Comprehensive Home Insurance

Securing your home and its contents is an essential aspect of responsible homeownership. Comprehensive home insurance, often referred to as homeowner's insurance, is a vital policy that every homeowner should consider to protect their investment and provide peace of mind. This article will delve into the world of comprehensive home insurance, exploring its coverage, benefits, and key considerations to help you make informed decisions about safeguarding your home.

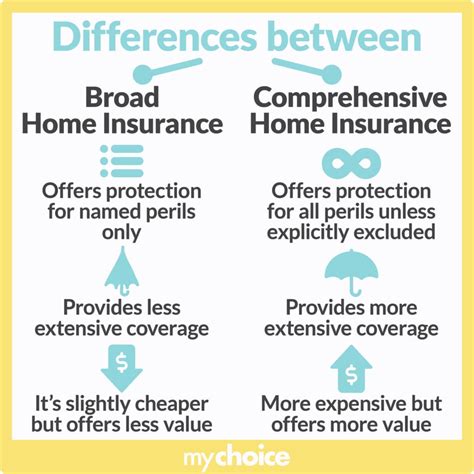

Understanding Comprehensive Home Insurance

Comprehensive home insurance is a type of property insurance specifically designed to protect homeowners from a wide range of potential risks and losses. It goes beyond the basic coverage offered by standard homeowner’s policies, providing an extensive safety net for your home and its contents. Let’s explore the key components and benefits of this essential insurance coverage.

Coverage for Your Home’s Structure

One of the primary purposes of comprehensive home insurance is to protect the physical structure of your home. This coverage extends to the walls, roof, floors, and other permanent fixtures, ensuring that in the event of damage or destruction, you have the financial means to rebuild or repair your home. Whether it’s a fire, storm damage, or other covered perils, this aspect of the policy is crucial for maintaining the integrity of your residence.

| Covered Perils | Description |

|---|---|

| Fire | Protection against damage caused by fire, including smoke damage. |

| Windstorms | Coverage for damage resulting from strong winds, including hurricanes and tornadoes. |

| Hail | Protection against damage caused by hail, which can be especially common in certain regions. |

| Lightning | Coverage for damage caused by lightning strikes, including power surges. |

| Explosions | Protection against damage caused by accidental explosions. |

| Riots | Coverage for damage resulting from civil unrest, including riots and vandalism. |

It's important to note that while comprehensive home insurance covers a wide range of perils, there are typically exclusions for certain natural disasters like earthquakes and floods. These require separate insurance policies to ensure full protection.

Protection for Your Personal Belongings

In addition to safeguarding your home’s structure, comprehensive home insurance also provides coverage for your personal belongings. This includes furniture, appliances, electronics, clothing, and other items you own that are typically used for personal or household purposes. In the event of a covered loss, the policy will help you replace or repair these items, ensuring that your daily life is not disrupted.

The level of coverage for personal belongings varies depending on the policy and the value of your possessions. Some policies offer a set percentage of the overall dwelling coverage, while others provide a separate limit for personal property. It's crucial to review your policy carefully and ensure that the coverage limits align with the value of your belongings.

Liability Protection

Comprehensive home insurance also extends to liability coverage, which is an essential aspect of protecting yourself and your assets. This coverage provides protection if someone is injured on your property or if you are held legally responsible for injuries or property damage caused by your actions away from home. It covers legal fees, medical expenses, and potential compensation claims, ensuring that you are financially prepared for such unforeseen circumstances.

The liability limits in your policy should be sufficient to cover potential risks. It's recommended to opt for higher limits, especially if you have valuable assets or a high net worth, to ensure comprehensive protection.

Additional Living Expenses

In the event that your home becomes uninhabitable due to a covered loss, comprehensive home insurance also provides coverage for additional living expenses. This includes the cost of temporary housing, meals, and other necessary expenses while your home is being repaired or rebuilt. This aspect of the policy ensures that you can maintain your standard of living during a difficult time.

The coverage for additional living expenses typically has a set daily or monthly limit, and it's important to review this limit to ensure it aligns with your expected expenses. Some policies may also have a time limit for this coverage, so it's crucial to understand the specifics of your policy.

Key Considerations for Comprehensive Home Insurance

When navigating the world of comprehensive home insurance, there are several key considerations to keep in mind to ensure you choose the right policy for your needs. These considerations will help you tailor your coverage to your specific circumstances and ensure that you have the protection you require.

Policy Deductibles and Coverage Limits

Deductibles and coverage limits are critical components of any insurance policy, including comprehensive home insurance. A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but it’s essential to select a deductible that you can afford in the event of a claim.

Coverage limits, on the other hand, define the maximum amount your insurance company will pay for a covered loss. These limits can vary based on the type of coverage, such as dwelling coverage, personal property coverage, or liability coverage. It's crucial to review these limits carefully and ensure they align with the value of your home and possessions.

Understanding Exclusions and Endorsements

Every insurance policy has exclusions, which are specific circumstances or perils that are not covered by the policy. It’s important to understand these exclusions to ensure you’re not relying on coverage that doesn’t exist. For example, as mentioned earlier, comprehensive home insurance typically excludes coverage for earthquakes and floods, requiring separate policies.

Endorsements, on the other hand, are additions or amendments to your policy that can provide extended coverage. These can be particularly useful for unique circumstances or high-value items. For instance, you might add an endorsement to cover jewelry, artwork, or other valuable possessions that may exceed the standard personal property coverage limits.

Choosing the Right Insurance Provider

Selecting the right insurance provider is crucial for ensuring you receive the best possible coverage and service. Consider factors such as the provider’s financial stability, customer satisfaction ratings, and their claims handling process. It’s also beneficial to seek recommendations from trusted sources and compare multiple providers to find the one that best suits your needs.

Additionally, consider the availability of 24/7 customer support and the provider's reputation for prompt and fair claim settlements. A reliable insurance company should be there for you when you need them most.

Regularly Review and Update Your Policy

Your home and its contents may change over time, so it’s essential to regularly review and update your comprehensive home insurance policy to ensure it remains adequate. Life events such as renovations, additions to your home, or significant purchases may impact your coverage needs. By reviewing your policy annually and adjusting it as necessary, you can maintain the appropriate level of protection.

Keep in mind that the value of your home and possessions may increase over time, so it's crucial to ensure your coverage limits keep pace with these changes. Failure to do so may result in inadequate coverage in the event of a claim.

Conclusion: The Peace of Mind That Comes with Comprehensive Home Insurance

Comprehensive home insurance is a powerful tool for safeguarding your home and the possessions within it. By understanding the coverage it provides, including protection for your home’s structure, personal belongings, liability, and additional living expenses, you can make informed decisions about your insurance needs.

Key considerations such as policy deductibles, coverage limits, exclusions, endorsements, and choosing the right insurance provider are all crucial aspects of ensuring you have the right coverage. By taking the time to review and update your policy regularly, you can maintain the peace of mind that comes with knowing your home and its contents are protected.

In the event of a covered loss, comprehensive home insurance provides the financial support needed to rebuild, repair, and replace, ensuring that your home remains a safe and comfortable haven for you and your loved ones. It's an investment in your future and a critical component of responsible homeownership.

What is the difference between comprehensive home insurance and standard homeowner’s insurance?

+Standard homeowner’s insurance typically provides basic coverage for the structure of your home and personal belongings, while comprehensive home insurance offers more extensive protection, including additional perils and coverage for liability and additional living expenses.

How often should I review and update my comprehensive home insurance policy?

+It’s recommended to review your policy annually and update it whenever there are significant changes to your home, such as renovations or additions, or when you acquire new possessions of substantial value.

Can I customize my comprehensive home insurance policy to fit my specific needs?

+Absolutely! Comprehensive home insurance policies can be tailored to your unique circumstances. You can choose different levels of coverage for your dwelling, personal property, and liability, and add endorsements for specific items or circumstances.