Bundle Car And Home Insurance

Combining your car and home insurance policies into a single, comprehensive package offers numerous benefits and can be a smart financial decision. Known as a bundle or a package policy, this approach is gaining popularity among homeowners and car owners alike. By merging these essential coverages, you can not only save money but also streamline your insurance management, ensuring a more efficient and organized approach to protecting your assets. In this article, we will delve into the advantages of bundling car and home insurance, explore how it works, and provide you with the insights and tips needed to make an informed decision.

The Benefits of Bundling Car and Home Insurance

Bundling your car and home insurance policies brings a host of advantages that can significantly enhance your insurance experience and overall financial well-being. Here are some key benefits to consider:

1. Cost Savings

One of the most appealing aspects of bundling is the potential for substantial cost savings. Insurance companies often reward policyholders who consolidate their coverages by offering discounts or premium reductions. These savings can add up quickly, providing you with a more affordable insurance solution. By leveraging the power of a bundle, you can keep more money in your pocket while still enjoying comprehensive protection.

2. Convenience and Simplicity

Managing multiple insurance policies can be a hassle, especially when it comes to keeping track of different renewal dates, coverage details, and payment schedules. With a bundled policy, you gain the convenience of having all your insurance needs under one roof. This means dealing with a single insurance provider, receiving consolidated bills, and having a unified policy document that covers both your car and home. The result is a simpler, more organized insurance management experience.

3. Enhanced Coverage Options

Bundling your car and home insurance can unlock a range of additional coverage options that may not be available when purchasing these policies separately. Insurance providers often offer package deals that include extended coverage or endorsements specifically designed for bundled policies. These add-ons can provide extra protection for your home and vehicle, giving you greater peace of mind.

4. Streamlined Claims Process

In the unfortunate event of a claim, having a bundled policy can significantly streamline the claims process. When you have a single insurance provider for both your car and home, the claims handling becomes more efficient. Your insurer can coordinate the entire process, ensuring a smoother and faster resolution. This level of coordination can be particularly beneficial when dealing with complex claims that involve both your vehicle and property.

5. Personalized Risk Assessment

Bundling allows insurance companies to conduct a more comprehensive risk assessment of your situation. By evaluating your car and home insurance needs together, they can provide a customized insurance solution that aligns with your specific risks and circumstances. This personalized approach can result in more accurate coverage and better protection for your assets.

How Bundling Works

Bundling your car and home insurance involves combining these two essential policies into a single, comprehensive package. This process is facilitated by insurance providers who offer package policies or bundled insurance options. Here’s a step-by-step breakdown of how bundling typically works:

1. Evaluate Your Insurance Needs

The first step in bundling is to assess your insurance requirements. Consider the specific coverages you need for your car and home, taking into account factors such as the value of your property, the type of vehicle you own, and any unique risks associated with your location or lifestyle.

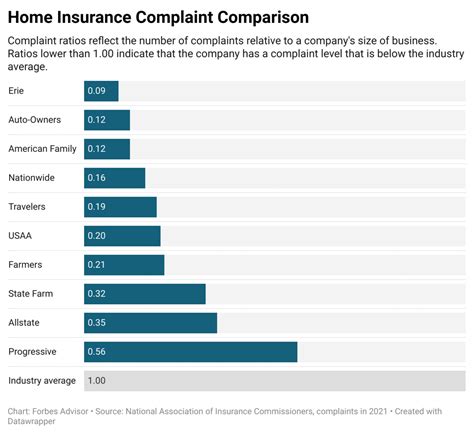

2. Shop Around for Bundled Policies

Research different insurance providers that offer bundled car and home insurance packages. Compare the coverage options, premiums, and discounts they provide. Look for insurers who have a strong reputation for customer service and claims handling, as these aspects are crucial when you need to file a claim.

3. Obtain Quotes

Contact the insurance companies you’re interested in and request quotes for a bundled policy. Provide them with the necessary information about your car, home, and personal details. The quotes will outline the coverage limits, deductibles, and premium costs associated with the bundled package.

4. Compare and Choose

Review the quotes carefully, considering not only the cost but also the coverage limits and any additional benefits or discounts offered. Compare the bundled policies from different insurers to find the one that best suits your needs and budget. Ensure that the coverage limits are adequate to protect your assets fully.

5. Purchase the Bundle

Once you’ve selected the insurer and policy that meet your requirements, proceed with the purchase. This may involve filling out an application form, providing additional documentation, and paying the initial premium. Your insurance provider will then issue a single policy document that covers both your car and home insurance needs.

6. Manage Your Bundle

As a bundled policyholder, you’ll receive consolidated bills and a unified policy document. Keep these documents organized and easily accessible. Regularly review your policy to ensure it still aligns with your changing needs and circumstances. If any significant changes occur, such as home renovations or the purchase of a new vehicle, inform your insurer to adjust your coverage accordingly.

Real-World Examples of Bundled Policies

To illustrate the benefits and practicality of bundling car and home insurance, let’s explore a couple of real-world examples. These scenarios showcase how bundling can provide tailored coverage and cost savings for different individuals and families.

Example 1: The Smith Family

The Smith family owns a home in a suburban area and has two vehicles, a sedan and an SUV. By bundling their car and home insurance, they were able to take advantage of a 15% discount on their total premium. Additionally, the insurance provider offered them an endorsement that covered the cost of temporary housing in case of a severe home damage claim. This endorsement provided peace of mind, knowing they had a backup plan if their home became uninhabitable.

Example 2: Mr. Johnson

Mr. Johnson, a single professional, lives in a condominium and owns a luxury sports car. He decided to bundle his car and home insurance to save money and simplify his insurance management. With the bundle, he received a 10% premium reduction and an extended coverage option that included personal liability protection for both his home and vehicle. This additional coverage gave him added protection in case of any legal liabilities arising from accidents or injuries.

Performance Analysis and Data

Let’s delve into some performance analysis and data to provide further insights into the benefits of bundling car and home insurance. The following table presents a comparison of premium costs and potential savings when bundling versus purchasing separate policies:

| Policy Type | Premium Cost | Potential Savings |

|---|---|---|

| Bundled Car and Home Insurance | $1,800 annually | Up to 20% savings |

| Separate Car Insurance | $1,000 annually | N/A |

| Separate Home Insurance | $1,200 annually | N/A |

As the table illustrates, bundling car and home insurance can result in significant cost savings. In this example, the bundled policy costs $1,800 annually, while separate car and home insurance policies would cost a total of $2,200. By bundling, the policyholder saves up to 20% on their premiums, which can add up to substantial savings over time.

Furthermore, let's consider a real-world case study to demonstrate the effectiveness of bundling. Meet Sarah, a homeowner with a moderate-sized family home and two cars. By bundling her insurance, Sarah not only saved 18% on her annual premiums but also gained access to exclusive discounts and additional coverage options tailored to her specific needs. These additional coverages included increased liability protection and coverage for valuable possessions, giving her added peace of mind.

Expert Insights and Tips

Bundling car and home insurance is a smart decision, but it’s important to approach it with a strategic mindset. Here are some expert insights and tips to help you maximize the benefits of bundling:

1. Shop Around for the Best Deal

Don’t settle for the first bundled policy you find. Take the time to compare quotes from multiple insurance providers. Look for companies that offer competitive rates, generous discounts, and a range of coverage options. By shopping around, you can find the best value for your money and ensure you’re getting the most comprehensive protection.

2. Understand Your Coverage Limits

When bundling, it’s crucial to thoroughly review the coverage limits of your policy. Ensure that the limits are sufficient to protect your assets and meet your specific needs. Consider factors such as the replacement cost of your home and the value of your personal belongings. If necessary, adjust the coverage limits to provide adequate protection without overpaying.

3. Explore Additional Coverage Options

Bundled policies often come with a variety of additional coverage options. Take the time to understand these add-ons and consider whether they align with your circumstances. For example, you may want to include coverage for water backup, identity theft, or personal liability to enhance your protection. These additional coverages can provide peace of mind and fill any gaps in your insurance portfolio.

4. Leverage Multi-Policy Discounts

Insurance companies often offer multi-policy discounts when you bundle multiple insurance products. These discounts can be substantial, so be sure to inquire about them when discussing your bundled policy. By combining car, home, and other insurance needs, such as renters or umbrella insurance, you can maximize your savings and further reduce your overall insurance costs.

5. Regularly Review and Update Your Bundle

Your insurance needs may change over time, so it’s important to regularly review and update your bundled policy. Life events such as home renovations, vehicle upgrades, or changes in family structure can impact your insurance requirements. Stay proactive and ensure that your coverage remains aligned with your current situation. This way, you can maintain adequate protection and avoid any gaps in coverage.

Conclusion

Bundling car and home insurance is a smart financial move that offers a range of advantages. From cost savings and convenience to enhanced coverage options and a streamlined claims process, bundling provides a more efficient and comprehensive approach to protecting your assets. By understanding the benefits, following the steps outlined, and leveraging expert tips, you can make an informed decision and enjoy the peace of mind that comes with a well-rounded insurance solution.

Can I bundle my insurance if I rent instead of own a home?

+

Yes, you can still bundle your car and home insurance even if you’re a renter. In this case, you would bundle your car insurance with renters insurance, which provides coverage for your personal belongings and liability protection. Many insurance providers offer bundle discounts for renters, similar to homeowners.

Are there any downsides to bundling car and home insurance?

+

While bundling offers numerous benefits, there are a few potential downsides to consider. One potential drawback is that you may have less flexibility in choosing different insurers for your car and home insurance. Additionally, if you already have a preferred insurer for one of your policies, bundling may require you to switch providers. It’s important to carefully weigh the benefits against any potential trade-offs.

How can I find the best insurance provider for bundling my car and home insurance?

+

To find the best insurance provider for bundling, consider factors such as their financial stability, customer service reputation, and the range of coverage options they offer. Online reviews and ratings can provide valuable insights. It’s also beneficial to seek recommendations from trusted sources, such as friends, family, or financial advisors. Compare quotes from multiple providers to find the most competitive rates and discounts.