High Yield Savings Accounts Fdic Insured

In today's economic landscape, where interest rates have been historically low, finding smart ways to grow your savings can be a challenge. However, one reliable option that has gained popularity is high-yield savings accounts. These accounts offer a unique blend of security and higher interest rates compared to traditional savings accounts, making them an attractive choice for savers. This article will delve into the world of high-yield savings accounts, exploring their features, benefits, and how they can be a valuable tool in your financial strategy.

Understanding High-Yield Savings Accounts

High-yield savings accounts are interest-bearing deposit accounts offered by various financial institutions, including online banks and credit unions. These accounts are designed to provide competitive interest rates, often significantly higher than those offered by standard savings accounts at traditional brick-and-mortar banks.

The key advantage of high-yield savings accounts is their ability to maximize the growth of your savings over time. While traditional savings accounts may offer nominal interest rates, high-yield accounts provide a substantial boost to your savings potential, especially in the current low-interest-rate environment.

FDIC Insurance and Security

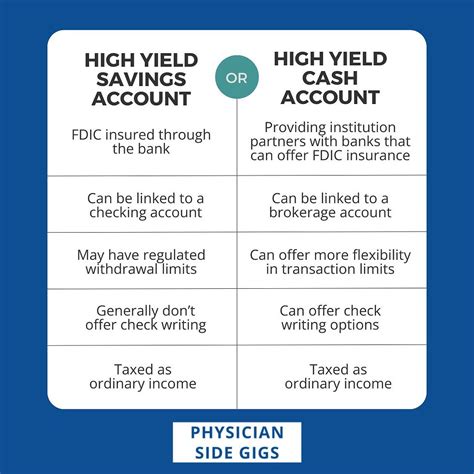

One of the critical aspects of high-yield savings accounts is their FDIC insurance coverage. The Federal Deposit Insurance Corporation (FDIC) is a US government agency that provides insurance on deposits at member banks, up to a specific limit. This insurance ensures that even if the bank fails, your deposits are protected.

High-yield savings accounts, like all FDIC-insured accounts, offer complete protection for your funds up to $250,000 per depositor, per insured bank. This security measure is a significant advantage, as it allows you to pursue higher interest rates without compromising the safety of your savings.

| FDIC Insurance Limit | $250,000 per depositor |

|---|---|

| Protection Scope | Covers all deposit accounts, including savings, checking, and CDs. |

| Insured Banks | Over 5,000 FDIC-insured banks and institutions nationwide. |

Key Features and Benefits of High-Yield Savings Accounts

High-yield savings accounts offer a range of features and benefits that make them an appealing choice for savers. Here’s a detailed look at some of these advantages:

Competitive Interest Rates

The standout feature of high-yield savings accounts is their competitive interest rates. These accounts typically offer APY (Annual Percentage Yield) rates that are significantly higher than traditional savings accounts. For example, while a standard savings account might offer an APY of 0.01%, high-yield accounts can provide rates upwards of 2% or more.

The higher interest rates mean your savings can grow faster, helping you achieve your financial goals sooner. Whether you're saving for an emergency fund, a down payment on a home, or simply looking to maximize the returns on your savings, high-yield accounts can be a powerful tool.

Convenience and Accessibility

High-yield savings accounts are convenient and accessible to a wide range of savers. Many of these accounts are offered by online banks, which means you can open and manage your account entirely online. This convenience eliminates the need for physical branch visits, making it easier to maintain your savings strategy.

Additionally, many high-yield savings accounts offer mobile banking apps, providing you with real-time access to your account information and the ability to make transactions on the go. This accessibility ensures you can stay on top of your savings, no matter your location.

Low or No Fees

Another advantage of high-yield savings accounts is their low or no fees. Unlike some traditional savings accounts, which may charge monthly maintenance fees or require high minimum balance requirements, high-yield accounts often have minimal or no fees associated with them.

This fee structure means you can maximize the growth of your savings without worrying about fees eating into your earnings. Many high-yield accounts also offer features like free online transfers and direct deposit, making it easy to manage your savings without additional costs.

Easy Account Management

High-yield savings accounts are designed with user-friendly account management in mind. Online platforms and mobile apps provide clear and concise account overviews, allowing you to monitor your savings and interest earnings with ease.

Additionally, many high-yield accounts offer automatic savings features, such as recurring transfers from your checking account. This automation can help you build your savings effortlessly, as funds are regularly transferred into your high-yield account without manual intervention.

Maximizing Your High-Yield Savings Account

To make the most of your high-yield savings account, there are a few strategies you can employ. Here are some tips to help you optimize your savings potential:

Compare Interest Rates

When choosing a high-yield savings account, it’s essential to compare interest rates offered by different financial institutions. Rates can vary significantly, so taking the time to research and find the best rate for your needs can make a substantial difference in the long run.

Consider using online tools and comparison websites to evaluate APY rates and choose an account that aligns with your savings goals. While interest rates may fluctuate, finding a competitive rate can ensure your savings continue to grow at a healthy pace.

Automate Your Savings

One of the most effective ways to maximize your high-yield savings account is to automate your savings contributions. Setting up regular transfers from your checking account to your high-yield savings account ensures that a portion of your income is consistently being saved.

Automating your savings removes the temptation to spend and helps you build your savings over time. You can start with a small amount and gradually increase your contributions as your financial situation allows, making this a powerful strategy for long-term savings success.

Monitor Your Account Regularly

Staying engaged with your high-yield savings account is crucial to ensuring it remains a productive part of your financial strategy. Regularly monitor your account to track your savings progress and ensure your funds are growing as expected.

Use the account management tools provided by your financial institution to review your balance, interest earnings, and transaction history. This practice helps you stay on top of your savings and make any necessary adjustments to your strategy.

The Future of High-Yield Savings Accounts

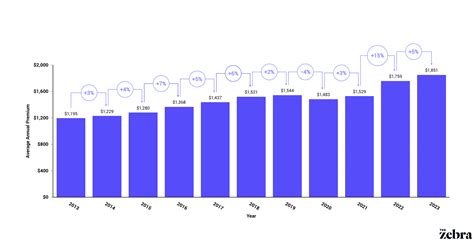

As the financial landscape continues to evolve, high-yield savings accounts are expected to remain a popular and reliable option for savers. While interest rates may fluctuate, the ability to earn competitive rates on your savings is a significant advantage, especially in an environment where traditional savings accounts offer minimal returns.

Additionally, with the increasing popularity of online banking and digital financial services, high-yield savings accounts are becoming more accessible to a wider range of consumers. This trend is likely to continue, making it easier for individuals to take control of their savings and achieve their financial goals.

How do I choose the best high-yield savings account for me?

+When selecting a high-yield savings account, consider factors such as the APY offered, account fees, minimum balance requirements, and the financial institution’s reputation. Online tools and comparison websites can help you find the best account for your needs.

Are there any disadvantages to high-yield savings accounts?

+One potential drawback is that high-yield savings accounts may have slightly lower interest rates than some other savings options, such as money market accounts or certificates of deposit (CDs). However, the convenience, accessibility, and FDIC insurance of high-yield savings accounts often make them a preferred choice.

Can I have multiple high-yield savings accounts?

+Yes, you can have multiple high-yield savings accounts. This can be beneficial if you have different savings goals or want to take advantage of varying interest rates and features offered by different financial institutions. Just ensure you stay within the FDIC insurance limits at each institution.