Types Life Insurance

Life insurance is a vital financial tool that provides security and peace of mind to individuals and their loved ones. It serves as a safety net, ensuring that in the event of an unforeseen tragedy, the policyholder's family or beneficiaries are financially protected and supported. With various types of life insurance policies available, understanding the differences and choosing the right one is crucial to meet specific needs and goals.

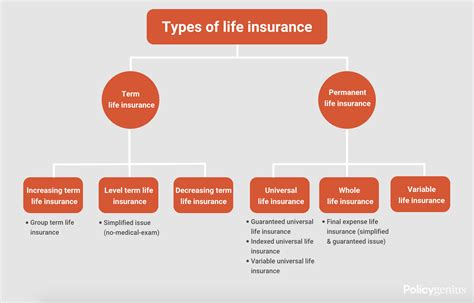

Term Life Insurance: A Temporary Solution for Long-Term Protection

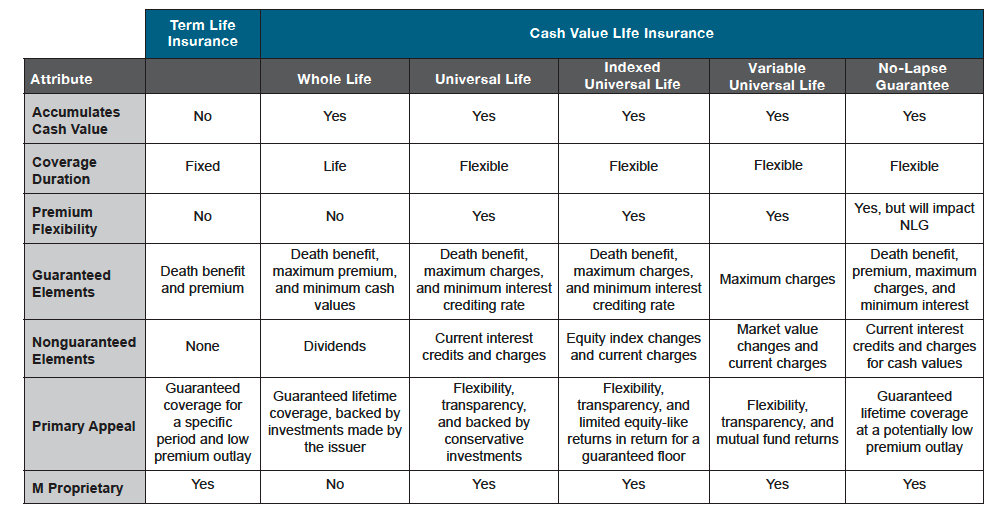

Term life insurance is one of the most common and straightforward types of life insurance policies. It offers coverage for a specified period, typically ranging from 10 to 30 years. During this term, the policyholder pays regular premiums, and in the event of their death within the policy term, the beneficiaries receive a tax-free death benefit.

The key advantage of term life insurance is its affordability. Since it provides coverage for a limited time, it is generally more cost-effective than permanent life insurance policies. This makes it an excellent option for individuals seeking temporary financial protection, such as covering mortgage payments, providing for dependent children, or ensuring financial stability during a particular life stage.

| Key Features of Term Life Insurance |

|---|

| Affordable premiums for a specified term |

| Provides a death benefit if the insured passes away during the term |

| No cash value or investment component |

| Renewable or convertible to permanent life insurance in some cases |

Term life insurance policies can be further categorized into two main types: level term and decreasing term.

Level Term Life Insurance

Level term life insurance offers a fixed death benefit throughout the policy term. This means that regardless of when the policyholder passes away during the term, the beneficiaries will receive the same amount. The premiums for level term life insurance remain constant throughout the policy’s duration, providing predictable and stable costs.

Decreasing Term Life Insurance

In contrast, decreasing term life insurance policies have a death benefit that decreases over time. This type of policy is often used to cover specific financial obligations that decrease over time, such as a mortgage. As the policyholder’s debt decreases, so does the death benefit. Consequently, the premiums for decreasing term life insurance are typically lower compared to level term policies.

Permanent Life Insurance: Lifetime Protection with Cash Value

Permanent life insurance, as the name suggests, provides coverage for the policyholder’s entire life, as long as premiums are paid. Unlike term life insurance, permanent life insurance policies offer a death benefit, along with a cash value component that grows over time. This cash value can be accessed through loans or withdrawals, providing additional financial flexibility.

There are several types of permanent life insurance policies, each with unique features and benefits. The three primary types are whole life insurance, universal life insurance, and variable life insurance.

Whole Life Insurance: Consistent Premiums and Guaranteed Benefits

Whole life insurance is a traditional form of permanent life insurance that offers guaranteed premiums and a fixed death benefit. The premiums remain level throughout the policyholder’s life, and the death benefit is guaranteed, providing financial security to beneficiaries.

One of the key advantages of whole life insurance is the cash value component. This cash value grows on a tax-deferred basis, meaning it accumulates without being taxed until it is withdrawn or used. Policyholders can borrow against this cash value or use it to pay premiums, providing a source of emergency funds or supplemental retirement income.

| Key Features of Whole Life Insurance |

|---|

| Guaranteed level premiums and death benefit |

| Cash value grows on a tax-deferred basis |

| Provides lifetime coverage |

| Offers financial flexibility through cash value loans or withdrawals |

Universal Life Insurance: Flexible Premiums and Death Benefits

Universal life insurance offers more flexibility compared to whole life insurance. Policyholders can adjust their premiums and death benefits within certain limits, allowing for greater control over their policy. The cash value component in universal life insurance also provides investment opportunities, as it can be allocated to various investment options, such as stocks, bonds, or money market funds.

The flexibility of universal life insurance makes it an attractive option for individuals with changing financial needs. Policyholders can increase or decrease their premiums based on their circumstances, ensuring that the policy remains affordable and tailored to their specific requirements.

| Key Features of Universal Life Insurance |

|---|

| Flexible premiums and death benefits |

| Cash value can be invested in various options |

| Provides lifetime coverage |

| Offers tax advantages on cash value growth |

Variable Life Insurance: Investment-Oriented Permanent Coverage

Variable life insurance is a type of permanent life insurance that focuses on investment potential. The cash value component of variable life insurance is invested in various sub-accounts, similar to mutual funds. These sub-accounts offer different investment options, allowing policyholders to customize their investment strategy based on their risk tolerance and financial goals.

The performance of the chosen sub-accounts directly impacts the cash value growth and, consequently, the death benefit. If the investments perform well, the cash value and death benefit increase. However, if the investments underperform, the cash value and death benefit may decrease.

| Key Features of Variable Life Insurance |

|---|

| Cash value is invested in various sub-accounts |

| Performance of sub-accounts affects cash value and death benefit |

| Offers lifetime coverage |

| Provides potential for higher investment returns |

Understanding the Differences and Choosing the Right Policy

When deciding between term and permanent life insurance, it’s essential to consider your specific needs, financial goals, and budget. Term life insurance is a cost-effective option for temporary financial protection, while permanent life insurance provides lifetime coverage and the potential for cash value growth.

Additionally, it's crucial to assess your financial situation and the potential impact of an untimely death on your loved ones. If you have significant financial obligations, such as a mortgage or dependent children, term life insurance can provide the necessary coverage during a critical period. On the other hand, if you're looking to build long-term financial security and have the means to invest in a permanent policy, whole life, universal life, or variable life insurance may be more suitable.

Working with a qualified insurance agent or financial advisor can help you navigate the various life insurance options and choose the policy that best aligns with your needs and goals. They can provide expert guidance and tailor a policy to your specific circumstances, ensuring that you and your loved ones are adequately protected.

FAQs

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage will expire, and you will no longer be insured. However, some term life insurance policies offer a conversion option, allowing you to convert your term policy into a permanent life insurance policy without undergoing a medical exam. This provides an opportunity to secure lifetime coverage if your financial needs change.

Can I borrow against the cash value of my permanent life insurance policy?

+Yes, one of the advantages of permanent life insurance is the ability to borrow against the cash value of your policy. This provides a source of emergency funds or additional financial flexibility. However, it’s important to note that any outstanding loans or withdrawals will reduce the death benefit and the cash value of your policy.

Are there any tax implications for cash value withdrawals in life insurance policies?

+The tax treatment of cash value withdrawals depends on the type of life insurance policy and the specific circumstances. In general, withdrawals from permanent life insurance policies are considered taxable income to the extent that they exceed the premiums paid. However, there are exceptions and nuances, so it’s advisable to consult with a tax professional for personalized advice.