Life Insurance Pru

In the realm of financial planning and risk management, life insurance stands as a cornerstone, offering individuals and families a vital safety net against unforeseen circumstances. One prominent player in this field is Prudential, a name synonymous with reliability and a comprehensive suite of insurance products. This article aims to delve deep into Prudential's life insurance offerings, exploring their features, benefits, and the ways they can provide financial security for policyholders.

Understanding Prudential’s Life Insurance Portfolio

Prudential, or Life Insurance Pru as it is often colloquially referred to, boasts an extensive array of life insurance policies designed to cater to diverse client needs. Their portfolio encompasses a range of options, each tailored to address specific financial objectives and life stages.

Term Life Insurance

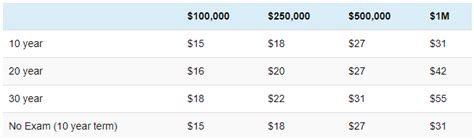

Term life insurance policies from Prudential provide coverage for a defined period, typically 10, 20, or 30 years. These policies are ideal for individuals seeking cost-effective coverage during key life stages, such as raising a family or paying off a mortgage. With premiums that remain stable throughout the term, policyholders can enjoy peace of mind without worrying about escalating costs.

| Policy Type | Coverage Period | Premium Flexibility |

|---|---|---|

| Standard Term | 10-30 years | Fixed premiums |

| Renewable Term | 1-5 year renewals | Renewable at set intervals |

| Convertible Term | Up to 30 years | Convert to permanent coverage |

One unique feature of Prudential's term life insurance is the Convertible Term option. This allows policyholders to convert their term policy into a permanent life insurance plan, ensuring continued coverage even as life circumstances change.

Whole Life Insurance

Whole life insurance from Prudential provides lifetime coverage, offering policyholders the assurance of financial protection for their entire lives. These policies also accrue cash value over time, which can be borrowed against or used to pay premiums, providing a degree of financial flexibility.

| Policy Feature | Description |

|---|---|

| Guaranteed Death Benefit | A set amount paid to beneficiaries upon the insured's death. |

| Cash Value Accumulation | Policyholders can access the cash value for various financial needs. |

| Flexible Premium Payment | Option to adjust premium payments based on financial circumstances. |

Prudential's whole life insurance policies are particularly beneficial for individuals seeking long-term financial security and those who value the potential for cash value growth.

Universal Life Insurance

Universal life insurance is a versatile option that combines the coverage benefits of term life insurance with the cash value accumulation of whole life insurance. Policyholders have the flexibility to adjust their premium payments and death benefits, making it adaptable to changing financial needs and circumstances.

| Universal Life Advantage | Description |

|---|---|

| Flexible Premiums | Policyholders can adjust premium payments based on their financial situation. |

| Cash Value Growth | The policy's cash value grows over time, offering financial flexibility. |

| Tax Advantages | Cash value growth is tax-deferred, providing potential tax benefits. |

Prudential's universal life insurance plans are an attractive choice for individuals who desire control over their policy's financial aspects and those seeking a balance between coverage and cash value growth.

Key Benefits of Prudential’s Life Insurance Policies

Beyond the diverse range of policy options, Prudential’s life insurance offerings are characterized by several key benefits that enhance their appeal to policyholders.

Financial Protection and Security

At its core, life insurance from Prudential is designed to provide financial protection and security. In the event of the policyholder’s untimely passing, the death benefit ensures that their loved ones are provided for, covering expenses such as funeral costs, outstanding debts, and ongoing living expenses.

Flexibility and Customization

Prudential’s life insurance policies offer a high degree of flexibility, allowing policyholders to tailor their coverage to their specific needs. Whether it’s adjusting premium payments, converting term policies, or utilizing the cash value of permanent policies, these options provide policyholders with the ability to adapt their coverage as their life circumstances change.

Long-Term Financial Planning

Whole life and universal life insurance policies from Prudential are valuable tools for long-term financial planning. The cash value accumulation feature allows policyholders to build wealth over time, which can be used for various financial goals, such as funding education, supplementing retirement income, or providing an emergency fund.

Tax Advantages

Prudential’s life insurance policies offer certain tax advantages. The cash value growth within permanent life insurance policies is typically tax-deferred, meaning it grows without immediate tax implications. Additionally, death benefits paid to beneficiaries are generally tax-free, providing a significant financial benefit to loved ones.

Prudential’s Life Insurance: A Comprehensive Review

Prudential’s life insurance portfolio is a testament to their commitment to providing comprehensive financial solutions. Whether it’s the affordability and simplicity of term life insurance, the long-term security of whole life insurance, or the adaptability of universal life insurance, Prudential has a policy to meet every client’s unique needs.

As a leading provider in the industry, Prudential's life insurance policies are backed by a reputation for reliability and financial strength. Their policies are underpinned by sound actuarial principles and are rigorously regulated, ensuring policyholders can trust in the security and stability of their coverage.

Prudential’s Commitment to Service

Beyond their insurance offerings, Prudential is renowned for its commitment to customer service. Their dedicated team of professionals is readily available to guide policyholders through the often complex world of life insurance, ensuring they understand their options and make informed decisions.

Furthermore, Prudential's online platforms and mobile apps offer policyholders convenient access to their policies, allowing them to manage their coverage, make payments, and track their policy's performance from the comfort of their homes.

Conclusion: Prudential’s Life Insurance - A Reliable Choice

In a world filled with uncertainties, Prudential’s life insurance policies provide a reliable anchor of financial security. Whether you’re starting a family, planning for retirement, or simply seeking peace of mind, Prudential’s comprehensive suite of life insurance options ensures you can find a policy that aligns with your financial goals and life stage.

With a focus on flexibility, customization, and long-term financial planning, Prudential's life insurance policies are designed to evolve with your life. Their commitment to service and financial strength make them a trusted partner in safeguarding your future and the future of your loved ones.

What is the typical cost of Prudential’s life insurance policies?

+The cost of Prudential’s life insurance policies can vary widely based on factors such as the type of policy, the coverage amount, and the age and health of the policyholder. Generally, term life insurance policies are more affordable, while whole life and universal life policies may have higher premiums due to their additional benefits and cash value accumulation.

How do I determine the right amount of coverage for my needs?

+Determining the right coverage amount involves assessing your financial obligations and future goals. Consider factors such as outstanding debts, the cost of raising your family, and your desired legacy. Financial advisors and insurance professionals can guide you in this process, ensuring you have adequate coverage without overpaying.

Can I switch between Prudential’s life insurance policies as my needs change?

+Yes, Prudential offers flexibility in switching between their life insurance policies. For instance, you can convert a term life policy to a permanent life policy, or adjust the coverage and premium payments of a universal life policy to align with your changing financial circumstances.