Does Health Insurance Cover Dental

Health insurance is a vital aspect of modern healthcare, offering financial protection and access to essential medical services. While health insurance plans typically cover a wide range of medical treatments and procedures, the inclusion of dental care can vary significantly. Understanding the extent of dental coverage in health insurance plans is crucial for individuals seeking comprehensive healthcare and maintaining optimal oral health.

The Intersection of Health Insurance and Dental Care

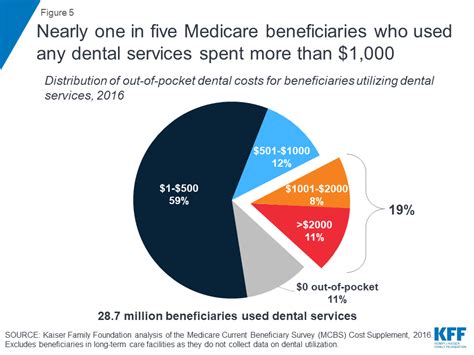

Dental care is an integral part of overall health, and many individuals rely on health insurance to manage the costs associated with dental treatments. However, the relationship between health insurance and dental coverage is complex and often dependent on various factors, including the specific plan chosen, the insurance provider, and the geographical location.

Understanding Dental Benefits

Health insurance plans may offer dental benefits as part of their comprehensive coverage or as a separate, optional add-on. These benefits can range from basic preventive care to more extensive restorative and cosmetic procedures. It is essential to carefully review the terms and conditions of your health insurance policy to determine the extent of dental coverage provided.

| Dental Procedure | Coverage Status |

|---|---|

| Routine Cleanings | Typically covered with low or no copay |

| Fillings | Covered with varying copays/deductibles |

| Root Canals | May be covered, but often with higher out-of-pocket costs |

| Dental Implants | Often not covered, or limited coverage |

| Orthodontic Treatments | Varies widely, some plans offer partial coverage |

The table above provides a general overview of common dental procedures and their typical coverage status. However, it's crucial to note that these details can vary significantly between insurance providers and plans. Always refer to your specific insurance policy for accurate and detailed information.

Factors Influencing Dental Coverage

Several factors come into play when determining the extent of dental coverage in health insurance plans. These include:

- Plan Type: Different health insurance plans offer varying levels of dental coverage. Some plans provide comprehensive dental benefits, while others may offer limited or no dental coverage at all.

- Provider Network: Many health insurance plans operate within a network of preferred providers. The inclusion of dental services within this network can impact the availability and cost of dental care.

- Geographical Location: Dental coverage can vary based on the state or region where the insurance policy is purchased. Different states may have varying regulations and requirements regarding dental benefits.

- Individual Policy Details: Even within the same plan, dental coverage can differ based on individual policy selections. Optional add-ons or customized coverage packages may be available to enhance dental benefits.

Maximizing Dental Coverage

If you prioritize dental care and wish to maximize your coverage, several strategies can be employed:

Selecting the Right Plan

Research and compare different health insurance plans to identify those that offer comprehensive dental benefits. Look for plans with a wide range of covered procedures, low copays or deductibles, and a robust network of dental providers.

Understanding Network Providers

Familiarize yourself with the network providers included in your health insurance plan. Choose a plan with a network that includes reputable and experienced dental professionals. Ensure that your preferred dentist is within the network to avoid higher out-of-pocket costs.

Exploring Optional Add-ons

Some health insurance plans offer optional add-ons or riders that specifically enhance dental coverage. These add-ons may provide additional benefits, such as coverage for orthodontic treatments or cosmetic procedures. Evaluate the cost and benefits of these add-ons to determine if they align with your dental needs.

Maintaining Regular Dental Check-ups

Preventive dental care is often the most cost-effective approach. Regular dental check-ups and cleanings are typically covered by health insurance plans, helping to identify and address potential issues early on. By maintaining good oral hygiene and adhering to recommended check-up schedules, you can minimize the need for more expensive dental procedures.

The Future of Dental Coverage in Health Insurance

The landscape of dental coverage in health insurance is evolving. As the importance of oral health becomes increasingly recognized, many insurance providers are expanding their dental benefits. This trend is likely to continue, with a focus on promoting preventive care and addressing the growing demand for dental services.

Additionally, advancements in dental technology and treatment options may influence the future of dental coverage. Insurance providers may adapt their policies to include innovative procedures and technologies, ensuring that individuals have access to the latest advancements in oral healthcare.

Frequently Asked Questions

Are dental emergencies typically covered by health insurance?

+Yes, many health insurance plans cover dental emergencies, such as tooth infections or injuries. However, the extent of coverage may vary, and some plans may require prior authorization or have specific guidelines for emergency dental care.

<div class="faq-item">

<div class="faq-question">

<h3>Can I switch my health insurance plan to get better dental coverage?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, during open enrollment periods or under certain qualifying life events, you may have the opportunity to switch your health insurance plan. Research and compare different plans to find one that offers better dental coverage suited to your needs.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any discounts or programs available to reduce dental costs for those without dental coverage?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, several organizations offer dental discount programs or assistance for individuals without dental coverage. These programs typically provide reduced rates for dental services. Additionally, some states have programs to help low-income individuals access affordable dental care.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How often should I visit the dentist if my health insurance covers routine cleanings and check-ups?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>It is generally recommended to visit your dentist for routine cleanings and check-ups at least once every six months. However, your dentist may recommend more frequent visits depending on your oral health status and specific needs.</p>

</div>

</div>

</div>