When Was Insurance Invented

The concept of insurance, an essential tool for risk management and financial protection, has a rich and fascinating history that dates back centuries. Its invention and evolution have played a pivotal role in shaping the modern world's economic landscape. This article delves into the origins of insurance, exploring its ancient roots, key milestones, and the transformative impact it has had on global trade, commerce, and personal financial security.

Ancient Origins: The Seeds of Insurance

The foundations of insurance can be traced to ancient civilizations, where the concept of risk sharing was an integral part of daily life. In the Babylonian era, as early as 2000 BCE, merchants would make arrangements to guarantee the safe arrival of their goods. These early forms of insurance were often embedded in legal codes, as seen in the Code of Hammurabi, which outlined principles for resolving disputes and compensating for losses.

The ancient Greeks also practiced a form of insurance, known as benevolent societies, where members would contribute to a common fund to cover the costs of funerals and other expenses. Similarly, the Romans developed a system called pecunia traiecticia, which involved transferring risk by making a small payment to a third party, a precursor to modern insurance practices.

| Ancient Civilization | Insurance Practice |

|---|---|

| Babylonians | Risk sharing agreements for trade |

| Ancient Greeks | Benevolent societies for mutual support |

| Romans | Pecunia Traiecticia: risk transfer for trade and personal protection |

Medieval Development: Insurance Grows

During the Middle Ages, insurance practices evolved significantly, particularly in Europe. The 13th century saw the emergence of bottomry contracts, where merchants would borrow money to finance their voyages, with the loan being forgiven if the ship was lost. This practice laid the groundwork for marine insurance, a critical component of global trade.

The 14th century brought about the concept of life annuities, where individuals would make a one-time payment to an insurer, who would then pay out a regular income for the rest of their life. This marked a significant shift towards personal financial protection and retirement planning.

The Great Fire of London and Its Impact

One of the most pivotal moments in the history of insurance was the Great Fire of London in 1666. This catastrophic event, which destroyed a significant portion of the city, highlighted the need for comprehensive property insurance. As a result, Nicholas Barbon established the first fire insurance company, the Fire Office, in 1680. This marked a turning point, as it prompted the development of standardized insurance policies and the establishment of professional insurance practices.

Modern Era: Insurance Transforms

The 18th and 19th centuries witnessed a rapid expansion of insurance across various sectors. The Industrial Revolution brought about a need for new forms of insurance, such as worker’s compensation and property insurance to protect businesses and their assets. During this period, insurance became more accessible to the general public, with the establishment of mutual insurance companies and the growth of life insurance policies.

The 20th century saw the continued evolution of insurance, with the introduction of new types of coverage, such as health insurance and automobile insurance. The post-World War II era brought about a surge in the demand for insurance, as people sought financial protection in an increasingly complex and uncertain world. This period also saw the rise of insurance regulation to protect consumers and ensure fair practices.

The Role of Technology

In recent decades, technology has played a transformative role in the insurance industry. The advent of computer systems and data analytics has revolutionized how insurance companies assess risk and price policies. The rise of telematics in auto insurance, for instance, has allowed insurers to offer personalized rates based on individual driving behavior. Additionally, the digital age has brought about new challenges and opportunities, with the emergence of cyber insurance to protect businesses and individuals from online risks.

The Future of Insurance

Looking ahead, the insurance industry is poised for further innovation and growth. The ongoing development of Artificial Intelligence and machine learning is expected to enhance risk assessment and claims processing, making insurance more efficient and personalized. Additionally, the rise of insurtech startups is challenging traditional insurance models, offering innovative solutions and greater accessibility.

Moreover, the increasing awareness of environmental risks and sustainability is driving the development of new insurance products, such as climate change insurance and green energy insurance. These products aim to protect businesses and individuals from the financial impacts of environmental challenges while promoting sustainable practices.

What was the first type of insurance developed?

+The first known form of insurance was likely marine insurance, which emerged in the 13th century as a way to protect merchants’ investments in sea voyages.

How has insurance impacted global trade and commerce?

+Insurance has been a critical enabler of global trade, providing a safety net for merchants and businesses against various risks, including loss of goods, damage to property, and liability issues.

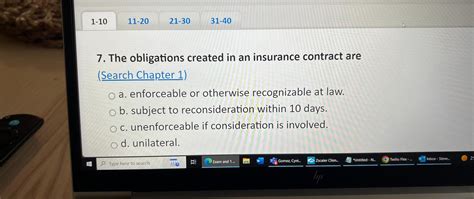

What is the role of insurance in personal financial planning?

+Insurance plays a vital role in personal financial planning by offering protection against unforeseen events, such as illness, accidents, or death, ensuring individuals and their families are financially secure.