Wegovy Not Covered By Insurance

Wegovy, a prescription medication known for its remarkable weight loss benefits, has gained significant attention in the healthcare industry. However, one of the key concerns for many individuals considering this treatment is the coverage status under insurance plans. This article aims to provide an in-depth exploration of Wegovy's insurance coverage, shedding light on the factors that influence accessibility and offering valuable insights for those seeking to utilize this medication.

Understanding Wegovy and its Therapeutic Benefits

Wegovy, scientifically known as semaglutide, is a glucagon-like peptide-1 (GLP-1) receptor agonist. It was initially developed for the management of type 2 diabetes, but its off-label use for weight loss has garnered considerable interest. The medication works by mimicking the action of GLP-1, a hormone that regulates blood sugar and appetite. This unique mechanism not only aids in controlling blood sugar levels but also promotes a feeling of fullness, thereby supporting sustainable weight loss.

Clinical trials have demonstrated the effectiveness of Wegovy in inducing significant weight loss, with some studies showing an average weight loss of up to 15% of initial body weight. This has positioned Wegovy as a promising tool in the fight against obesity and its associated health complications.

Insurance Coverage: A Complex Landscape

The landscape of insurance coverage for prescription medications is intricate and varies significantly across different health plans and regions. While some medications enjoy widespread coverage, others like Wegovy find themselves in a more challenging position due to various factors.

Factors Influencing Insurance Coverage

Several key factors come into play when determining whether a medication will be covered by insurance:

- Medical Necessity: Insurance providers often assess the medical necessity of a drug. For Wegovy, its primary indication as a diabetes medication can influence coverage decisions. However, its off-label use for weight loss might present a different scenario.

- Formulary Status: Formularies are lists of medications covered by a specific insurance plan. The inclusion or exclusion of Wegovy in these formularies is a critical determinant of coverage.

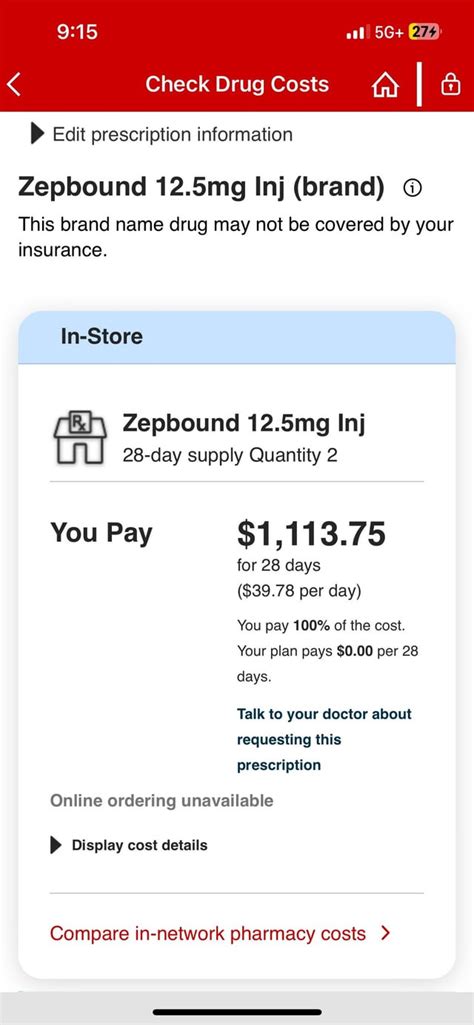

- Cost Considerations: The cost of Wegovy, which can run into hundreds of dollars per month, is a significant factor. Insurance companies evaluate the cost-effectiveness of a drug, especially when compared to other weight loss interventions.

- Individual Health Plans: Each insurance plan has its own unique set of rules and guidelines. What might be covered under one plan may not be the case for another, even within the same insurance provider.

Given these complexities, it's crucial for individuals interested in Wegovy to thoroughly understand their insurance coverage and the steps they can take to maximize their chances of obtaining coverage.

Navigating Insurance Coverage for Wegovy

The process of securing insurance coverage for Wegovy can be daunting, but with the right approach and strategies, it is achievable. Here are some steps to consider:

Step 1: Check Your Insurance Plan

Start by reviewing your insurance plan’s benefits and coverage details. Look for information on prescription drug coverage, particularly for specialty medications like Wegovy. Pay attention to any specific requirements or limitations outlined in your plan.

Step 2: Consult with Your Healthcare Provider

Discuss your interest in Wegovy with your healthcare provider. They can provide valuable insights into the medication’s suitability for your health condition and guide you on the necessary steps to obtain a prescription. Additionally, they can assist in documenting the medical necessity of Wegovy for your specific case.

Step 3: Submit Prior Authorization

Many insurance plans require a prior authorization process for medications like Wegovy. This process involves submitting detailed medical information to the insurance company to demonstrate the necessity and appropriateness of the medication. Work closely with your healthcare provider and pharmacist to ensure all the required documentation is submitted accurately and timely.

Step 4: Appeal Denials

If your insurance company denies coverage for Wegovy, don’t lose hope. You have the right to appeal the decision. Gather additional medical evidence and consider seeking support from patient advocacy groups or legal professionals who specialize in healthcare insurance matters. A well-prepared appeal can often lead to a favorable outcome.

Step 5: Explore Cost-Saving Strategies

Even with coverage, the out-of-pocket costs for Wegovy can be substantial. Explore cost-saving strategies such as manufacturer coupons, patient assistance programs, or pharmacy discount cards. These can help reduce the financial burden and make Wegovy more accessible.

Real-World Experiences and Insights

To gain a deeper understanding of the insurance coverage landscape for Wegovy, let’s explore some real-world experiences and insights from individuals who have navigated this process:

| Case Study | Insurance Status | Outcome |

|---|---|---|

| Patient A | Commercial Insurance Plan | Coverage approved after submitting detailed medical records and completing a prior authorization process. The patient had to pay a small copay for each prescription. |

| Patient B | Medicaid | Initially denied coverage, but after an appeal process that included a letter from the patient's endocrinologist, coverage was approved. The patient received the medication at no cost due to Medicaid's comprehensive coverage. |

| Patient C | High-Deductible Health Plan | The patient had to pay the full cost of Wegovy until their deductible was met. However, they utilized manufacturer coupons to reduce the financial burden during this period. |

These case studies highlight the variability in insurance coverage and the importance of perseverance and a well-informed approach.

Future Prospects and Advocacy

As the demand for weight loss interventions grows, there is a need for increased advocacy and awareness around medications like Wegovy. While the current insurance coverage landscape for Wegovy presents challenges, there are ongoing efforts to improve access and affordability.

Advocacy groups, healthcare professionals, and patients themselves play a crucial role in shaping the future of Wegovy's insurance coverage. By sharing experiences, raising awareness, and engaging with insurance providers and policymakers, progress can be made toward more inclusive coverage.

Conclusion

Securing insurance coverage for Wegovy is a complex but not insurmountable task. By understanding the factors that influence coverage, adopting a strategic approach, and leveraging available resources, individuals can increase their chances of obtaining coverage for this innovative weight loss medication. As the healthcare industry evolves, so too will the accessibility of medications like Wegovy, offering hope to those seeking effective weight loss solutions.

Can I get Wegovy if I don’t have insurance coverage for it?

+Yes, it is possible to obtain Wegovy without insurance coverage. However, the out-of-pocket costs can be substantial. Explore manufacturer coupons, patient assistance programs, or pharmacy discount cards to reduce expenses. Additionally, consider discussing payment plans with your healthcare provider or pharmacy.

What are the potential side effects of Wegovy?

+Like any medication, Wegovy may cause side effects. Common side effects include nausea, vomiting, diarrhea, and constipation. More serious but rare side effects can include pancreatitis and allergic reactions. It’s important to discuss potential side effects with your healthcare provider before starting Wegovy.

How long does it typically take to receive a decision on insurance coverage for Wegovy?

+The timeline for insurance coverage decisions can vary significantly. In some cases, it may take a few days, while in others it can extend to several weeks. Factors such as the complexity of your medical condition, the responsiveness of your insurance provider, and the completeness of the documentation submitted can influence the decision timeline.