Insurance Liability Quotes

Insurance liability quotes are a crucial aspect of the insurance industry, offering financial protection and peace of mind to individuals and businesses alike. In today's dynamic and unpredictable world, liability coverage is essential to mitigate the risks associated with various activities and operations. This article aims to provide an in-depth exploration of insurance liability quotes, delving into the factors that influence them, the processes involved in obtaining accurate quotes, and the strategies to secure the most suitable coverage for your specific needs.

Understanding Insurance Liability Quotes

Insurance liability quotes serve as a financial roadmap, outlining the potential costs and coverage limits for liability insurance policies. These quotes are tailored to the unique circumstances and risks associated with individuals or entities seeking protection. By understanding the factors that influence liability quotes, individuals and businesses can make informed decisions to safeguard their financial well-being and ensure compliance with legal obligations.

Key Factors Affecting Liability Quotes

The complexity of insurance liability quotes stems from the myriad of factors that influence them. These factors can be broadly categorized into personal, professional, and external elements. Personal factors include an individual’s age, occupation, and personal history, while professional factors encompass the nature of the business, industry, and operational risks. External factors, such as geographical location and prevailing economic conditions, also play a significant role in determining liability quotes.

Let's delve into some specific factors that insurance providers consider when generating liability quotes:

- Risk Assessment: Insurance companies conduct thorough risk assessments to evaluate the potential liabilities associated with an individual or business. This assessment considers the nature of operations, the likelihood of accidents or claims, and the severity of potential losses.

- Claims History: A history of frequent or significant claims can impact liability quotes. Insurance providers analyze past claims data to assess the risk profile of the applicant and determine appropriate coverage and premium rates.

- Industry and Business Type: Different industries and business types carry varying levels of risk. High-risk industries, such as construction or manufacturing, may attract higher liability quotes due to the increased likelihood of accidents or property damage.

- Location and Environmental Factors: The geographical location of a business or individual can influence liability quotes. Areas with higher crime rates, natural disaster risks, or environmental hazards may result in elevated insurance costs.

- Coverage Limits and Deductibles: The desired coverage limits and deductibles chosen by the policyholder can significantly impact the overall liability quote. Higher coverage limits and lower deductibles generally result in increased premiums.

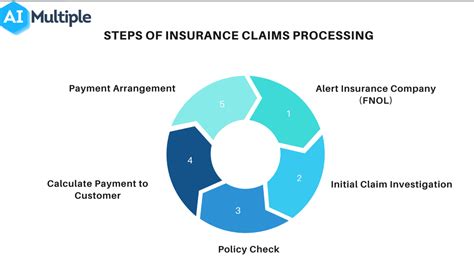

The Process of Obtaining Insurance Liability Quotes

Securing accurate insurance liability quotes involves a systematic process that ensures a comprehensive understanding of the risks and coverage needs. This process begins with a thorough evaluation of the applicant’s circumstances and extends to the final selection of an appropriate insurance policy.

Step-by-Step Guide to Obtaining Liability Quotes

To obtain accurate and tailored insurance liability quotes, follow these steps:

- Assess Your Needs: Begin by identifying the specific risks and liabilities you wish to insure against. Consider your personal or business activities, the potential hazards involved, and the level of coverage required. This assessment forms the foundation for obtaining accurate quotes.

- Research Insurance Providers: Explore the market and identify reputable insurance companies that offer liability coverage suited to your needs. Consider their financial stability, reputation, and the range of products and services they provide. Online resources, industry reviews, and recommendations from trusted sources can aid in this research process.

- Gather Relevant Information: Compile the necessary information and documentation required by insurance providers to generate accurate quotes. This may include personal or business details, financial records, claims history, and any specific coverage requirements.

- Complete Quote Applications: Reach out to the selected insurance providers and complete their quote application forms. Provide accurate and comprehensive information to ensure the quotes are tailored to your unique circumstances. Be prepared to answer questions about your risks, operations, and desired coverage limits.

- Compare Quotes and Coverage: Once you receive the liability quotes from various insurance providers, take the time to carefully compare them. Analyze the coverage limits, deductibles, exclusions, and any additional benefits or services offered. Consider not only the premium costs but also the overall value and suitability of the policies.

- Seek Professional Advice: Consult with insurance brokers or financial advisors who specialize in liability insurance. They can provide expert guidance, explain complex terms and conditions, and help you navigate the quote comparison process. Their insights can ensure you make an informed decision.

- Negotiate and Finalize: If you find an insurance provider that meets your needs and offers competitive quotes, engage in negotiations to secure the best possible terms. Discuss coverage options, premium discounts, and any additional services or benefits. Finalize the policy by reviewing and accepting the terms and conditions, ensuring you understand your obligations and rights.

Strategies for Securing Competitive Liability Quotes

Obtaining competitive insurance liability quotes requires a strategic approach that optimizes your risk profile and leverages market opportunities. By implementing these strategies, you can secure coverage that aligns with your needs while minimizing financial burden.

Tips for Lowering Liability Quotes

To reduce insurance liability quotes and secure more favorable coverage, consider the following strategies:

- Improve Risk Management Practices: Implement robust risk management strategies to minimize potential liabilities. This may involve investing in safety equipment, training employees in risk prevention, and adopting best practices to reduce the likelihood of accidents or claims. A demonstrated commitment to risk mitigation can positively impact liability quotes.

- Bundle Insurance Policies: Consider bundling your insurance policies with a single provider. Many insurance companies offer discounts when multiple policies, such as liability, property, and workers' compensation, are purchased together. Bundling can result in significant savings and streamline your insurance management process.

- Review and Adjust Coverage Regularly: Insurance needs evolve over time, so it's essential to regularly review and adjust your coverage. Stay updated on industry trends, changes in your operations, and any modifications to your risk profile. By ensuring your coverage remains aligned with your current needs, you can avoid overpaying for unnecessary coverage or underinsuring yourself.

- Utilize Technology and Online Tools: Leverage digital resources and online platforms to streamline the quote comparison process. Many insurance providers offer online quote generators, allowing you to input your details and receive instant estimates. These tools can provide a quick and convenient way to compare quotes and identify the most competitive options.

- Negotiate with Insurance Providers: Don't hesitate to negotiate with insurance providers to secure the best possible terms. Discuss your specific needs, risk management practices, and any unique circumstances that may influence your liability risks. Highlight your commitment to safety and responsible operations to demonstrate your low-risk profile.

Case Studies: Real-World Examples of Insurance Liability

Understanding the practical application of insurance liability quotes is essential to appreciating their significance. Let’s explore two real-world case studies that highlight the importance of liability coverage and the impact of insurance quotes on individuals and businesses.

Case Study 1: Small Business Owner

John, a small business owner, operates a local bakery. He is passionate about creating unique, artisanal baked goods and has built a loyal customer base over the years. However, his business is not without risks. One day, a customer trips and falls in his bakery, sustaining injuries. The customer files a lawsuit, seeking compensation for medical expenses and lost wages.

John's liability insurance quote, which he secured when starting his business, included coverage for such incidents. The insurance policy covered the legal fees and any settlement costs, providing John with the financial protection he needed to navigate this challenging situation. Without this coverage, John could have faced significant financial strain and potential business disruption.

Case Study 2: Professional Services Firm

Imagine a professional services firm specializing in financial consulting. The firm, known for its expertise and integrity, has a solid reputation in the industry. However, a client accuses the firm of providing inaccurate financial advice, leading to significant financial losses. The client initiates legal action, seeking damages.

The firm's insurance liability quote included coverage for professional liability, or errors and omissions (E&O) insurance. This policy protects professionals against claims arising from their services. The insurance coverage allowed the firm to defend itself against the client's allegations, providing the necessary financial resources to cover legal fees and potential settlements. The firm's reputation and operations were safeguarded, allowing them to continue providing quality services to their clients.

The Future of Insurance Liability Quotes

The insurance industry is continuously evolving, driven by technological advancements, changing consumer expectations, and evolving risk landscapes. As we look to the future, several trends and innovations are shaping the way insurance liability quotes are generated and delivered.

Emerging Trends and Innovations

Here are some key trends and innovations that are influencing the future of insurance liability quotes:

- Data Analytics and Predictive Modeling: Insurance providers are leveraging advanced data analytics and predictive modeling techniques to enhance their risk assessment capabilities. By analyzing vast amounts of data, including historical claims data, industry trends, and real-time information, insurers can make more accurate predictions about potential liabilities and tailor quotes accordingly.

- Telematics and Sensor Technology: In certain industries, such as automotive insurance, telematics and sensor technology are revolutionizing risk assessment. These technologies collect real-time data on driving behavior, vehicle performance, and environmental conditions. By analyzing this data, insurance providers can offer usage-based insurance policies, providing more personalized and dynamic liability quotes.

- Blockchain and Smart Contracts: The integration of blockchain technology and smart contracts is transforming the insurance industry. These decentralized systems enhance transparency, security, and efficiency in insurance transactions. Smart contracts can automate certain insurance processes, including quote generation, policy issuance, and claim management, reducing administrative burdens and providing faster, more accurate quotes.

- Artificial Intelligence (AI) and Machine Learning: AI and machine learning algorithms are being employed to analyze vast datasets, identify patterns, and make data-driven decisions. Insurance providers can utilize these technologies to develop more sophisticated risk models, optimize pricing strategies, and deliver highly personalized liability quotes.

- Collaborative Risk Assessment: The future of insurance liability quotes may involve collaborative efforts between insurers, policyholders, and other stakeholders. By sharing data and insights, insurers can develop more comprehensive risk profiles, leading to more accurate and tailored quotes. This collaborative approach can also foster trust and transparency between insurance providers and their clients.

Conclusion

Insurance liability quotes are a critical component of financial planning and risk management for individuals and businesses. By understanding the factors that influence liability quotes, following a systematic process to obtain accurate quotes, and implementing strategic approaches to secure competitive coverage, you can navigate the insurance landscape with confidence. Remember, insurance is not just a financial safeguard but a strategic tool to protect your personal and professional interests in an increasingly complex and unpredictable world.

How often should I review my insurance liability coverage and quotes?

+It is recommended to review your insurance liability coverage and quotes at least once a year. Changes in your personal or business circumstances, industry trends, and economic conditions can impact your risk profile and the adequacy of your coverage. Regular reviews ensure that your insurance remains aligned with your evolving needs and that you are not overpaying for unnecessary coverage.

Can I negotiate lower liability quotes if I have a clean claims history?

+Absolutely! A clean claims history is a strong indicator of your low-risk profile. When negotiating with insurance providers, highlight your excellent claims record and emphasize your commitment to risk management. Insurers often reward policyholders with a proven track record of responsible behavior by offering more favorable liability quotes and premium discounts.

What are some common exclusions or limitations in liability insurance policies?

+Liability insurance policies may have exclusions or limitations that are important to understand. Common exclusions include intentional acts, fraud, pollution, and certain types of professional services. Additionally, policies may have coverage limits for specific types of claims or per incident. It is crucial to carefully review the policy terms and conditions to ensure you are aware of any exclusions or limitations that may impact your coverage.