Medical Insurance Canada

Medical insurance is a vital aspect of healthcare systems worldwide, ensuring individuals have access to essential medical services without incurring excessive financial burdens. In Canada, the healthcare landscape is unique, with a robust publicly funded system known as Medicare. However, private medical insurance still plays a significant role in supplementing and enhancing the coverage provided by the government. This article aims to delve into the intricacies of medical insurance in Canada, exploring its various facets, benefits, and implications.

Understanding Canada’s Healthcare System: Medicare and its Coverage

Canada’s healthcare system is renowned for its universal coverage, providing essential medical services to all citizens and permanent residents. Medicare, officially known as the Canada Health Act, was introduced in 1984 and ensures that all Canadians have access to medically necessary hospital and physician services without facing financial barriers. This publicly funded system is administered by each province and territory, allowing for some regional variations in coverage and administration.

Medicare covers a wide range of services, including:

- Inpatient and outpatient hospital care

- Physician services

- Diagnostic tests and procedures

- Ambulance services

- Some prescription medications for hospitalized patients

However, there are certain limitations and exclusions to Medicare coverage. For instance, it does not cover prescription drugs for outpatients, dental care, vision care, and many other non-medically necessary services. This is where private medical insurance steps in to bridge the gap and provide additional coverage.

The Role of Private Medical Insurance in Canada

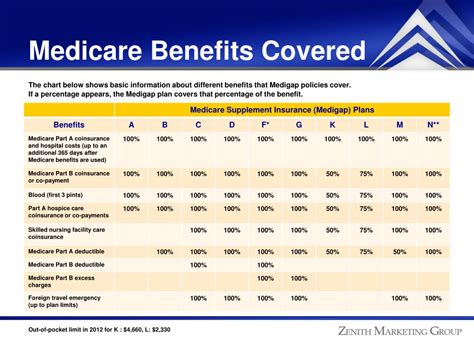

Private medical insurance in Canada is designed to complement the publicly funded Medicare system, offering additional benefits and services that are not covered by the government. While the specific features and coverage options can vary widely between insurers and plans, private medical insurance generally provides coverage for the following:

- Prescription Drugs: One of the most significant benefits of private medical insurance is the coverage of prescription medications. Canadians often face high out-of-pocket costs for their medications, especially those with chronic conditions. Private insurance plans can help reduce these expenses by covering a portion or all of the drug costs.

- Dental Care: Dental services are not typically covered by Medicare. Private insurance plans often include dental coverage, which can range from basic cleaning and check-ups to more extensive procedures like root canals and implants.

- Vision Care: Similar to dental care, vision services are generally not covered by Medicare. Private insurance plans may offer vision care benefits, including eye exams, glasses, and contact lenses.

- Private Hospital Rooms: While Medicare covers hospital stays, it does not guarantee a private room. Private medical insurance can provide coverage for a private or semi-private hospital room, offering more comfort and privacy during hospitalization.

- Alternative Therapies: Some private insurance plans offer coverage for alternative or complementary therapies, such as acupuncture, chiropractic care, and massage therapy. These services are often not covered by Medicare.

- Travel Insurance: Many private medical insurance plans include travel insurance, which provides coverage for medical emergencies while traveling outside of Canada.

Private medical insurance plans can be purchased on an individual basis or as part of an employer-sponsored group plan. Group plans are often more cost-effective and can offer additional benefits due to the larger pool of participants. These plans are particularly valuable for self-employed individuals, small business owners, and those who do not have access to employer-sponsored coverage.

Choosing the Right Medical Insurance Plan

Selecting the appropriate medical insurance plan is crucial to ensure you receive the coverage you need at an affordable cost. Here are some key considerations when choosing a medical insurance plan in Canada:

Assess Your Healthcare Needs

Evaluate your current and potential future healthcare needs. Consider factors such as your age, health status, family history, and lifestyle. If you have pre-existing conditions or are at risk for certain health issues, ensure that the plan covers these adequately. For instance, if you have a history of heart disease, a plan that covers cardiovascular procedures and medications would be beneficial.

Coverage Options and Limitations

Review the coverage options and limitations of each plan. Pay attention to the specific services and treatments covered, as well as any exclusions or restrictions. Look for plans that offer comprehensive coverage for prescription drugs, dental care, and vision services, as these are often the most expensive out-of-pocket expenses for Canadians.

Network of Healthcare Providers

Check the network of healthcare providers associated with the insurance plan. Ensure that your preferred doctors, specialists, and hospitals are included in the network. This is particularly important if you have an ongoing relationship with specific healthcare professionals.

Cost and Premium Structure

Consider the cost of the plan, including the premium structure and any deductibles or co-payments. Assess your ability to afford the premiums on a monthly or annual basis. Keep in mind that while a plan with lower premiums may be more affordable upfront, it might have higher out-of-pocket expenses or limited coverage.

Reputation and Financial Stability of the Insurer

Research the reputation and financial stability of the insurance company. Look for insurers with a solid track record of paying claims promptly and efficiently. A financially stable insurer is less likely to face insolvency or sudden policy changes that could impact your coverage.

Additional Benefits and Services

Explore the additional benefits and services offered by the plan. Some plans may include wellness programs, mental health support, or travel insurance. Consider which of these benefits would be most valuable to you and your family.

| Plan Type | Coverage Highlights |

|---|---|

| Basic | Essential coverage for prescription drugs, dental care, and vision services. |

| Enhanced | Comprehensive coverage with higher limits and additional benefits like alternative therapies and private hospital rooms. |

| Premium | Top-tier coverage with no limits on certain services, including full coverage for prescription drugs and dental care. |

The Future of Medical Insurance in Canada

The landscape of medical insurance in Canada is constantly evolving, driven by advancements in healthcare technology, changing demographics, and evolving societal needs. Here are some key trends and developments that are shaping the future of medical insurance in the country:

Digital Transformation and Telemedicine

The COVID-19 pandemic accelerated the adoption of digital health technologies, including telemedicine. Telemedicine allows patients to access healthcare services remotely, reducing the need for in-person visits and providing convenient access to medical professionals. Private medical insurance providers are increasingly incorporating telemedicine services into their plans, offering coverage for virtual consultations, remote monitoring, and digital health apps.

Focus on Preventive Care

There is a growing emphasis on preventive care and wellness programs in the Canadian healthcare system. Private medical insurance plans are recognizing the value of promoting healthy lifestyles and preventing diseases. Many plans now offer coverage for preventive services such as annual physical exams, health screenings, and wellness coaching. By investing in preventive care, insurers aim to reduce the burden of chronic diseases and lower long-term healthcare costs.

Mental Health Coverage

Mental health is a growing concern in Canada, and private medical insurance plans are expanding their coverage to include mental health services. Plans now often cover psychotherapy, counseling, and medication management for mental health conditions. This increased focus on mental health coverage is crucial for addressing the rising demand for mental health support and ensuring that Canadians have access to the care they need.

Innovative Insurance Models

The insurance industry is exploring innovative models to enhance coverage and accessibility. One such model is the use of health savings accounts (HSAs) or health spending accounts (HSAs). These accounts allow individuals to set aside pre-tax dollars to pay for eligible healthcare expenses, providing greater flexibility and control over their healthcare spending. Some insurance plans are also incorporating wearable technology and health tracking devices to incentivize healthy behaviors and offer personalized coverage options.

Collaboration with Healthcare Providers

Private medical insurance providers are collaborating more closely with healthcare professionals and organizations to improve the efficiency and effectiveness of healthcare delivery. These partnerships aim to streamline administrative processes, reduce costs, and enhance the overall patient experience. By working together, insurers and healthcare providers can develop more integrated and patient-centric care models.

FAQs about Medical Insurance in Canada

What is the difference between Medicare and private medical insurance in Canada?

+Medicare is Canada's publicly funded healthcare system, which provides universal coverage for medically necessary hospital and physician services. Private medical insurance, on the other hand, complements Medicare by offering additional benefits such as prescription drug coverage, dental care, vision services, and alternative therapies.

How much does private medical insurance cost in Canada?

+The cost of private medical insurance in Canada can vary widely depending on factors such as the level of coverage, the age and health status of the individual, and whether the plan is purchased individually or as part of a group. On average, monthly premiums can range from a few hundred dollars to over a thousand dollars for comprehensive plans.

Can I purchase private medical insurance if I already have coverage through my employer?

+Yes, individuals can purchase private medical insurance plans even if they already have coverage through their employer. This allows them to supplement their existing coverage and access additional benefits. However, it's important to review both plans to ensure there is no duplication of coverage.

What happens if I need to travel outside of Canada while on a private medical insurance plan?

+Many private medical insurance plans in Canada include travel insurance coverage. This coverage typically provides emergency medical assistance and coverage for unexpected medical expenses incurred while traveling outside of Canada. It's important to review the specific terms and conditions of your plan before traveling.

Can I switch my private medical insurance plan if I'm not satisfied with the coverage or service?

+Yes, individuals have the option to switch their private medical insurance plans. However, it's important to carefully review the terms and conditions of the new plan, including any waiting periods or exclusions. Additionally, some plans may have cancellation fees or require a minimum tenure before switching.

Medical insurance in Canada is a complex yet essential component of the healthcare system, ensuring that Canadians have access to a wide range of medical services. While Medicare provides universal coverage for essential healthcare needs, private medical insurance fills the gaps, offering additional benefits and peace of mind. As the healthcare landscape continues to evolve, private medical insurance will play a crucial role in shaping the future of healthcare accessibility and affordability in Canada.