple providers. This increased competition has driven insurers to improve their offerings, enhance customer service, and provide more transparent pricing. The result is a more dynamic and consumer-centric insurance market.

- Digital Transformation: Insurance comparison websites have accelerated the digital transformation of the industry. Insurers have recognized the importance of an online presence and have invested in digital technologies to enhance their online visibility and provide better user experiences. This shift towards digital has improved efficiency, reduced costs, and enhanced overall customer satisfaction.

- Data-Driven Insights: Insurance comparison websites collect vast amounts of data, providing insurers with valuable insights into consumer behavior and preferences. This data-driven approach allows insurers to tailor their products and marketing strategies, ensuring they meet the evolving needs of their target audience. By leveraging data analytics, insurers can make more informed decisions and stay ahead of the competition.

- Enhanced Customer Engagement: Insurance comparison websites have facilitated better customer engagement. Consumers can now interact with insurers more easily, ask questions, and receive real-time quotes. This direct interaction fosters trust and loyalty, leading to improved customer retention and satisfaction.

Performance Analysis and Consumer Satisfaction

The success of insurance comparison websites can be gauged by their performance and the level of satisfaction they bring to consumers. Here are some key performance indicators and consumer feedback:

| Metric | Performance |

|---|---|

| User Satisfaction | Insurance comparison websites consistently receive high satisfaction ratings from users. Consumers appreciate the convenience, transparency, and time savings these platforms offer. Many users report feeling more confident and informed about their insurance choices, leading to higher levels of satisfaction. |

| Policy Comparison | These websites excel at providing comprehensive policy comparisons. Users can easily navigate through various options, making side-by-side comparisons and accessing detailed information about each policy. This feature has proven to be highly effective in helping consumers make well-informed decisions. |

| Price Transparency | Insurance comparison websites have been instrumental in improving price transparency within the insurance industry. Consumers can quickly identify the most competitive prices, ensuring they get the best value for their money. This transparency has empowered consumers and encouraged insurers to offer more competitive rates. |

| Customer Support | Many insurance comparison websites provide dedicated customer support, offering assistance and guidance throughout the insurance shopping process. Users appreciate the availability of live chat, email, and phone support, ensuring they receive timely help and accurate information. |

Future Implications and Innovations

As technology continues to advance, insurance comparison websites are expected to evolve further, offering even more sophisticated features and enhanced user experiences. Here are some potential future implications and innovations:

- Artificial Intelligence (AI) Integration: AI and machine learning technologies are likely to play a significant role in the future of insurance comparison websites. These advancements can further personalize recommendations, provide more accurate predictions, and even assist in claim processing. AI-powered chatbots and virtual assistants could enhance user interactions, making the insurance journey more intuitive and efficient.

- Blockchain Technology: Blockchain technology has the potential to revolutionize the insurance industry, and insurance comparison websites could be at the forefront of this transformation. Blockchain can enhance data security, streamline processes, and improve transparency. By leveraging blockchain, these websites could offer even more secure and efficient services, ensuring a seamless experience for users.

- Expanded Product Offerings: Insurance comparison websites may expand their product offerings to include a wider range of insurance types. While they currently focus on popular categories like car and health insurance, the future could see the inclusion of niche insurance products such as cyber insurance, gap insurance, or even insurance for emerging technologies like autonomous vehicles.

- Personalized Risk Assessment: With the availability of vast amounts of data, insurance comparison websites could develop more advanced risk assessment models. By analyzing user data and behavior, these platforms could provide personalized risk profiles, helping consumers understand their unique risks and choose policies that offer the right coverage.

- Incorporating IoT and Telematics: The Internet of Things (IoT) and telematics technologies are transforming various industries, and insurance is no exception. Insurance comparison websites could integrate these technologies to offer more accurate and real-time risk assessments. For example, telematics data from connected cars could be used to provide more precise car insurance quotes based on actual driving behavior.

Frequently Asked Questions (FAQ)

How do insurance comparison websites make money?

+

Insurance comparison websites generate revenue through various business models. They often receive commissions from insurance providers when users purchase policies through their platforms. Additionally, these websites may offer paid advertising or lead generation services, where insurers pay to have their products promoted or to receive user information.

Are insurance comparison websites reliable?

+

Yes, insurance comparison websites can be highly reliable. Reputable platforms follow strict guidelines and regulations to ensure accurate and unbiased information. They often partner with trusted insurance providers and use advanced technologies to deliver precise comparisons. However, it’s essential to choose well-established websites with positive user reviews and ratings.

Can I get personalized recommendations on insurance comparison websites?

+

Absolutely! Many insurance comparison websites offer personalized recommendation features. By providing your preferences, demographics, and other relevant information, these platforms can suggest insurance policies that align with your specific needs. This level of customization enhances the user experience and helps you find the right coverage.

Do insurance comparison websites provide support for policy changes or renewals?

+

Some insurance comparison websites go beyond comparison and offer additional services, including policy management. These platforms allow users to make policy changes, renew policies, or even file claims directly through the platform. However, the availability of these features may vary depending on the website and insurance provider.

Are there any hidden costs or fees associated with using insurance comparison websites?

+

No, reputable insurance comparison websites do not charge users any hidden fees or costs. Their services are typically free, and users can compare policies without any obligations. However, it’s always advisable to read the terms and conditions and any fine print to understand the platform’s policies and any potential fees associated with specific services.