Individual Insurance California

The world of insurance can often be a complex and confusing realm, especially when it comes to navigating the unique regulations and requirements of different states. In California, understanding the intricacies of individual insurance is crucial for residents to ensure they are adequately protected and have the coverage they need. This comprehensive guide aims to shed light on the specifics of individual insurance in California, providing valuable insights and information to help you make informed decisions.

Understanding Individual Insurance in California

Individual insurance, also known as personal insurance, refers to policies purchased by individuals or families to protect against financial losses arising from various risks. In California, the insurance landscape is governed by a set of regulations and laws that ensure consumer protection and provide guidelines for insurers. Let’s delve into the key aspects of individual insurance in the Golden State.

Health Insurance: A Priority in California

When discussing individual insurance, health insurance takes center stage. California has made significant strides in ensuring access to healthcare for its residents. The state has implemented various initiatives and programs to make health insurance more affordable and accessible, including the expansion of Medicaid (known as Medi-Cal in California) and the establishment of the Covered California marketplace.

Under the Affordable Care Act (ACA), also known as Obamacare, individuals in California are required to have minimum essential health coverage or face a tax penalty. This has led to a greater emphasis on health insurance and the need for residents to understand their options. Covered California, the state's official health insurance marketplace, provides a platform for individuals and families to compare and enroll in qualified health plans.

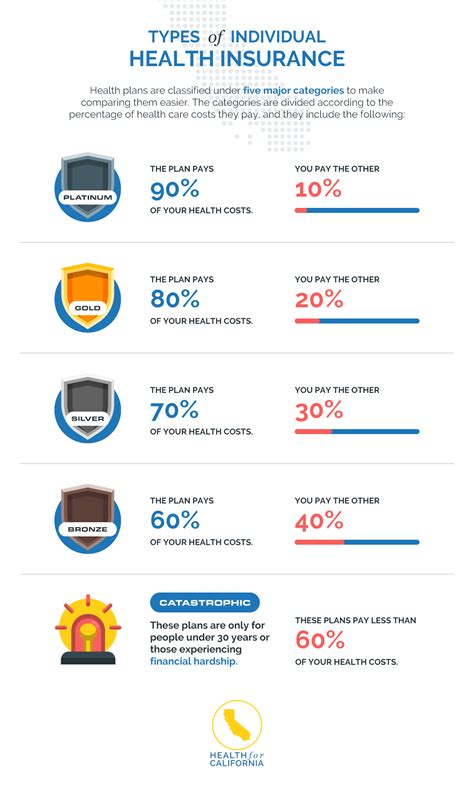

Health insurance plans in California are categorized into different metal tiers, ranging from Bronze to Platinum, indicating the level of coverage and out-of-pocket costs. These plans offer essential health benefits, including hospital stays, outpatient care, prescription drugs, maternity care, and more. It's essential for Californians to review their options and choose a plan that best suits their healthcare needs and budget.

| Health Insurance Metal Tiers in California | Coverage Level |

|---|---|

| Bronze | 60% coverage by the plan, 40% by the individual |

| Silver | 70% coverage by the plan, 30% by the individual |

| Gold | 80% coverage by the plan, 20% by the individual |

| Platinum | 90% coverage by the plan, 10% by the individual |

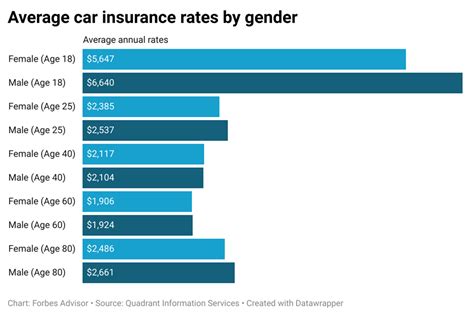

Auto Insurance: A Legal Requirement

In California, auto insurance is mandatory for all drivers. The state requires a minimum level of liability coverage to protect against damages caused in an accident. This includes bodily injury liability and property damage liability.

Beyond the legal requirement, California drivers have the option to purchase additional coverage to enhance their protection. This may include collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage. These additional coverages can provide financial security in the event of accidents, theft, or other unforeseen circumstances.

When selecting auto insurance, it's important to consider factors such as the value of your vehicle, your driving record, and your personal preferences. Different insurers offer varying levels of coverage and pricing, so it's beneficial to shop around and compare quotes to find the best policy for your needs.

| California Auto Insurance Requirements | Minimum Coverage |

|---|---|

| Bodily Injury Liability | $15,000 per person / $30,000 per accident |

| Property Damage Liability | $5,000 per accident |

Homeowners Insurance: Protecting Your Residence

California, known for its diverse landscape and weather conditions, poses unique risks to homeowners. From earthquakes to wildfires, the state’s natural hazards require residents to have adequate insurance coverage.

Homeowners insurance in California typically includes coverage for the structure of the home, personal belongings, and liability protection. However, it's important to note that standard homeowners insurance policies often exclude coverage for certain natural disasters, such as earthquakes and floods. Californians should carefully review their policies and consider purchasing additional coverage to address these specific risks.

For those residing in high-risk areas, such as earthquake zones or wildfire-prone regions, specialized insurance policies may be necessary. These policies are designed to provide comprehensive coverage for the unique challenges faced by residents in these areas. It's essential to consult with an insurance professional to ensure you have the right level of protection for your home and its contents.

Life Insurance: Securing Your Loved Ones’ Future

Life insurance is an essential aspect of financial planning, providing peace of mind and ensuring the financial security of your loved ones in the event of your passing. In California, there are various types of life insurance policies available, each with its own features and benefits.

Term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years. It provides a death benefit to beneficiaries upon the policyholder's death during the term. This type of insurance is often more affordable and suitable for individuals with temporary needs, such as covering mortgage payments or providing for dependent children.

Whole life insurance, on the other hand, provides coverage for the policyholder's entire life. It combines a death benefit with a cash value component, allowing policyholders to build savings over time. Whole life insurance can be a more expensive option but offers the advantage of guaranteed coverage and the potential for cash value growth.

When selecting a life insurance policy, it's crucial to consider factors such as your financial goals, the number of dependents you have, and your long-term financial planning. Consulting with a financial advisor or insurance professional can help you determine the right amount of coverage and the most suitable type of policy for your needs.

Choosing the Right Individual Insurance Coverage

Navigating the world of individual insurance in California can be daunting, but with the right knowledge and guidance, you can make informed choices to protect yourself and your loved ones. Here are some key considerations to keep in mind when selecting insurance coverage:

- Assess Your Risks: Identify the specific risks you and your family face. Consider factors such as your health, driving record, location, and financial responsibilities. This assessment will help you determine the types of insurance and the level of coverage you require.

- Understand Your Budget: Insurance coverage can vary significantly in price. It's essential to evaluate your financial situation and determine how much you can comfortably afford to pay for premiums. Balancing coverage and affordability is key to finding the right policy.

- Compare Providers: Different insurance companies offer varying levels of coverage, pricing, and customer service. Take the time to compare multiple providers to find the one that best aligns with your needs and preferences. Online tools and insurance brokers can simplify this process.

- Review Policy Details: Before finalizing your insurance purchase, carefully review the policy documents. Pay attention to the coverage limits, exclusions, and any additional benefits or riders. Ensure that the policy meets your expectations and provides the protection you desire.

- Seek Professional Advice: If you're unsure about your insurance needs or have complex circumstances, consider consulting with an insurance agent or financial advisor. These professionals can provide personalized guidance and help you navigate the insurance landscape effectively.

The Role of Insurance Brokers in California

Insurance brokers play a vital role in the California insurance market. These professionals act as intermediaries between insurance companies and consumers, offering valuable expertise and guidance. Brokers can help you compare policies, understand the nuances of different coverages, and find the best fit for your needs.

Working with an insurance broker in California can provide several benefits. They have access to a wide range of insurance companies and products, allowing them to offer a comprehensive selection of options. Brokers can also provide personalized advice, taking into account your unique circumstances and goals. Additionally, they can assist with policy management, helping you make adjustments as your needs evolve over time.

When selecting an insurance broker, it's essential to choose one with a strong reputation and a track record of providing excellent service. Look for brokers who specialize in the types of insurance you require and who have a deep understanding of the California insurance market. Referrals from trusted sources or online reviews can be valuable resources in finding a reputable broker.

The Future of Individual Insurance in California

The insurance landscape in California is constantly evolving, driven by technological advancements, changing regulations, and emerging risks. Here’s a glimpse into the future of individual insurance in the Golden State:

- Digital Transformation: The insurance industry is embracing digital technologies, with insurers investing in online platforms and mobile apps. Californians can expect a more seamless and efficient insurance experience, with the ability to manage policies, file claims, and access information from their devices.

- Innovative Coverages: Insurers are developing new products to address emerging risks. This includes coverage for cyber risks, identity theft, and even climate change-related hazards. Californians can anticipate a wider range of options to protect against evolving threats.

- Enhanced Customer Service: Insurance companies are focusing on improving customer service and satisfaction. This includes faster claim processing, more personalized support, and proactive risk management advice. Californians can look forward to a more responsive and supportive insurance experience.

- Regulatory Changes: The California Department of Insurance continues to implement measures to protect consumers and promote a fair and competitive market. Stay informed about any changes in regulations that may impact your insurance coverage and rights.

FAQs

What is the penalty for not having health insurance in California?

+As of 2023, the penalty for not having minimum essential health coverage in California is the greater of 2.5% of your household income or 888 per adult and 444 per child, up to a maximum of $2,664 for a family. This penalty is assessed when filing your federal income tax return.

Can I get auto insurance without a driver’s license in California?

+While it may be challenging, it is possible to obtain auto insurance without a valid driver’s license in California. Some insurance companies offer non-owner policies, which cover you when driving someone else’s vehicle. However, having a valid driver’s license is typically required for standard auto insurance policies.

Do I need earthquake insurance in California?

+Earthquake insurance is not mandatory in California, but it is highly recommended, especially if you live in a high-risk area. Standard homeowners insurance policies typically exclude coverage for earthquake damage. Consult with an insurance professional to assess your risk and determine if earthquake insurance is necessary for your situation.

How much life insurance coverage do I need in California?

+The amount of life insurance coverage you need depends on your individual circumstances and financial goals. Factors to consider include your income, debts, number of dependents, and future financial obligations. Consulting with a financial advisor or insurance agent can help you determine the appropriate coverage amount to meet your needs.

Understanding individual insurance in California is crucial for residents to make informed decisions and protect their financial well-being. By staying informed about the various types of insurance, assessing your risks, and working with reputable insurance professionals, you can navigate the insurance landscape with confidence and ensure you have the coverage you need.