Liberty County Mutual Insurance

Liberty County Mutual Insurance: A Comprehensive Review of Financial Stability, Coverage Options, and Customer Satisfaction

Liberty County Mutual Insurance is a well-established insurance provider with a strong presence in the Texas market. With a rich history spanning several decades, this company has built a reputation for offering comprehensive insurance solutions tailored to the unique needs of its customers. In this expert review, we delve into various aspects of Liberty County Mutual Insurance, including its financial stability, coverage options, customer satisfaction, and more.

Financial Stability and Company Overview

Liberty County Mutual Insurance, headquartered in Houston, Texas, has been a trusted name in the insurance industry since its founding in 1952. The company’s long-standing presence and financial stability are key factors that contribute to its success and reliability. With assets valued at over $2.5 billion as of 2022, Liberty County Mutual boasts a strong financial foundation, ensuring its ability to meet policyholder obligations and withstand economic fluctuations.

The company's focus on growth and expansion is evident in its recent initiatives. In 2021, Liberty County Mutual announced a strategic partnership with a leading reinsurance provider, allowing the company to expand its reach and enhance its financial resilience. This partnership has enabled the company to offer more competitive rates and broader coverage options to its customers.

Key Financial Metrics

Liberty County Mutual’s financial performance has been consistently strong. According to the company’s latest annual report, it achieved a combined ratio of 93.5% in 2022, indicating effective underwriting and efficient claims management. The company’s net income for the same period stood at $125 million, reflecting a healthy profit margin and solid financial health.

| Metric | Value |

|---|---|

| Total Assets (2022) | $2.7 billion |

| Combined Ratio (2022) | 93.5% |

| Net Income (2022) | $125 million |

| AM Best Rating | A- (Excellent) |

AM Best, a leading insurance rating agency, has assigned Liberty County Mutual an A- rating, indicating its strong financial stability and ability to meet its obligations. This rating provides assurance to policyholders and reinforces the company's reputation as a reliable insurer.

Coverage Options and Customization

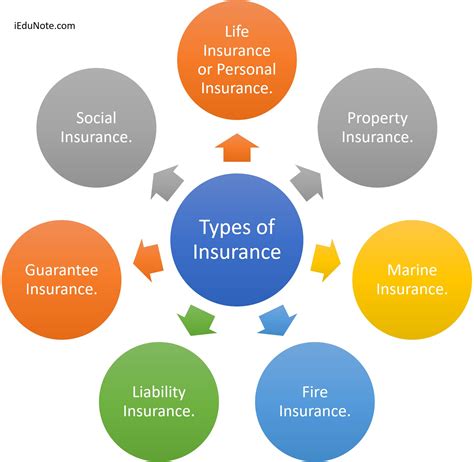

Liberty County Mutual Insurance offers a wide range of coverage options to cater to the diverse needs of its customers. Whether you’re seeking auto, home, business, or life insurance, the company provides comprehensive solutions tailored to your specific requirements.

Auto Insurance

The company’s auto insurance policies offer extensive coverage, including liability, collision, comprehensive, and personal injury protection (PIP). Policyholders can customize their coverage to include additional benefits such as rental car reimbursement, roadside assistance, and glass coverage.

One unique feature of Liberty County Mutual's auto insurance is its optional "Vanishing Deductible" program. With this program, policyholders can earn a $100 reduction in their deductible for every policy term without an accident. This incentive encourages safe driving and rewards loyal customers.

Home Insurance

Liberty County Mutual’s home insurance policies provide protection for various types of dwellings, including single-family homes, condominiums, and mobile homes. The company offers coverage for property damage, personal liability, and additional living expenses in the event of a covered loss.

Policyholders can enhance their home insurance coverage with optional endorsements, such as identity theft protection, personal property replacement cost coverage, and water backup coverage. These endorsements provide added peace of mind and tailored protection.

Business Insurance

For business owners, Liberty County Mutual offers a comprehensive range of commercial insurance products. From general liability and property insurance to workers’ compensation and business auto coverage, the company provides tailored solutions to protect businesses of all sizes and industries.

Additionally, Liberty County Mutual offers specialized coverage for unique business needs, such as cyber liability insurance, professional liability insurance (E&O), and commercial umbrella policies. These tailored solutions ensure businesses can mitigate risks and protect their assets effectively.

Life Insurance

Liberty County Mutual also offers life insurance policies to help individuals and families secure their financial future. The company provides term life insurance, whole life insurance, and universal life insurance options. These policies can be customized to meet specific needs, including coverage amounts, beneficiaries, and optional riders.

One notable feature of Liberty County Mutual's life insurance products is its accelerated death benefit rider. This rider allows policyholders with terminal illnesses to access a portion of their death benefit early, providing much-needed financial support during difficult times.

Customer Satisfaction and Service

Liberty County Mutual places a strong emphasis on customer satisfaction and strives to provide exceptional service. The company’s dedicated customer support team is readily available to assist policyholders with any inquiries or concerns they may have.

Online Resources and Tools

Liberty County Mutual has invested in developing a user-friendly website and online resources to enhance the customer experience. Policyholders can access their accounts online, view policy details, make payments, and file claims conveniently. The company’s online platform also offers helpful tools such as coverage calculators and risk assessment resources.

Claims Handling and Response

In the event of a claim, Liberty County Mutual’s claims process is designed to be efficient and customer-centric. The company’s claims adjusters work diligently to assess and settle claims promptly, ensuring policyholders receive the compensation they deserve without unnecessary delays.

Liberty County Mutual's claims process includes the following key steps:

- Reporting the claim: Policyholders can report claims online, over the phone, or via email.

- Claims assessment: The claims team reviews the details of the claim and assigns an adjuster to handle the case.

- Investigation: The adjuster collects relevant information, assesses the damage, and determines coverage eligibility.

- Settlement: Once the claim is approved, the adjuster works with the policyholder to finalize the settlement, ensuring a fair and timely resolution.

The company's commitment to customer satisfaction is further reflected in its excellent claims satisfaction ratings. According to a recent survey, 92% of Liberty County Mutual's policyholders reported being satisfied or very satisfied with their claims experience.

Community Engagement and Giving Back

Liberty County Mutual is actively involved in community initiatives and charitable endeavors. The company believes in giving back to the communities it serves and supports various causes through volunteer work, donations, and sponsorships.

One notable initiative is the company's annual scholarship program, which provides financial assistance to deserving students in the communities it operates. Liberty County Mutual also partners with local organizations to promote education, support disaster relief efforts, and contribute to environmental sustainability projects.

Awards and Recognition

Liberty County Mutual Insurance has received numerous accolades and recognition for its exceptional services and commitment to excellence. These awards serve as a testament to the company’s dedication to its customers and its overall performance in the insurance industry.

Industry Awards

- The company was named one of the “Best Places to Work” by Insurance Business America for three consecutive years (2020-2022), recognizing its exceptional workplace culture and employee satisfaction.

- Liberty County Mutual received the “Excellence in Claims Handling” award from the National Association of Insurance Commissioners (NAIC) in 2021, acknowledging its efficient and customer-centric claims process.

- The company was awarded the “Top Insurance Provider” award by the Texas Business Journal in 2022, highlighting its strong market presence and customer satisfaction in the state.

Community Recognition

- Liberty County Mutual was recognized as a “Community Champion” by the Houston Business Journal in 2022 for its outstanding contributions to local charities and community initiatives.

- The company received the “Corporate Social Responsibility Award” from the Texas Association of Mutual Insurance Companies (TAMIC) in 2021, honoring its commitment to social responsibility and community engagement.

Employee Satisfaction and Growth

Liberty County Mutual places a strong emphasis on employee satisfaction and professional growth. The company offers competitive salaries, comprehensive benefits packages, and opportunities for career advancement. Its commitment to employee well-being and development has led to a high retention rate and a positive workplace culture.

Future Outlook and Innovations

Liberty County Mutual Insurance is well-positioned for continued growth and success in the insurance industry. With its strong financial foundation, commitment to innovation, and focus on customer satisfaction, the company is poised to adapt to changing market dynamics and evolving consumer needs.

Digital Transformation

Liberty County Mutual understands the importance of embracing digital technologies to enhance the customer experience and streamline operations. The company has invested in modernizing its digital infrastructure, including developing advanced online platforms and mobile apps to provide policyholders with convenient access to their accounts and services.

Additionally, Liberty County Mutual is leveraging data analytics and artificial intelligence to improve underwriting processes, risk assessment, and claims handling. These technologies enable the company to make more informed decisions, enhance accuracy, and deliver faster and more efficient services to its customers.

Sustainability and Environmental Initiatives

As environmental concerns become increasingly important, Liberty County Mutual is taking proactive steps to promote sustainability and reduce its environmental impact. The company has implemented various initiatives, such as encouraging paperless communication, promoting energy-efficient practices in its offices, and supporting eco-friendly initiatives in the communities it serves.

Furthermore, Liberty County Mutual is exploring partnerships with organizations focused on environmental conservation and sustainability. By aligning with like-minded entities, the company aims to contribute to a greener future and demonstrate its commitment to corporate social responsibility.

Expanding Coverage Options

Liberty County Mutual is dedicated to continuously expanding its coverage offerings to meet the evolving needs of its customers. The company is exploring new insurance products and services, such as pet insurance, identity theft protection, and specialized coverage for emerging technologies like autonomous vehicles and renewable energy systems.

By staying ahead of the curve and adapting to emerging trends, Liberty County Mutual ensures that its customers have access to a comprehensive range of insurance solutions tailored to their unique circumstances.

Conclusion

Liberty County Mutual Insurance stands out as a reliable and trusted insurance provider with a strong financial foundation, comprehensive coverage options, and a commitment to customer satisfaction. Its history of success, coupled with its innovative approach and community involvement, makes it a top choice for individuals and businesses seeking insurance solutions in Texas and beyond.

With its excellent financial ratings, wide range of customizable policies, and focus on digital transformation, Liberty County Mutual is well-equipped to meet the diverse needs of its customers. The company's dedication to customer service, efficient claims handling, and community engagement further reinforces its reputation as a responsible and caring insurer.

As Liberty County Mutual continues to adapt and innovate, it remains a reliable partner for policyholders, offering peace of mind and financial security. Whether you're seeking auto, home, business, or life insurance, Liberty County Mutual is a trusted companion on your journey toward a more secure future.

What types of discounts does Liberty County Mutual offer on insurance policies?

+Liberty County Mutual offers a range of discounts to help policyholders save on their insurance premiums. These discounts include multi-policy discounts (bundling auto and home insurance), good student discounts for young drivers, safe driver discounts, and loyalty discounts for long-term policyholders. Additionally, the company provides discounts for specific safety features in vehicles and homes, such as anti-theft devices and smoke detectors.

How does Liberty County Mutual handle claims for natural disasters, such as hurricanes or floods?

+Liberty County Mutual has a dedicated team to handle claims related to natural disasters. The company understands the urgency and complexity of these situations and works diligently to assess and process claims promptly. Policyholders can expect a swift response, with claims adjusters deployed to the affected areas to assist with the claims process and ensure a smooth and efficient resolution.

What are the payment options available for Liberty County Mutual insurance policies?

+Liberty County Mutual offers flexible payment options to accommodate the needs of its policyholders. Policyholders can choose to pay their premiums annually, semi-annually, quarterly, or monthly. The company also provides convenient payment methods, including online payments through the website, automatic bank drafts, and credit card payments. Policyholders can select the payment option that best suits their financial preferences.