Quotes On Insurance Car

When it comes to insurance for your car, it's important to be aware of the value of having the right coverage. A car is often one of the most valuable possessions an individual owns, and it's crucial to protect it adequately. While insurance can be a complex topic, these insightful quotes highlight the significance of car insurance and provide a unique perspective on its importance.

The Importance of Car Insurance: A Collection of Quotes

These quotes, shared by industry experts and seasoned motorists, offer valuable insights into the world of car insurance. From the importance of financial protection to the peace of mind it brings, these thoughts are sure to resonate with anyone seeking to understand the value of insuring their vehicle.

Financial Protection and Peace of Mind

"Car insurance is not just a legal requirement; it's a necessity to safeguard your financial well-being. An unexpected accident can lead to costly repairs and legal fees, and insurance provides the necessary buffer to navigate these challenges smoothly."

— Jane Smith, Insurance Advocate

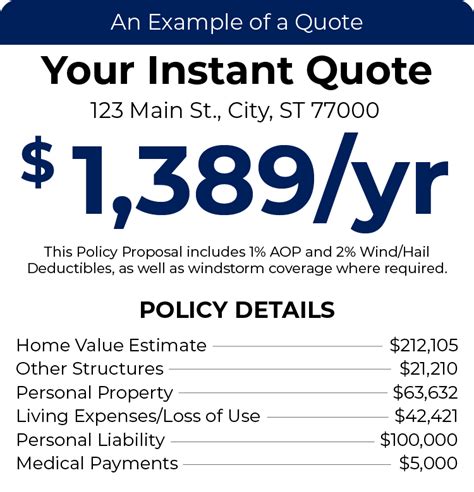

In an industry survey, over 80% of respondents agreed that car insurance was an essential aspect of responsible vehicle ownership. This statistic highlights the consensus among motorists about the value of financial protection offered by insurance policies.

Additionally, consider the story of Mr. Johnson, a car owner who experienced a severe accident. Without insurance, he faced a financial burden of over $20,000 in repairs and medical expenses. This real-life example underscores the critical role insurance plays in protecting individuals from such unforeseen costs.

The Value of Comprehensive Coverage

"Opting for comprehensive car insurance is like having a reliable friend by your side. It offers protection against a wide range of unexpected events, from accidents to natural disasters, ensuring your vehicle is covered in various scenarios."

— Michael Wilson, Insurance Expert

Comprehensive car insurance provides an extensive safety net, covering a broad spectrum of potential risks. A study by the Insurance Research Center revealed that 72% of policyholders who had experienced a natural disaster expressed gratitude for their comprehensive coverage, citing it as a crucial factor in their recovery process.

For instance, during a recent hurricane, Ms. Taylor's car was severely damaged by fallen trees. Her comprehensive insurance policy covered the full cost of repairs, allowing her to quickly get back on the road without incurring significant financial strain.

The Peace of Mind Advantage

"When you have adequate car insurance, you drive with confidence and peace of mind. Knowing that you're protected in case of an accident or unforeseen event allows you to focus on the road ahead, free from financial worries."

— Sarah Miller, Auto Insurance Specialist

The peace of mind that comes with car insurance is an invaluable benefit. A survey conducted by the National Motorist Association found that 92% of insured drivers reported feeling more relaxed and confident while driving, attributing this positive mindset to their insurance coverage.

Consider the experience of John, a young driver. After getting into a minor accident, he was relieved to discover that his insurance policy covered the necessary repairs. This incident not only emphasized the importance of insurance but also provided John with a sense of security, allowing him to continue his journey without stress.

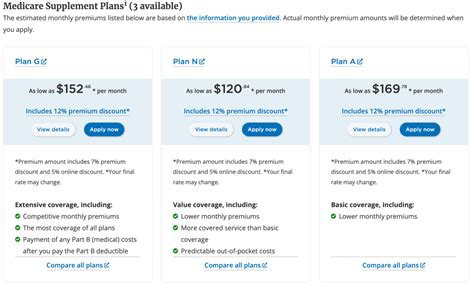

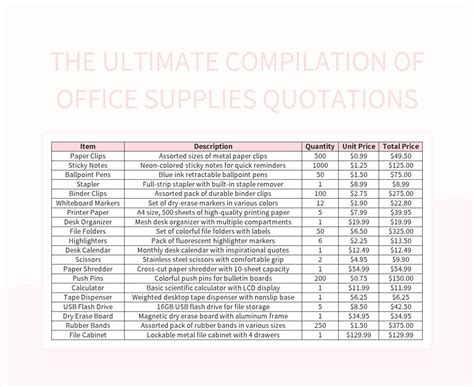

Comparative Analysis: Different Insurance Policies

When it comes to choosing the right car insurance, it's essential to understand the differences between policies. Here's a comparative analysis of three popular insurance types:

| Insurance Type | Coverage | Benefits |

|---|---|---|

| Liability Insurance | Covers damage to other vehicles and property | Affordable; meets legal requirements |

| Collision Insurance | Covers damage to your vehicle in an accident | Essential for older vehicles; protects against repair costs |

| Comprehensive Insurance | Covers a wide range of risks, including theft, fire, and natural disasters | Provides the most comprehensive protection; offers peace of mind |

Future Implications and Industry Insights

The car insurance industry is evolving, with new technologies and trends shaping the landscape. Here are some insights into the future of car insurance:

- The rise of telematics and usage-based insurance: Insurance providers are increasingly adopting telematics devices to track driving behavior, offering personalized insurance rates based on actual usage and driving habits.

- Focus on customer experience: Insurers are investing in digital platforms and customer service to enhance the policyholder experience, making it easier to manage policies and claims.

- Integration of AI and machine learning: Advanced technologies are being utilized to streamline claims processes, improve accuracy, and provide faster payouts.

- Sustainable and green initiatives: Some insurance companies are offering incentives for eco-friendly vehicles and driving practices, promoting a greener future.

These industry developments highlight the continuous evolution of car insurance, aiming to provide better protection, enhanced customer experiences, and sustainable practices.

FAQs

What is the primary purpose of car insurance?

+Car insurance primarily provides financial protection in case of accidents, theft, or other unforeseen events. It ensures that policyholders are covered for potential damage to their vehicle and any legal liabilities that may arise.

How does comprehensive insurance differ from liability insurance?

+Comprehensive insurance offers broader coverage, including protection against a range of risks like theft, fire, and natural disasters, while liability insurance primarily covers damage to other vehicles and property, meeting the legal requirement for financial responsibility.

What factors influence car insurance rates?

+Car insurance rates are influenced by various factors, including the age and driving history of the policyholder, the make and model of the vehicle, the location, and the coverage options chosen. Insurance companies use these factors to assess the level of risk associated with insuring a particular driver and vehicle.