Average Car Insurance Costs

Car insurance is an essential aspect of vehicle ownership, providing financial protection in case of accidents, theft, or other unforeseen events. Understanding the average costs associated with car insurance is crucial for both new and experienced drivers, as it helps in budgeting and choosing the right coverage. This article aims to delve into the world of car insurance, exploring the factors that influence costs, regional variations, and strategies to obtain the best value. By analyzing real-world data and industry insights, we will provide a comprehensive guide to average car insurance costs, offering valuable knowledge to assist in making informed decisions.

Unraveling the Average Car Insurance Costs: A Comprehensive Guide

The average cost of car insurance can vary significantly depending on numerous factors, making it a complex and dynamic market. In this section, we will dissect these factors, providing a detailed understanding of what influences insurance premiums.

Key Factors Influencing Car Insurance Premiums

Numerous elements play a pivotal role in determining the cost of car insurance. These include:

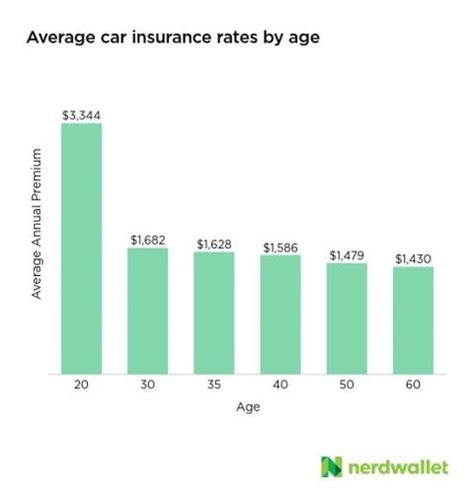

- Driver’s Age and Gender: Younger drivers, especially males, often face higher premiums due to their perceived higher risk of accidents. Age and gender-based premiums can vary significantly, with teenagers and young adults paying a premium.

- Driving Record: A clean driving record with no accidents or traffic violations is favorable. Conversely, a history of accidents, DUI convictions, or speeding tickets can lead to higher insurance costs.

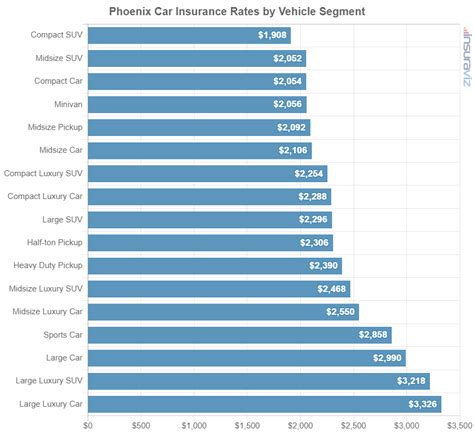

- Vehicle Type and Usage: The make, model, and year of your vehicle impact insurance costs. Sports cars, luxury vehicles, and high-performance cars typically attract higher premiums due to their increased risk of theft or damage. Additionally, the purpose of your vehicle (commuting, leisure, business) and annual mileage can influence rates.

- Coverage Options: The level of coverage you choose impacts your premium. Comprehensive and collision coverage, which provide protection against theft, damage, and accidents, can increase costs. Liability-only coverage, on the other hand, is generally more affordable but offers limited protection.

- Location: The state and city where you reside can significantly affect insurance rates. Factors such as traffic density, crime rates, and the frequency of accidents in your area all contribute to the cost of insurance.

- Credit Score: In many states, insurers are permitted to consider an individual’s credit score when determining premiums. A good credit score can lead to lower insurance rates, while a poor credit score may result in higher costs.

- Insurance Company and Policy: Different insurance providers offer varying rates and coverage options. Shopping around and comparing quotes from multiple insurers is essential to finding the best value.

Understanding these factors is crucial in navigating the car insurance landscape. By considering these elements and making informed choices, individuals can better manage their insurance costs.

Analyzing Regional Variations: A Deep Dive into Average Car Insurance Costs

The average cost of car insurance can vary significantly across different regions, with state-specific laws, regulations, and demographics playing a significant role. In this section, we will explore regional variations, providing a detailed analysis of car insurance costs in different parts of the country.

State-by-State Breakdown of Average Car Insurance Costs

The cost of car insurance varies widely across the United States. Here’s a state-by-state breakdown of average insurance costs, based on recent data:

| State | Average Annual Premium |

|---|---|

| California | 1,342</td> </tr> <tr> <td>New York</td> <td>1,487 |

| Texas | 1,128</td> </tr> <tr> <td>Florida</td> <td>1,692 |

| Illinois | 1,044</td> </tr> <tr> <td>Pennsylvania</td> <td>1,188 |

| Ohio | 984</td> </tr> <tr> <td>Michigan</td> <td>2,592 |

| New Jersey | 1,836</td> </tr> <tr> <td>Massachusetts</td> <td>1,356 |

These figures highlight the wide range of car insurance costs across the country. States with higher population density, frequent accidents, or stricter regulations often have higher average premiums. Conversely, states with lower traffic density and fewer accidents tend to have more affordable insurance rates.

Regional Factors Impacting Car Insurance Costs

Several regional factors contribute to the variation in car insurance costs. These include:

- Population Density: States with higher population density, such as California and New York, often experience more traffic congestion and a higher risk of accidents, leading to increased insurance costs.

- Weather Conditions: Regions prone to severe weather, such as hurricanes or heavy snowfall, can face higher insurance costs due to the increased risk of weather-related accidents and damage.

- Crime Rates: Areas with higher crime rates may experience more vehicle thefts and vandalism, which can drive up insurance premiums.

- State Regulations: Different states have varying laws and regulations regarding car insurance. Some states require more extensive coverage, which can increase the cost of insurance.

- Competitive Market: In some regions, a highly competitive insurance market can lead to more affordable rates as insurers strive to offer competitive pricing.

Understanding these regional factors is essential for individuals looking to move or travel to different parts of the country. By being aware of these variations, individuals can better prepare for the costs associated with car insurance in different regions.

Strategies to Optimize Your Car Insurance Costs: Expert Insights

While the average cost of car insurance is influenced by numerous factors, there are strategies that individuals can employ to optimize their insurance costs. In this section, we will explore expert insights and practical tips to help you reduce your insurance premiums.

Expert Tips for Reducing Car Insurance Costs

Here are some expert-recommended strategies to help you lower your car insurance costs:

- Shop Around: Compare quotes from multiple insurance providers. Rates can vary significantly between companies, so it’s crucial to shop around to find the best deal. Online comparison tools can make this process easier and faster.

- Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies, such as car insurance with home or renters insurance. Bundling can result in significant savings, so it’s worth considering.

- Increase Deductibles: Opting for a higher deductible can lower your insurance premium. However, it’s essential to choose a deductible amount that you can afford to pay out of pocket in the event of a claim.

- Take Advantage of Discounts: Many insurers offer discounts for various reasons, such as good driving records, safe driving courses, student discounts, and multi-car policies. Ask your insurer about available discounts and ensure you’re taking advantage of them.

- Maintain a Good Credit Score: As mentioned earlier, your credit score can impact your insurance premium. Improving your credit score can lead to lower insurance rates, so it’s worth focusing on financial habits that boost your creditworthiness.

- Consider Usage-Based Insurance: Usage-based insurance programs, also known as pay-as-you-drive, can reward safe drivers with lower premiums. These programs use telematics devices to track driving behavior and reward safe driving habits.

- Review Coverage Regularly: Your insurance needs may change over time. Regularly review your coverage to ensure it aligns with your current needs and circumstances. You may be able to reduce your premium by adjusting your coverage limits or deductibles.

By implementing these strategies, you can potentially save hundreds of dollars on your car insurance costs. It's important to remember that car insurance is a necessary expense, but with careful planning and research, you can find the best value for your money.

The Future of Car Insurance: Industry Insights and Predictions

The car insurance industry is constantly evolving, driven by technological advancements, changing consumer behaviors, and regulatory shifts. In this section, we will explore the future of car insurance, providing industry insights and predictions on how the landscape may change.

Industry Trends Shaping the Future of Car Insurance

Several trends are currently shaping the future of car insurance. These include:

- Telematics and Usage-Based Insurance: As mentioned earlier, usage-based insurance programs are becoming increasingly popular. With the advancement of telematics technology, insurers can more accurately assess individual driving behavior, rewarding safe drivers with lower premiums.

- Connected Cars and Data Analytics: The rise of connected cars and advanced data analytics is transforming the insurance industry. Insurers can now collect real-time data on driving behavior, vehicle performance, and location, allowing for more precise risk assessment and personalized insurance offerings.

- Autonomous Vehicles: The development of autonomous vehicles is expected to have a significant impact on car insurance. As self-driving cars become more prevalent, insurance premiums may decrease due to the reduced risk of accidents caused by human error.

- Digitalization and Online Insurance: The shift towards digital insurance platforms and online purchasing is streamlining the insurance process. Consumers can now compare quotes, purchase policies, and manage their insurance needs entirely online, leading to increased convenience and potentially lower costs.

- Regulation and Consumer Protection: Regulatory changes and consumer protection initiatives are also shaping the insurance landscape. For example, the introduction of usage-based insurance regulations in some states has encouraged insurers to offer more personalized and affordable coverage options.

These trends highlight the dynamic nature of the car insurance industry and the potential for significant changes in the future. As technology continues to advance and consumer behaviors evolve, the insurance landscape will likely undergo further transformations, offering new opportunities for both insurers and consumers.

What is the average cost of car insurance for teenagers?

+The average cost of car insurance for teenagers can be significantly higher compared to older drivers due to their lack of driving experience and higher risk of accidents. On average, teenagers can expect to pay between 2,000 and 6,000 annually for car insurance. However, this cost can vary depending on various factors such as the state, the insurer, and the teenager’s driving record.

How does my credit score affect my car insurance premium?

+In many states, insurers are allowed to consider an individual’s credit score when determining insurance premiums. Generally, a good credit score is associated with lower insurance costs, while a poor credit score may result in higher premiums. This practice is based on the idea that individuals with higher credit scores are considered more financially responsible and are less likely to file insurance claims.

Are there any discounts available for car insurance?

+Yes, there are various discounts available for car insurance. Some common discounts include multi-policy discounts (when you bundle your car insurance with other policies like home or renters insurance), safe driver discounts, student discounts, and loyalty discounts for long-term customers. It’s worth asking your insurer about available discounts and ensuring you’re eligible for them.

How often should I review my car insurance policy and coverage?

+It’s recommended to review your car insurance policy and coverage at least once a year, or whenever there are significant changes in your life or circumstances. These changes could include moving to a new state, getting married, buying a new car, or adding young drivers to your policy. Regular reviews ensure that your coverage remains adequate and that you’re not overpaying for unnecessary coverage.