Error And Omission Insurance

Error and Omission (E&O) Insurance is a specialized form of liability coverage that has become increasingly important in today's complex and litigious business landscape. This type of insurance safeguards professionals and businesses from the financial risks associated with mistakes, negligence, or oversights in their work. As the world becomes more interconnected and digital, the potential for errors and their impact on clients has grown exponentially. E&O insurance provides a critical safety net, ensuring that professionals can focus on their expertise without the constant worry of legal repercussions.

Understanding Error and Omission Insurance

Error and Omission Insurance, often referred to as Professional Liability Insurance, is designed to protect individuals and businesses against claims arising from their professional services. These claims can stem from a wide range of scenarios, including missed deadlines, incorrect advice, faulty workmanship, or any other situation where a client experiences a financial loss due to the insured party’s error or omission.

The insurance policy covers the legal costs associated with defending such claims, as well as any damages that may be awarded against the insured. It is a vital component of risk management for professionals in fields as diverse as accounting, consulting, real estate, technology, and many more.

Coverage Details

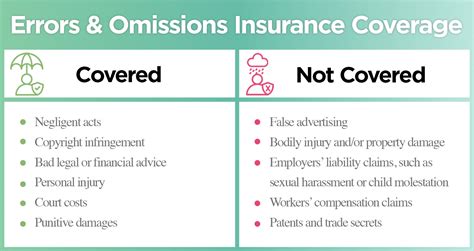

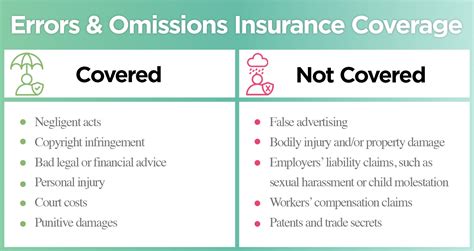

E&O insurance policies typically cover a variety of claims, including:

- Negligence: Failure to exercise reasonable care and skill in the provision of professional services.

- Errors and Omissions: Mistakes or oversights in work performed for clients.

- Misrepresentation: Providing incorrect or misleading information to clients.

- Breach of Confidentiality: Disclosure of confidential client information.

- Infringement of Intellectual Property: Unintentional violation of intellectual property rights.

The coverage limits and deductibles vary depending on the policy and the nature of the business. It's crucial for professionals to carefully review the policy terms and conditions to ensure they have adequate protection for their specific risks.

The Importance of E&O Insurance

In today’s highly competitive business environment, clients expect a high standard of service. A single mistake or oversight can lead to significant financial losses for them, which may result in legal action. E&O insurance provides the necessary financial backing to defend against such claims and compensate the client if the claim is valid.

For professionals, the potential impact of a claim can be devastating. It can lead to significant financial strain, damage to reputation, and even career disruption. E&O insurance offers peace of mind, allowing professionals to focus on delivering their expertise without the constant worry of potential legal repercussions.

Key Benefits of E&O Insurance

Error and Omission Insurance offers several critical benefits:

- Risk Mitigation: It protects professionals from the financial risks associated with their work.

- Legal Defense: Covers the costs of defending against claims, including legal fees and settlements.

- Client Trust: Demonstrates a commitment to client well-being, fostering trust and confidence.

- Business Continuity: Ensures that businesses can continue operating despite claims, protecting their financial stability.

Types of E&O Insurance

E&O insurance policies can vary significantly depending on the industry and the specific risks involved. Here are some common types of E&O insurance:

Professional Liability Insurance for Consultants

Consultants, especially those in specialized fields like management consulting, IT consulting, or financial advising, face unique risks. E&O insurance for consultants covers claims arising from the advice, recommendations, or services they provide to their clients. It protects them from financial losses resulting from errors, omissions, or negligence in their professional practice.

Real Estate E&O Insurance

Real estate professionals, including agents, brokers, and appraisers, often rely on E&O insurance to protect themselves from claims related to property transactions. These claims can range from misrepresentation of property details to errors in valuation or transaction management. Real estate E&O insurance provides the necessary coverage to defend against such claims and maintain the integrity of their professional practice.

Technology Professionals E&O Insurance

In the rapidly evolving field of technology, professionals such as software developers, IT consultants, and cyber security experts face unique challenges. E&O insurance for technology professionals covers claims arising from errors or omissions in the development, implementation, or maintenance of technology solutions. It protects them from financial losses resulting from bugs, system failures, or data breaches.

Case Studies: Real-World Applications

The impact of E&O insurance can be seen in a variety of real-world scenarios. Consider the following examples:

Accounting Firm’s Mistake

An accounting firm failed to identify a client’s tax liability, resulting in a significant financial loss for the client. The client sued the firm for negligence. The accounting firm’s E&O insurance policy covered the legal costs and settled the claim, protecting the firm’s reputation and financial stability.

Software Glitch in Healthcare

A software company developed a healthcare management system that had a critical bug, leading to incorrect patient data and delayed treatments. The healthcare provider sued the software company for damages. The software company’s E&O insurance policy covered the legal fees and provided compensation to the healthcare provider, demonstrating their commitment to resolving the issue.

Legal Misstep by a Law Firm

A law firm missed a critical filing deadline, resulting in the loss of a client’s case. The client sued the firm for negligence. The law firm’s E&O insurance policy covered the legal costs and provided compensation to the client, ensuring that the firm’s mistake did not lead to a long-term loss of trust or reputation.

Performance Analysis and Comparison

When evaluating E&O insurance policies, it’s essential to consider the coverage limits, deductibles, and policy exclusions. Here’s a table comparing key aspects of three leading E&O insurance providers:

| Provider | Coverage Limits | Deductibles | Notable Exclusions |

|---|---|---|---|

| Insurer A | $2 million per claim, $6 million aggregate | $5,000 per claim | Intellectual property infringement, intentional acts |

| Insurer B | $1.5 million per claim, $4.5 million aggregate | $2,500 per claim | Employment practices liability, punitive damages |

| Insurer C | $3 million per claim, $9 million aggregate | $10,000 per claim | Criminal acts, pollution liability |

Future Implications and Industry Trends

As the business landscape continues to evolve, the importance of E&O insurance is only set to increase. The rise of remote work, digital transformation, and new technologies introduces fresh risks and challenges. Professionals and businesses must stay vigilant and ensure their E&O insurance coverage keeps pace with these changes.

The insurance industry is also evolving to meet these new challenges. Insurers are developing innovative solutions, such as customizable policies that can adapt to the unique risks of different industries and professions. They are also leveraging data analytics to better understand and mitigate emerging risks.

Key Takeaways

- Error and Omission Insurance is crucial for professionals and businesses to manage financial risks associated with their work.

- It provides coverage for a wide range of claims, including negligence, errors, omissions, and intellectual property infringement.

- Different industries and professions have unique E&O insurance needs, and policies should be tailored accordingly.

- The insurance industry is evolving to meet new challenges, offering innovative solutions and data-driven risk management.

Conclusion

Error and Omission Insurance is an essential component of any professional’s risk management strategy. It provides the necessary financial protection and peace of mind to navigate the complex and ever-changing business landscape. By understanding the importance of E&O insurance and staying informed about industry trends, professionals can ensure they have the coverage they need to thrive in their respective fields.

What is the difference between E&O insurance and general liability insurance?

+E&O insurance and general liability insurance are distinct types of coverage. General liability insurance protects against claims arising from accidents or injuries on your business premises, whereas E&O insurance covers claims related to your professional services, including errors, omissions, and negligence.

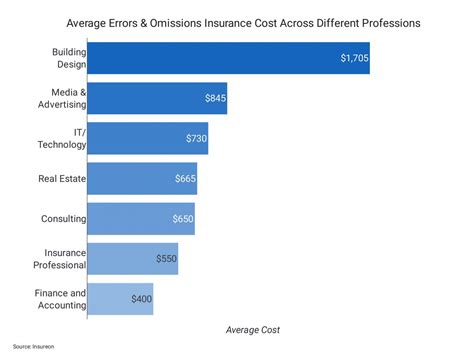

How much does E&O insurance typically cost?

+The cost of E&O insurance varies depending on factors such as your industry, the nature of your work, and the coverage limits you require. On average, professionals can expect to pay between 500 to 2,000 annually for E&O insurance, but this can vary significantly.

Can E&O insurance cover claims related to data breaches or cyber attacks?

+Yes, many E&O insurance policies include coverage for data breaches and cyber attacks. However, it’s important to carefully review the policy terms and conditions to understand the specific coverage provided. Some policies may require additional endorsements or specialized cyber liability insurance for comprehensive protection.

What happens if I don’t have E&O insurance and a client sues me for an error or omission?

+Without E&O insurance, you would be personally responsible for defending against the claim and any resulting damages. This can lead to significant financial strain and potential damage to your reputation and business. It’s crucial to have E&O insurance to protect yourself and your business.