Progressive Insurance Toll Free Number

When it comes to insurance, having easy access to customer support is crucial. Progressive Insurance, a well-known name in the industry, understands the importance of providing efficient and accessible assistance to its policyholders. In this article, we will delve into the world of Progressive Insurance and explore the details surrounding their toll-free number, uncovering the various ways it can benefit customers and streamline the insurance experience.

Understanding the Progressive Insurance Toll-Free Number

The Progressive Insurance toll-free number serves as a dedicated line for customers to connect with the company’s customer support team. This number, often advertised prominently on their website and marketing materials, aims to offer a convenient and cost-effective way for policyholders to reach out for assistance.

Progressive Insurance recognizes that insurance-related queries and concerns can arise at any time, and having a toll-free number ensures that customers can seek help without incurring additional charges. Whether it's understanding policy details, filing a claim, or simply seeking clarification, the toll-free number provides a direct line of communication with the insurance provider.

The toll-free number is typically a 1-800 or 1-888 number, making it easily memorable and accessible. By dialing this number, customers can bypass the hassle of navigating through a series of automated menus and quickly connect with a live agent who can address their specific needs.

Benefits of the Progressive Insurance Toll-Free Number

The implementation of a toll-free number by Progressive Insurance brings several advantages to both the company and its customers. Let’s explore some of the key benefits:

- Convenience and Accessibility: Customers can reach out for assistance at their convenience, without worrying about the cost of the call. This is especially beneficial for those who may have limited phone plans or are calling from remote areas.

- Prompt Customer Service: By providing a dedicated toll-free number, Progressive ensures that customers receive timely assistance. The number connects callers directly to a trained customer service representative, reducing wait times and enhancing the overall customer experience.

- Enhanced Customer Satisfaction: Easy access to customer support leads to higher customer satisfaction. Progressive's toll-free number allows customers to quickly resolve queries, providing them with peace of mind and a positive impression of the insurance provider.

- Efficient Claim Process: In the event of an accident or claim, having a toll-free number streamlines the process. Customers can receive guidance on filing a claim, understand the necessary steps, and ensure a smooth and timely resolution.

- Personalized Support: The toll-free number enables customers to speak directly with a representative who can provide personalized advice and guidance. This level of personalized support can be especially valuable when navigating complex insurance matters.

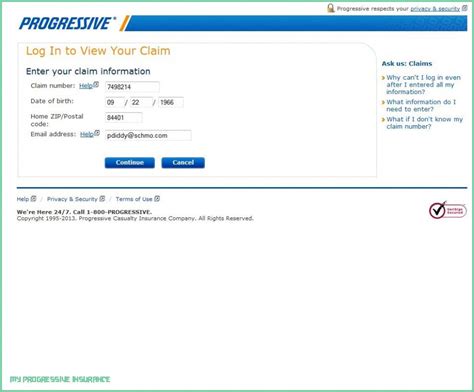

How to Utilize the Progressive Insurance Toll-Free Number

To make the most of the Progressive Insurance toll-free number, customers can follow these simple steps:

- Have Your Policy Information Ready: Before calling, gather your policy number and any relevant details. This ensures a smooth and efficient conversation with the customer service representative.

- Identify Your Query: Determine the specific reason for your call. Whether it's seeking information, filing a claim, or discussing a policy change, having a clear idea of your query will help the representative assist you effectively.

- Call the Toll-Free Number: Dial the Progressive Insurance toll-free number, which is typically displayed on their website or policy documents. The number is usually a 1-800 or 1-888 line, ensuring it is accessible nationwide.

- Follow the Automated Instructions: Listen carefully to the automated instructions provided by the call center. These instructions often guide you through a series of options to connect you with the appropriate department or representative.

- Speak with a Representative: Once connected, clearly explain your query or concern to the customer service representative. Provide all necessary details and be ready to answer any questions they may have to ensure a swift resolution.

By following these steps, customers can maximize the benefits of the Progressive Insurance toll-free number and receive the assistance they need in a timely and efficient manner.

Progressive Insurance: A Customer-Centric Approach

Progressive Insurance’s commitment to providing excellent customer service extends beyond their toll-free number. The company strives to create a seamless and positive experience for its policyholders, ensuring that they feel supported and valued throughout their insurance journey.

In addition to the toll-free number, Progressive offers a range of digital tools and resources to enhance customer engagement. Their website provides a comprehensive online platform where customers can manage their policies, make payments, and access important documents. The company also leverages technology to offer convenient features such as mobile apps, online claim filing, and real-time updates, further streamlining the insurance process.

Furthermore, Progressive recognizes the importance of building strong relationships with its customers. They prioritize prompt claim processing, fair settlement practices, and transparent communication. By fostering a culture of trust and reliability, Progressive aims to establish long-term partnerships with its policyholders, ensuring their peace of mind and satisfaction.

The Future of Progressive Insurance

As the insurance industry continues to evolve, Progressive Insurance remains dedicated to staying at the forefront of innovation. The company continuously invests in research and development to enhance its products and services, ensuring they meet the changing needs of its customers.

Progressive's focus on technology and customer-centric approaches positions them well for the future. They aim to leverage artificial intelligence, machine learning, and data analytics to further improve efficiency, personalize experiences, and provide even more tailored insurance solutions. By embracing these advancements, Progressive strives to remain a leading insurer, offering cutting-edge services and exceptional customer support.

In conclusion, the Progressive Insurance toll-free number serves as a vital link between the company and its customers, providing a convenient and accessible means of communication. By offering this dedicated line, Progressive demonstrates its commitment to customer satisfaction and efficient support. With a combination of traditional customer service and innovative digital tools, Progressive Insurance continues to set the standard for excellence in the insurance industry.

How can I find the Progressive Insurance toll-free number if I don’t have it readily available?

+If you don’t have the Progressive Insurance toll-free number, you can easily find it by visiting their official website. The toll-free number is typically displayed prominently on the homepage or in the “Contact Us” section. Alternatively, you can search for “Progressive Insurance toll-free number” on a search engine, and you will be directed to the correct contact information.

Are there any additional charges for calling the Progressive Insurance toll-free number?

+No, calling the Progressive Insurance toll-free number is completely free. The toll-free designation ensures that you won’t incur any additional charges for the call, regardless of the duration. This feature makes it convenient for customers to reach out for assistance without worrying about phone plan limitations.

Can I make payments or manage my policy using the toll-free number?

+While the primary purpose of the Progressive Insurance toll-free number is to provide customer support, you can also use it to make certain inquiries related to payments and policy management. The representative on the line can guide you through the process and provide the necessary information. However, for more complex transactions, it is recommended to use their online platform or mobile app for a seamless experience.