Good And Cheap Car Insurance

Finding affordable car insurance that offers comprehensive coverage can be a challenging task, especially with the numerous options and variables involved. However, it is possible to secure good and cheap car insurance by understanding the factors that influence premiums and taking advantage of strategies to reduce costs. This comprehensive guide will delve into the world of car insurance, providing expert insights and practical tips to help you find the best coverage at an affordable price.

Understanding Car Insurance Premiums

Car insurance premiums are influenced by a variety of factors, including your personal information, vehicle details, driving history, and the coverage options you choose. By understanding these factors, you can make informed decisions to lower your insurance costs.

Personal Information and Driving History

Insurance providers consider your age, gender, marital status, and driving record when calculating premiums. Younger drivers, especially males, typically face higher insurance costs due to their higher risk profile. A clean driving record with no accidents or traffic violations can lead to lower premiums. Additionally, some insurers offer discounts for safe driving habits and defensive driving courses.

Insurance companies also analyze your credit score, as it is considered a predictor of risk. Maintaining a good credit score can potentially lower your insurance costs.

Vehicle Details

The make, model, and year of your vehicle play a significant role in determining insurance premiums. Generally, newer and more expensive vehicles tend to have higher insurance costs due to their replacement and repair expenses. Additionally, vehicles with advanced safety features and anti-theft systems may qualify for discounts.

The type of vehicle you drive also matters. Sports cars and high-performance vehicles often carry higher insurance premiums due to their increased risk of accidents and higher repair costs. On the other hand, sedans and family-oriented vehicles are typically more affordable to insure.

Coverage Options

The coverage options you choose directly impact your insurance premiums. While it's essential to have adequate coverage, selecting additional coverage that you may not need can drive up costs. Understanding the different types of coverage and their benefits will help you make informed choices.

- Liability Coverage: This is the most basic and legally required coverage. It covers damages and injuries you cause to others in an accident.

- Collision Coverage: This coverage pays for repairs to your vehicle if you're involved in an accident, regardless of fault.

- Comprehensive Coverage: This covers damage to your vehicle caused by events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Personal Injury Protection (PIP): PIP covers medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This provides protection if you're involved in an accident with a driver who has no insurance or insufficient coverage.

Strategies to Find Good and Cheap Car Insurance

Now that we have a better understanding of the factors influencing car insurance premiums, let's explore some strategies to find good and affordable coverage.

Shop Around and Compare Quotes

One of the most effective ways to find cheap car insurance is to compare quotes from multiple providers. Insurance rates can vary significantly between companies, so it's essential to shop around. Use online quote comparison tools or contact insurance agents to get multiple quotes. Compare the coverage options, deductibles, and premiums to find the best deal.

Bundle Policies and Take Advantage of Discounts

Many insurance companies offer discounts when you bundle multiple policies, such as car insurance with home or renters insurance. Additionally, insurers often provide discounts for various reasons, including:

- Safe Driver Discounts: As mentioned earlier, a clean driving record can lead to substantial discounts.

- Good Student Discounts: Students with a certain GPA or honor roll status may qualify for discounts.

- Low Mileage Discounts: If you drive fewer miles annually, you may be eligible for a low mileage discount.

- Multi-Car Discounts: Insuring multiple vehicles with the same insurer can result in lower premiums.

- Anti-Theft Device Discounts: Vehicles equipped with anti-theft devices or tracking systems may qualify for discounts.

Raise Your Deductible

Increasing your deductible, the amount you pay out of pocket before your insurance kicks in, can lower your insurance premiums. However, it's essential to choose a deductible amount that you can afford in case of an accident. A higher deductible means you'll pay more upfront, but it can significantly reduce your insurance costs over time.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, uses a device installed in your vehicle to track your driving habits. Insurers then use this data to calculate your premiums. This type of insurance can be beneficial for safe drivers, as it rewards good driving habits with lower premiums. However, it may not be suitable for drivers with poor driving records.

Maintain a Good Driving Record

A clean driving record is one of the most effective ways to keep your insurance costs low. Avoid accidents, traffic violations, and speeding tickets. If you have a clean record, consider requesting a "good driver" discount from your insurance provider.

Review Your Coverage Regularly

Insurance needs can change over time, so it's essential to review your coverage annually. Evaluate your driving habits, vehicle usage, and personal circumstances to ensure your insurance policy aligns with your current needs. This can help you identify opportunities to save money on your premiums.

Understanding Car Insurance Claims

Knowing how to navigate the car insurance claims process is crucial to ensuring a smooth and efficient experience. Here's a step-by-step guide to help you understand the claims process and maximize your benefits.

Step 1: Report the Accident

After an accident, it's essential to report it to your insurance company as soon as possible. Most insurers have a dedicated claims hotline or online reporting system. Provide as many details as you can about the accident, including the date, time, location, and any relevant information about the other driver(s) involved.

Step 2: Gather Information

Collect as much information as possible at the scene of the accident. This includes taking photos of the damage to your vehicle and any other vehicles involved. Note down the other driver's insurance information, license plate number, and contact details. If there are witnesses, obtain their contact information as well.

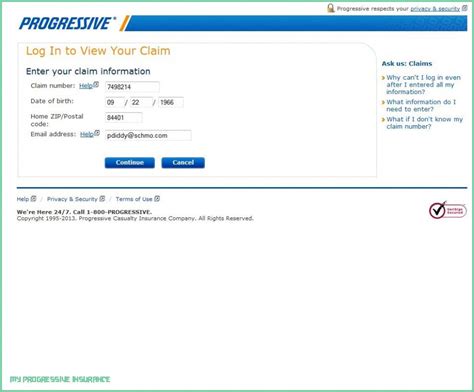

Step 3: Contact Your Insurance Company

Once you've gathered the necessary information, contact your insurance company to initiate the claims process. Provide them with the details of the accident and any supporting documentation you have. The insurer will assign a claims adjuster to handle your case.

Step 4: Cooperate with the Claims Adjuster

The claims adjuster will guide you through the claims process and assess the damage to your vehicle. Cooperate with them by providing any additional information or documentation they request. Be honest and accurate in your statements, as any misrepresentation can lead to claim denials or legal consequences.

Step 5: Receive an Estimate and Repair Options

The claims adjuster will provide an estimate for the repairs to your vehicle. They may recommend a preferred repair shop or give you the option to choose your own. If you choose a preferred shop, the insurer may cover the cost of rental car expenses while your vehicle is being repaired.

Step 6: Negotiate and Resolve the Claim

If you disagree with the insurer's estimate or believe it doesn't adequately cover the repairs, you can negotiate with the claims adjuster. Provide additional evidence, such as repair quotes from other shops, to support your claim. The goal is to reach a fair settlement that covers the cost of repairs and any additional expenses you may have incurred.

Choosing the Right Car Insurance Provider

With numerous car insurance providers in the market, selecting the right one can be daunting. Here are some key factors to consider when choosing an insurer:

Financial Stability and Reputation

Look for an insurance company with a strong financial rating and a solid reputation in the industry. Check independent rating agencies like AM Best, Moody's, or Standard & Poor's to assess the insurer's financial stability. A financially stable insurer is more likely to be able to pay out claims promptly and honor their commitments.

Coverage Options and Customization

Evaluate the range of coverage options offered by the insurer. Ensure they provide the specific coverage you need, such as liability, collision, comprehensive, and any additional coverages like rental car reimbursement or roadside assistance. Some insurers also offer customizable policies, allowing you to tailor your coverage to your unique needs.

Customer Service and Claims Handling

Excellent customer service and efficient claims handling are crucial aspects of a good insurance provider. Read reviews and testimonials from existing customers to gauge the insurer's customer service reputation. Look for an insurer with a dedicated claims department and a proven track record of handling claims promptly and fairly.

Pricing and Discounts

Of course, pricing is a significant factor when choosing an insurance provider. Compare quotes from multiple insurers to find the most competitive rates. Additionally, look for insurers that offer a variety of discounts, such as safe driver, multi-policy, or loyalty discounts. These discounts can help you save money on your premiums over time.

The Future of Car Insurance

The car insurance industry is evolving, and several trends are shaping the future of insurance coverage. Here's a glimpse into what the future holds:

Autonomous Vehicles and Safety Features

The rise of autonomous vehicles and advanced safety features is expected to significantly impact car insurance. With self-driving cars becoming more prevalent, insurance providers may adjust their premiums based on the level of autonomy and safety features equipped in the vehicle. Cars with advanced driver-assistance systems and crash avoidance technologies may qualify for lower insurance rates.

Telematics and Usage-Based Insurance

Usage-based insurance, as mentioned earlier, is gaining popularity and is expected to become more mainstream. Insurers will continue to utilize telematics data to assess driving behavior and personalize insurance rates. This shift towards usage-based insurance could lead to more affordable coverage for safe drivers.

Digitalization and Insurtech

The insurance industry is embracing digitalization and Insurtech innovations. Insurers are leveraging technology to streamline the claims process, offer more efficient customer service, and provide personalized coverage options. Online platforms and mobile apps are making it easier for customers to manage their policies, file claims, and access insurance information.

Data-Driven Risk Assessment

Insurers are increasingly using advanced analytics and data-driven approaches to assess risk. By analyzing vast amounts of data, including driving behavior, weather patterns, and traffic conditions, insurers can more accurately predict risks and price insurance policies accordingly. This data-driven approach can lead to more precise and fair insurance premiums.

Conclusion

Finding good and cheap car insurance requires a combination of understanding the factors that influence premiums, implementing cost-saving strategies, and choosing the right insurance provider. By shopping around, comparing quotes, and taking advantage of discounts, you can secure affordable coverage that meets your needs. Additionally, staying informed about the evolving car insurance landscape can help you make the most of the opportunities available.

Remember, car insurance is an essential investment to protect yourself and your vehicle. Take the time to research and compare options to find the best coverage at a price that fits your budget. With the right approach and a bit of diligence, you can navigate the car insurance market successfully and drive with peace of mind.

Frequently Asked Questions

What are the basic types of car insurance coverage?

+The basic types of car insurance coverage include liability coverage, which covers damages and injuries you cause to others, collision coverage for repairs to your vehicle in case of an accident, and comprehensive coverage for damage caused by events other than accidents, such as theft or natural disasters.

How can I reduce my car insurance premiums?

+To reduce your car insurance premiums, you can shop around and compare quotes from multiple providers, bundle your policies, take advantage of discounts, raise your deductible, and maintain a clean driving record. Additionally, consider usage-based insurance if you’re a safe driver.

What factors influence car insurance rates?

+Car insurance rates are influenced by personal information (age, gender, marital status, driving record), vehicle details (make, model, year, safety features), and the coverage options you choose. Insurers also consider your credit score and may offer discounts for safe driving habits and anti-theft devices.

How do I choose the right car insurance provider?

+When choosing a car insurance provider, consider their financial stability and reputation, the range of coverage options and customization available, their customer service and claims handling reputation, and the pricing and discounts they offer. Compare multiple providers to find the best fit for your needs.

What should I do after an accident to file a car insurance claim?

+After an accident, report it to your insurance company promptly. Gather information, including photos of the damage, the other driver’s details, and witness contacts. Contact your insurer, cooperate with the claims adjuster, and provide any necessary documentation. Negotiate the repair estimate if needed to ensure fair coverage.