Car Full Coverage Insurance

Car insurance is an essential aspect of vehicle ownership, offering protection and peace of mind to drivers worldwide. Full coverage insurance, a comprehensive plan, provides extensive protection against a range of potential risks and damages. In this expert-driven guide, we will delve into the intricacies of car full coverage insurance, exploring its benefits, components, and how it safeguards your vehicle and finances. By understanding the ins and outs of this insurance type, you can make informed decisions to ensure your vehicle is adequately protected.

Understanding Car Full Coverage Insurance

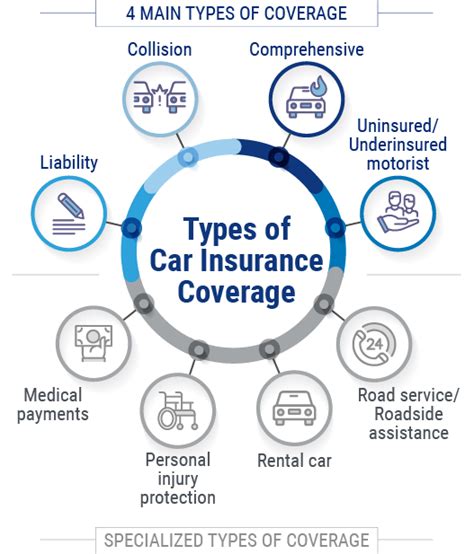

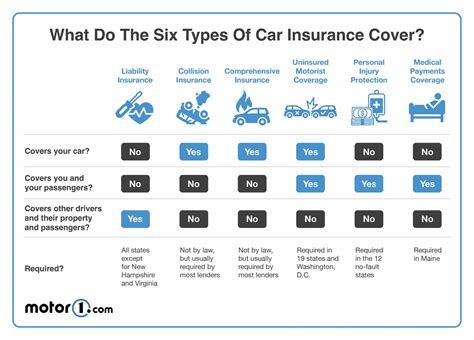

Full coverage insurance is a comprehensive automotive insurance policy that combines collision coverage and comprehensive coverage to provide a wide range of protections for your vehicle. This type of insurance goes beyond the basic liability coverage, offering financial security in various scenarios, from accidents to natural disasters.

Collision Coverage

Collision coverage is a fundamental component of full coverage insurance. It is designed to cover repair costs or the replacement value of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is particularly beneficial for newer or pricier vehicles, as it ensures you won’t be left with substantial out-of-pocket expenses.

For instance, if your car collides with another vehicle at an intersection, collision coverage would step in to cover the repair costs. This coverage also applies if you hit an object, such as a tree or a pole.

Comprehensive Coverage

Comprehensive coverage is another critical aspect of full coverage insurance. It provides protection against damages caused by events other than collisions, such as theft, vandalism, natural disasters (like hail or storms), or even animal collisions. This coverage is vital for safeguarding your vehicle against unexpected and often costly damages.

Consider a scenario where a severe hailstorm damages your car’s roof and windshield. In such a case, comprehensive coverage would cover the repairs, ensuring your vehicle is restored to its pre-storm condition.

| Coverage Type | Key Benefits |

|---|---|

| Collision | Covers repair or replacement costs for vehicle damage caused by collisions, regardless of fault. |

| Comprehensive | Protects against non-collision damages, including theft, vandalism, and natural disasters. |

Key Features and Benefits

Car full coverage insurance offers a multitude of benefits and features that make it an attractive choice for vehicle owners. Here’s a closer look at some of its key advantages:

Comprehensive Protection

As mentioned earlier, full coverage insurance provides comprehensive protection against a wide array of risks. This includes not only accidents but also damages caused by theft, vandalism, and natural disasters. By offering a holistic coverage approach, it ensures your vehicle is safeguarded against most potential threats.

For example, if your car is damaged in a flood, full coverage insurance would step in to cover the necessary repairs or, in severe cases, the replacement cost.

Peace of Mind

Having full coverage insurance provides peace of mind for vehicle owners. Knowing that your vehicle is protected against a broad spectrum of risks allows you to drive with confidence, knowing you’re prepared for the unexpected. This peace of mind extends to situations where you’re involved in an accident, as the insurance covers the costs, reducing the financial burden on you.

Consider a scenario where you’re in an accident, and your vehicle is severely damaged. With full coverage insurance, you can rest assured that the insurance provider will handle the repairs or replacement, minimizing your financial stress.

Enhanced Resale Value

Full coverage insurance can also enhance the resale value of your vehicle. Many buyers prefer vehicles with a comprehensive insurance history, as it indicates the vehicle has been well-maintained and protected. This can make your vehicle more appealing to potential buyers, potentially fetching a higher resale price.

When selling your vehicle, having a full coverage insurance history can be a significant selling point, giving you an edge over other sellers in the market.

Customizable Options

Full coverage insurance policies often offer customizable options to suit your specific needs and preferences. You can choose different levels of coverage, deductibles, and additional benefits to create a policy that aligns with your requirements and budget. This flexibility ensures you get the coverage you need without unnecessary expenses.

For instance, you might opt for a higher deductible to reduce your monthly premiums, a strategy that works well if you have a good driving record and are comfortable covering smaller expenses out of pocket.

| Feature | Benefit |

|---|---|

| Comprehensive Protection | Covers a wide range of risks, providing financial security in various scenarios. |

| Peace of Mind | Reduces financial stress and provides confidence while driving. |

| Enhanced Resale Value | Attracts potential buyers, potentially increasing your vehicle's resale price. |

| Customizable Options | Allows you to tailor the policy to your specific needs and budget. |

Performance Analysis and Real-World Examples

Let’s explore some real-world scenarios to understand how car full coverage insurance performs in various situations:

Accident Scenario

Imagine you’re driving on a rainy day, and due to slippery roads, you collide with another vehicle. In this scenario, full coverage insurance would come into play, covering the costs of repairing your vehicle, regardless of who is at fault. This coverage ensures you aren’t left with a substantial financial burden after an accident.

Vandalism and Theft

Suppose your parked car is vandalized, with scratches and broken windows. In such a case, comprehensive coverage would step in to cover the costs of repairing or replacing the damaged parts. Additionally, if your car is stolen, comprehensive coverage would also apply, providing compensation for the loss.

Natural Disaster

During a severe storm, your vehicle is damaged by falling debris and hail. Comprehensive coverage would be activated, covering the costs of repairing your car, ensuring it’s restored to its pre-storm condition.

Hit-and-Run Incidents

In a hit-and-run situation, where the other driver flees the scene, full coverage insurance can still provide protection. Collision coverage would cover the damages to your vehicle, ensuring you’re not left stranded without assistance.

| Scenario | Coverage Applied |

|---|---|

| Accident | Collision Coverage |

| Vandalism and Theft | Comprehensive Coverage |

| Natural Disaster | Comprehensive Coverage |

| Hit-and-Run | Collision Coverage |

Future Implications and Industry Insights

The car insurance industry is continuously evolving, and full coverage insurance is no exception. Here are some future implications and industry insights to consider:

Technological Advancements

With the rise of autonomous and connected vehicles, insurance providers are adapting their policies to accommodate these technological advancements. Full coverage insurance policies may evolve to include specific provisions for self-driving cars, addressing unique risks and liabilities.

Data-Driven Pricing

Insurance companies are increasingly leveraging data analytics to offer more accurate and personalized pricing. Full coverage insurance policies may utilize advanced data models to determine premiums, taking into account factors like driving behavior, location, and vehicle usage patterns.

Enhanced Digital Experiences

The insurance industry is moving towards more digital and streamlined processes. Full coverage insurance providers are likely to invest in enhancing their digital platforms, offering convenient online policy management, claims submission, and real-time support, improving the overall customer experience.

Environmental Considerations

As environmental concerns continue to rise, insurance providers may incorporate eco-friendly practices into their policies. Full coverage insurance could potentially offer incentives or discounts for drivers who adopt sustainable practices, such as using electric vehicles or carpooling.

| Future Trend | Potential Impact |

|---|---|

| Technological Advancements | Policies may adapt to accommodate autonomous and connected vehicles. |

| Data-Driven Pricing | Premiums could be determined based on personalized data models. |

| Enhanced Digital Experiences | Insurance providers will focus on improving digital platforms and customer service. |

| Environmental Considerations | Incentives for sustainable practices may be incorporated into policies. |

Conclusion

Car full coverage insurance is a vital aspect of vehicle ownership, offering comprehensive protection and peace of mind. By understanding the components, benefits, and real-world performance of full coverage insurance, you can make informed decisions to safeguard your vehicle and finances. With its wide-ranging coverage and customizable options, full coverage insurance provides an effective solution for drivers seeking financial security and peace of mind on the road.

Is full coverage insurance mandatory for all drivers?

+Full coverage insurance is not mandatory in all states, but it is highly recommended for comprehensive vehicle protection. While liability coverage is typically required by law, full coverage provides an additional layer of financial security.

How much does full coverage insurance typically cost?

+The cost of full coverage insurance can vary significantly based on factors like your location, driving record, and the make and model of your vehicle. On average, full coverage insurance can range from 100 to 200 per month, but it’s best to obtain quotes tailored to your specific situation.

Can I customize my full coverage insurance policy?

+Yes, full coverage insurance policies often offer customizable options. You can choose different levels of coverage, adjust deductibles, and add optional benefits to create a policy that suits your needs and budget.

What happens if I’m involved in an accident with a driver who doesn’t have insurance?

+If you’re in an accident with an uninsured driver, your collision coverage will typically cover the damages to your vehicle. However, it’s important to review your policy’s specific provisions and consider adding uninsured motorist coverage for additional protection.