Is It Against The Law To Not Have Health Insurance

The topic of health insurance mandates and their legal implications has become increasingly pertinent, especially with the evolving healthcare landscape and various legislative changes. Understanding the legal requirements surrounding health insurance is crucial for individuals and businesses alike.

The Evolution of Health Insurance Mandates

Health insurance mandates, or requirements for individuals to maintain minimum essential coverage, have a complex history. In the United States, the Patient Protection and Affordable Care Act (ACA), commonly known as Obamacare, introduced a significant shift in the healthcare system. One of its key provisions was the individual mandate, which aimed to ensure that a critical mass of people had health insurance, thus stabilizing the risk pool and reducing costs for all.

The individual mandate required most Americans to have qualifying health insurance coverage or face a tax penalty. This mandate played a pivotal role in the functioning of the ACA's insurance exchanges, where individuals could purchase health plans with federal subsidies for those meeting certain income criteria.

Legal Landscape and Exceptions

The legality of not having health insurance has been a subject of debate and litigation. While the individual mandate was a core component of the ACA, it faced legal challenges. In 2012, the Supreme Court ruled that the individual mandate was constitutional, but in a later decision, the tax penalty for non-compliance was deemed unconstitutional.

As a result, the legal landscape surrounding health insurance mandates became more complex. While there is no longer a federal penalty for not having health insurance, some states have implemented their own mandates and penalties. For instance, New Jersey and Rhode Island have enacted individual mandates with state-level penalties for non-compliance.

Additionally, certain exemptions exist for individuals who meet specific criteria. These exemptions include financial hardship, religious objections, membership in a recognized healthcare sharing ministry, and more. It's crucial for individuals to understand their state's specific laws and exemptions to determine their legal obligations.

Implications for Individuals and Businesses

The absence of a federal penalty for not having health insurance has significant implications for individuals and businesses. For individuals, it provides more flexibility in choosing whether to purchase health insurance, especially if they are healthy and do not anticipate significant medical expenses.

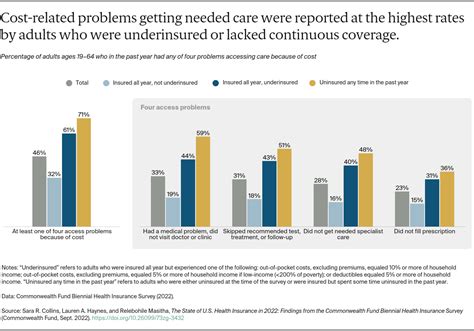

However, it's essential to note that going without health insurance carries substantial risks. Unexpected medical emergencies can lead to astronomical costs, potentially resulting in financial ruin. Additionally, pre-existing conditions can make it challenging to obtain coverage in the future, further emphasizing the importance of maintaining continuous coverage.

For businesses, the legal requirements regarding health insurance vary depending on their size and location. Large employers (typically those with 50 or more full-time equivalent employees) are subject to the ACA's employer mandate, which requires them to offer affordable health insurance to their full-time employees or face potential penalties. Small businesses, on the other hand, may qualify for tax credits and other incentives to provide health coverage to their employees.

Employer Considerations

Employers must navigate a complex web of regulations when it comes to health insurance. They need to ensure compliance with both federal and state laws, which can vary significantly. For instance, some states have more stringent requirements for employer-sponsored health plans, such as mandating specific coverage levels or including certain benefits.

Furthermore, employers must stay updated on changes to the law, as legislative decisions can impact their obligations. For example, if a state introduces an individual mandate with penalties, employers may need to consider the implications for their workforce and benefits strategies.

Health Insurance Trends and Innovations

The legal landscape surrounding health insurance is not static, and several trends and innovations are shaping the industry’s future.

Short-Term Health Insurance Plans

The availability of short-term health insurance plans has expanded in recent years. These plans offer temporary coverage for individuals between jobs or those who choose not to enroll in traditional health insurance. While they provide a degree of financial protection, they often come with limitations and exclusions, making them less comprehensive than traditional plans.

Healthcare Sharing Ministries

Healthcare sharing ministries have gained attention as an alternative to traditional health insurance. These faith-based organizations facilitate the sharing of medical expenses among members, often without the regulatory requirements of traditional insurance. However, they typically have strict eligibility criteria and may not cover all medical services.

Telehealth and Virtual Care

The rise of telehealth and virtual care services has revolutionized healthcare access. These services allow individuals to receive medical consultations, diagnoses, and even prescriptions remotely, often at a lower cost. While they do not replace the need for comprehensive health insurance, they provide an additional layer of accessibility and convenience.

The Future of Health Insurance Mandates

The future of health insurance mandates remains uncertain, with ongoing debates and legislative proposals. Some advocate for a return to an individual mandate, arguing that it is necessary to maintain a stable insurance market. Others propose alternative approaches, such as expanding public insurance programs like Medicare or Medicaid to cover more individuals.

Regardless of the future direction, staying informed about legal requirements and healthcare innovations is crucial for both individuals and businesses. Understanding the complex web of regulations and staying adaptable to changes ensures compliance and enables informed decision-making in an ever-evolving healthcare landscape.

Are there any states with individual health insurance mandates and penalties?

+Yes, some states, such as New Jersey and Rhode Island, have implemented individual health insurance mandates with penalties for non-compliance. It’s essential to check your state’s specific laws to understand your obligations.

What are the risks of not having health insurance?

+Going without health insurance can lead to significant financial risks in the event of unexpected medical emergencies. It may also result in challenges obtaining coverage in the future due to pre-existing conditions.

How do employers navigate health insurance regulations?

+Employers must stay updated on both federal and state laws, as requirements can vary significantly. They should also consider the implications of state-level individual mandates and adjust their benefits strategies accordingly.