Annual Car Rental Insurance

For many people, renting a car is a necessary part of traveling or even conducting business. While rental car companies offer insurance coverage, it can be a complex and confusing process to navigate. Understanding the options and making informed decisions about annual car rental insurance is crucial to ensure you're protected without unnecessary expenses.

Understanding Annual Car Rental Insurance

Annual car rental insurance, also known as a rental car damage insurance policy, provides coverage for damages or theft that may occur while you’re renting a vehicle. It offers an alternative to the daily insurance rates offered by rental car companies, providing a more cost-effective solution for frequent renters or those planning extended trips.

This type of insurance typically covers the following:

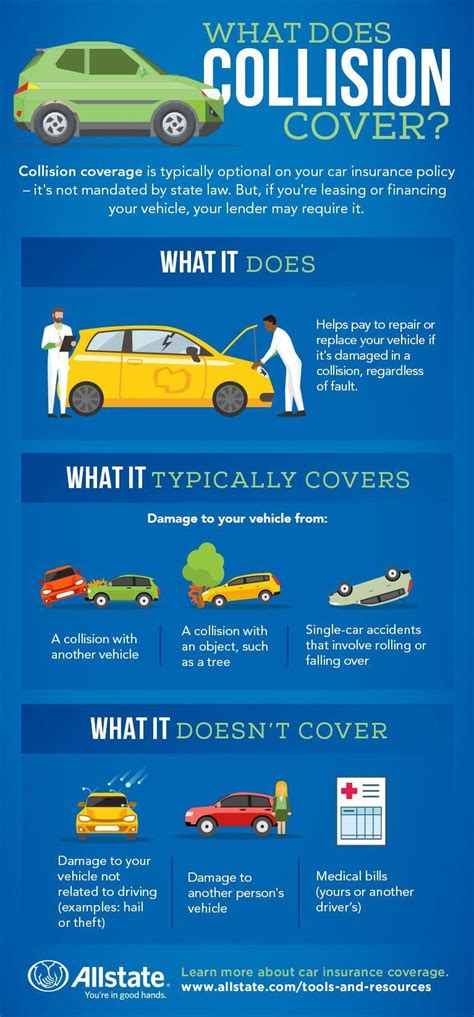

- Collision Damage Waiver (CDW): Covers damage to the rental car due to an accident.

- Loss Damage Waiver (LDW): Similar to CDW, but also covers theft of the rental vehicle.

- Liability Insurance: Protects you against claims for bodily injury or property damage caused to others in an accident.

- Personal Accident Insurance (PAI): Provides coverage for medical expenses and accidental death or dismemberment for the renter and authorized drivers.

Benefits of Annual Policies

Opting for an annual car rental insurance policy offers several advantages over daily rates:

- Cost-effectiveness: Daily insurance rates can quickly add up, especially for longer trips. An annual policy provides a flat rate for the entire year, making it a more economical choice for frequent renters.

- Convenience: With an annual policy, you don't need to worry about purchasing insurance each time you rent a car. It simplifies the rental process and saves time.

- Broader Coverage: Annual policies often include additional benefits like roadside assistance and personal effects coverage, which may not be available with daily rates.

Types of Annual Car Rental Insurance

There are several types of annual car rental insurance policies available, each offering different levels of coverage and benefits. The most common include:

- Basic Coverage: This is the most affordable option, providing CDW and LDW coverage only. It's suitable for renters who already have comprehensive and collision coverage on their personal vehicle.

- Standard Coverage: In addition to CDW and LDW, standard policies include liability insurance and personal accident insurance. This is a good option for renters who want more comprehensive protection.

- Deluxe Coverage: The most comprehensive option, deluxe policies include all the benefits of standard coverage, plus additional perks like personal effects coverage and roadside assistance.

Choosing the Right Policy

When selecting an annual car rental insurance policy, consider the following factors:

- Your Personal Insurance: Check your existing auto insurance policy to see if it provides any coverage for rental cars. If you have comprehensive and collision coverage, you may only need liability insurance and personal accident insurance through your rental policy.

- Trip Duration: If you frequently rent cars for short periods, a basic coverage policy may suffice. However, for extended trips or multiple rentals throughout the year, a standard or deluxe policy may offer better value.

- Additional Benefits: Assess your specific needs and consider the added perks of each policy type. For example, if you often travel with valuable items, personal effects coverage may be a worthwhile investment.

Comparing Providers

As with any insurance, it's important to compare providers and policies to find the best fit for your needs. Consider the following when researching annual car rental insurance:

- Coverage Limits: Check the maximum coverage limits for each type of insurance included in the policy. Ensure they align with your requirements and provide adequate protection.

- Deductibles: Understand the deductible amounts for each type of coverage. Lower deductibles mean you'll pay less out of pocket in the event of a claim.

- Exclusions: Carefully review the policy's exclusions to ensure there aren't any surprises. Some policies may exclude certain types of vehicles or damage caused by specific events.

- Claims Process: Inquire about the claims process and customer support. A provider with a straightforward claims process and responsive customer service can make a significant difference when you need to file a claim.

Real-Life Example: John's Rental Experience

John, a frequent business traveler, decided to invest in an annual car rental insurance policy after multiple confusing and expensive experiences with daily rates. He opted for a standard coverage policy, which provided him with peace of mind and significant savings. During one of his trips, John accidentally damaged the rental car's side mirror. With his annual policy, he was able to quickly and easily file a claim, and the damage was covered without any hassle.

Performance Analysis and Industry Insights

Annual car rental insurance policies have gained popularity among frequent renters due to their cost-effectiveness and convenience. According to a recent survey, over 60% of business travelers prefer annual policies over daily rates. This trend is expected to continue as more travelers seek streamlined rental experiences and better value for their money.

However, it's important to note that annual policies may not be suitable for everyone. Renters who only need a car occasionally or for short periods may find daily rates more flexible and cost-effective. Additionally, those with comprehensive coverage on their personal vehicles may already have adequate protection for rental cars.

| Policy Type | Coverage | Average Annual Cost |

|---|---|---|

| Basic | CDW, LDW | $150 - $250 |

| Standard | CDW, LDW, Liability, PAI | $250 - $350 |

| Deluxe | All Standard Benefits + Personal Effects, Roadside Assistance | $350 - $500 |

What is the difference between CDW and LDW?

+

CDW (Collision Damage Waiver) covers damage to the rental car in the event of an accident, while LDW (Loss Damage Waiver) includes theft coverage. LDW is essentially an expanded version of CDW.

Do I need annual car rental insurance if I have personal auto insurance?

+

It depends on your existing coverage. If you have comprehensive and collision coverage on your personal vehicle, you may only need liability insurance and personal accident insurance through your rental policy. Always review your personal insurance policy to understand your coverage.

Can I purchase annual car rental insurance through my rental car company?

+

Yes, many rental car companies offer annual policies. However, it’s a good idea to shop around and compare prices and coverage from different providers to find the best value.

What should I do if I have an accident while renting a car?

+

First, ensure the safety of yourself and others involved. Then, contact the rental car company and your insurance provider to report the accident and begin the claims process. Having annual car rental insurance can simplify this process and provide you with peace of mind.