Quote For Car Insurance Online

Welcome to this comprehensive guide on car insurance quotes. Obtaining a quote for car insurance online has become an essential aspect of modern-day vehicle ownership, offering convenience and a range of benefits to drivers worldwide. This article will delve into the intricacies of online car insurance quotes, exploring the process, the factors that influence quotes, and the advantages it provides to consumers. Whether you're a seasoned driver or a first-time car owner, understanding the nuances of online car insurance quotes is key to making informed decisions about your vehicle's protection.

Understanding the Online Car Insurance Quote Process

The process of obtaining an online car insurance quote is straightforward yet detailed, ensuring that the quote you receive is accurate and tailored to your specific needs. Here's a step-by-step breakdown of the typical journey:

- Choose a Reputable Insurance Provider: Start by selecting a well-known and trusted insurance company. This is crucial as it ensures the quote you receive is from a legitimate source and offers the coverage you require.

- Gather Relevant Information: Before initiating the quote process, gather essential details about your vehicle, driving history, and personal information. This includes the make, model, and year of your car, your driving record, and any additional coverage options you might be interested in.

- Visit the Insurance Provider's Website: Navigate to the chosen insurance company's website. Most providers have user-friendly interfaces designed to guide you through the quoting process.

- Provide Vehicle and Personal Details: On the website, you'll be prompted to input the vehicle and personal information you gathered earlier. This step is crucial as it allows the insurance company to assess your risk profile and provide an accurate quote.

- Select Coverage Options: The insurance provider will present you with various coverage options. These may include liability coverage, collision coverage, comprehensive coverage, and additional add-ons like rental car reimbursement or roadside assistance. Choose the options that best suit your needs and budget.

- Review and Finalize Your Quote: After selecting your coverage options, review the quote thoroughly. Ensure that all the details, including the coverage limits, deductibles, and any additional fees, are as you expected. If everything is in order, finalize the quote by providing your contact and payment information.

By following these steps, you can obtain a personalized car insurance quote online, making the process of securing adequate coverage for your vehicle more accessible and efficient.

Factors Influencing Your Car Insurance Quote

Car insurance quotes are influenced by a myriad of factors, each playing a role in determining the final cost of your policy. Understanding these factors can help you make informed decisions about your coverage and potentially reduce your insurance costs.

Vehicle-Specific Factors

The make, model, and year of your vehicle are significant determinants of your insurance quote. Some vehicles, especially luxury or high-performance cars, may have higher insurance costs due to their expensive repair or replacement costs. Additionally, the safety features and anti-theft systems in your car can impact your quote, potentially leading to lower premiums.

Driver Profile

Your driving history and personal details are crucial in assessing your risk profile. Factors such as your age, gender, and driving record (including any accidents or violations) significantly influence your insurance quote. Younger drivers or those with a history of accidents or traffic violations may expect higher premiums.

Coverage Options and Add-Ons

The coverage options you choose can greatly impact your insurance quote. Comprehensive coverage, which protects against non-collision incidents like theft or natural disasters, typically costs more than liability-only coverage. Additional add-ons like rental car reimbursement or roadside assistance can also increase your premium.

Location and Usage

Where you live and how you use your vehicle can affect your insurance quote. Areas with higher crime rates or a history of natural disasters may have higher insurance costs. Similarly, if you primarily use your vehicle for commuting to work or long-distance travel, your insurance needs and associated costs may differ from those who primarily use their car for pleasure driving.

| Factor | Impact on Quote |

|---|---|

| Vehicle Make and Model | Influences repair and replacement costs |

| Driver Age and Gender | Younger drivers or those with accidents may pay more |

| Coverage Options | Comprehensive coverage typically costs more |

| Location | Areas with higher crime rates may have increased premiums |

Benefits of Obtaining Car Insurance Quotes Online

The shift towards obtaining car insurance quotes online offers numerous advantages to consumers. Here's a closer look at some of the key benefits:

Convenience and Speed

Online quotes are accessible 24/7, allowing you to compare insurance options and obtain quotes at your convenience. The process is typically quick and straightforward, providing you with instant estimates for your insurance needs.

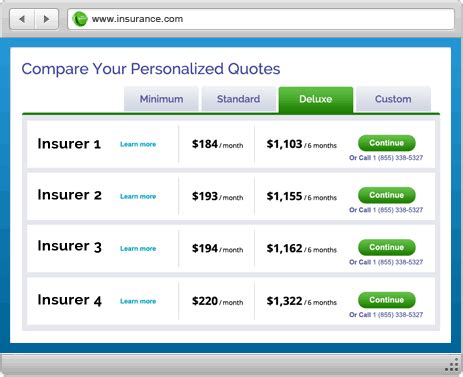

Price Comparison

With online quotes, you can easily compare prices and coverage options from multiple insurance providers. This transparency in pricing empowers you to make informed decisions about your vehicle's protection and potentially save money.

Personalized Coverage

Online quoting platforms often allow you to customize your coverage based on your specific needs. Whether you're looking for comprehensive coverage or more basic liability protection, you can tailor your policy to fit your requirements and budget.

Efficiency and Accuracy

Online quote systems are designed to provide accurate estimates based on the information you provide. This ensures that the quotes you receive are precise and reflective of your risk profile, helping you avoid unexpected surprises when it comes to your insurance costs.

No Obligation

Obtaining an online car insurance quote does not obligate you to purchase a policy. You can explore various options, compare quotes, and make informed decisions without any commitment. This freedom to shop around is a significant advantage when seeking the best insurance coverage for your vehicle.

| Benefit | Description |

|---|---|

| Convenience | Access quotes anytime, anywhere |

| Price Comparison | Compare multiple providers' prices and coverage |

| Personalized Coverage | Tailor your policy to your specific needs |

| Efficiency | Quick and accurate estimates |

| No Obligation | Explore options without commitment |

FAQs

Can I get an online car insurance quote if I have a poor driving record?

+Yes, you can still obtain an online car insurance quote even with a poor driving record. However, it's important to note that your driving history is a significant factor in determining your insurance premium. A history of accidents or violations may result in higher quotes. Despite this, shopping around and comparing quotes from different providers can help you find the most competitive rates for your specific situation.

Are online car insurance quotes always accurate?

+Online car insurance quotes are generally accurate, but they are estimates based on the information you provide. To ensure the most accurate quote, it's crucial to provide detailed and honest information about your vehicle, driving history, and desired coverage options. Additionally, remember that the final premium may vary slightly once the insurance company conducts a more thorough assessment of your risk profile.

Can I switch insurance providers after getting an online quote?

+Absolutely! Obtaining an online car insurance quote does not bind you to a particular provider. You are free to explore and compare quotes from multiple insurers to find the best coverage and price that suits your needs. Switching insurance providers can be a great way to save money or enhance your coverage, especially if you find a better deal or a policy that aligns more closely with your requirements.

By leveraging the convenience and transparency of online car insurance quotes, you can take control of your vehicle’s protection and make informed decisions that best fit your budget and coverage needs.