Business Insurance Agency Near Me

Welcome to this comprehensive guide on navigating the world of business insurance. Finding the right insurance coverage for your business is crucial to protect your hard work and investments. Whether you're a startup or an established enterprise, understanding the complexities of business insurance is essential. This article will delve into the factors that influence insurance costs, the types of coverage available, and how to locate reputable insurance agencies near you. By the end of this article, you'll have the knowledge and tools to make informed decisions about your business insurance needs.

Understanding Business Insurance Costs

The cost of business insurance can vary significantly based on several key factors. These factors include the type of business you operate, its size and revenue, and the specific risks associated with your industry. Additionally, your business’s location and the coverage limits you choose will impact the overall cost. Understanding these variables is essential to tailor an insurance plan that fits your budget and provides adequate protection.

Industry-Specific Risks

Different industries face unique challenges and risks. For instance, a construction business may need coverage for heavy equipment and liability for workplace accidents, while a tech startup might prioritize cybersecurity and intellectual property protection. Recognizing these industry-specific risks is crucial when selecting insurance coverage.

| Industry | Common Risks |

|---|---|

| Construction | Workplace accidents, equipment damage, and liability claims. |

| Healthcare | Malpractice claims, patient injuries, and data breaches. |

| Retail | Property damage, product liability, and theft. |

| Manufacturing | Equipment failure, product defects, and worker injuries. |

Coverage Limits and Deductibles

The coverage limits you choose will directly affect your insurance premiums. Higher limits provide more extensive protection but come at a cost. Similarly, selecting a higher deductible can reduce your premium but means you’ll pay more out-of-pocket in the event of a claim. Balancing these choices is a crucial aspect of tailoring your insurance plan.

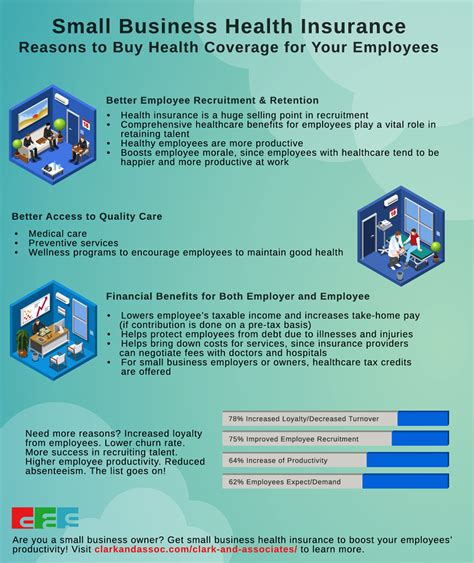

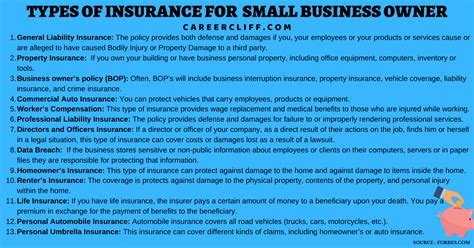

Types of Business Insurance Coverage

Business insurance offers a wide range of coverage options to protect your enterprise. The type of coverage you need will depend on the nature of your business and the specific risks you face. Here are some common types of business insurance coverage:

General Liability Insurance

General liability insurance is a cornerstone of business coverage. It protects your business from third-party claims, such as customer injuries on your premises, property damage, and advertising-related disputes. This type of insurance is essential for most businesses, as it covers a broad range of common risks.

Professional Liability Insurance (E&O Insurance)

Professional liability insurance, also known as Errors and Omissions (E&O) insurance, is crucial for businesses that provide professional services. It protects against claims of negligence, errors, or omissions in the services provided. This coverage is particularly important for industries like consulting, healthcare, legal, and financial services.

Product Liability Insurance

Product liability insurance is designed to protect manufacturers and retailers from claims arising from defective products. It covers legal fees and potential damages if a product causes injury or property damage. This coverage is essential for businesses involved in the design, manufacture, or sale of physical products.

Commercial Property Insurance

Commercial property insurance safeguards your business’s physical assets, including buildings, inventory, and equipment. It provides coverage for damage or loss due to events like fires, storms, vandalism, or theft. This type of insurance is vital for businesses with significant investments in physical assets.

Business Interruption Insurance

Business interruption insurance provides financial protection during periods when your business is unable to operate due to covered events, such as natural disasters or property damage. It can cover lost income and ongoing expenses, helping your business stay afloat during challenging times.

Workers’ Compensation Insurance

Workers’ compensation insurance is mandated by law in most states and provides coverage for workplace injuries and illnesses. It pays for medical expenses and lost wages for employees who are injured or become ill due to their work. This insurance is essential for businesses with employees, ensuring their well-being and protecting the business from potential lawsuits.

Locating a Reputable Insurance Agency Near You

Finding a trustworthy insurance agency to guide you through the complex world of business insurance is crucial. Here are some steps to help you locate a reputable agency near you:

Online Research

Start by conducting online research to identify insurance agencies in your area. Search for terms like “business insurance agency near me” or “local business insurance brokers.” Explore the websites of the agencies that appear in the search results to get a sense of their services and expertise.

Industry-Specific Agencies

Consider seeking out insurance agencies that specialize in your industry. These agencies often have a deeper understanding of the unique risks and coverage needs within your sector. For instance, if you operate a healthcare business, look for agencies with experience in healthcare insurance.

Read Reviews and Testimonials

Take the time to read reviews and testimonials from other business owners who have worked with the agencies you’re considering. Online platforms like Google Reviews, Yelp, and industry-specific forums can provide valuable insights into an agency’s reputation and the quality of their services.

Check Licensing and Credentials

Verify that the insurance agency you’re considering is licensed to operate in your state. You can check with your state’s insurance department to ensure the agency is in good standing. Additionally, look for agencies with reputable credentials and affiliations, such as membership in industry associations or recognition for excellence in insurance services.

Request Quotes and Consultations

Contact the shortlisted agencies and request quotes for your specific business needs. Compare the quotes, but remember that the lowest price doesn’t always indicate the best value. Also, inquire about their consultation process and the level of support they provide throughout the insurance journey.

Referrals and Word-of-Mouth

Ask for referrals from other business owners in your network. Word-of-mouth recommendations can be a powerful indicator of an agency’s reliability and customer satisfaction. Reach out to these referrals to learn more about their experiences with the agency.

The Importance of Expert Guidance

Business insurance is a complex field, and navigating it effectively requires expert guidance. A knowledgeable insurance agent can help you understand the nuances of different coverage options and tailor a plan that aligns with your business’s unique needs. They can also provide valuable insights into risk management strategies and help you make informed decisions to protect your business.

Conclusion

Understanding the factors that influence business insurance costs and the types of coverage available is crucial for making informed decisions. By researching, comparing, and seeking expert guidance, you can find a reliable insurance agency near you that will provide the coverage your business needs. Remember, business insurance is an investment in your company’s security and success, and the right agency will be your trusted partner in navigating the complexities of this essential aspect of business ownership.

How do I know if I have enough business insurance coverage?

+Assessing your business insurance coverage involves evaluating your specific risks and needs. Consider factors like your industry, size, and potential liabilities. It’s recommended to consult with an insurance professional who can guide you in selecting the right coverage limits and policies to ensure you’re adequately protected.

What happens if I don’t have enough business insurance coverage and a claim arises?

+If you don’t have sufficient business insurance coverage and a claim arises, you may be personally liable for the costs associated with the claim. This could include legal fees, damages, and other expenses. It’s crucial to ensure you have adequate coverage to protect your business and personal assets.

How often should I review and update my business insurance coverage?

+It’s recommended to review your business insurance coverage annually or whenever significant changes occur in your business, such as expansion, new products or services, or changes in ownership. Regular reviews ensure that your coverage remains aligned with your business’s evolving needs.