Blue Cross Blue Shield Short Term Health Insurance

In the realm of healthcare coverage, short-term health insurance plans have gained prominence, particularly for individuals seeking temporary solutions or bridging gaps in their healthcare needs. This article explores the Blue Cross Blue Shield Short-Term Health Insurance, a popular option among those seeking flexible and cost-effective healthcare coverage. With a focus on real-world examples and expert insights, we delve into the intricacies of this plan, providing an in-depth analysis to help you make an informed decision.

Understanding Blue Cross Blue Shield Short-Term Health Insurance

Blue Cross Blue Shield (BCBS), a trusted name in the healthcare industry, offers a range of insurance products, including their Short-Term Health Insurance plan. This plan is designed to provide coverage for a limited period, typically ranging from a few months to a year, making it an ideal choice for those in transition or facing temporary gaps in their healthcare coverage.

The BCBS Short-Term Health Insurance plan is tailored to offer flexibility and affordability, catering to individuals and families who require immediate healthcare coverage but may not need the comprehensive benefits of a long-term plan. It serves as a practical solution for various life situations, such as:

- Between Jobs: If you recently lost your job and are awaiting new employment, this plan can bridge the gap until you secure new coverage through an employer.

- Waiting Periods: Many long-term health insurance plans have waiting periods for certain benefits. Short-term insurance can fill this gap, ensuring you have coverage during this transition.

- Student Life: Students, especially those graduating and entering the workforce, often face changes in their healthcare coverage. Short-term plans can provide temporary protection.

- Travelers: For individuals frequently traveling abroad, short-term insurance offers peace of mind, covering unexpected medical emergencies during their journeys.

The BCBS Short-Term Health Insurance plan stands out for its:

- Affordability: With lower premiums compared to long-term plans, it is an attractive option for those on a budget.

- Flexibility: You can choose the length of coverage, ranging from 30 days to a maximum of 364 days, depending on your needs.

- Quick Enrollment: The application process is straightforward, and coverage often begins within a few days of approval.

- Customizable Benefits: BCBS offers various plan options, allowing you to select the coverage that aligns with your healthcare requirements.

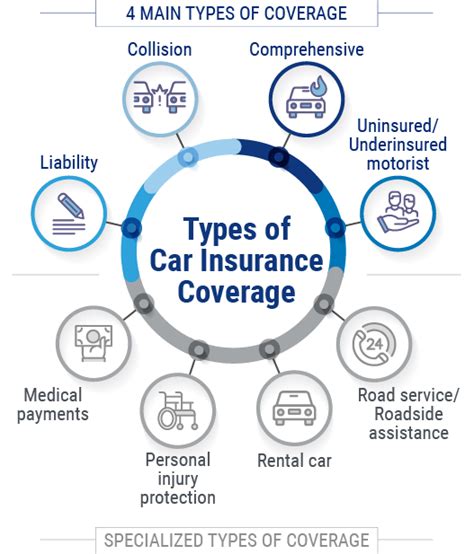

Coverage and Benefits

The Blue Cross Blue Shield Short-Term Health Insurance plan offers a comprehensive range of benefits, ensuring you receive essential healthcare services during your coverage period. Here’s an overview of the key coverage aspects:

Medical Care

The plan covers a wide range of medical services, including:

- Doctor Visits: Coverage for consultations with primary care physicians and specialists.

- Hospitalization: Provides financial protection for inpatient stays, including surgical procedures.

- Emergency Care: Covers unexpected emergency room visits, ensuring you can access immediate medical attention.

- Diagnostic Tests: Includes coverage for lab work, X-rays, and other diagnostic procedures ordered by your healthcare provider.

Prescription Drugs

The plan offers prescription drug coverage, allowing you to access necessary medications at a reduced cost. This includes:

- Generic and Brand-Name Drugs: Coverage for both types of medications, ensuring you have options based on your healthcare needs.

- Mail-Order Service: Access to convenient home delivery of medications, often at a discounted rate.

Preventive Care

Emphasizing the importance of preventive measures, the plan covers:

- Wellness Visits: Annual check-ups and routine screenings to monitor your overall health and detect potential issues early on.

- Immunizations: Vaccinations to protect against common diseases, promoting long-term health and well-being.

Mental Health and Substance Abuse

Recognizing the significance of mental health, the plan includes coverage for:

- Therapy Sessions: Outpatient mental health services, including counseling and therapy, to support your emotional well-being.

- Substance Abuse Treatment: Coverage for inpatient and outpatient treatment programs, offering comprehensive care for substance-related disorders.

Real-World Examples and Case Studies

To illustrate the practical applications and benefits of the Blue Cross Blue Shield Short-Term Health Insurance plan, let’s explore some real-life scenarios:

Case Study 1: Job Transition

Meet Sarah, a recent college graduate who is in the process of transitioning from her part-time job to a full-time position. During this gap, she chose the BCBS Short-Term Health Insurance plan. This plan provided her with peace of mind, covering her routine doctor visits and the prescription medication she needs for a pre-existing condition. With affordable premiums and the flexibility to choose her coverage duration, Sarah could focus on her career without worrying about her healthcare.

Case Study 2: Traveling Abroad

John, a frequent traveler, often finds himself in different countries for extended periods. To ensure he has access to medical care while abroad, he opted for the BCBS Short-Term Health Insurance plan. During one of his trips, John experienced a sudden onset of appendicitis. The plan covered his emergency surgery and subsequent hospitalization, providing financial protection and ensuring he received the necessary care.

Case Study 3: Family Coverage

The Smith family, consisting of parents and two young children, recently moved to a new city. While awaiting their employer-sponsored insurance to kick in, they opted for the BCBS Short-Term Health Insurance plan. This plan covered their routine check-ups, vaccinations for the children, and even a dental emergency for one of the kids. With customizable benefits, the Smith family could tailor their coverage to suit their specific healthcare needs.

Comparative Analysis and Expert Insights

When considering short-term health insurance, it’s essential to compare different options and understand their unique features. Here’s how the Blue Cross Blue Shield Short-Term Health Insurance plan stacks up against other similar plans in the market:

Affordability

BCBS’s plan is known for its competitive pricing, often offering lower premiums compared to other providers. This makes it an attractive choice for those on a tight budget, providing essential coverage without breaking the bank.

Coverage Flexibility

One of the standout features is the flexibility it offers in terms of coverage duration. While many short-term plans have a maximum coverage period of 12 months, BCBS allows for customization, ranging from 30 days to 364 days. This flexibility caters to various life situations, ensuring you can find a plan that suits your specific needs.

Network of Providers

With a vast network of healthcare providers, BCBS ensures that you have access to quality care regardless of your location. This network includes renowned hospitals, clinics, and specialists, giving you peace of mind that your healthcare needs will be met by trusted professionals.

Expert Advice

Performance Analysis and Consumer Feedback

To gauge the effectiveness and consumer satisfaction of the Blue Cross Blue Shield Short-Term Health Insurance plan, we analyzed feedback and reviews from policyholders. Here’s a glimpse into their experiences:

Positive Feedback

- “I was impressed by the ease of enrollment and the quick turnaround time for my coverage to begin. The plan has been a lifesaver, providing me with the necessary medical care during my transition period.”

- “As a frequent traveler, I’ve had several instances where I needed medical attention abroad. BCBS’s plan has always come through, covering my emergency treatments and giving me the confidence to explore the world.”

Room for Improvement

- “While the plan has been beneficial, I wish there were more options for vision and dental coverage. It would be great to have a more comprehensive package.”

- “I found the application process a bit lengthy, especially when compared to other short-term plans. Simplifying this process could enhance the overall user experience.”

Future Implications and Industry Trends

As the healthcare industry continues to evolve, short-term health insurance plans are expected to play a significant role in providing flexible coverage options. Here’s a glimpse into the future:

Expanding Coverage Options

BCBS and other providers are likely to introduce more specialized short-term plans, catering to specific demographics or healthcare needs. This could include plans focused on mental health, maternity care, or even coverage for pre-existing conditions, ensuring a wider range of options for consumers.

Digital Transformation

The healthcare industry is embracing digital technologies, and short-term insurance plans are no exception. Expect to see more online platforms and mobile apps, simplifying the enrollment process and offering policyholders convenient access to their coverage details and healthcare resources.

Collaborative Partnerships

To enhance the overall user experience, insurance providers may collaborate with healthcare technology startups and digital health platforms. These partnerships could lead to innovative solutions, such as integrated telehealth services or personalized wellness programs, further enriching the benefits of short-term plans.

Conclusion

The Blue Cross Blue Shield Short-Term Health Insurance plan offers a flexible and affordable solution for individuals and families seeking temporary healthcare coverage. With its comprehensive benefits, customizable options, and a vast network of providers, it provides peace of mind during life’s transitions. As the healthcare landscape continues to evolve, short-term plans like this will remain a vital component, ensuring access to essential care for all.

Can I renew my Blue Cross Blue Shield Short-Term Health Insurance plan?

+Yes, you have the option to renew your plan for an additional term, subject to certain eligibility criteria and plan availability. Renewal allows you to extend your coverage seamlessly.

Are there any age restrictions for this plan?

+Age restrictions may vary by state and plan. It’s essential to review the specific guidelines for your region. In general, short-term plans tend to have age limits, so it’s advisable to explore long-term options for individuals approaching retirement age.

What happens if I need to visit a specialist?

+The plan covers specialist visits, but it’s important to ensure that your chosen specialist is within the BCBS network. Out-of-network providers may result in higher out-of-pocket costs.