American Insurance Group

The American Insurance Group, or AIG, is a well-known name in the insurance industry, with a rich history and a global presence. This comprehensive article will delve into the world of AIG, exploring its origins, evolution, key services, and its impact on the insurance landscape. From its humble beginnings to its current status as a leading insurer, we will uncover the factors that have contributed to AIG's success and its role in shaping the industry.

A Legacy of Innovation: AIG’s Journey to Global Leadership

American Insurance Group, commonly known as AIG, has emerged as one of the leading insurance providers in the world, with a history spanning over a century. Founded in 1919, AIG has grown from a small insurance agency to a global conglomerate, offering a diverse range of insurance products and financial services. The company’s journey is a testament to its ability to adapt, innovate, and stay at the forefront of the industry.

AIG's story began with the vision of a group of insurance professionals who sought to create a company that would provide comprehensive risk management solutions. Their goal was to offer insurance coverage that was not only reliable but also accessible to a wide range of individuals and businesses. Over the years, AIG has expanded its operations, acquiring numerous insurance companies and diversifying its portfolio to meet the evolving needs of its customers.

A Timeline of Milestones: AIG’s Growth and Expansion

The early years of AIG were marked by rapid growth and strategic acquisitions. In the 1920s, the company expanded its reach by establishing offices in Europe and Asia, solidifying its global presence. This period also saw AIG introduce innovative products, such as aviation insurance, reflecting its commitment to staying ahead of the curve.

The post-World War II era brought significant changes to the insurance industry, and AIG adapted by expanding its product offerings to include life insurance, property insurance, and casualty insurance. This diversification strategy proved successful, allowing AIG to establish itself as a trusted provider of multiple insurance solutions.

The 1980s and 1990s were a period of aggressive expansion for AIG. The company acquired numerous insurance companies, including American General, and expanded its international operations, solidifying its position as a global leader. During this time, AIG also ventured into financial services, offering investment and retirement planning solutions.

However, AIG's journey has not been without challenges. The financial crisis of 2008 significantly impacted the company, leading to a government bailout and a restructuring of its operations. Despite these setbacks, AIG has demonstrated resilience and has since rebounded, focusing on its core insurance businesses and strengthening its risk management practices.

| Year | Milestone |

|---|---|

| 1919 | American Insurance Group is founded. |

| 1920s | AIG expands globally, establishing offices in Europe and Asia. |

| 1950s | Diversification of product offerings, including life and property insurance. |

| 1980s | Aggressive acquisitions and expansion into financial services. |

| 2008 | Financial crisis leads to government bailout and restructuring. |

| 2010s | AIG rebounds, focusing on core insurance businesses and risk management. |

Core Insurance Services: Protecting What Matters

AIG’s comprehensive insurance portfolio is designed to address a wide range of risks faced by individuals, families, and businesses. The company offers specialized insurance products tailored to specific industries and personal needs, ensuring that its customers receive the protection they require.

Property and Casualty Insurance: Securing Assets

AIG’s property and casualty insurance division provides coverage for a vast array of risks, including:

- Homeowners Insurance: Protecting residences from damage, theft, and liability.

- Auto Insurance: Offering coverage for vehicles, including collision, liability, and comprehensive protection.

- Business Insurance: Tailored solutions for small businesses, large corporations, and specific industries, covering property damage, liability, and business interruption.

- Umbrella Insurance: Providing additional liability coverage beyond standard policies.

Life and Health Insurance: Securing Futures

AIG’s life and health insurance products focus on safeguarding individuals and their families:

- Life Insurance: Offering term, whole life, and universal life insurance policies to provide financial protection for loved ones.

- Health Insurance: Providing comprehensive medical coverage, including individual and family plans, as well as group health insurance for businesses.

- Long-Term Care Insurance: Addressing the costs of long-term care, such as nursing home stays and home health care.

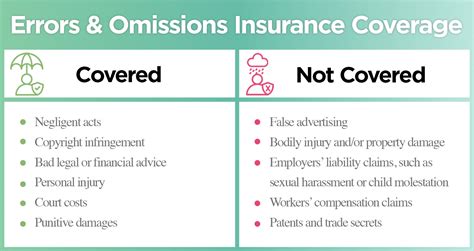

Specialty Insurance: Tailored Solutions

AIG’s specialty insurance division caters to unique and niche markets, offering specialized coverage such as:

- Marine Insurance: Protecting marine-related assets and activities, including shipping, cargo, and marine construction.

- Aviation Insurance: Covering aircraft, airports, and aviation-related businesses.

- Cyber Insurance: Addressing the risks associated with cyber threats, data breaches, and online activities.

- Surety Bonds: Providing financial guarantees to businesses and individuals in various industries.

Global Reach and Local Expertise: AIG’s International Presence

AIG’s global footprint is a key strength, allowing the company to provide localized services while leveraging its international resources. With operations in over 80 countries, AIG has established a strong presence in key markets, ensuring that its customers receive tailored solutions and support.

Regional Offices and Expertise

AIG has regional headquarters in major markets, including North America, Europe, Asia Pacific, and Latin America. These regional offices are staffed with local experts who understand the unique risks and regulatory environments of their regions. This localized approach ensures that AIG’s products and services are tailored to meet the specific needs of each market.

International Partnerships and Acquisitions

AIG’s global strategy has been further strengthened through strategic partnerships and acquisitions. The company has formed alliances with local insurance providers, allowing it to leverage their expertise and expand its reach. Additionally, AIG has acquired several international insurance companies, solidifying its position as a leading global insurer.

| Region | Key Markets |

|---|---|

| North America | United States, Canada |

| Europe | United Kingdom, Germany, France |

| Asia Pacific | China, Japan, Australia |

| Latin America | Brazil, Mexico, Argentina |

Financial Strength and Stability: AIG’s Commitment to Security

AIG’s financial strength is a cornerstone of its reputation and a key factor in attracting and retaining customers. The company has consistently demonstrated its ability to manage risks and maintain financial stability, even in challenging economic environments.

Financial Ratings and Awards

AIG’s financial performance has been recognized by leading rating agencies. The company holds strong financial ratings from reputable organizations such as Standard & Poor’s, Moody’s, and A.M. Best. These ratings reflect AIG’s financial strength, creditworthiness, and ability to meet its obligations to policyholders.

Additionally, AIG has been the recipient of numerous awards for its financial performance and risk management practices. These accolades further reinforce the company's commitment to maintaining a robust financial position and providing secure insurance solutions.

Risk Management and Mitigation

AIG’s approach to risk management is comprehensive and proactive. The company employs advanced risk assessment tools and models to identify and mitigate potential risks across its operations. This includes developing innovative risk management solutions, such as customized insurance products and strategic partnerships, to address specific industry risks.

Regulatory Compliance and Governance

AIG operates in a highly regulated industry, and the company is committed to maintaining the highest standards of compliance and governance. It works closely with regulatory authorities in various jurisdictions to ensure that its operations are compliant with local and international regulations. This commitment to regulatory compliance further enhances AIG’s reputation for financial integrity and trustworthiness.

Customer Experience and Service Excellence

AIG places a strong emphasis on delivering exceptional customer experiences, recognizing that satisfied customers are the foundation of its success. The company has implemented various initiatives and strategies to ensure that its customers receive timely, personalized, and efficient service.

Digital Transformation and Innovation

AIG has embraced digital transformation to enhance its customer service capabilities. The company has invested in developing user-friendly online platforms and mobile applications, allowing customers to access their policies, make payments, and file claims conveniently. These digital tools have streamlined the customer experience, making insurance interactions more efficient and accessible.

Personalized Service and Claims Management

AIG understands that every customer has unique needs and circumstances. Its customer service teams are trained to provide personalized assistance, ensuring that customers receive tailored advice and support. Additionally, AIG has streamlined its claims process, offering prompt and fair assessments to ensure that customers receive the coverage they deserve in a timely manner.

Community Engagement and Social Responsibility

AIG is committed to making a positive impact in the communities it serves. The company engages in various social responsibility initiatives, including supporting disaster relief efforts, promoting environmental sustainability, and investing in educational programs. These community engagement efforts not only benefit local communities but also reinforce AIG’s reputation as a responsible corporate citizen.

How can I purchase an AIG insurance policy?

+You can purchase an AIG insurance policy by contacting an AIG agent or broker in your area. You can also visit the AIG website to get a quote and learn more about their insurance offerings. Once you've chosen the policy that suits your needs, you can complete the application process and make the necessary payments to activate your coverage.

What makes AIG's insurance products unique?

+AIG offers a diverse range of insurance products tailored to meet the specific needs of its customers. From property and casualty insurance to life and health insurance, AIG provides comprehensive coverage options. Additionally, the company's specialty insurance division offers unique solutions for niche markets, such as marine and aviation insurance. AIG's global presence also allows it to provide localized services with international support.

How does AIG ensure financial stability for its policyholders?

+AIG maintains strong financial ratings from reputable agencies, reflecting its financial strength and creditworthiness. The company's commitment to risk management and regulatory compliance further enhances its financial stability. AIG's proactive approach to risk assessment and mitigation, along with its robust governance practices, ensures that it can meet its obligations to policyholders, even in challenging economic conditions.

What is AIG's approach to customer service?

+AIG places a strong emphasis on delivering exceptional customer experiences. The company has invested in digital transformation to provide convenient online and mobile platforms for policy management and claims filing. AIG's customer service teams are trained to offer personalized assistance, ensuring that customers receive tailored support. The company's commitment to social responsibility and community engagement also enhances its reputation for customer satisfaction.

In conclusion, American Insurance Group has solidified its position as a leading insurer through a combination of innovation, financial strength, and customer-centric approaches. With a rich history and a global presence, AIG continues to shape the insurance industry, offering comprehensive solutions to protect what matters most to its customers.