Insurance Plans For Dental

When it comes to dental health, many individuals and families seek comprehensive insurance plans to ensure they can access quality dental care without breaking the bank. Dental insurance plans offer a range of benefits, from routine check-ups and cleanings to more complex procedures like root canals and dental implants. In this comprehensive guide, we will delve into the world of dental insurance, exploring the various types of plans, their coverage options, and how to make informed choices to protect your smile and your wallet.

Understanding Dental Insurance Plans

Dental insurance plans are designed to provide financial coverage for a wide array of dental services. These plans can be offered through employers as part of employee benefit packages or purchased individually on the open market. The primary goal of dental insurance is to make dental care more affordable and accessible, encouraging individuals to maintain good oral health.

One of the key aspects of dental insurance is the concept of coverage limits and deductibles. Coverage limits refer to the maximum amount an insurance plan will pay for a specific service or within a given period, often annually. Deductibles, on the other hand, are the amounts you, the policyholder, must pay out of pocket before the insurance coverage kicks in. Understanding these limits and deductibles is crucial when evaluating dental insurance plans.

Types of Dental Insurance Plans

There are several types of dental insurance plans, each with its own set of features and coverage options. The most common types include:

Indemnity Plans

Indemnity plans, also known as fee-for-service plans, offer the most flexibility in terms of provider choice. With this type of plan, you can visit any licensed dentist and receive coverage for the services provided. The insurance company typically pays a percentage of the total cost, and you are responsible for the remainder. Indemnity plans often have higher premiums but provide more freedom in choosing dental providers.

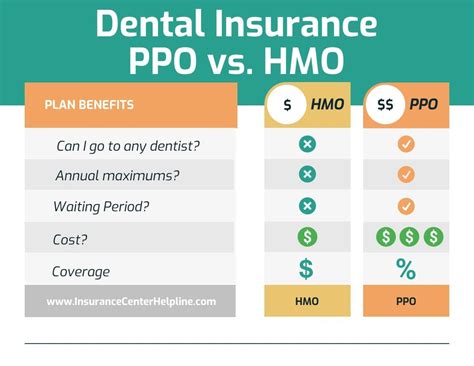

Preferred Provider Organization (PPO) Plans

PPO plans offer a balance between flexibility and cost-effectiveness. These plans have a network of preferred dentists and specialists who have negotiated discounted rates with the insurance company. You can visit any dentist within the network and receive coverage, often with lower out-of-pocket costs compared to indemnity plans. However, if you choose to visit a dentist outside the network, you may pay higher rates.

Dental Health Maintenance Organization (DHMO) Plans

DHMO plans operate similarly to traditional health maintenance organizations (HMOs). With this type of plan, you select a primary dentist from within the network, and all your dental care is coordinated through this provider. DHMO plans typically have lower premiums and no deductibles, but you may have limited provider choices and need referrals for specialist care.

Dental Discount Plans

Dental discount plans, also referred to as dental savings plans, are not traditional insurance plans. Instead, they offer members discounted rates on dental services through a network of participating providers. Members pay a monthly or annual fee to access these discounts, which can range from 10% to 60% off regular prices. While dental discount plans don’t provide insurance coverage, they can be a cost-effective option for those seeking basic dental care.

Coverage and Benefits

Dental insurance plans typically cover a range of dental services, each with its own level of coverage. The most common coverage categories include:

Preventive Care

Preventive care is a cornerstone of dental insurance plans. It covers routine services such as dental cleanings, exams, X-rays, and fluoride treatments. The goal is to catch dental issues early and prevent more complex and costly problems down the line. Many plans cover preventive care at 100% or with minimal out-of-pocket costs.

Basic Procedures

Basic procedures include fillings, root canals, extractions, and periodontal (gum) treatments. The coverage for these procedures can vary, with some plans covering a higher percentage of the cost than others. It’s important to review the specific coverage limits for basic procedures to understand your potential out-of-pocket expenses.

Major Procedures

Major procedures, such as dental implants, bridges, crowns, and orthodontic treatments, are often covered at a lower percentage or have higher out-of-pocket costs. These procedures are typically more expensive, and insurance plans may have annual limits on coverage for major work. It’s crucial to carefully review the coverage details for major procedures to avoid unexpected expenses.

| Procedure | Average Coverage Percentage |

|---|---|

| Preventive Care | 80% - 100% |

| Basic Procedures | 50% - 80% |

| Major Procedures | 20% - 50% |

Choosing the Right Dental Insurance Plan

Selecting the right dental insurance plan involves considering several factors. Here are some key aspects to keep in mind:

Your Dental Needs

Assess your current and potential future dental needs. If you have a history of dental issues or anticipate needing extensive work, a plan with higher coverage limits and lower out-of-pocket costs for major procedures may be beneficial. On the other hand, if you primarily need preventive care and basic procedures, a more cost-effective plan with lower premiums could be a suitable choice.

Provider Network

Review the provider network of the plan you’re considering. Ensure that your preferred dentist is in-network, especially if you’re comfortable with their care and want to continue seeing them. If you have a family, consider whether the plan covers dependent care and whether your family’s dentists are included in the network.

Coverage Limits and Deductibles

Understand the coverage limits and deductibles associated with the plan. Higher coverage limits can provide peace of mind, especially if you anticipate needing extensive dental work. Similarly, lower deductibles can reduce your out-of-pocket costs in the short term. Evaluate these factors based on your financial situation and expected dental needs.

Plan Flexibility

Consider the flexibility of the plan. Indemnity plans offer the most freedom in provider choice, while DHMO plans may have more restrictions. Evaluate your preferences and comfort level with provider selection to choose a plan that aligns with your needs.

FAQs

Can I use my dental insurance for cosmetic procedures?

+

Cosmetic procedures, such as teeth whitening or veneers, are typically not covered by dental insurance plans. These procedures are considered elective and are often not medically necessary. However, it’s worth checking with your specific insurance provider to see if they offer any coverage or discounts for cosmetic treatments.

How often should I schedule dental cleanings?

+

The recommended frequency for dental cleanings is typically every six months. Regular cleanings help remove plaque and tartar buildup, preventing gum disease and other dental issues. However, your dentist may recommend more frequent cleanings if you have specific oral health concerns or a history of gum disease.

What happens if I exceed my plan’s coverage limits for major procedures?

+

If you exceed your plan’s coverage limits for major procedures, you will be responsible for paying the remaining balance out of pocket. It’s important to carefully review your plan’s coverage details and consider setting aside funds for potential out-of-pocket expenses, especially if you anticipate needing extensive dental work.

Can I switch dental insurance plans mid-year?

+

Switching dental insurance plans mid-year is generally possible, but it may depend on your specific circumstances and the rules of your current plan. Some plans allow changes during open enrollment periods or if you experience a qualifying life event, such as a job change or marriage. Check with your insurance provider to understand your options for switching plans.