Farm Bureau Insurance Company

Farm Bureau Insurance Company, often referred to as simply "Farm Bureau," is a renowned player in the insurance industry, offering a comprehensive range of services to protect the diverse needs of individuals and businesses. With a rich history spanning over eight decades, this company has established itself as a trusted provider of insurance solutions, particularly catering to the unique requirements of agricultural communities and rural areas.

A Legacy of Protection: The Story of Farm Bureau Insurance

Farm Bureau Insurance Company’s journey began in 1949, born out of a vision to safeguard the agricultural industry and its vital contributors. Over the years, it has evolved into a robust organization, expanding its reach and services to cater to a wide spectrum of customers. Today, Farm Bureau stands as a testament to the power of community-driven insurance, offering a personalized and reliable approach to risk management.

Headquartered in Michigan, USA, Farm Bureau Insurance operates with a strong network of independent agents, ensuring a local and personalized touch to its services. This unique structure allows the company to deeply understand the specific needs of its clients, whether they are farmers, small business owners, or families seeking comprehensive protection.

A Comprehensive Portfolio of Insurance Solutions

Farm Bureau Insurance offers an extensive array of insurance products, designed to cater to various aspects of life and business. Their portfolio includes:

- Auto Insurance: Tailored coverage for a range of vehicles, including cars, trucks, and recreational vehicles. Farm Bureau provides comprehensive, collision, and liability insurance, along with specialized options for classic cars and young drivers.

- Home Insurance: Protection for homeowners and renters, covering damages, theft, and liability. Farm Bureau offers customized plans to suit different housing types and locations, ensuring adequate coverage for the specific risks faced by each policyholder.

- Farm and Agriculture Insurance: A specialized suite of products designed for the unique needs of agricultural operations. This includes coverage for farm equipment, livestock, crops, and agricultural liability, providing a safety net for farmers against potential losses.

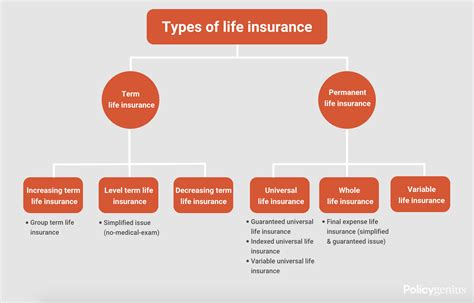

- Life Insurance: A range of life insurance policies, including term life, whole life, and universal life insurance. Farm Bureau helps individuals and families secure their financial future, offering customizable plans to fit different needs and budgets.

- Business Insurance: Comprehensive commercial insurance solutions for small businesses and startups. This includes coverage for property damage, liability, business interruption, and specialized needs such as cyber insurance and professional liability.

- Health Insurance: A variety of health insurance plans, including individual and family health insurance, Medicare supplement plans, and dental and vision insurance. Farm Bureau aims to provide accessible and affordable healthcare coverage, ensuring policyholders can access the care they need.

| Insurance Type | Key Features |

|---|---|

| Auto Insurance | Customizable coverage, roadside assistance, accident forgiveness options |

| Home Insurance | Coverage for dwellings, personal property, and liability, with options for additional endorsements |

| Farm Insurance | Protection for agricultural operations, including equipment, livestock, and crops, with specialized liability coverage |

| Life Insurance | Term, whole, and universal life options, with accelerated death benefit riders and waiver of premium features |

| Business Insurance | Customized commercial policies, including property, liability, and business interruption coverage |

| Health Insurance | Individual, family, and Medicare plans, with dental, vision, and prescription drug coverage options |

A Community-Centric Approach to Service

At the heart of Farm Bureau Insurance’s success is its community-centric philosophy. The company believes in building strong relationships with its policyholders, offering personalized service and support. With a network of over 3,000 independent agents across 18 states, Farm Bureau ensures that each client receives dedicated attention and tailored solutions.

This approach extends to claims management as well. Farm Bureau is known for its efficient and fair claims process, ensuring policyholders receive the coverage they need when it matters most. The company's commitment to its community is further evident through its involvement in various initiatives supporting local businesses, educational programs, and charitable causes.

Industry Recognition and Financial Stability

Farm Bureau Insurance’s dedication to its clients and communities has not gone unnoticed. The company has consistently received high ratings from industry analysts, with A.M. Best awarding it an A (Excellent) rating for financial strength and stability. This rating reflects Farm Bureau’s strong financial position and its ability to meet its obligations to policyholders.

Furthermore, Farm Bureau has been recognized for its innovative approaches to insurance, particularly in the digital space. The company has embraced technology to enhance its services, offering online policy management, digital claims filing, and a mobile app for added convenience.

A Vision for the Future: Expanding Horizons

As Farm Bureau Insurance looks ahead, its focus remains on innovation and expansion. The company is committed to staying ahead of the curve, anticipating the changing needs of its clients and adapting its services accordingly.

One key area of focus is the expansion of its digital capabilities. Farm Bureau aims to enhance its online presence, offering even more streamlined services and improved accessibility for policyholders. This includes the development of advanced tools for policy management, claims tracking, and personalized risk assessment.

Additionally, Farm Bureau is dedicated to community education and empowerment. The company believes in equipping individuals and businesses with the knowledge and tools to better understand and manage their risks. Through educational initiatives and partnerships, Farm Bureau strives to make insurance more accessible and understandable, empowering its communities to make informed decisions about their protection.

Conclusion: A Trusted Partner for All Your Insurance Needs

Farm Bureau Insurance Company stands as a beacon of reliability and innovation in the insurance industry. With its rich history, comprehensive portfolio of services, and unwavering commitment to its communities, Farm Bureau has earned its place as a trusted partner for individuals and businesses seeking protection and peace of mind.

Whether you're a farmer in need of specialized coverage, a business owner seeking comprehensive protection, or a family looking for reliable insurance solutions, Farm Bureau Insurance is poised to meet your needs. With its community-centric approach, financial stability, and focus on innovation, Farm Bureau is well-positioned to navigate the future, ensuring its clients' protection for years to come.

What sets Farm Bureau Insurance apart from other insurance providers?

+Farm Bureau Insurance’s unique selling point lies in its deep-rooted connection to agricultural communities and its commitment to offering specialized insurance solutions for farmers and rural businesses. With a focus on personalized service and community involvement, Farm Bureau provides a level of care and understanding that sets it apart.

How can I find a Farm Bureau Insurance agent near me?

+Farm Bureau Insurance operates through a network of independent agents across 18 states. You can visit their official website, where you can use the agent locator tool to find the closest Farm Bureau agent to your location. Alternatively, you can contact their customer service team for assistance in connecting with a local agent.

What types of discounts does Farm Bureau Insurance offer?

+Farm Bureau Insurance offers a range of discounts to its policyholders, including multi-policy discounts for bundling multiple insurance types (such as auto and home insurance), loyalty discounts for long-term customers, and safety discounts for individuals who take proactive measures to reduce risks (e.g., installing security systems or taking defensive driving courses). Specific discounts may vary by state and policy type.