Good Health Insurance

In today's world, having comprehensive and reliable health insurance is not just a necessity but a cornerstone of financial security and peace of mind. With rising healthcare costs and the complexities of modern medical treatment, finding the right health insurance plan can be a daunting task. This comprehensive guide aims to demystify the process, providing you with the knowledge and tools to make informed decisions and secure the best health insurance coverage for your needs.

Understanding Health Insurance: A Fundamental Necessity

Health insurance is a vital component of any financial plan, offering protection against the potentially devastating costs of medical care. It provides a safety net, ensuring that you can access the healthcare services you need without facing overwhelming financial burdens. The concept of health insurance is built on the principle of risk sharing, where a group of individuals pays into a collective fund, enabling them to cover the medical expenses of those who require treatment.

The benefits of health insurance extend beyond the immediate financial protection. It promotes early detection and treatment of health issues, which can lead to better health outcomes and potentially reduce long-term healthcare costs. Additionally, many health insurance plans offer preventive care services and wellness programs, encouraging a proactive approach to health management.

Navigating the Landscape of Health Insurance Plans

The health insurance market offers a wide array of plans, each designed to cater to different needs and budgets. Understanding the key types of health insurance plans is the first step in making an informed choice.

1. Fee-for-Service (FFS) Plans

Fee-for-Service plans provide the most flexibility, allowing individuals to choose their healthcare providers and specialists without any restrictions. These plans typically require the individual to pay for services upfront and then submit claims to the insurance company for reimbursement. While FFS plans offer a high degree of freedom, they can also be more expensive and require more administrative work.

2. Health Maintenance Organizations (HMOs)

HMOs are known for their cost-effectiveness and structured approach to healthcare. Under an HMO plan, individuals are required to select a primary care physician (PCP) who acts as a gatekeeper for their healthcare. This means that the PCP must approve any referrals to specialists. HMOs often have a network of preferred providers, and using out-of-network services may result in higher costs or lack of coverage.

3. Preferred Provider Organizations (PPOs)

PPOs offer a balance between the flexibility of FFS plans and the cost-effectiveness of HMOs. Individuals have the freedom to choose their healthcare providers, both in and out of the PPO's network. While using in-network providers typically results in lower out-of-pocket costs, PPOs still provide coverage for out-of-network services, albeit at a higher cost-sharing rate.

4. Point-of-Service (POS) Plans

POS plans combine elements of both HMOs and PPOs. Like HMOs, POS plans require individuals to select a PCP and obtain referrals for specialist care. However, like PPOs, POS plans allow individuals to use providers outside the network, although at a higher cost-sharing rate. POS plans offer a degree of flexibility, making them a good choice for those who value the option to choose their healthcare providers.

Key Factors to Consider When Choosing a Health Insurance Plan

Selecting the right health insurance plan involves careful consideration of several critical factors. These factors will influence the level of coverage, out-of-pocket costs, and overall value of the plan.

1. Coverage and Benefits

Review the plan's coverage details thoroughly. Ensure that the plan covers the specific healthcare services you anticipate needing, including any pre-existing conditions you may have. Look for plans that offer a comprehensive range of benefits, including hospital stays, outpatient services, prescription drugs, mental health services, and preventive care.

| Plan Type | Coverage Highlights |

|---|---|

| FFS Plans | Flexibility to choose providers; often includes comprehensive coverage. |

| HMOs | Cost-effective; covers a wide range of services, but may have limited provider options. |

| PPOs | Balanced coverage and flexibility; allows choice of providers, both in and out of network. |

| POS Plans | Combines features of HMOs and PPOs; offers flexibility with some cost-sharing considerations. |

2. Cost and Out-of-Pocket Expenses

Evaluate the plan's cost structure, including premiums, deductibles, copayments, and coinsurance. Premiums are the regular payments you make to maintain your coverage. Deductibles are the amounts you pay out of pocket before the insurance coverage kicks in. Copayments are fixed amounts you pay for specific services, and coinsurance is the percentage of the service cost you pay after meeting your deductible.

| Plan Type | Cost Considerations |

|---|---|

| FFS Plans | May have higher premiums; typically requires individuals to pay for services upfront and then seek reimbursement. |

| HMOs | Generally more affordable; often has lower out-of-pocket costs, but may have higher copayments for out-of-network services. |

| PPOs | Balanced cost structure; may have higher premiums but offers more flexibility in provider choice. |

| POS Plans | Similar to PPOs in terms of cost structure, but may have higher cost-sharing for out-of-network services. |

3. Network of Providers

If you have a preferred healthcare provider or specialist, it's crucial to ensure they are in the plan's network. Out-of-network services can be significantly more expensive and may not be fully covered by your insurance.

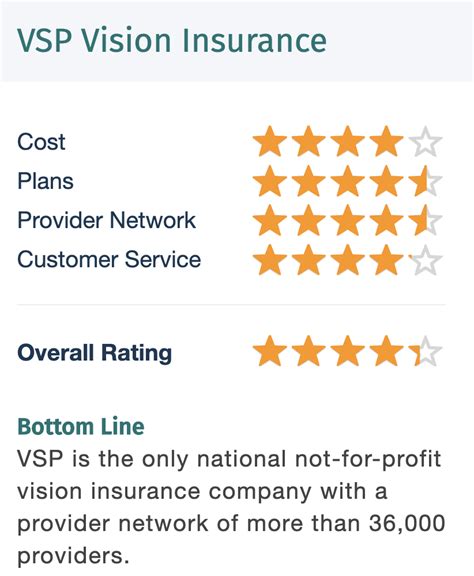

4. Customer Service and Claims Process

The ease of interacting with the insurance company and the efficiency of their claims process can significantly impact your experience. Look for plans with a responsive customer service team and a straightforward, transparent claims process.

Maximizing the Benefits of Your Health Insurance Plan

Once you've selected your health insurance plan, it's important to understand how to maximize its benefits to ensure you get the most out of your coverage.

1. Understanding Your Plan's Details

Familiarize yourself with your plan's benefits, exclusions, and limitations. Know your deductible, copayments, and coinsurance rates, as well as any maximum out-of-pocket expenses. Understanding these details will help you budget effectively and make informed decisions about your healthcare.

2. Utilizing Preventive Care Services

Many health insurance plans offer preventive care services at little to no cost. These services, such as annual check-ups, screenings, and immunizations, are designed to help detect potential health issues early on and maintain your overall health. Taking advantage of these services can lead to better health outcomes and potentially reduce future healthcare costs.

3. Managing Chronic Conditions

If you have a chronic condition, it's important to understand how your plan covers the management of that condition. This includes understanding medication coverage, specialist referrals, and any additional services or programs the plan may offer to support individuals with chronic illnesses.

4. Staying Informed and Engaged

Keep yourself updated on any changes to your plan's coverage, benefits, or network of providers. Attend any educational workshops or webinars offered by your insurance provider to better understand your coverage and rights. By staying informed, you can make the most of your health insurance and ensure you're getting the best possible care.

Conclusion: Securing Your Health and Financial Well-being

Navigating the world of health insurance can be complex, but with the right knowledge and resources, you can make informed choices to protect your health and financial stability. By understanding the different types of health insurance plans, evaluating key factors, and maximizing the benefits of your chosen plan, you can take control of your healthcare journey and ensure you have the coverage you need when you need it.

Frequently Asked Questions

How do I choose the right health insurance plan for my needs?

+Choosing the right health insurance plan involves assessing your healthcare needs, understanding the coverage and benefits offered by different plans, and considering your budget. Evaluate factors such as coverage details, cost structure, network of providers, and customer service. Consider your anticipated healthcare needs and choose a plan that aligns with your priorities, whether it’s flexibility, cost-effectiveness, or comprehensive coverage.

What are the key differences between HMOs and PPOs?

+HMOs and PPOs differ in terms of provider choice and cost structure. HMOs typically require individuals to select a primary care physician and use in-network providers, resulting in lower costs. PPOs offer more flexibility in provider choice, both in and out of network, but may have higher premiums. The right choice depends on your healthcare needs and preferences.

How can I maximize the benefits of my health insurance plan?

+To maximize your health insurance benefits, thoroughly understand your plan’s coverage, exclusions, and limitations. Utilize preventive care services and stay informed about any changes to your plan. If you have a chronic condition, work closely with your healthcare providers and insurance company to ensure you receive the necessary care and support.