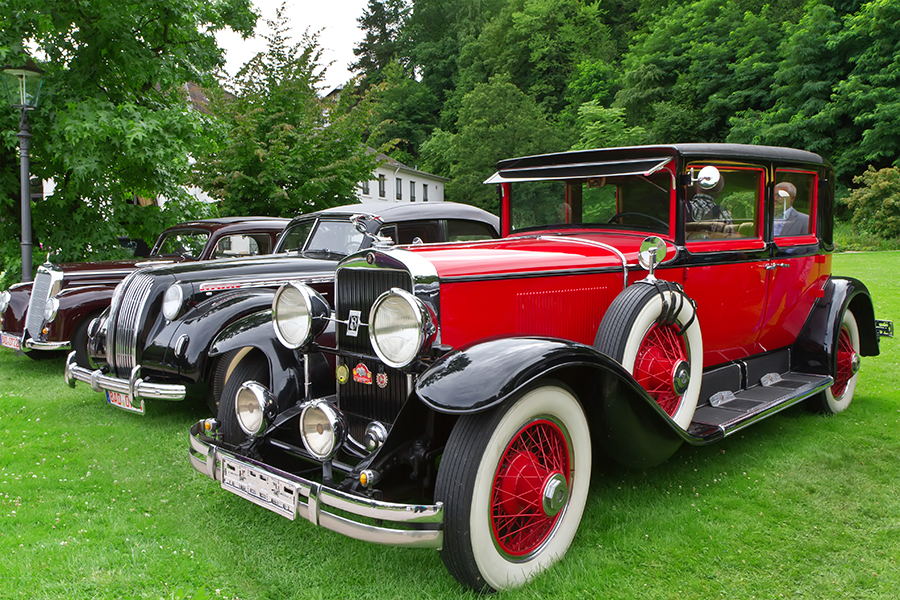

Insurance Collector Car

Unveiling the World of Insurance for Collector Cars: A Comprehensive Guide

In the realm of automotive enthusiasts, collector cars hold a special place. These vintage and classic vehicles are not just a means of transportation; they are cherished pieces of automotive history, often meticulously restored and maintained. As the pride and joy of their owners, collector cars require a unique insurance approach to ensure they receive the protection they deserve. This comprehensive guide delves into the intricacies of insurance for collector cars, exploring the key considerations, coverage options, and the benefits of tailoring policies to these distinctive vehicles.

Understanding the Collector Car Insurance Landscape

Collector car insurance is a specialized branch of the automotive insurance industry, catering to the unique needs of vintage and classic vehicle owners. Unlike standard auto insurance policies, which primarily focus on modern vehicles used for daily commuting, collector car insurance is designed to provide comprehensive protection for vehicles that are often more valuable, rarer, and used primarily for pleasure rather than daily transportation.

The landscape of collector car insurance is diverse, with various providers offering tailored policies to meet the specific needs of this niche market. These policies recognize that collector cars are more than just a means of getting from point A to point B; they are investments, historical artifacts, and sources of immense pride for their owners. As such, the coverage offered extends beyond the typical liability and collision coverage found in standard auto insurance policies.

The Importance of Specialized Coverage

Collector car insurance is essential for several reasons. Firstly, classic and vintage vehicles often have higher replacement and repair costs due to their rarity and the specialized parts and craftsmanship involved. A standard auto insurance policy might not adequately cover these costs, leaving the owner vulnerable to significant financial losses in the event of an accident or other covered perils.

Secondly, collector cars often appreciate in value over time, unlike modern vehicles which typically depreciate. Specialized insurance policies take into account this unique aspect, offering agreed value or stated value coverage options that ensure the vehicle is insured for its actual worth, not just its depreciated market value. This is crucial for owners who want to protect their investment and ensure they receive fair compensation in the event of a total loss.

Lastly, collector car insurance policies often provide additional benefits and services tailored to the needs of classic car enthusiasts. This can include coverage for transportation to car shows and events, agreed value coverage for spare parts and accessories, and even concierge services to assist with the unique needs of maintaining and storing these vehicles.

Key Considerations for Collector Car Insurance

When exploring insurance options for a collector car, there are several key considerations to keep in mind. These considerations ensure that the chosen policy provides the right level of protection and peace of mind for the vehicle's owner.

Vehicle Value and Agreed Value Coverage

One of the primary considerations is ensuring the vehicle's value is accurately assessed and reflected in the insurance policy. Collector cars can range widely in value, from a few thousand dollars for a well-preserved vintage vehicle to hundreds of thousands or even millions for rare classics or race cars. An agreed value policy, where the insurer and the owner agree on the vehicle's value upfront, provides the most comprehensive protection. This ensures the owner receives the full agreed amount in the event of a total loss, without the need for further negotiations or assessments.

It's important to note that agreed value policies typically require a thorough appraisal of the vehicle, taking into account its make, model, year, condition, and any modifications or enhancements. This appraisal is then used to determine the agreed value, which is reviewed and updated periodically to account for any changes in the vehicle's condition or the market value of similar vehicles.

Coverage for Unique Risks

Collector cars often face unique risks that standard auto insurance policies might not cover. For instance, these vehicles are more likely to be targeted by thieves due to their rarity and value. Therefore, comprehensive coverage that includes protection against theft, vandalism, and other perils is crucial. Additionally, collector cars may require specialized storage or transportation, and the insurance policy should cover these needs.

Furthermore, collector cars often participate in car shows, rallies, and other events. The insurance policy should provide coverage for these activities, including liability coverage in case of any accidents or incidents that may occur during these events. This ensures that the owner can enjoy the full experience of owning a collector car without worrying about potential liabilities.

Dedicated Claims Handling

In the unfortunate event of a claim, collector car owners want to ensure their vehicle is handled with the utmost care and expertise. Specialized insurance providers often have dedicated claims teams with experience in dealing with classic and vintage vehicles. These teams understand the unique nature of these vehicles and can provide efficient and effective claims handling, ensuring the vehicle is repaired or replaced with the right parts and craftsmanship.

Moreover, dedicated claims handling can include assistance with finding reputable repair shops or restorers who have the necessary expertise to work on collector cars. This ensures the vehicle is restored to its original condition, maintaining its value and preserving its historical integrity.

Benefits of Tailored Collector Car Insurance

Choosing a tailored insurance policy for a collector car offers several benefits that standard auto insurance policies cannot provide.

Protection for the Vehicle's True Value

As mentioned earlier, collector cars often appreciate in value over time. A tailored insurance policy ensures that the vehicle is insured for its actual worth, not just its depreciated value. This provides peace of mind for the owner, knowing that they are adequately protected in the event of a total loss. The agreed value coverage option is particularly beneficial in this regard, as it eliminates the need for tedious negotiations and assessments after a loss.

Enhanced Coverage for Unique Needs

Collector car owners have unique needs and requirements when it comes to insuring their vehicles. A tailored insurance policy can provide enhanced coverage for these needs, including protection for spare parts, accessories, and even collectibles associated with the vehicle. This ensures that the entire investment, including the vehicle and its associated items, is adequately protected.

Furthermore, tailored policies often include coverage for transportation to and from car shows, events, and restoration shops. This provides added convenience and peace of mind, knowing that the vehicle can be safely and securely transported without the owner having to worry about additional costs or risks.

Expertise and Dedicated Support

Specialized insurance providers often have a team of experts who are passionate about classic and vintage vehicles. This expertise extends beyond just understanding the unique risks and needs of collector cars; it also involves providing dedicated support and guidance to owners. This can include assistance with maintenance and restoration recommendations, advice on the best practices for storing and displaying the vehicle, and even help with finding reputable mechanics or restorers.

The dedicated support offered by specialized insurance providers is a valuable asset for collector car owners, providing them with the knowledge and resources to make informed decisions about their vehicle's care and protection.

Collector Car Insurance: A Case Study

To illustrate the benefits of specialized collector car insurance, let's consider a case study involving a 1967 Shelby GT500, one of the most iconic muscle cars ever produced. This particular vehicle, owned by John, a passionate car enthusiast, was insured with a standard auto insurance policy before he discovered the benefits of collector car insurance.

The Value of Agreed Value Coverage

John's Shelby GT500, in pristine condition, was worth considerably more than the standard policy's market value assessment. When he decided to upgrade his insurance to a specialized collector car policy, he worked with an insurer who provided an agreed value coverage option. After a thorough appraisal, the insurer agreed on a value that accurately reflected the car's rarity, condition, and historical significance.

This agreed value coverage provided John with peace of mind, knowing that if his beloved Shelby was ever totaled in an accident or stolen, he would receive the full agreed amount to either restore or replace the vehicle, without any depreciation considerations.

Coverage for Unique Risks

John's Shelby, due to its iconic status, was at a higher risk of theft or vandalism. The specialized insurance policy he chose provided comprehensive coverage for these risks, giving him added protection for his valuable asset. Additionally, the policy included coverage for transportation to car shows and events, which John frequently attended with his Shelby, showcasing it to fellow enthusiasts.

Dedicated Claims Handling

Unfortunately, John's Shelby was involved in an accident while being transported to a car show. The specialized insurance provider he had chosen had a dedicated claims team with extensive experience in handling classic and vintage vehicles. This team worked closely with John to ensure the Shelby was repaired with the highest quality parts and craftsmanship, maintaining its historical integrity.

The claims process was efficient and transparent, with the team providing regular updates to John throughout the repair process. This level of dedication and expertise in handling collector car claims is a significant benefit of choosing a specialized insurance provider.

The Future of Collector Car Insurance

As the collector car market continues to evolve, so too will the insurance landscape that serves it. The future of collector car insurance is poised to offer even more tailored coverage options and innovative services that cater to the unique needs of this niche market.

Expanding Coverage Options

Insurance providers are increasingly recognizing the diversity within the collector car market. As a result, they are expanding their coverage options to cater to a wider range of vehicles and their specific needs. This includes offering policies for classic motorcycles, hot rods, vintage race cars, and even pre-war vehicles, each with their own unique considerations and requirements.

Additionally, insurers are exploring new coverage options to address emerging risks and trends within the collector car market. For instance, as more collector cars are being driven on public roads for pleasure rather than just stored in collections, insurers are developing policies that provide adequate liability coverage for these vehicles when they are in use.

Technology-Driven Solutions

The insurance industry is embracing technology to enhance the collector car insurance experience. This includes the use of digital platforms and apps that allow owners to easily manage their policies, access important documents, and even file claims. These technology-driven solutions streamline the insurance process, making it more convenient and efficient for collector car owners.

Furthermore, technology is being utilized to enhance the accuracy of vehicle valuations. Advanced algorithms and data analytics are being employed to assess the value of collector cars, taking into account a range of factors such as historical performance, market trends, and even the vehicle's condition and provenance. This ensures that collector car owners receive fair and accurate valuations for their vehicles, which is crucial for agreed value coverage.

Enhanced Customer Service

Collector car owners often have unique questions and concerns when it comes to insuring their vehicles. Insurance providers are investing in dedicated customer service teams with expertise in collector car insurance to provide personalized support and guidance. These teams can offer advice on policy options, answer questions about coverage, and assist with any issues or claims that may arise.

Additionally, insurers are exploring ways to enhance the overall customer experience, such as offering concierge services or providing access to exclusive events and experiences for collector car owners. This not only adds value to the insurance policy but also creates a sense of community and camaraderie among these passionate enthusiasts.

What is the typical cost of collector car insurance?

+

The cost of collector car insurance can vary widely depending on several factors, including the make and model of the vehicle, its age, condition, and value, as well as the coverage options and deductibles chosen by the policyholder. Generally, collector car insurance tends to be more expensive than standard auto insurance due to the unique risks and needs associated with these vehicles. However, it’s important to note that the cost is often well worth it for the comprehensive protection and peace of mind it provides.

Can I insure multiple collector cars under one policy?

+

Yes, many collector car insurance providers offer policies that can cover multiple vehicles. This can be particularly beneficial for individuals who have a collection of classic and vintage vehicles, as it simplifies the insurance process and often results in cost savings. However, it’s important to ensure that each vehicle is adequately covered based on its unique value and needs.

How often should I have my collector car appraised for insurance purposes?

+

It’s recommended to have your collector car appraised every few years, or whenever there are significant changes to the vehicle’s condition, modifications, or the market value of similar vehicles. Regular appraisals ensure that your insurance coverage accurately reflects the current value of your vehicle, providing you with the peace of mind that you’re adequately protected.

What should I do if I’m involved in an accident with my collector car?

+

If you’re involved in an accident with your collector car, it’s important to remain calm and take the necessary steps to ensure your safety and the safety of others involved. Contact your insurance provider as soon as possible to report the accident and initiate the claims process. They will guide you through the next steps, which may include filing a police report, taking photos of the damage, and arranging for the vehicle to be assessed by a professional.