Insurance Co Pay

In the world of health insurance, understanding the concept of co-pay is crucial, as it directly impacts the financial responsibility of policyholders. Co-pay, short for co-payment, is a common term in insurance policies, but its implications can vary depending on the type of insurance and the specific plan one chooses. This article aims to delve into the intricacies of insurance co-pay, exploring its definition, how it works, its variations, and its significance in the healthcare system.

Understanding Co-pay in Insurance

Co-pay, in the context of insurance, refers to the fixed amount that an insured individual or policyholder pays out of pocket at the time of receiving a covered medical service. It is a predetermined cost-sharing mechanism between the insurance company and the policyholder, designed to encourage responsible healthcare utilization and manage costs.

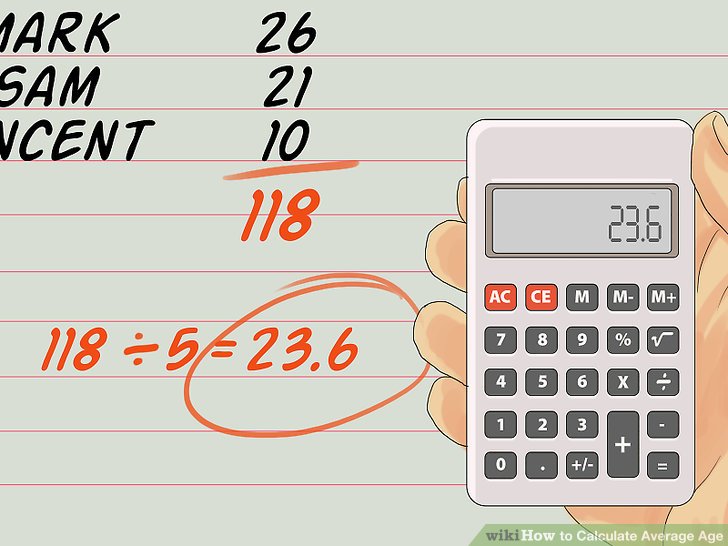

The co-pay amount is typically a flat rate, which means it remains the same regardless of the actual cost of the medical service. For instance, if your insurance plan has a $20 co-pay for doctor visits, you will pay $20 each time you visit a doctor, regardless of whether the visit costs $100 or $200. This contrasts with a co-insurance arrangement, where the amount you pay is a percentage of the total cost.

How Co-pay Works

When an insured individual seeks medical care, they present their insurance card to the healthcare provider. The provider then bills the insurance company for the services rendered. At the point of service, the insured individual pays the agreed-upon co-pay amount directly to the provider. The insurance company, on the other hand, pays the remaining balance, up to the policy’s coverage limits.

Co-pay amounts can vary based on the type of service and the specific plan. For example, a health insurance plan might have a $25 co-pay for specialist visits and a $40 co-pay for emergency room visits. These co-pay amounts are usually outlined in the insurance policy's summary of benefits and coverage, providing policyholders with clear information about their financial responsibilities.

The Significance of Co-pay

Co-pay serves multiple purposes in the insurance landscape. Firstly, it acts as a deterrent for unnecessary or excessive healthcare utilization. By requiring policyholders to pay a portion of the cost, insurance companies aim to encourage individuals to seek medical care only when necessary, thereby reducing overall healthcare spending.

Secondly, co-pay helps to manage the financial risk associated with insurance. By sharing a portion of the cost, policyholders have a vested interest in the efficient use of healthcare services. This can lead to better health outcomes as individuals are more likely to prioritize necessary treatments and avoid wasteful spending.

Lastly, co-pay contributes to the overall affordability of insurance plans. By spreading the cost burden between the insurance company and the policyholder, insurance providers can offer more competitive premiums, making healthcare coverage accessible to a wider range of individuals and families.

Variations of Co-pay

While the fundamental concept of co-pay remains the same, there are variations in its implementation across different insurance types and plans.

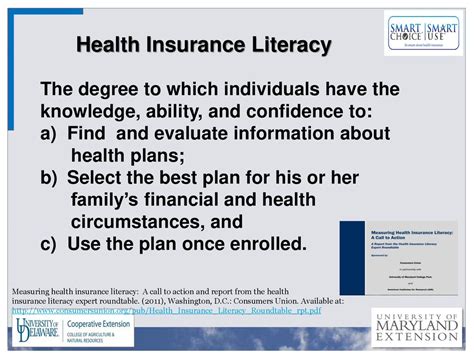

Health Insurance Co-pay

In health insurance, co-pay is a common feature, especially in preferred provider organization (PPO) and health maintenance organization (HMO) plans. These plans often have a list of preferred providers, and the co-pay amount may vary depending on whether the policyholder chooses an in-network or out-of-network provider. In-network providers typically have negotiated rates with the insurance company, resulting in lower co-pay amounts.

Health insurance co-pays can cover a wide range of services, including doctor visits, specialist consultations, prescription medications, and even preventive care. For instance, a policy might have a $15 co-pay for generic prescription drugs and a $30 co-pay for brand-name medications.

Dental and Vision Insurance Co-pay

Dental and vision insurance plans also often incorporate co-pay mechanisms. For dental care, co-pay amounts may vary based on the type of procedure, such as 25 for a routine cleaning and 50 for a filling. Vision insurance co-pays, on the other hand, might be structured as a flat rate for an eye exam and a separate amount for contact lens or eyeglass purchases.

Life and Disability Insurance Co-pay

While co-pay is less common in life and disability insurance, it can still be a feature in certain policies. For instance, some disability insurance plans may have a co-pay arrangement where the insured individual pays a percentage of their benefit amount, with the insurance company covering the remainder.

The Future of Co-pay

As the healthcare industry evolves, the role of co-pay is likely to adapt as well. With the rising costs of healthcare and the increasing focus on value-based care, insurance companies may explore new models of cost-sharing. Some potential future developments include:

- Variable Co-pay: Insurance plans may implement variable co-pay amounts based on the individual's health status or the predicted cost-effectiveness of a particular treatment.

- Reward-Based Co-pay: Some insurance companies are experimenting with reward systems, where policyholders can earn reduced co-pay amounts by meeting certain health milestones or participating in wellness programs.

- Dynamic Co-pay: Co-pay amounts could be adjusted in real-time based on factors like the urgency of the medical need, the provider's availability, or the individual's financial situation.

While these innovations are on the horizon, the traditional co-pay model remains a cornerstone of insurance plans, offering a balance between affordability and access to healthcare services.

FAQs

Can I negotiate my insurance co-pay amount?

+In most cases, insurance co-pay amounts are predetermined and outlined in your insurance policy. However, some insurance companies may offer flexible plans where you can choose between different co-pay options. It’s always worth reviewing your policy details and discussing any concerns with your insurance provider.

What happens if I can’t afford my co-pay at the time of service?

+If you’re unable to pay your co-pay at the time of service, you may discuss payment options with the healthcare provider. Some providers offer payment plans or have financial assistance programs for patients facing financial hardship. It’s important to communicate your situation to avoid any unnecessary complications.

Do all insurance plans have co-pay?

+No, not all insurance plans have co-pay. Some plans, especially those with high deductibles, may have a co-insurance arrangement instead, where you pay a percentage of the total cost. Other plans, particularly those with a health savings account (HSA) component, may have no co-pay for certain services or providers.

How do I know if a provider is in-network for my insurance plan?

+You can check the provider’s in-network status by contacting your insurance company or using their online provider search tool. In-network providers have negotiated rates with your insurance company, which can result in lower co-pay amounts and reduced out-of-pocket costs.