How To Get Workers Compensation Insurance

Navigating the Path to Workers' Compensation Insurance: A Comprehensive Guide

In the realm of business and employment, ensuring the well-being of your workforce is paramount. Workers' compensation insurance serves as a vital safety net, offering financial protection to employees in the event of work-related injuries or illnesses. This guide will walk you through the process of securing this essential coverage, highlighting the key steps, considerations, and benefits it brings to both employers and employees.

Understanding Workers' Compensation Insurance

Workers' compensation, often referred to as workman's comp or work comp, is a form of insurance mandated by state laws to provide wage replacement and medical benefits to employees who suffer work-related injuries or illnesses. It's a crucial aspect of employee welfare, ensuring that workers receive the necessary care and support without bearing the financial burden themselves.

The specifics of workers' compensation vary across jurisdictions, with each state in the US having its own set of regulations. These regulations outline the coverage requirements, the process for claiming benefits, and the rights and responsibilities of both employers and employees.

Here's a breakdown of the key components typically covered by workers' compensation insurance:

- Medical Care: This includes the cost of treating injuries or illnesses sustained on the job, covering everything from emergency room visits and specialist care to rehabilitation and prescription medications.

- Wage Replacement: Employees who are temporarily or permanently unable to work due to their injuries receive a portion of their regular wages as compensation.

- Vocational Rehabilitation: For employees who can no longer perform their original job duties, workers' comp may provide support for retraining and finding suitable alternative employment.

- Death Benefits: In the unfortunate event of a worker's death due to a work-related cause, this insurance provides financial support to their dependents or beneficiaries.

The Process of Acquiring Workers' Compensation Insurance

1. Research and Understand State Regulations

Before embarking on the journey to obtain workers' compensation insurance, it's imperative to familiarize yourself with the specific regulations governing your state. Each state has its own set of rules regarding coverage requirements, premium rates, and the process for claiming benefits. The National Council on Compensation Insurance (NCCI) provides a comprehensive overview of state-specific workers' compensation laws, which can be an excellent starting point for your research.

Key considerations when researching state regulations include:

- Mandatory Coverage: Most states mandate that employers carry workers' compensation insurance for their employees. However, there may be exemptions for certain industries or business types, so it's crucial to understand your state's requirements.

- Premium Rates: Insurance providers calculate premiums based on a variety of factors, including the nature of your business, the number of employees, and your company's claims history. Understanding how these rates are determined can help you budget effectively.

- Claim Process: Knowing the steps involved in filing a workers' compensation claim, including the timelines and necessary documentation, will ensure a smoother process for both you and your employees.

2. Assess Your Business Needs and Risks

Every business is unique, and the risks associated with different industries can vary significantly. Assessing your specific business needs and potential risks is a crucial step in determining the right level of workers' compensation coverage. Consider the following factors when evaluating your coverage requirements:

- Industry: High-risk industries such as construction, manufacturing, or transportation may require more comprehensive coverage due to the nature of the work and the associated risks.

- Number of Employees: The size of your workforce is a significant factor in determining premium rates. Larger businesses with a higher number of employees may benefit from group policies, while smaller businesses might find tailored policies more cost-effective.

- Past Claims History: If your business has a history of workplace injuries or illnesses, it's essential to review and analyze these claims to understand the areas where you can improve workplace safety and reduce potential future claims.

- Unique Business Circumstances: Consider any specific circumstances unique to your business that may impact your coverage needs. For example, do you have employees who regularly travel for work, or do you operate in multiple states with varying regulations?

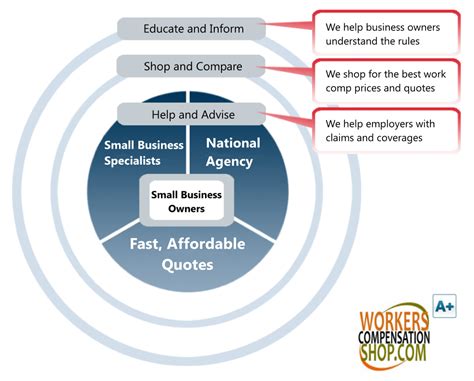

3. Compare Insurance Providers and Policies

Once you have a clear understanding of your state's regulations and your business's specific needs, it's time to compare insurance providers and policies. There are numerous options available, including traditional insurance companies, specialty providers, and even state-run funds in certain states. Here's how to navigate this process effectively:

- Get Multiple Quotes: Obtain quotes from at least three different providers to compare rates and coverage. Be sure to ask about any discounts or incentives they may offer, such as safe workplace programs or loyalty discounts.

- Review Policy Details: Carefully scrutinize the policy details, including the coverage limits, deductibles, and any exclusions or limitations. Ensure that the policy aligns with your state's regulations and adequately covers your business's specific needs.

- Consider Customer Service and Claims Handling: The quality of an insurance provider's customer service and claims handling can significantly impact your experience. Look for providers with a strong reputation for prompt and fair claims processing and consider reading reviews or seeking recommendations from other business owners.

- Evaluate Additional Services: Some insurance providers offer additional services that can enhance your overall risk management strategy, such as safety training programs, loss control services, or employee assistance programs. These services can help reduce the likelihood of workplace incidents and support employee well-being.

4. Obtain and Review Your Policy

Once you've selected an insurance provider and policy that aligns with your business's needs, it's time to obtain and carefully review the policy documentation. This step is crucial to ensure that the policy you've chosen meets your expectations and complies with your state's regulations.

Key considerations when reviewing your policy include:

- Coverage Limits: Verify that the policy provides adequate coverage limits for medical expenses, wage replacement, and other benefits, as mandated by your state's regulations.

- Deductibles and Co-Pays: Understand the financial obligations you'll incur in the event of a claim, including any deductibles or co-pays you may be responsible for.

- Exclusions and Limitations: Carefully review any exclusions or limitations in the policy. These may include specific types of injuries or illnesses that are not covered, or restrictions on certain types of treatment or rehabilitation.

- Renewal Process: Familiarize yourself with the policy's renewal process, including any requirements for renewing your coverage and any potential changes in premium rates.

The Benefits of Workers' Compensation Insurance

Securing workers' compensation insurance brings a multitude of benefits to both employers and employees, fostering a culture of safety and support within the workplace.

Benefits for Employers

- Legal Compliance: By obtaining workers' compensation insurance, employers ensure compliance with state laws, avoiding potential legal consequences and fines.

- Reduced Liability: Workers' comp insurance provides a crucial layer of protection for employers, limiting their financial liability in the event of workplace injuries or illnesses.

- Improved Risk Management: The process of obtaining and managing workers' compensation insurance encourages employers to implement safety measures and risk management strategies, reducing the likelihood of workplace incidents.

- Enhanced Employee Morale: Knowing that they are covered in the event of a work-related injury or illness can boost employee morale and satisfaction, leading to improved productivity and retention.

Benefits for Employees

- Financial Security: Workers' compensation insurance provides employees with a vital safety net, ensuring they receive the necessary medical care and financial support in the event of a work-related injury or illness.

- Prompt Medical Treatment: With workers' comp, employees can access timely medical treatment without worrying about the financial burden, allowing for faster recovery and return to work.

- Vocational Rehabilitation: For employees who can no longer perform their original job duties, workers' compensation may provide support for retraining and finding suitable alternative employment, ensuring they can continue to earn a living.

- Peace of Mind: Knowing that their well-being is a priority for their employer can foster a sense of trust and loyalty among employees, leading to a more positive and productive work environment.

Conclusion: A Commitment to Employee Welfare

Workers' compensation insurance is more than just a legal requirement; it's a commitment to the well-being and financial security of your workforce. By understanding the process of obtaining this essential coverage and the benefits it brings, employers can create a safer and more supportive work environment, fostering a culture of trust and productivity.

As you navigate the path to workers' compensation insurance, remember that this journey is an investment in your business's future, ensuring the health and happiness of your most valuable asset—your employees.

How much does workers’ compensation insurance cost?

+

The cost of workers’ compensation insurance varies based on several factors, including the nature of your business, the number of employees, and your company’s claims history. Premium rates are typically calculated as a percentage of your payroll, with rates ranging from 0.5% to 10% or higher, depending on your industry and risk profile. It’s essential to obtain multiple quotes and compare policies to find the most cost-effective coverage for your business.

What happens if an employee files a workers’ compensation claim?

+

When an employee files a workers’ compensation claim, the process typically involves the following steps: 1. The employee reports the injury or illness to their employer and seeks medical treatment. 2. The employer submits the claim to their insurance provider, providing the necessary documentation and supporting evidence. 3. The insurance provider reviews the claim and, if approved, begins processing the benefits, which may include medical care, wage replacement, and vocational rehabilitation. 4. The employee receives the approved benefits, allowing them to focus on their recovery without the added financial burden.

Can I be sued by an employee if I have workers’ compensation insurance?

+

Workers’ compensation insurance provides a crucial layer of protection for employers, limiting their financial liability in the event of workplace injuries or illnesses. In most states, employees who are covered by workers’ compensation insurance waive their right to sue their employer for negligence, as long as the employer maintains the required insurance coverage. However, it’s essential to consult with legal professionals to understand the specific laws and regulations governing your state.

How can I reduce the cost of workers’ compensation insurance?

+

There are several strategies you can employ to reduce the cost of workers’ compensation insurance: 1. Implement robust safety measures and training programs to reduce the likelihood of workplace incidents. 2. Encourage employees to report any safety concerns or potential hazards promptly. 3. Review your claims history and identify areas where you can improve workplace safety to reduce future claims. 4. Consider implementing a return-to-work program to help injured employees transition back to their jobs more quickly, which can reduce the overall cost of claims. 5. Work with your insurance provider to explore any available discounts or incentives, such as safe workplace programs or loyalty discounts.