Life Insurance With State Farm

In the complex landscape of financial planning, life insurance stands as a crucial pillar, offering security and peace of mind to individuals and their loved ones. Among the myriad of options, State Farm emerges as a prominent player, offering a comprehensive range of life insurance policies tailored to meet diverse needs. This in-depth exploration will delve into the intricacies of State Farm's life insurance offerings, shedding light on their unique features, benefits, and the compelling reasons why they are a preferred choice for many.

Understanding State Farm’s Life Insurance Suite

State Farm, a name synonymous with reliability and customer satisfaction, extends its expertise into the realm of life insurance, providing a comprehensive suite of policies designed to cater to a wide spectrum of life stages and financial goals. Their approach is characterized by a commitment to simplicity, transparency, and a deep understanding of the unique needs of their clientele.

Term Life Insurance

Term life insurance, a cornerstone of State Farm’s offerings, provides coverage for a specified period, often ranging from 10 to 30 years. This type of insurance is ideal for individuals seeking protection during critical phases of life, such as raising a family or paying off a mortgage. State Farm’s term policies are renowned for their affordability and flexibility, allowing policyholders to choose the coverage amount and term length that aligns perfectly with their current life circumstances.

| Term Lengths | Coverage Amounts |

|---|---|

| 10, 15, 20, 30 years | $100,000 - $5,000,000 |

A notable advantage of State Farm's term life insurance is the option to convert it into a permanent policy, ensuring continuous coverage without the need for additional medical underwriting. This feature is particularly beneficial for those whose life circumstances evolve over time, offering a seamless transition into a more comprehensive policy.

Permanent Life Insurance

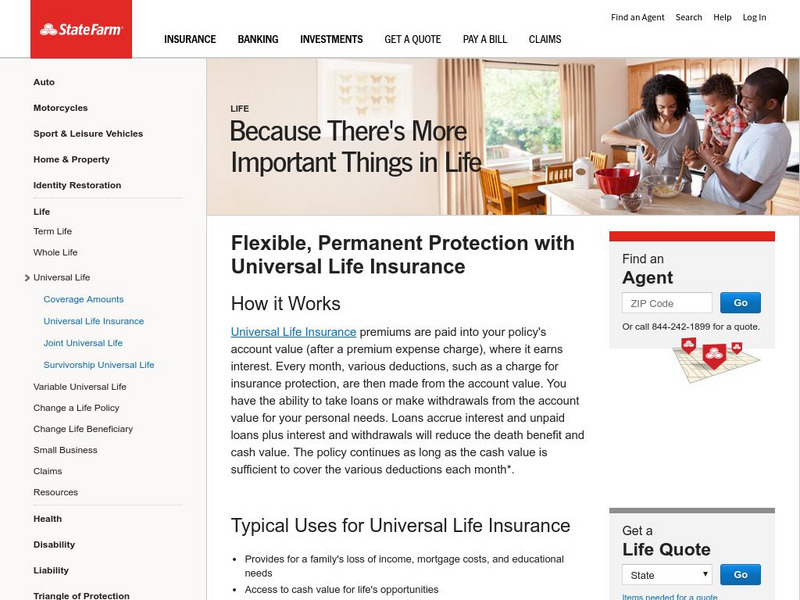

State Farm’s permanent life insurance policies, including whole life and universal life insurance, offer lifelong protection and a range of additional benefits. These policies not only provide a death benefit but also accrue cash value over time, offering policyholders the flexibility to access funds through loans or withdrawals.

| Policy Type | Key Benefits |

|---|---|

| Whole Life | Fixed premiums, guaranteed death benefit, cash value accumulation |

| Universal Life | Flexible premiums and death benefit, cash value accumulation, potential for higher returns |

The whole life insurance policies from State Farm are ideal for those seeking a stable, long-term investment with a guaranteed return. In contrast, universal life insurance offers more flexibility, allowing policyholders to adjust their premiums and death benefit amounts based on changing needs and financial circumstances.

Specialized Policies

State Farm also offers specialized life insurance policies tailored to specific needs. These include policies designed for final expense coverage, which can help cover funeral and burial costs, and policies with long-term care benefits, providing financial support for extended care needs.

Additionally, State Farm's life insurance portfolio includes policies with accelerated death benefits, which can be particularly beneficial for individuals with critical or chronic illnesses. These policies allow for a portion of the death benefit to be accessed while the insured is still alive, providing financial support during times of medical need.

The Advantages of State Farm’s Life Insurance

State Farm’s life insurance offerings are underpinned by a host of advantages that make them a compelling choice for individuals and families seeking comprehensive financial protection.

Competitive Pricing and Customizable Policies

State Farm is renowned for its competitive pricing, offering life insurance policies that are affordable and accessible to a wide range of budgets. Their policies are highly customizable, allowing policyholders to tailor their coverage to their unique needs and financial circumstances. Whether it’s adjusting the coverage amount, term length, or adding additional riders, State Farm provides the flexibility to create a policy that fits perfectly.

Excellent Customer Service and Support

State Farm’s commitment to customer satisfaction is legendary. Their customer service team is highly knowledgeable, responsive, and dedicated to ensuring that policyholders understand their coverage and feel supported throughout the life of their policy. From the initial application process to claims assistance, State Farm’s customer service sets a high standard in the industry.

Financial Strength and Stability

State Farm is a financially strong and stable company, consistently earning high ratings from leading independent rating agencies. This financial strength translates to security for policyholders, ensuring that State Farm will be able to meet its obligations and provide the promised benefits, even in uncertain economic times.

A Wide Network of Agents and Support

State Farm operates through a network of dedicated agents who are knowledgeable and passionate about helping individuals and families secure their financial futures. These agents provide personalized advice, guidance, and support, ensuring that policyholders understand their options and make informed decisions. Additionally, State Farm’s digital platforms and mobile apps offer convenient access to policy information and management, making it easy for policyholders to stay connected and informed.

Real-World Benefits and Success Stories

State Farm’s life insurance policies have made a tangible difference in the lives of countless individuals and families. Here are a few real-world examples of how State Farm’s life insurance has provided security, peace of mind, and financial support in times of need.

Protecting Families and Securing Their Future

John and Emily, a young couple with two small children, understood the importance of life insurance in protecting their family’s future. They chose State Farm’s term life insurance policy, ensuring that if either of them passed away, the surviving spouse would have the financial means to care for their children and maintain their lifestyle. The policy provided them with the peace of mind that their family’s future was secure, no matter what life threw their way.

Supporting Long-Term Care Needs

Sarah, a retired teacher, wanted to ensure she had the financial means to cover any long-term care needs that might arise as she aged. She opted for State Farm’s universal life insurance policy with long-term care benefits. This policy not only provided her with a death benefit but also gave her access to funds for extended care needs, ensuring she could receive the care she deserved without financial strain.

Covering Final Expenses and Funeral Costs

Michael, a single man in his 60s, wanted to ensure that his final expenses and funeral costs were covered, so he chose State Farm’s final expense life insurance policy. This policy provided him with the peace of mind that his funeral and burial wishes would be respected and that his loved ones wouldn’t be burdened with unexpected financial costs.

Future Trends and Innovations

State Farm continues to innovate and adapt its life insurance offerings to meet the evolving needs of its clientele. With a focus on digital transformation and customer-centric design, State Farm is enhancing the life insurance experience, making it more accessible, personalized, and responsive to individual needs.

Digital Innovations and Enhanced Customer Experience

State Farm is investing in digital technologies to streamline the life insurance process, from policy application to claims management. Their digital platforms offer a seamless and secure experience, allowing policyholders to manage their policies, access information, and make adjustments quickly and efficiently. Additionally, State Farm is exploring innovative ways to utilize data and analytics to offer more personalized and targeted life insurance solutions.

Adapting to Changing Customer Needs

State Farm recognizes that life insurance needs are not static and can change significantly over time. They are committed to adapting their policies and offerings to meet these evolving needs, whether it’s providing more flexible term lengths, offering specialized policies for specific life stages, or introducing innovative riders that address emerging risks and concerns.

Focus on Education and Financial Literacy

State Farm understands that financial literacy is a cornerstone of effective financial planning. They are dedicated to educating their clients about the importance of life insurance and the various options available. Through informative resources, workshops, and personalized guidance, State Farm empowers individuals and families to make informed decisions about their financial future, ensuring that life insurance serves as a solid foundation for their overall financial well-being.

What is the application process for State Farm’s life insurance policies?

+The application process is straightforward and can be completed online or with the assistance of a State Farm agent. It typically involves providing personal and health information, as well as answering a series of health-related questions. In some cases, a medical exam may be required, but State Farm strives to make the process as simple and convenient as possible.

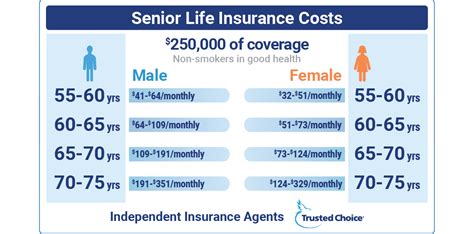

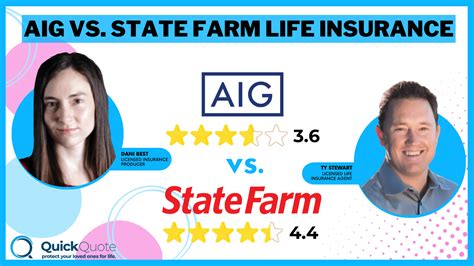

How do State Farm’s life insurance rates compare to other providers?

+State Farm’s life insurance rates are highly competitive and often offer significant value for the coverage provided. Their policies are designed to be affordable and accessible, ensuring that individuals from various financial backgrounds can secure the protection they need. Comparing quotes from multiple providers is always recommended to find the best fit for your specific needs.

Can I add riders to my State Farm life insurance policy to enhance coverage?

+Absolutely! State Farm offers a range of riders that can be added to your policy to enhance coverage and address specific needs. These riders can include options like accelerated death benefits for critical illnesses, waiver of premium in case of disability, or even riders that provide additional benefits for children. Your State Farm agent can help you choose the riders that best fit your situation.