Student Auto Insurance

Student auto insurance is a vital topic for young drivers and their families, offering crucial protection and financial peace of mind. With many students heading off to college and facing the challenge of finding affordable coverage, understanding the intricacies of student auto insurance becomes essential. This article delves into the world of student auto insurance, exploring the unique considerations, cost-saving strategies, and key factors that influence coverage for this demographic.

Understanding Student Auto Insurance: Navigating Coverage for Young Drivers

Student auto insurance policies cater to the specific needs of young drivers, many of whom are new to the road and face unique financial constraints. These policies typically provide liability coverage, which is essential for protecting the student and their family against claims arising from accidents they cause. This coverage includes bodily injury liability and property damage liability, ensuring that medical expenses and property repairs are covered in the event of an accident.

In addition to liability coverage, student auto insurance policies often offer comprehensive and collision coverage. Comprehensive coverage safeguards against non-accident-related incidents like theft, vandalism, or natural disasters, while collision coverage steps in when the student's vehicle is involved in an accident with another vehicle or object. These additional coverages provide a safety net for students, ensuring their financial stability in the face of unexpected events.

Key Factors Influencing Student Auto Insurance Rates

Several factors play a significant role in determining the cost of student auto insurance. Age is a primary consideration, with younger drivers often facing higher premiums due to their lack of driving experience. The type of vehicle being insured also impacts rates; sports cars and high-performance vehicles, for instance, typically attract higher premiums due to their association with higher accident risks and repair costs.

The student's driving history is another critical factor. A clean driving record with no accidents or traffic violations can lead to more affordable insurance rates. Conversely, a history of accidents or moving violations may result in higher premiums or even difficulty finding coverage. Insurance companies also consider the student's grades, with good academic performance often leading to discounts or more favorable rates.

The location where the student resides and attends school also influences insurance rates. Urban areas, for example, tend to have higher rates due to the increased risk of accidents and theft. Additionally, the student's chosen college or university can impact rates, as some institutions are located in areas with higher crime rates or more congested traffic conditions.

| Factor | Impact on Rates |

|---|---|

| Age | Younger drivers often face higher premiums. |

| Vehicle Type | Sports cars and high-performance vehicles attract higher rates. |

| Driving History | Clean records lead to lower rates; accidents and violations increase premiums. |

| Location | Urban areas and colleges in high-risk zones may result in higher rates. |

| Grades | Good academic performance can lead to discounts. |

Cost-Saving Strategies for Students: Maximizing Savings on Auto Insurance

For students, finding ways to reduce auto insurance costs is crucial to managing their financial responsibilities. Here are some effective strategies to achieve significant savings on student auto insurance:

1. Shop Around and Compare Quotes

Insurance rates can vary significantly between providers. By obtaining multiple quotes, students can identify the most competitive rates and choose the policy that best suits their needs. Online comparison tools and direct quotes from insurance companies can provide a clear picture of the market, helping students make informed decisions.

2. Explore Discounts and Rewards Programs

Many insurance companies offer discounts and rewards programs that can significantly reduce premiums. Students should inquire about these programs, which may include discounts for good grades, safe driving records, or even membership in certain organizations. Additionally, some providers offer rewards for completing defensive driving courses or maintaining a clean driving history.

3. Opt for Higher Deductibles

Choosing a higher deductible can lower insurance premiums. While this strategy requires the student to pay more out-of-pocket in the event of a claim, it can result in substantial savings over time. It’s important to select a deductible that aligns with the student’s financial capabilities and comfort level.

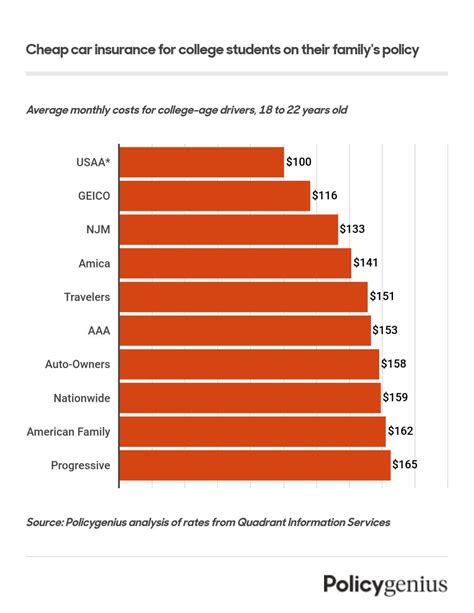

4. Bundle Policies with Parents

Students can often access significant discounts by bundling their auto insurance with their parents’ policies. Many insurance companies offer multi-policy discounts, which can result in substantial savings for the entire family. This strategy is particularly effective for students who are still financially dependent on their parents or living at home.

5. Maintain a Good Driving Record

A clean driving record is a powerful tool for reducing insurance costs. Students should strive to avoid accidents and traffic violations, as even a single citation can lead to increased premiums. Safe driving habits, such as obeying speed limits, avoiding distracted driving, and practicing defensive driving techniques, can help students maintain a clean record and access more affordable insurance rates.

6. Choose a Safer Vehicle

The type of vehicle a student drives can impact insurance rates. Safer vehicles, such as those with high safety ratings and advanced safety features, often attract lower premiums. Students should research vehicle safety ratings and consider the long-term financial implications when choosing a car. Opting for a safer vehicle can lead to lower insurance costs and potentially better resale value down the line.

Future Outlook: Evolving Trends in Student Auto Insurance

The landscape of student auto insurance is continually evolving, driven by technological advancements, changing demographics, and shifts in consumer behavior. Here’s a glimpse into the future of student auto insurance and the trends that are shaping this industry:

1. Digitalization and Convenience

The digital revolution is transforming the insurance industry, with student auto insurance set to become increasingly digital and convenient. Insurance providers are investing in mobile apps and online platforms, enabling students to manage their policies, file claims, and access real-time assistance with just a few clicks. This shift towards digitalization enhances efficiency, speeds up claim processing, and provides students with greater control over their insurance experience.

2. Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and habits, is gaining traction in the student auto insurance market. Usage-based insurance policies leverage telematics data to offer personalized premiums based on a student’s actual driving habits. This approach rewards safe driving and can lead to significant savings for students who practice defensive driving and maintain a clean record. As telematics technology advances, it is expected to play an even more prominent role in shaping student auto insurance rates.

3. Enhanced Personalization

The future of student auto insurance is moving towards increased personalization. Insurance providers are leveraging data analytics and machine learning to tailor policies to individual student needs. This includes offering customized coverage options, flexible payment plans, and incentives for adopting safe driving behaviors. By understanding each student’s unique circumstances and driving habits, insurance companies can provide more accurate and affordable coverage.

4. Integration of New Technologies

The integration of emerging technologies, such as autonomous driving features and advanced driver-assistance systems (ADAS), is expected to influence student auto insurance. As these technologies become more prevalent, insurance companies may adjust their underwriting criteria to reflect the reduced risk associated with these advanced safety features. Students who opt for vehicles equipped with ADAS may benefit from lower insurance premiums, further incentivizing the adoption of these innovative safety technologies.

5. Sustainability and Environmental Considerations

Sustainability and environmental concerns are growing in importance, and this trend is expected to impact student auto insurance. Insurance providers are increasingly incorporating sustainability factors into their underwriting processes, rewarding students who opt for electric or hybrid vehicles. As the market for eco-friendly vehicles expands, insurance companies may offer discounts or incentives for students who choose more environmentally conscious transportation options.

6. Expanding Coverage Options

The student auto insurance market is likely to see the introduction of new and innovative coverage options. This includes expanded liability coverage, enhanced personal injury protection, and specialized add-ons tailored to the unique needs of students. For instance, insurance providers may offer coverage for study abroad trips, rental car usage, or even coverage for shared mobility services like bike-sharing or ride-hailing apps.

7. Collaboration and Partnerships

Insurance companies are recognizing the value of partnerships and collaborations to enhance their offerings for students. This may involve collaborations with educational institutions, student organizations, or even tech startups focused on student life. Through these partnerships, insurance providers can access valuable insights into student needs and preferences, leading to the development of more relevant and appealing insurance products.

What is the average cost of student auto insurance?

+The average cost of student auto insurance varies widely based on factors such as location, driving history, and vehicle type. However, students can expect to pay anywhere from 500 to 1,500 annually for basic liability coverage. Comprehensive and collision coverage can significantly increase these costs, so it’s important for students to carefully consider their coverage needs and budget.

Can students get discounts on their auto insurance?

+Absolutely! Students can access a variety of discounts on their auto insurance. These may include good student discounts for maintaining a certain GPA, safe driver discounts for maintaining a clean driving record, and multi-policy discounts when bundling their auto insurance with other policies, such as their parents’ home insurance.

How can students improve their driving record to lower insurance costs?

+Improving one’s driving record is crucial for reducing insurance costs. Students should focus on developing safe driving habits, such as obeying speed limits, avoiding distractions, and practicing defensive driving techniques. Additionally, completing a defensive driving course can often lead to insurance discounts and a cleaner driving record.