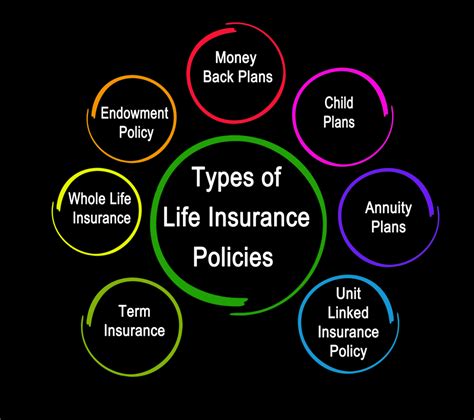

What Are The Different Types Of Life Insurance

Life insurance is a crucial financial tool that provides security and peace of mind to individuals and their loved ones. It offers a financial safety net by ensuring that, in the event of an unexpected demise, the insured person's beneficiaries receive a predetermined sum of money. This sum can help cover various expenses, ranging from immediate financial needs to long-term goals. With a diverse range of life insurance policies available, it's essential to understand the different types to make informed decisions tailored to your specific circumstances.

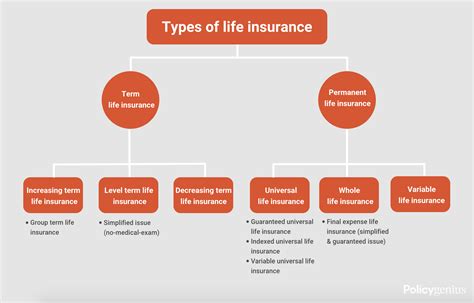

Term Life Insurance

Term life insurance is a straightforward and cost-effective option, providing coverage for a specific period, often ranging from 10 to 30 years. It offers a fixed death benefit, meaning that if the insured individual passes away during the policy term, their beneficiaries will receive the full sum insured. This type of insurance is ideal for those seeking coverage during a particular life stage, such as when raising a family or paying off a mortgage. Key features include:

- Affordable Premiums: Term life insurance is generally more affordable than permanent life insurance, making it accessible to a wider range of individuals.

- Flexibility: Policy terms can be customized to fit the insured’s needs, ensuring coverage during critical life stages.

- No Cash Value: Unlike permanent life insurance, term life does not accumulate cash value over time.

Level Term Insurance

Level term insurance offers a consistent death benefit and premium rate throughout the policy term. This means that regardless of when the insured passes away during the term, their beneficiaries will receive the same sum insured, and the premium remains fixed. It provides straightforward coverage without the complexity of increasing or decreasing benefits.

Increasing Term Insurance

Increasing term insurance offers a death benefit that rises over time, typically at a fixed percentage or in line with inflation. This type of policy is beneficial for individuals whose financial needs are expected to increase over time, such as those with growing families or changing financial responsibilities. The increasing death benefit ensures that the coverage remains relevant and adequate as the insured’s circumstances evolve.

Renewable Term Insurance

Renewable term insurance allows the policyholder to renew the policy at the end of the term, often without undergoing a new medical examination. While the premium may increase with each renewal, this type of insurance provides the flexibility to extend coverage beyond the initial term. It’s particularly useful for individuals who may not be able to qualify for new insurance due to health or age factors.

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides lifelong coverage, offering both a death benefit and a cash value component that accumulates over time. This type of insurance is more comprehensive and often comes with higher premiums. The cash value can be used for various purposes, such as paying premiums, borrowing against the policy, or withdrawing funds.

Whole Life Insurance

Whole life insurance is a classic form of permanent insurance that offers a guaranteed death benefit and stable premium payments throughout the insured’s lifetime. The policy accumulates cash value, which can be accessed through loans or withdrawals. Whole life insurance provides consistent coverage and is often chosen for its reliability and long-term financial planning benefits.

Universal Life Insurance

Universal life insurance offers more flexibility than whole life, allowing policyholders to adjust their premium payments and death benefits within certain limits. The cash value component grows based on the policy’s investment performance, and policyholders can choose how the cash value is invested. This type of insurance provides a balance between coverage and investment opportunities.

Variable Life Insurance

Variable life insurance allows policyholders to invest their cash value in a range of investment options, such as stocks, bonds, and mutual funds. The death benefit and cash value are tied to the performance of these investments, meaning they can increase or decrease based on market conditions. This type of insurance appeals to those seeking more control over their investments and potentially higher returns.

Other Types of Life Insurance

In addition to the traditional term and permanent life insurance policies, there are specialized types designed for specific needs:

Guaranteed Issue Life Insurance

Guaranteed issue life insurance is designed for individuals who may have difficulty obtaining traditional coverage due to health or age-related factors. This type of insurance does not require a medical exam and provides a simplified application process. However, it often comes with limited coverage and higher premiums.

Final Expense Insurance

Final expense insurance, also known as burial insurance, is a specialized policy designed to cover the costs associated with end-of-life expenses, such as funeral and burial costs. It typically offers smaller coverage amounts and is often chosen by individuals seeking to ensure their final wishes are carried out without burdening their loved ones financially.

Mortgage Life Insurance

Mortgage life insurance is a type of term insurance specifically designed to cover the outstanding balance of a mortgage in the event of the insured’s death. It provides peace of mind by ensuring that the insured’s family can remain in their home without the financial burden of a mortgage.

Group Life Insurance

Group life insurance is often offered through employers as part of employee benefit packages. It provides coverage to a group of individuals, such as employees, at a discounted rate. While it may not offer the same level of customization as individual policies, it is a convenient and cost-effective option for many.

| Life Insurance Type | Key Features |

|---|---|

| Term Life Insurance | Affordable, flexible coverage for a specific term. |

| Level Term | Fixed death benefit and premium rate throughout the term. |

| Increasing Term | Rising death benefit over time, ideal for growing financial needs. |

| Renewable Term | Renewable at the end of the term, providing extended coverage. |

| Permanent Life Insurance | Lifelong coverage with a cash value component. |

| Whole Life | Guaranteed death benefit and stable premiums. |

| Universal Life | Flexible premium payments and death benefits. |

| Variable Life | Cash value tied to investment performance. |

| Specialized Policies | Tailored to specific needs, such as final expenses or mortgages. |

How much life insurance coverage do I need?

+

The amount of life insurance coverage you need depends on various factors, including your financial responsibilities, outstanding debts, and future goals. As a general guideline, experts recommend having coverage that is 10-15 times your annual income. However, it’s essential to consider your specific circumstances and consult with a financial advisor to determine the appropriate coverage amount.

Can I switch from term life insurance to permanent life insurance later on?

+

Yes, it is possible to convert a term life insurance policy into a permanent life insurance policy. However, the conversion process may be subject to certain conditions, such as a medical exam or age restrictions. It’s best to review the terms of your policy and consult with your insurance provider to understand the options available for converting your coverage.

Are there any tax benefits associated with life insurance policies?

+

Yes, life insurance policies can offer tax advantages. The death benefit received by beneficiaries is generally tax-free, providing a valuable financial benefit. Additionally, the cash value component of permanent life insurance may offer tax-deferred growth, further enhancing its financial appeal. It’s advisable to consult a tax professional for specific advice regarding the tax implications of life insurance.