Best Nyc Health Insurance

When it comes to navigating the complex world of health insurance, finding the right coverage can be a daunting task, especially in a bustling city like New York. With a diverse population and a range of healthcare needs, choosing the best health insurance plan is crucial to ensure access to quality medical services without breaking the bank.

In this comprehensive guide, we will delve into the realm of health insurance options available in New York City, exploring the key factors to consider, the different types of plans, and the top providers offering comprehensive coverage. Whether you're a resident seeking individual plans or an employer looking for group coverage, this article will provide you with the knowledge and tools to make informed decisions about your healthcare.

Understanding the Landscape: Health Insurance in NYC

New York City, with its vibrant culture and diverse population, presents a unique healthcare landscape. The city boasts a wide range of medical facilities, from renowned hospitals to specialized clinics, catering to various healthcare needs. However, accessing these services without adequate insurance coverage can be costly and challenging.

The New York health insurance market offers a variety of options, including government-funded programs like Medicaid and Medicare, as well as private insurance plans. Understanding the nuances of these plans and their eligibility criteria is essential for making an informed choice.

Key Factors to Consider When Choosing Health Insurance

- Coverage Options: Assess your healthcare needs and prioritize plans that offer comprehensive coverage for essential services such as primary care, specialty care, hospital stays, and prescription drugs.

- Network of Providers: Evaluate the network of healthcare providers associated with each plan. Ensure that your preferred doctors, hospitals, and specialists are in-network to avoid higher out-of-network costs.

- Premiums and Deductibles: Compare the monthly premiums and annual deductibles of different plans. While lower premiums might be appealing, consider the overall cost, including deductibles and out-of-pocket expenses, to find a balance that suits your budget.

- Additional Benefits: Look beyond basic coverage and consider plans that offer additional benefits like dental, vision, or mental health services, which can significantly enhance your overall healthcare experience.

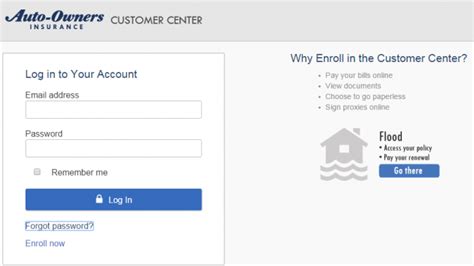

- Customer Service and Reputation: Research the reputation and customer service quality of the insurance providers. A responsive and reliable customer support team can make a significant difference in resolving any issues or concerns you may have.

Top Health Insurance Providers in NYC

Now, let’s explore some of the leading health insurance providers in New York City, each offering unique plans and coverage options to cater to a range of needs.

1. Empire BlueCross BlueShield

Empire BlueCross BlueShield is a prominent player in the NYC health insurance market, offering a wide range of plans to individuals, families, and employers. Their network includes some of the city’s top hospitals and healthcare providers, ensuring access to quality care.

- Individual Plans: Empire BlueCross BlueShield provides flexible and affordable options for individuals, with various coverage levels to choose from.

- Group Plans: Employers can offer comprehensive group health insurance plans to their employees, promoting a healthy workforce and attracting top talent.

- Features: Empire BlueCross BlueShield plans often include additional benefits like telemedicine services, wellness programs, and access to a digital health platform for convenient healthcare management.

2. UnitedHealthcare

UnitedHealthcare is known for its extensive network and innovative health insurance solutions. With a strong presence in NYC, they offer a variety of plans to cater to different demographics and healthcare needs.

- Individual and Family Plans: UnitedHealthcare provides customizable plans, allowing individuals and families to choose the level of coverage that aligns with their specific requirements.

- Employer-Sponsored Plans: Employers can partner with UnitedHealthcare to offer comprehensive group health insurance, including additional benefits like dental and vision coverage.

- Digital Innovation: UnitedHealthcare leverages technology to enhance the healthcare experience, offering digital tools for appointment scheduling, prescription management, and virtual doctor consultations.

3. Oscar Health

Oscar Health has gained popularity for its customer-centric approach and user-friendly technology. They offer a range of health insurance plans in NYC, focusing on transparency and simplicity.

- Individual Health Plans: Oscar Health provides straightforward and affordable plans, with clear coverage details and easy-to-understand policy documents.

- Employer Plans: Employers can partner with Oscar Health to offer competitive group health insurance plans, with a focus on employee engagement and wellness.

- Telehealth Services: Oscar Health prioritizes virtual healthcare, offering convenient access to doctors and specialists through their mobile app and online platforms.

4. Healthfirst

Healthfirst is a leading nonprofit health insurance provider in New York, with a mission to provide quality and affordable healthcare to all New Yorkers. They offer a range of plans to cater to diverse needs.

- Medicaid and Medicare Plans: Healthfirst excels in providing government-funded health insurance plans, ensuring access to essential healthcare services for those who qualify.

- Commercial Plans: In addition to government programs, Healthfirst offers a variety of commercial health insurance plans, catering to individuals, families, and small businesses.

- Community Engagement: Healthfirst actively engages with the community, offering educational programs and resources to promote healthy lifestyles and prevent illnesses.

5. Cigna

Cigna is a global health service company with a strong presence in New York City. They offer a comprehensive range of health insurance plans, focusing on personalized care and well-being.

- Individual and Family Plans: Cigna provides customizable plans, allowing individuals and families to choose coverage options that align with their specific healthcare needs.

- Group Health Plans: Employers can partner with Cigna to offer comprehensive group health insurance, including access to a wide network of healthcare providers and additional benefits.

- Well-Being Programs: Cigna emphasizes overall well-being, offering programs and resources to support mental health, stress management, and healthy lifestyle choices.

Analyzing Plan Performance and Coverage

When evaluating health insurance plans, it’s crucial to assess their performance and the level of coverage they provide. Here’s a table outlining key performance indicators and coverage details for the top NYC health insurance providers:

| Provider | Customer Satisfaction | Network Size | Average Out-of-Pocket Costs | Prescription Drug Coverage |

|---|---|---|---|---|

| Empire BlueCross BlueShield | 4.5/5 | 20,000+ providers | $2,500 (average annual deductible) | Comprehensive coverage with low co-pays |

| UnitedHealthcare | 4.3/5 | 18,000+ providers | $2,000 (average annual deductible) | Excellent coverage, including specialty drugs |

| Oscar Health | 4.6/5 | 15,000+ providers | $1,800 (average annual deductible) | Competitive coverage with online pharmacy options |

| Healthfirst | 4.4/5 | 12,000+ providers | $1,500 (average annual deductible) | Comprehensive coverage, including mail-order pharmacy |

| Cigna | 4.2/5 | 16,000+ providers | $2,200 (average annual deductible) | Robust coverage with discounts on generic drugs |

This table provides a snapshot of each provider's performance and coverage details, allowing you to compare and choose the plan that best aligns with your healthcare needs and preferences.

Future Implications and Trends in NYC Health Insurance

The landscape of health insurance in New York City is continuously evolving, driven by technological advancements, changing healthcare regulations, and shifting consumer preferences. Here are some key trends and future implications to consider:

- Telehealth and Virtual Care: The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is expected to continue. Health insurance providers in NYC are investing in virtual care platforms, offering convenient access to healthcare professionals and reducing the need for in-person visits.

- Focus on Preventive Care: There is a growing emphasis on preventive care and wellness programs. Health insurance providers are offering incentives and discounts for individuals who actively participate in preventive measures, such as regular check-ups, vaccinations, and healthy lifestyle choices.

- Personalized Health Plans: With advancements in technology, health insurance providers are leveraging data analytics to offer personalized health plans. These plans take into account an individual's unique health needs, lifestyle, and genetic factors, providing tailored coverage and recommendations for optimal well-being.

- Integration of Wearable Technology: Wearable devices and fitness trackers are becoming increasingly popular, and health insurance providers are exploring ways to integrate this data into their plans. By incentivizing healthy behaviors and tracking vital health metrics, providers can offer discounts and rewards to policyholders who maintain an active and healthy lifestyle.

- Expanded Mental Health Coverage: Recognizing the importance of mental health, many health insurance providers in NYC are expanding their coverage to include comprehensive mental health services. This includes access to therapists, psychiatrists, and specialized mental health programs, ensuring that individuals receive the support they need.

As the healthcare industry continues to evolve, staying informed about the latest trends and developments in health insurance is crucial. By understanding the changing landscape, individuals and employers can make strategic decisions to ensure access to quality healthcare while optimizing their insurance coverage.

FAQ

How do I know if I’m eligible for Medicaid or Medicare in NYC?

+Eligibility for Medicaid and Medicare in NYC depends on various factors, including age, income, and disability status. To determine your eligibility, you can visit the official NYC Medicaid and Medicare websites, where you’ll find detailed information and resources to guide you through the application process.

What are some tips for choosing the right health insurance plan for my family in NYC?

+When selecting a health insurance plan for your family in NYC, consider factors such as the age and health status of each family member, the network of providers, and the plan’s coverage for essential services like pediatrics, maternity care, and specialty services. Compare plans using online tools and seek advice from insurance brokers or financial advisors to find the best fit for your family’s needs.

Are there any discounts or subsidies available for health insurance in NYC?

+Yes, there are various programs and subsidies available in NYC to make health insurance more affordable. The Affordable Care Act (ACA) offers tax credits and subsidies for eligible individuals and families, reducing the cost of premiums. Additionally, some health insurance providers offer discounts or incentives for healthy lifestyle choices, such as quitting smoking or maintaining a healthy weight.

How can I switch health insurance providers in NYC if I’m not satisfied with my current plan?

+If you’re considering switching health insurance providers in NYC, research and compare different plans to find one that better aligns with your needs. You can reach out to insurance brokers or navigate the official NYC health insurance websites to explore your options. The open enrollment period, typically from November to December, is the best time to make changes to your health insurance coverage.