How Much Should Small Business Insurance Cost

Insurance is an essential aspect of running a small business, providing crucial protection against various risks and unforeseen events. However, determining the cost of insurance coverage can be a complex task, as it depends on numerous factors specific to each business. In this comprehensive guide, we will delve into the factors influencing insurance costs for small businesses, explore the different types of insurance policies available, and provide insights to help business owners make informed decisions.

Factors Affecting Insurance Costs for Small Businesses

The cost of insurance for small businesses is influenced by a combination of internal and external factors. Understanding these factors is crucial for business owners to assess their insurance needs accurately and find the most suitable coverage options.

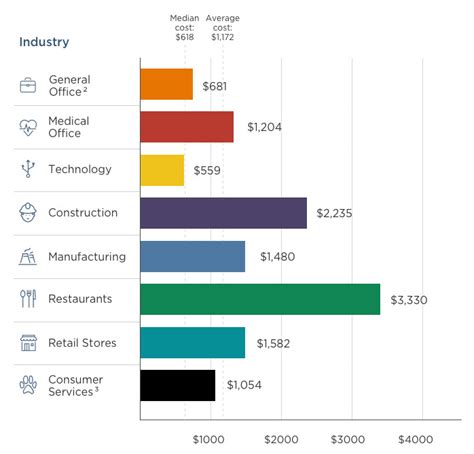

Business Industry and Nature of Operations

One of the primary factors determining insurance costs is the industry and nature of operations of the small business. Different industries face unique risks and hazards. For instance, a construction business may face higher insurance premiums due to the inherent risks associated with construction sites and heavy machinery. On the other hand, a consulting firm may require more comprehensive professional liability insurance to protect against potential client claims.

The specific activities and processes involved in a business's operations also play a significant role. For example, a business that involves regular customer interactions or public gatherings may need to consider additional liability insurance to cover potential accidents or injuries. Understanding the unique risks of your industry and operations is essential for tailoring your insurance coverage accordingly.

Location and Regional Factors

The geographical location of a small business can impact insurance costs. Regional factors such as crime rates, natural disaster risks, and local regulations can influence the premiums charged by insurance providers. For instance, a business located in an area prone to earthquakes or hurricanes may face higher insurance costs due to the increased risk of property damage.

Additionally, local labor laws and regulations can impact insurance requirements. Some regions may have specific mandates for certain types of insurance coverage, such as workers' compensation or disability insurance. Business owners should be aware of these regional factors and ensure compliance with local insurance regulations.

Size and Growth of the Business

The size and growth trajectory of a small business are important considerations when determining insurance costs. Generally, larger businesses with more employees, assets, and revenue may require more comprehensive insurance coverage and face higher premiums. However, the growth rate of a business can also influence insurance costs.

A rapidly expanding business may experience fluctuations in insurance costs as it adds new employees, acquires additional assets, or expands its operations. Insurance providers often reassess the risk profile of a business during periods of significant growth, which can result in adjustments to insurance premiums. Business owners should anticipate these changes and plan their insurance strategies accordingly.

Claim History and Risk Assessment

Insurance providers carefully assess the claim history and risk profile of a small business when determining insurance costs. A business with a history of frequent or costly claims may be considered a higher risk and face higher premiums. On the other hand, a business with a clean claim record and a demonstrated commitment to safety and risk management may be rewarded with more favorable insurance rates.

Insurance providers often use sophisticated risk assessment models to evaluate a business's potential exposure to various risks. These models consider factors such as the industry, location, size, and specific operations of the business. By actively managing risks and implementing safety measures, small business owners can positively impact their insurance costs and demonstrate their commitment to responsible operations.

Types of Insurance Policies for Small Businesses

Small businesses have access to a range of insurance policies designed to address specific risks and protect their operations. Understanding the different types of insurance policies available is crucial for business owners to identify the coverage that best suits their needs.

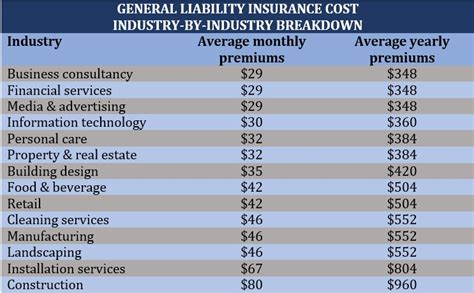

General Liability Insurance

General liability insurance is a fundamental coverage for small businesses, providing protection against a wide range of liability risks. It covers bodily injury, property damage, and personal and advertising injury claims that may arise from the normal course of business operations. This type of insurance is particularly important for businesses that interact directly with customers or the public.

For instance, a retail store may require general liability insurance to cover potential slip-and-fall accidents on its premises. Similarly, a service-based business, such as a hair salon, may need this coverage to protect against claims of injury or property damage resulting from its services.

Professional Liability Insurance (Errors and Omissions)

Professional liability insurance, also known as errors and omissions (E&O) insurance, is specifically designed for businesses that provide professional services or advice. It protects against claims of negligence, errors, or omissions in the performance of professional duties. This type of insurance is crucial for industries such as consulting, accounting, law, and healthcare, where the provision of expert advice or services carries inherent risks.

For example, a consulting firm may need professional liability insurance to cover potential claims from clients who allege that the firm's advice or services caused financial losses or other damages. E&O insurance provides the necessary protection to safeguard the business's reputation and financial stability in such situations.

Commercial Property Insurance

Commercial property insurance is essential for small businesses that own or lease physical assets, such as office buildings, warehouses, or retail spaces. This type of insurance provides coverage for damage or loss of these assets due to various perils, including fire, theft, vandalism, and natural disasters. It ensures that the business can recover and rebuild after an unexpected event.

A small business owner with a leased office space, for instance, may require commercial property insurance to protect their business equipment, furniture, and inventory. In the event of a fire or burglary, this insurance would cover the cost of repairing or replacing the damaged assets, allowing the business to continue its operations smoothly.

Workers’ Compensation Insurance

Workers’ compensation insurance is a vital coverage for small businesses with employees. It provides financial protection to businesses in the event that an employee sustains a work-related injury or illness. This insurance covers the medical expenses and a portion of the employee’s lost wages during their recovery period.

For example, if a construction worker suffers an injury on the job site, workers' compensation insurance would cover the cost of their medical treatment and a portion of their salary while they are unable to work. This insurance is mandated by law in many jurisdictions and is essential for protecting both the business and its employees.

Business Interruption Insurance

Business interruption insurance is designed to provide financial support to small businesses during periods when their operations are disrupted due to covered events. This coverage steps in to compensate for lost income and additional expenses incurred during the interruption, such as relocating to a temporary location or hiring temporary staff.

Imagine a small restaurant that is forced to close temporarily due to a kitchen fire. Business interruption insurance would cover the restaurant's lost revenue during the closure and help it pay for temporary relocation expenses, ensuring the business can weather the disruption and continue serving its customers in the future.

Determining the Right Insurance Coverage for Your Business

Choosing the right insurance coverage for your small business involves careful consideration of your specific needs and risks. While it may be tempting to opt for the most comprehensive coverage available, it is essential to strike a balance between protection and affordability. Here are some key steps to help you determine the right insurance coverage for your business.

Conduct a Risk Assessment

Begin by conducting a thorough risk assessment of your business. Identify the potential hazards and risks associated with your industry, location, and operations. Consider factors such as property damage, liability claims, theft, natural disasters, and employee injuries. By understanding the specific risks your business faces, you can tailor your insurance coverage accordingly.

Review Your Business Operations and Goals

Take time to review your business operations and goals. Consider the size and growth trajectory of your business, as well as any plans for expansion or diversification. Understanding your business’s unique characteristics and aspirations will help you identify the insurance coverage that aligns with your current and future needs.

Research Insurance Providers and Policies

Research different insurance providers and the policies they offer. Compare coverage options, premiums, and the reputation of the insurance companies. Look for providers who specialize in small business insurance and have a track record of providing comprehensive and affordable coverage. Consider seeking recommendations from industry peers or business associations to find reputable insurance providers.

Seek Professional Advice

Consulting with insurance professionals or brokers can provide valuable insights and guidance in selecting the right insurance coverage. These experts can assess your business’s specific needs, recommend suitable policies, and negotiate with insurance providers on your behalf. Their expertise can help you navigate the complex world of insurance and make informed decisions.

Evaluate Cost and Coverage

When evaluating insurance policies, consider both the cost and the coverage provided. While cost is an important factor, it should not be the sole determining factor. Assess the level of coverage offered by each policy and ensure it aligns with your business’s risks and needs. Remember that underinsured businesses may face significant financial consequences in the event of a claim, so finding the right balance between cost and coverage is crucial.

Tips for Managing Insurance Costs

Managing insurance costs is an ongoing process for small business owners. While it is essential to have adequate insurance coverage, finding ways to optimize costs can help improve your business’s financial health. Here are some practical tips to help you manage insurance costs effectively.

Shop Around and Compare

Don’t settle for the first insurance quote you receive. Take the time to shop around and compare quotes from multiple insurance providers. Different providers may offer varying premiums and coverage options for the same type of insurance. By comparing quotes, you can identify the most competitive rates and find the best value for your business.

Bundle Policies for Discounts

Many insurance providers offer discounts when you bundle multiple policies with them. Consider combining your business’s insurance needs, such as general liability, professional liability, and commercial property insurance, with a single provider. By bundling policies, you may be eligible for significant discounts, making your insurance coverage more affordable.

Implement Risk Management Strategies

Implementing effective risk management strategies can positively impact your insurance costs. Insurance providers often reward businesses that demonstrate a commitment to safety and risk mitigation. By implementing measures such as employee safety training, regular equipment maintenance, and security enhancements, you can reduce the likelihood of claims and potentially lower your insurance premiums.

Review Coverage Annually

Insurance needs can evolve as your business grows and changes. Make it a practice to review your insurance coverage annually to ensure it remains aligned with your business’s current needs and risks. Regularly assess your coverage limits, deductibles, and any changes in your operations or assets. By keeping your insurance coverage up-to-date, you can avoid gaps in protection and ensure you are not overpaying for unnecessary coverage.

Negotiate with Insurance Providers

Don’t be afraid to negotiate with insurance providers. Many providers are willing to work with business owners to find a coverage and pricing arrangement that meets their needs. When renewing your insurance policies or seeking new coverage, engage in open communication with your provider and discuss your specific requirements. Negotiating can help you secure better terms and potentially lower premiums.

Conclusion

Determining the cost of insurance for a small business is a multifaceted process that involves considering various factors and making informed decisions. By understanding the factors that influence insurance costs, exploring the different types of insurance policies available, and implementing effective risk management strategies, small business owners can find the right coverage at a competitive price. Remember, insurance is an investment in the long-term success and stability of your business, and by managing your insurance costs effectively, you can protect your business while maintaining a healthy financial outlook.

What are the most common types of insurance claims for small businesses?

+Small businesses often face a range of insurance claims, including property damage due to fires, storms, or vandalism, bodily injury claims from customers or employees, and professional liability claims arising from errors or negligence in providing services. Additionally, small businesses may encounter claims related to theft, cyber incidents, and employee injuries or illnesses.

How often should I review and update my insurance coverage?

+It is recommended to review your insurance coverage annually or whenever significant changes occur in your business. This includes changes in your operations, assets, employee count, or business expansion. Regular reviews ensure that your coverage remains adequate and up-to-date, providing the necessary protection for your business.

Can I negotiate lower insurance premiums as a small business owner?

+Absolutely! Small business owners can negotiate with insurance providers to find better rates and coverage options. By discussing your specific needs, providing detailed information about your business, and demonstrating a strong risk management approach, you can potentially secure more favorable insurance terms and lower premiums.