What Are Claims In Insurance

In the world of insurance, understanding the concept of claims is crucial, as they form the backbone of the entire industry. A claim, in simple terms, is a formal request made by an insured individual or entity to their insurance company, seeking financial coverage or reimbursement for a loss, damage, or liability covered by their insurance policy.

The process of filing an insurance claim is a critical step for policyholders, allowing them to recover from unforeseen events and manage financial risks effectively. From natural disasters to medical emergencies, insurance claims provide a safety net, offering peace of mind and financial stability in times of need.

The Fundamentals of Insurance Claims

At its core, an insurance claim is a legal right and responsibility outlined in an insurance contract. When a policyholder experiences a covered event, they have the right to initiate a claim process, which involves providing evidence and documentation to support their request for compensation.

The insurance company, upon receiving a claim, assesses the situation based on the terms and conditions of the policy. This assessment determines whether the claim is valid and eligible for coverage. If approved, the insurer will provide the necessary financial assistance as outlined in the policy, helping the policyholder restore their financial stability.

Types of Insurance Claims

Insurance claims can vary widely depending on the type of insurance policy and the nature of the incident. Here are some common types of insurance claims:

- Property Damage Claims: These claims arise when an insured property, such as a home or vehicle, suffers damage due to events like fires, storms, theft, or accidents. The claim process involves assessing the damage, determining the cause, and providing evidence to support the request for repair or replacement costs.

- Health and Medical Claims: In health insurance, claims are filed when an insured individual requires medical treatment or hospitalization. The claim process involves submitting bills, receipts, and medical records to the insurer for reimbursement of covered expenses.

- Liability Claims: Liability insurance claims arise when an insured individual or business is held legally responsible for causing harm or damage to a third party. This could include bodily injury, property damage, or other forms of liability. The claim process involves investigating the incident and determining the extent of the insured's liability.

- Life Insurance Claims: Life insurance claims are unique, as they are typically filed by the beneficiary of the policy upon the death of the insured. The claim process involves providing proof of the insured's death, such as a death certificate, and fulfilling any other requirements outlined in the policy.

- Auto Insurance Claims: Auto insurance claims are filed when a vehicle insured under the policy is involved in an accident or suffers damage. The claim process involves assessing the extent of the damage, determining fault, and providing estimates or receipts for repairs.

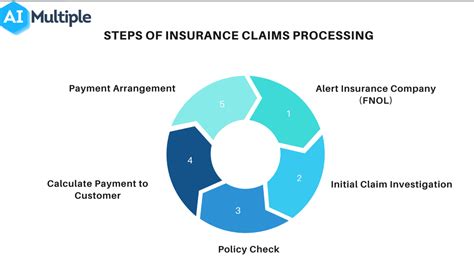

The Claim Process: A Step-by-Step Guide

The insurance claim process can vary slightly depending on the insurer and the type of claim, but here's a general overview:

- Report the Incident: Policyholders should promptly report any event that might lead to a claim. This could be done by contacting the insurer's claims department or using their online portal.

- Assess the Damage: The insurer will send an adjuster or assessor to evaluate the extent of the damage or loss. This step is crucial for determining the value of the claim.

- Provide Documentation: Policyholders must provide all relevant documentation, including photographs, receipts, bills, and any other evidence supporting the claim.

- Review and Investigation: The insurer will review the claim and investigate the circumstances surrounding the incident. This may involve further communication with the policyholder or additional inspections.

- Decision and Settlement: Once the investigation is complete, the insurer will decide whether to approve or deny the claim. If approved, they will determine the amount of compensation and settle the claim accordingly.

It's important to note that the claim process can sometimes be complex and time-consuming, especially for larger or more complex claims. Policyholders should remain patient and provide all the necessary information to ensure a smooth and efficient process.

Maximizing Your Insurance Claims

To make the most of your insurance claims, consider the following tips:

- Understand Your Policy: Familiarize yourself with the terms and conditions of your insurance policy. Know what is covered and what is not, as this knowledge will guide you in filing accurate claims.

- Document Everything: Keep detailed records and documentation of any incident that may lead to a claim. This includes taking photographs, obtaining estimates, and maintaining receipts.

- Communicate Clearly: When communicating with your insurer, be clear and concise. Provide all the necessary information and respond promptly to any requests for additional details.

- Seek Professional Advice: If you're unsure about the claim process or have a complex claim, consider seeking advice from an insurance professional or a public adjuster who can guide you through the process.

- Negotiate if Necessary: In some cases, you may need to negotiate with your insurer to reach a fair settlement. Be prepared to present your case and provide additional evidence if needed.

Remember, insurance claims are a vital aspect of the insurance industry, providing financial protection and peace of mind to policyholders. By understanding the claim process and taking proactive steps, you can ensure a smoother and more successful outcome when facing unexpected events.

What should I do if my insurance claim is denied?

+If your insurance claim is denied, you have the right to appeal the decision. Review the denial letter and understand the reasons for the denial. Gather additional evidence or seek professional advice to strengthen your case. You can then resubmit your claim with the new information. If the denial still stands, you may consider legal options or alternative dispute resolution methods.

How long does it typically take to process an insurance claim?

+The processing time for insurance claims can vary depending on several factors, including the complexity of the claim, the insurer’s workload, and the availability of necessary documentation. Simple claims may be processed within a few days to a week, while more complex claims can take several weeks or even months. It’s best to stay in touch with your insurer and provide any requested information promptly to expedite the process.

Can I make multiple claims on the same insurance policy?

+Yes, you can make multiple claims on the same insurance policy, as long as each claim is for a separate and distinct incident. However, it’s important to note that making excessive claims or claims for minor incidents may affect your insurance rates or policy renewal. Some insurers may also impose claim limits or deductibles, so it’s best to review your policy terms and conditions.