How Does Medical Insurance Work

Medical insurance, often referred to as health insurance, is a vital aspect of modern healthcare systems worldwide. It provides individuals and families with financial protection against the costs associated with medical treatments, hospitalizations, and other healthcare services. With rising healthcare expenses, understanding how medical insurance works is crucial for making informed decisions about your health and financial well-being.

In this comprehensive guide, we will delve into the intricacies of medical insurance, exploring its mechanics, coverage options, and the benefits it offers. Whether you're a curious consumer, a healthcare professional, or someone seeking to navigate the complex world of healthcare financing, this article will provide you with an in-depth understanding of medical insurance and its role in ensuring accessible and affordable healthcare.

The Fundamentals of Medical Insurance

Medical insurance operates on the principle of risk pooling, where a large group of individuals or policyholders contribute premiums to a common pool. This pool of funds is then used to cover the healthcare expenses of those who require medical treatment. By spreading the financial risk across a diverse population, insurance companies can offer coverage to individuals at a manageable cost.

The process of acquiring medical insurance typically involves the following steps:

- Policy Selection: Individuals or employers choose an insurance plan that best suits their healthcare needs and budget. Plans can vary significantly in terms of coverage, deductibles, copayments, and out-of-pocket maximums.

- Premium Payment: Policyholders pay a regular premium, typically on a monthly or annual basis, to maintain their coverage. The premium amount is determined by factors such as age, location, and the chosen plan's benefits.

- Enrollment and Coverage: Once the premium is paid, the policyholder is enrolled in the insurance plan and receives a policy document outlining the coverage details, including covered services, exclusions, and any pre-existing condition clauses.

Types of Medical Insurance Plans

Medical insurance plans can be broadly categorized into several types, each offering unique features and coverage options. Understanding these plan types is essential for selecting the right insurance for your needs.

- Fee-for-Service Plans (Indemnity Insurance): These traditional plans allow policyholders to choose their healthcare providers and hospitals without restrictions. The insurance company reimburses a portion of the medical expenses, and the policyholder pays the remaining amount. Fee-for-service plans offer flexibility but may have higher out-of-pocket costs.

- Health Maintenance Organizations (HMOs): HMOs provide comprehensive coverage but require policyholders to select a primary care physician (PCP) within the HMO's network. The PCP acts as a gatekeeper, referring patients to specialists and coordinating their care. HMOs typically have lower out-of-pocket costs but may limit the choice of providers.

- Preferred Provider Organizations (PPOs): PPOs offer a balance between HMOs and fee-for-service plans. Policyholders can choose from a network of preferred providers, receiving discounted rates. They have the flexibility to seek treatment outside the network but may incur higher costs. PPOs are popular for their balance of choice and cost-effectiveness.

- Exclusive Provider Organizations (EPOs): EPOs are similar to PPOs but with a more restricted network of providers. Policyholders are required to use in-network providers, and out-of-network care is typically not covered. EPOs can offer lower premiums but may limit access to certain specialists.

- Point-of-Service (POS) Plans: POS plans combine features of HMOs and PPOs. Policyholders have a primary care physician within the network but can also seek treatment outside the network with higher out-of-pocket costs. POS plans provide flexibility while still encouraging in-network care.

| Plan Type | Key Features |

|---|---|

| Fee-for-Service | Flexibility, choice of providers, higher out-of-pocket costs |

| HMO | Comprehensive coverage, PCP coordination, limited provider choice |

| PPO | Balance of choice and cost, network discounts, flexibility |

| EPO | Lower premiums, restricted provider network, limited out-of-network coverage |

| POS | Flexibility, in-network and out-of-network options, PCP coordination |

Understanding Coverage and Benefits

Medical insurance plans offer a range of coverage options and benefits, which can vary significantly between plans and insurance providers. It’s crucial to carefully review the policy document to understand the specifics of your coverage.

Covered Services

Most medical insurance plans cover a wide range of essential healthcare services, including:

- Hospitalization: Covers the cost of inpatient stays, surgeries, and other medical procedures performed in a hospital setting.

- Doctor Visits: Includes routine check-ups, specialist consultations, and follow-up appointments.

- Prescription Drugs: Provides coverage for medications prescribed by healthcare professionals.

- Preventive Care: Offers coverage for preventive services such as immunizations, screenings, and wellness checks.

- Mental Health Services: Covers treatment for mental health conditions, including counseling and therapy.

- Maternity and Newborn Care: Provides coverage for prenatal care, childbirth, and postnatal care for both mother and child.

- Emergency Services: Covers unexpected medical emergencies and urgent care visits.

Cost-Sharing Mechanisms

Medical insurance plans employ various cost-sharing mechanisms to distribute the financial burden between the insurance company and the policyholder. These mechanisms include:

- Deductibles: A deductible is the amount a policyholder must pay out of pocket before the insurance coverage kicks in. Deductibles can vary by plan and may be applied annually or per incident.

- Copayments: Copayments, or copays, are fixed amounts paid by the policyholder for specific services, such as doctor visits or prescription drugs. Copays are typically a set dollar amount and are paid at the time of service.

- Coinsurance: Coinsurance is the percentage of the medical bill that the policyholder is responsible for paying after the deductible has been met. For example, a 20% coinsurance means the policyholder pays 20% of the covered expenses while the insurance company pays the remaining 80%.

- Out-of-Pocket Maximum: The out-of-pocket maximum is the maximum amount a policyholder will pay for covered services in a given year. Once this limit is reached, the insurance company covers 100% of the costs for the remainder of the year.

Choosing the Right Medical Insurance Plan

Selecting the right medical insurance plan involves considering several factors, including your healthcare needs, budget, and personal preferences. Here are some key considerations to guide your decision-making process:

Assessing Your Healthcare Needs

Evaluate your current and anticipated healthcare needs. Consider factors such as:

- Chronic Conditions: If you have a chronic illness or require ongoing medical treatment, ensure the plan covers these conditions adequately.

- Prescription Medications: Assess the cost of your prescription medications and choose a plan that provides good coverage for your specific needs.

- Specialist Care: If you require frequent specialist visits, select a plan with a robust network of specialists.

- Preventive Care: Prioritize plans that offer comprehensive preventive care services to maintain your overall health.

Understanding Plan Networks

Review the provider networks associated with each plan. Networks can include healthcare providers, hospitals, and facilities. Consider the following:

- In-Network vs. Out-of-Network: In-network providers are typically preferred, as they offer discounted rates and better coverage. Out-of-network care may be more expensive and may not be fully covered.

- Network Size: A larger network provides more flexibility and access to a wider range of providers.

- Specialist Access: Ensure the plan's network includes specialists relevant to your healthcare needs.

Comparing Premiums and Out-of-Pocket Costs

Examine the premium amounts and out-of-pocket costs associated with each plan. Consider your budget and financial stability when making this comparison. Remember that lower premiums may come with higher out-of-pocket expenses, while higher premiums may offer more comprehensive coverage.

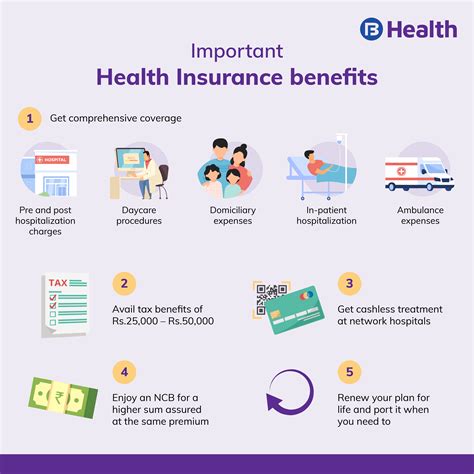

Evaluating Additional Benefits

Some medical insurance plans offer additional benefits beyond standard coverage. These may include:

- Dental and Vision Coverage: Plans with bundled dental and vision benefits can be cost-effective for those who require these services.

- Wellness Programs: Some plans offer incentives and discounts for participating in wellness programs and maintaining a healthy lifestyle.

- Telemedicine Services: Telemedicine has become increasingly popular, and some plans offer coverage for virtual healthcare consultations.

- Travel Coverage: If you frequently travel, consider plans that provide coverage for medical emergencies while abroad.

Navigating the Claims Process

When you receive medical treatment, you or your healthcare provider will need to submit a claim to your insurance company to receive reimbursement. The claims process can vary depending on your insurance plan and the type of treatment received.

Submitting a Claim

To submit a claim, you will typically need to provide the following information:

- Policyholder's Information: Your name, policy number, and date of birth.

- Provider's Information: Name, address, and contact details of the healthcare provider or facility.

- Treatment Details: A description of the medical services received, including dates, procedures, and diagnoses.

- Billing Information: Itemized bills or statements from the healthcare provider or facility.

Claims can be submitted online, via mail, or through a dedicated claims portal provided by your insurance company.

Claim Processing and Reimbursement

Once your claim is submitted, the insurance company will review and process it. The timeline for claim processing can vary, but most insurance companies aim to provide a response within a reasonable timeframe.

Upon approval, the insurance company will reimburse you or the healthcare provider for the covered expenses. Reimbursement methods can include checks, direct deposits, or adjustments to your future premium payments.

Appealing Claim Denials

In some cases, insurance companies may deny a claim. This can occur due to various reasons, such as incorrect information, lack of coverage for a specific service, or pre-existing condition exclusions. If your claim is denied, you have the right to appeal the decision.

The appeals process typically involves submitting additional documentation or providing further clarification to support your claim. It's important to carefully review the denial notice and follow the instructions provided by your insurance company to ensure a successful appeal.

Conclusion: Empowering Your Healthcare Journey

Medical insurance is a powerful tool for ensuring access to quality healthcare while managing the financial risks associated with medical treatments. By understanding the fundamentals of medical insurance, exploring different plan types, and carefully selecting the right coverage, you can take control of your healthcare journey and make informed decisions that align with your needs and budget.

As you navigate the world of medical insurance, remember to stay informed, ask questions, and seek guidance from healthcare professionals and insurance experts. With the right coverage and a proactive approach, you can achieve peace of mind, knowing that you and your loved ones are protected during times of medical need.

What is the difference between medical insurance and health insurance?

+Medical insurance and health insurance are often used interchangeably, but they can have slight variations in meaning. Medical insurance typically refers to coverage for specific medical treatments and services, while health insurance encompasses a broader range of healthcare-related benefits, including preventive care, wellness programs, and mental health services.

How do I choose the right medical insurance plan for my family?

+When selecting a medical insurance plan for your family, consider factors such as your family’s healthcare needs, budget, and preferences. Evaluate plan networks, coverage options, and cost-sharing mechanisms. It’s beneficial to seek advice from insurance experts or healthcare professionals to make an informed decision.

Are there any government-sponsored medical insurance programs?

+Yes, many countries have government-sponsored medical insurance programs to ensure access to healthcare for their citizens. Examples include Medicare in the United States, the National Health Service (NHS) in the United Kingdom, and the Canada Health Act in Canada. These programs vary in their coverage and eligibility criteria.

What happens if I need emergency medical care while traveling internationally?

+If you require emergency medical care while traveling internationally, it’s important to have travel insurance or medical insurance that covers international emergencies. These plans often provide access to a network of healthcare providers and facilities abroad, ensuring you receive necessary treatment. Check your policy’s coverage details before your trip.

Can I switch medical insurance plans during the year?

+Switching medical insurance plans during the year is possible in certain circumstances, such as changing jobs, experiencing a life event (e.g., marriage, birth of a child), or during open enrollment periods. However, it’s important to carefully review the terms and conditions of your current plan and the new plan to ensure a smooth transition and maintain continuity of coverage.